Volatility option methods for currency ETF's

Rationalizations for more advanced traders.

If you are an option trader, it is very important for you to determine the suitability of plays before you trade. When you are looking at trades, there may be some equities that look like they offer some very good potential plays but instead of trying to force yourself into a position one has to look at the trade across a spectrum of plays. If there are no good plays, the trader should just walk away. Following is an interesting scenario.

Currency ETF's (electronically traded funds) offer some very interesting potential strategies. I am not a Forex trader per-se but am an stock option strategist. Let's introduce some currency ETF's

FXA: Australian Dollar

FXB: British Pound Sterling

FXC: Canadian Dollar

FXE: Euro

FXY: Japenese Yen

FXM: Mexican Peso

FXS: Swedish Krona

FXF: Swiss Franc

So what are we expecting to happen? The dollar has been dropping like a rock lately. At this point in time, there must be some very nice leveraged plays for the upward movement of these ETF's. Yes there are certainly some very good potential positions. However, what happens if the equity goes the opposite way of your position? The answer is obvious that you would lose and in option plays quite often that can be the entire trade. Now many people would consider these volatilty plays to be technical trades. I don't consider them technical trades. In my book technical trades are trades that play purely time or volatility. We are looking for movement in the underlying equity in volatility trades.

Well lets look at the charts of some of the ETF's and see what is happening. FXB is on a downward trend. FXY is on a uptrend. FXF is on a short term uptrend. FXM has been traveling in a 90.50 to a 93.50 channel for some time. FXA, FXC, FXE, and FXS are all coiling off a pole (This is nothing more than a consolidation period after a recent rise). As counter trend traders, we are going to expect these to break from the flags and pennats and continue the trend. This is where we can get into trouble because the ETF's can just keep consolidating or they can go the wrong way. Also if you observe the charts many of these equities have already broken through their triggers.

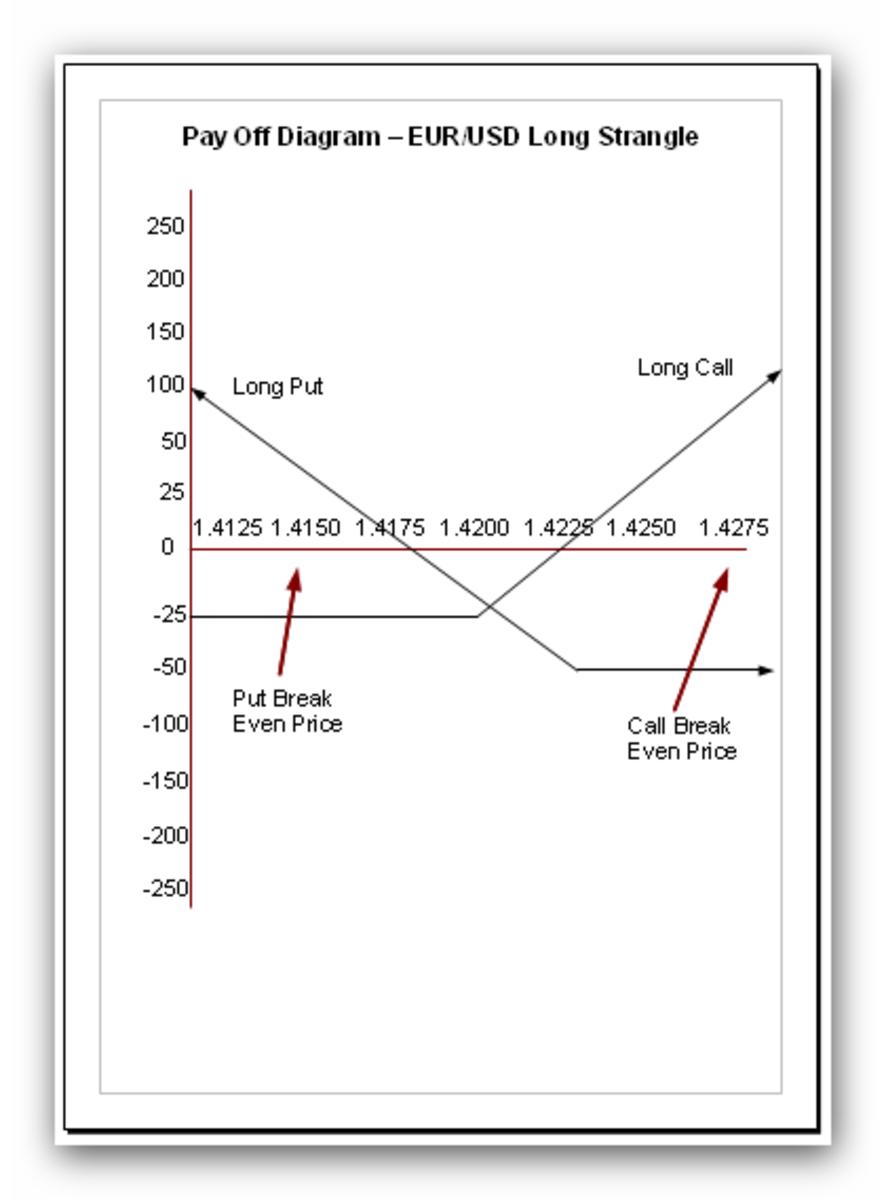

There are a couple of ways to trade this. One would be to look for continued consolidation and the other would be to look for movement either way. I am going to explain non-direction volatility trades. We are going to look for movement in either direction. Lets look at some plays on FXC.

March long strangle/straddle: FXC is currently at 99.40 so lets look at a straddle at 99. The put would cost $1.40 and the call would cost $1.60. This would be a combination that would cost $3.00. A 100/98 strangle would cost $2.20 (call=$1.20 and put=$1.00). A 101/97 straddle would cost $1.40(call=$.70 and put=$.70). The 99 straddle might be a good play but for a break even of $3.00 and a time frame of a little more than a month, it is a risky play. The strangles are the same. After commisions and the bid ask spread, I think these plays would become a little too risky for the potential reward.

March long iron butterfly: Lets take a look at a spread centered at 99. With a centered long iron butterfly, we are creating a position which would have a long straddle at 99 and a short straddle on the outside. A long 99 and short 100/98 iron butterfly would cost $.80 and a long 99 and short 101/97 straddle would cost $1.60. These positions provide a little profit but offer a fair probability of success. Being a four leg position, this will be a position that is hard to fill. I would stay away from this position.

March short call or put butterfly or condor. All of these position provide around a dime to $.40 credit. These types of positions become more profitable with less time to expiration. At current credits, I would only play these around expiration and an event like a FOMC meeting that would move the currency market.

March backspread: If we are looking at a backspread position at a 1 to 2 ratio, we are going to have at a ratio 1 short position at higher cost and 2 long positions at lower cost. A 1 short 99 call and 2 long 101 calls would provide a $.20 credit and with a large move upward this could be a very profitable trade. With a drop, the credit would make this lossless to slightly profitable. The large risk: If FXC ends up at 101 at OE, then this position is at a $2.00 loss. FXC would also have to rise a little under 103 to break even at any point above the short calls.

The verdict is that I don't really like any of these plays. In finding potential plays, we have to do these excercises to determine the suitability of the trades. A person has to go through this step by step process to find suitable plays. In the next post, I will go through some rationalizations for some more technical trades like long butterflies, long condors, Iron condors, and the short strangle.

Note: This post is for educational and entertainment purposes only. Option trades can be very risky and a trader must be aware of these risks before making a trade. The trader is solely responsible for his or her trades. I am not currently long or short any of the positions described in this post.