Managing Your Money and Basic of Budgeting

Video on Managing and Budgeting Money

Easy budgeting as I call it needs patience, determination and discipline. Now ask yourself can I do it? Of course you can, expenses depends on behavioral patterns of consuming so you are the boss of your own self. You might want to ask, but I don’t know anything about accounting, you don’t need to learn it, only the basic ones if you have time, but for budgeting all you need to do is subtraction, and of course addition. Sometimes we tend to go away with budgeting because it gives us headache specially if there is nothing to budget. Well, if we want a certain lifestyle and our earnings is not enough we have two options, cut back on your expenses due to limiting of lifestyle or get a new job so that your income is higher and you can have leeway on your luxuries.

Lifestyle is a choice we make but it is dependent on our budget, whatever we do now greatly affect our prospects for our future too.

The main objective of budgeting is for you to avoid having debts so that you can have savings also.

Simple tips on budgeting:

You decide for yourself the time frame of your budget

. This should go hand in hand when you received your salary or household salary lump together. I recommend bi-monthly which is easily manageable. I have chosen this one because I have my own earnings every two weeks

Work on a budget.

Don’t overspend only in case of emergency. The expenses should always be lesser than the earnings. If the expenses is greater than the amount of money coming in, then you will incur negative and this means debt.

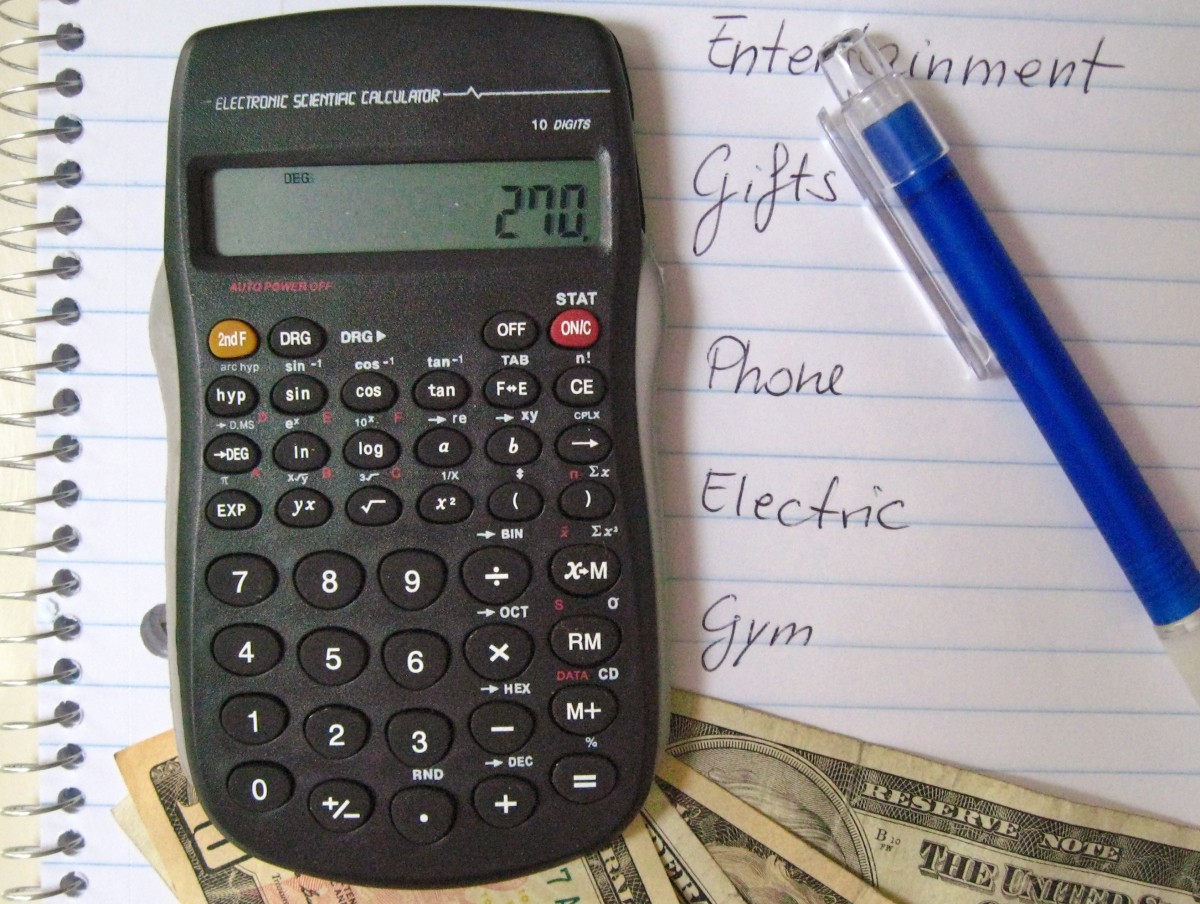

Steps on How to Budget Your Money

Get a notebook, (there are available spreadsheet notebook at stores). You may want to monitor expenses, although it may sound tedious but you need to jot it down, in three columns, first column will be the projected budget, second column is emergency expenses (things that are needed to buy but you didn’t foresee it) and the third column is the actual amount of expenses. List all the expenses on one side and add it up. You can buy all stuff, food grocery items at a time, so that budgeting is easier. Going to the store, you need to have a projected amount of money to spent, it is a must not to exceed on that budget, only in case of emergency need.

Utilities:

Put off lights when not in use. Sometimes it is nice to use sunlight and see the beauty outside, move curtains so that you don’t need light anymore. Wash using dishwasher at a time. Use only air-conditioning and heating unit when the weather is not comfortable anymore. Cut back on the use of electricity. Put off A/C when not needed and also heater. Sometimes nobody is monitoring this, so there should be somebody to do it.

Insurance:

For insurances, you choose car insurance and health insurance which best suit to your family, and family health insurance has more advantage in the long run than individual.

House/Apartment:

Studies have shown that owning a house is more advisable in the long run, but how about those who are not settled yet and who has jobs which require them to go to different places? If you are just renting an apartment, and you are just living alone, you might want to find somebody who will stay with you and help you out in paying it. It really depends in the person, if you are not comfortable living with a room mate for example, then dont do it, but then if you want to save and cut back on expenses, you have to sacrifice a bit.

Transportation:

You decide whether you will just use the transit system or drive your own, for some places of course a car is needed because a public transit system is far, you have no choice.

Luxuries, entertainments and comforts:

