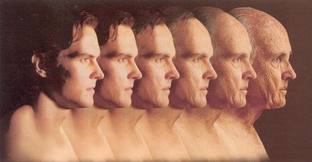

Saving Money at Different Life Stages

Mindful Spending

Being mindful of how we spend our money and what we spend our money on is part of our own belief system. Being thrifty and not wasting money is a matter of being proactive and making constructive decisions toward saving money. Believing you can create a positive situation will help you realistically deal with living within your means. Managing money is not a matter of brilliance or intelligence. It boils down to adapting good habits and living a lifestyle that is simple and functional for you. There are different ways and different degrees of being frugal. For some people, being frugal could mean cutting coupons. For some people it is cutting the toothpaste tube to get out the remainder of toothpaste so nothing goes to waste. Some people may define frugality as economical, thrifty,scrimping or living sparingly. The reality of frugality is that it is a choice people make to apply to their lifestyle and has a lot to do with how restrictive you are in spending your money. People who are frugal, may not have choices because they don’t have enough money, or some people do not feel comfortable spending money freely. You can choose to be frugal in some areas of your life and not others, and reflects our habits and thinking about money.

Frugality at Every Age

Teenagers spend money and help boost the economy. We have less to say about what they purchase and the choices they make have a lot to do with fitting in with their peers. It can be hard to teach monetary values when they believe the value of keeping up socially is more important than saving money for their future needs. Yet, there are ways to help them be a little more frugal in their purchases. We need to not feed their desires. If you give them an allowance, stick to the agreed upon amount. If they overspend too bad, you are not a bank they can easily go to, when they need more money. Lead by example, by showing them the things you bought on sale or discuss the things you didn’t buy because you don’t really need them. Logic may not readily prevail at this age, when it is more important to be “cool” but you can try to help them give some thought to the spending choices they make. You can help them manage their money, give to charity, and make good spending choices. Encourage your kids to take a part time job or do odd jobs to earn extra money for themselves. Being frugal very often comes as a result of realizing how long it takes to make money and how fast it goes. It is a good idea to guide your teens with the money they have earned. If they spend each week.s earnings, they are not getting lessons in thriftiness. Help them start a savings strategy, teach them to give a piece of their wages to charity, and teach them to think about what they are choosing to spend their money on.

Teaching kids and teens about controlling their spending will help prepare them for the real world where they will have to balance their income and expenditures. Struggles with money don’t have to exist, when people make wise and purposeful choices. Help your children and teens by instilling habits that will last a lifetime.

Frugality through Different Life Stages

Getting Your Career Going:

- participate in the company health care program

- be part of the company retirement plan and make the maximum contribution

- stick to a budget

- make sure you have adequate car insurance

- get all the accreditions, education and licenses you can in your field to make yourself as valuable as you can in the marketplace

Marriage

- set up a budget and stick to it to save for the wedding and honeymoon

- before you get married have a good talk about money and make sure you can meet in the middle about your spending and buying habits

- acquire life insurance

- get renters or home owners insurance to protect your assets

- have an emergency fund for unexpected expenses

- create a budet so that you can save for a house, kids, vacations, furniture and other desires you both share

- keep your credit rating clean

Buying a house

- Save money towards the house of your dreams or even just a starter house

- investigate mortgages and other costs to buy a home and save towards it

- get pre approval for a mortgage and monitor your credit score

- anticipate the costs of running a home and cut out expenses you can do without.

- buy the biggest house you can afford, but don’t go above your means

Having Kids

- set aside money for having kids

- put money away for their college

- increase your life insurance

- set up a will and estate trust

- be a conscientious spender so that you and your family are living within your means

- be a good role model for your children to teach them to be thrifty

Career Change

- stick to a budget, even if you are making more money

- rollover your retirement account from your old job

- participate in the new employer’s benefit and retirement opportunities

- if you are going into your own business set up a SEP -IRA account for your retirement

- get disability insurance

- keep your business and personal expenses separate

- set up and stick to a business budget so you don’t have to dip into your personal funds to keep the business going

Children’s College

- hopefully through foresight, thriftiness, and budgeting you have saved for many years for the college education of your children

Aged Parents

- get a power of attorney

- talk to an estate attorney to protect your parents assets

- see if they have long term care insurance

- see what implications their care may have on your pocketbook

Children’s Weddings

- save money towards this wonderful event

- you want to have put aside money, so you don’t borrow to pay for the wedding

- teach your children to live within their means as they start their life together

Inheriting Money

- talk to an accountant or tax attorney to understand the tax implications

- put the money in an interest bearing account while your sort everything out

- consider what is best to do with the money, whether to pay off debt, or invest in stocks, real estates, bonds, mutual funds, etc

- try to live within your means, and let this money last a lifetime for you and your children

- be savvy, avoid poor investments and get rich quick temptations

Divorce

- Get a lawyer and good advice to reduce your costs of the dissolution of the marriage

- change beneficiaries on important documents

- re adjust your lifestyle for the alimony and child support

- adjust your budget to consider the change in taxes

- file your returns married filing separately

- change all your bank accounts to name

- let your creditors know of your change in marital status

- cancel joint credit accounts

- live within your means

Retirement

- know what your monthly income is

- adjust your lifestyle to the fixed income you are receiving

- adjust your budget if you are still making retirement investments in some accounts

- figure in payments if you buy long term care insurance

- review important estate documents to make sure you have protected your assets for your older years and for your children

- decide at what age you will be taking social security payments

- at 70 ½ take out your minimum distributions

Value Your Self

Life is full of stages and phases, some we can anticipate, some we can’t. The best we can do is to teach ourselves and our children to live within our means. Saving money should not cause a hardship, and neither should spending it. As in everything, there needs to be a balance. The saying is, you think you need money when you are younger, you really need money when you are older. Good financial habits will help you achieve financial security for a lifetime. Enjoy your days, go on vacation, spend time with your family, treat yourself well and live a good life. Keep your perspective, and make sure money never controls your life. True freedom is not in your bank account, but in your mind. Good habits, and a good attitude, and good values are not related to money. Balance your life in as many ways as you can.

![These Companies Will Send You Free Stickers [#07] These Companies Will Send You Free Stickers [#07]](https://images.saymedia-content.com/.image/t_share/MTczOTY3MTE2NDA2MzY3NTM5/stickers-by-mail.png)