Top 3 Credit Cards for Those with Bad Credit

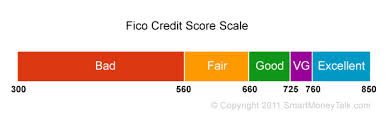

What’s bad credit? To some credit high achievers, bad credit is any score below 660. Still yet, to the average consumer, a bad credit score could mean a lot less—perhaps even a 100 basis points lower. In fact, according to FICO’s scoring model, a score of 560 and below is considered to be quite bad. Do you have below average FICOs—perhaps you’ve been stressing yourself out about this ordeal? You shouldn’t. Actually, millions of Americans are in the same situation. Moreover, what bring about these kinds of ordeals isn’t that hard to understand—namely, millions of Americans each year fall victim to identity theft; a vast number fall ill with medical emergencies; an ever growing number experience horrible divorces; and more importantly, most simply end up unemployed due to a sudden job loss—all of which can cause consumers to stop paying his or her bills, thus causing this natural declivity towards subprime status. What’s subprime? The word subprime simply means below prime, which is the financial equivalence to above-average; hence, subprime credit cards, (which are credit cards marketed to consumers with less than stellar credit) tend to come with a hold host of “buyer bewares.” Needless to say, at its barest minimum level, some aren’t all that bad, especially when you factor in its ability to help rebuild your credit score. The following list below highlights three of the best credit cards for those suffering with bad credit.

Credit Card#3: First Premier Credit Card(s)

Albeit, most consumers would fringe at the prospect of doing business with a subprime lender—especially after the “Financial Crisis of 2007-2009.” To say the least, before you berate a financial product, remember this: 1) with a FICO score of 560 and below, you as a consumer represent a greater risk of default to most lenders; 2) you need credit to have “good credit;” and more importantly 3) banks, just like any other enterprise, are in the business to make a profit. So, it goes without saying what you as a consumer represent to an organization like First Premier, who over the years has gain a nasty reputation for charging its customers outrageously high fees on just about everything. In this same vein, before you take the plunge in applying for this card, remember that you’re going to be charged a one-time processing fee of $75 just to activate the card. This activation fee, (aka, processing fee) along with any other charges you manage to make on this very subprime credit card should be immediately paid in full—that is, of course, if you plan on avoiding paying even more fees in the form of high annual percent rates (APRs), which for this particular subprime financial product can be quite astronomical.

Credit Card#2: Credit One Credit Card(s)

Just like its main rival in First Premier, Credit One subprime product comes in several varieties, including Credit One Platinum Card, Credit One Platinum Card with Gas Rewards, etc. Sounds good on the surface, right? Credit Rebuild Rule#1: There’s no such thing as "good" about subprime credit cards, other than its ability to report timely payments to the three main credit bureaus. Thus, it can be left with very little speculation what you must do in order to avoid being trapped with fees: 1) only use this card for credit rebuilding purposes; 2) use this card for only extreme emergencies; and quite frankly, 3) before you even think of using this card, make certain to have the monies to pay the entire balance off. By and large, your ultimate goal with a subprime product of any kind is to avoid being overwhelmed by those ridiculously high fees, which can spiral out of control, thus causing great damage to your personal finances.

Credit Card#1: Capital One Credit Card(s)

Although considered to be a subprime credit card, a Capital One Credit Card, is considered to be a fairly decent subprime product. This is an excellent rebuild card. The only downside is that if you’ve already had defaulted on a previous capital credit card, it can be quite difficult to get approved for another one. Other than that, the features of the card appears to be geared towards mainly rebuilding your credit, which is the main reason why you applied for the card in the first place. In addition, Capital One is notoriously known for being very generous, giving its subprime customers a chance at prime credit card status in just a 12 month period of on-time payments.

Alas, subprime credit cards aren’t designed for everyone. Sadly, for those few individuals who exhibit impulsive behavior, a better option might be to obtain a secured credit card, that way, if you managed to fall behind on your payments and need a cushion to help with paying-off the balance, the initial security deposit is there to protect your finances from taking a hit.