Some families eat out during weekends and you should always include this in your budget if you can if it will still fit in your budget. Clothes, shoes and other accessories should be minimal. It is not wrong to buy new clothes and shoes but if you will just incur additional debt then just forget it. Learn things on your own, like DIY (do it yourself), repair, self manicure, pedicure etc. For children, learn to trim their hair so that they will not go to salon anymore. It is better to watch movies in cable than renting out CD. Choose a cable facilities that will suit to your choices. For holidays, like thanksgiving, birthdays, plan the expenses. The budget for these change from month to month so it is a must that you also need to have savings.

Now, these are just tips for you to keep in mind, there is nothing like living meeting some of the luxuries in life, so it is really up to you to have a balance between luxuries and income.

Art of budgeting

Each of us live in a household , either we are living alone (singe household) or with our family, we still need to learn the art of budgeting. Even the richest people have a budget, the only difference is that they hire personnel to do it for them. That’s how lucky they are, for most of us who are lesser mortals, we really need to learn the art of budgeting specially because times are hard and we don’t want to have debts which is a result of poor budgeting.

I learn the art of budgeting when I was nine (9) years old. My parents own a small store which caters to the need of farmers and small scale entrepreneurs in our place. The grocery store my parents owned is at the front of our house in the market and this is in a farm place away from the city. Being the second to the eldest in the family, I am expected to help in the business just like my sister. My sister and I agreed that she will help in the household chores instead of attending to the store. I will watch over the store and sit down at the cashier on weekends. I learned how to operate the cashier machine and it is very easy. My duty is like an overseer and to punch in the amount of money and give the change.

It is not a hard thing to do at all because the machine will spew out the exact amount of change. You just need to be perfect when inputting numbers. I like that job of mine that time because I feel like I am powerful, thus I learn the art of basic budgeting. I will tell my mother how much is the sales money in that day, and how much money incur as expenses on buying new items. I learned the value of money and importance of negative earnings and losses. When it is time to buy new products my mother will always ask my assistance, to check how many of these items we need for ordering. Suffice it to say that even though I am not an economist, I would like to share to you some tip on budgeting and how to do it like eating rice, easy as it does.

This is simpler if you are a single household component. It becomes complicated only if you are budgeting for a whole family. Usually, it is the wife who budgets for the whole family, or that person who is willing and who knows more about controlling expenses. Talk about it with your partner and decide together.

Once you decided who will manage the amount of money, there are necessary things to bear in mind.

Your budget is actually the money in your hands after paying your debts-credit card debt, health insurance if monthly or car insurance etc. These are fixed ones monthly unless you changed or you didn’t pay the last due amount. It will just accumulate.

Food:

It is advisable to buy them by schedule and by bulk. You should have a list and projected budget on how much to spend. You cannot just go to a store and then pick up things as you see them. You will be surprised at times how much your items cost already if you do that.