How Good Credit Can Put You In Debt

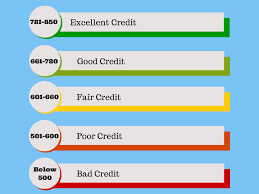

Whats A Good Credit Score

The Importance Of a High Credit Score

A good credit score is a necessity. if you want to buy a home. Your credit score is what determines how loan worthy you would be to lenders.

A low credit score

- can cost you to be turned down for a loan.

- You may be charged higher interest rates

- Cost you a larger down payment on a house.

Approved Credit at The Register

Department Store Credit Card Temptation

Department Store Credit Temptation

Okay what is the department store credit card temptation? It happens at the check out stand. Department stores make appealing offers to consumers trying to persuade them into applying for credit at their store Such as 15% off first day of using the credit card. The application process takes less then five minutes and can be applied for right at the register. It is tempting and not hard to get consumers to apply.

But here is the thing that 15% discount offered at the register or the first purchase is going to cost them and then some. Because on a average the interest rate on department stores;s credit cards is 15% to 22%. Consumers don’t save a dime. Do the math you decide.

Department Store Credit Cards

Have you ever applied for a department store credit card to get saving?

56% of Americians have a poor credit score.

Credit Card Debt

The Credit Card Scam

Credit card companies make appealing offers to consumers of promises of 0% interest rate and no annual fees. The 0% interest is only good for as long as the promotion is which on the average is 6 months to a year. Be sure to keep track of the 0% interest rate period and have your balance paid off. By law because of the credit card act of 2009. The credit card company is suppose to notify you in writing 45 days before they apply a higher interest rate.

But the bad thing is consumers sometimes cant pay off the debt in time and depending what their credit score is. The interest rate may be anywhere from 8 to 18% high. Then they have a annual fee for just having the credit card which runs from anywhere $35 to $95 dollars a year. Remember 30% of your credit score is based on how much debt you have. If the debt on your credit cards is using just over 50% of the credit limit. Your credit score is going to be affected in a negative way.

Here is the thing. Your annual fee depends on how much you use your credit card. If you use it allot it will be lowered. The more you use it however the higher your debt is and the lower your credit score will be. And the lower the credit score the higher the interest rate becomes.You see you are set up to lose no matter which way you go. Its a catch 22.

Keep Your Good Credit Score

Avoid Debt to Keep Good Credit

- Avoid the temptation of opening department store credit cards. With all their perks on the average their APR is 20%. Each time you apply for credit with them. It shows on your credit report which affects your credit score.

- Avoid buying a expensive car. If you have good credit you will be offered low interest rates on car loans. The car loan you are approved for is based on your credit score not on what you can afford. So buyer beware.

- When buying a home. You should not buy a home for what you have been approved for but what you can afford.

- Don't apply for those 0 down 0% interest rates that they offer for electronics, TV's and computers. The 0% interest rate is offered only for a certain amount of time and if it is not paid off. A high interest rate will be added to the balance.

- Avoid transferring one balance of credit card to another one because of the 0% interest rate that is offered and then doing it again after the promotion to avoid paying interest rates.Because opening new cards lowers your credit score.

- Don't overspend on your credit card to get rewards it will only put you in danger of using the maximum of credit offered which will be a negative point on your Credit report. For a good credit score only use 40% of credit offered.

The Statics on Debt in America Today

- 56% Americans are in debt

- The average household is in debt 130,920. 15,762 of that debt is on credit cards.

- The average american is paying $6,658 dollars a year in interest rates.

- In the past 12 years. The household income has grown 26% while the cost of living has grown 29%.

- In a survey 23% of Americans report that at least once in their lifetime. They were surprised at the amount owed on a credit card.

- Will My Credit Score Go Up When I Pay Off My Debt? - NerdWallet

Paying off your debt may or may not help your credit score. Here's how to protect your credit standing as you pay down debt.