What Is the Difference between a Traditional IRA and a Roth IRA?

Most Americans hope to retire before poor health forces them to hang up their time card. The past couple of generations had the benefit of defined benefit retirement plans and an increasing amount of social security to help them transition from gainful employment to the ranks of the retired. Many company pension plans have become unstable, and many companies are moving away from traditional pensions for 401k plans in which future retirees are responsible for most of the saving. Because employees are limited in the amount of money that they can contribute to a 401k plan, many people are interested in other ways to supplement their income when it comes to retirement. Basically anyone in America can set up an Individual Retirement Account (IRA) for themselves. There are two basic types of IRAs that current workers can choose to utilize.

Traditional IRA Accounts

Traditional IRAs are both a retirement savings program and a tax deferral vehicle. The main intent of IRA saving is to provide income during the retirement years. There is also a tax benefit on current-year tax returns for most people who contribute to traditional IRAs.

Those who do not work for an employer that provides a retirement account for employees can deduct the entire amount of their contributions up to the current limit from their adjusted gross income. While this does not cut taxes on a dollar-for-dollar basis, it does reduce the amount of tax owed in the current year.

Those whose employer provides another retirement benefit might be limited on the amount that they can deduct from their adjusted gross income. Singles can still deduct the full amount of their contribution from their adjusted gross income if their income does not exceed $59,000 in a year. Those who are married and filing jointly can deduct the entire amount until their combined income reaches $95,000.

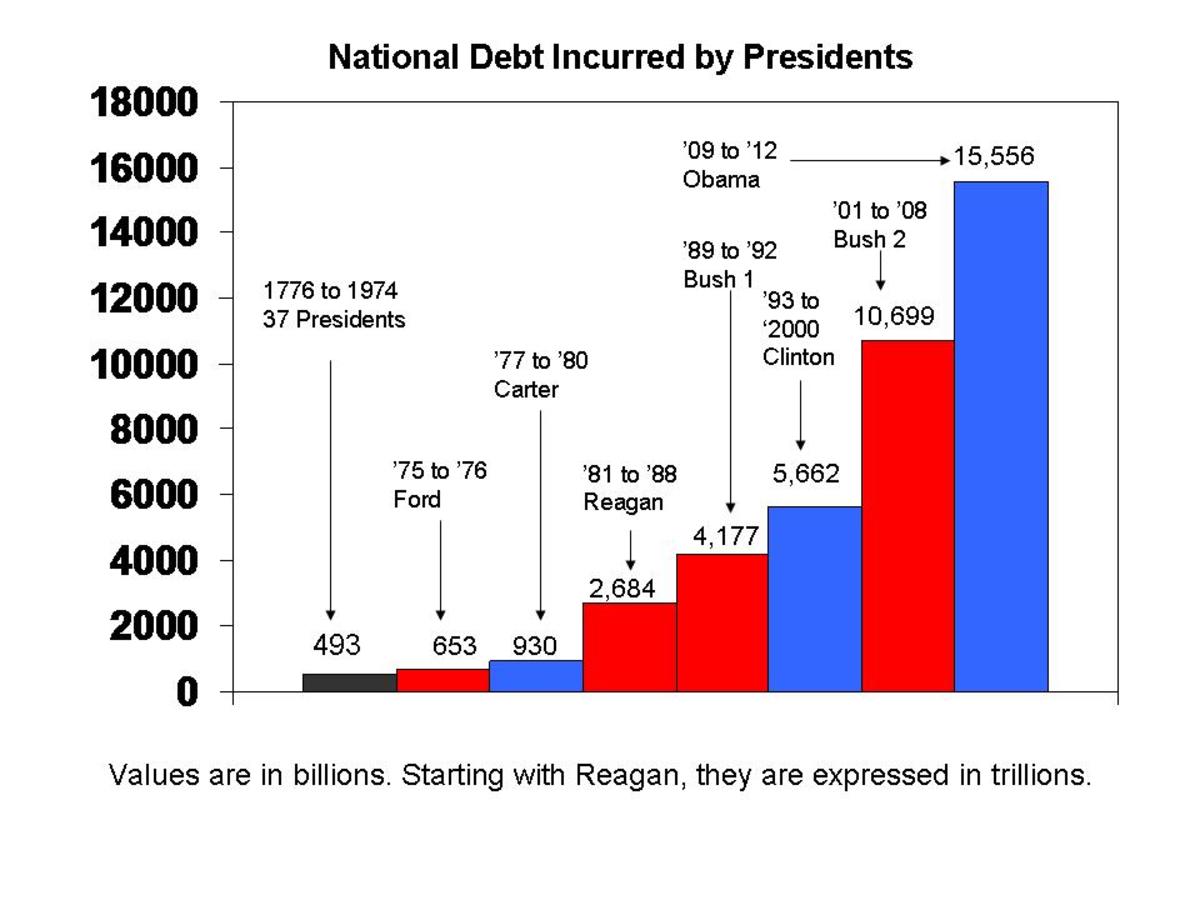

While the deductions can cut current-year taxes, the disbursements from IRAs are taxable when taken out after age 59 1/2. This is admittedly a gamble, because many working people pay little to no income tax today. With the national debt, it is quite possible that the tax rate on retirees (and all other income earners) will be higher in the future.

There is a limit to how much money can be stashed away each year. In 2013, the maximum contribution to an IRA rises to $5,500. Those over 50 years of age can contributed $6,500 as a catchup contribution.

Benefits of a Traditional IRA

- Increased Retirement Income

- Current-year Tax Benefits

- $5,500 Contribution Limit

Roth IRAs

Within the past 20 years, Congress passed a law that modified the possibilities when it came to Individual Retirement Accounts. The new Roth IRAs are very similar to traditional IRAs when it comes to income and contribution levels. The main difference in the Roth IRA is related to taxes.

Roth IRA savings are not tax deductible in the current year. Contributors pay taxes on the Roth IRA contributions when earned, not when disbursed. They will then accrue interest, dividends, and capital gains that are tax-free when disbursed. While contributing to a Roth IRA will not help with taxes in the current year, it will definitely help with taxes in retirement because disbursements will not be counted against taxable income.

One other benefit of the Roth IRA is the ability to cash out contributions at any time. As long as earnings are left in the account, there is no penalty. Those who have a traditional IRA or a 401k plan can actually transfer their money into a Roth account. This is a big difference between a traditional and Roth IRA, as well.

Benefits of a Roth IRA

- Possibly Increased Retirement Income

- No Taxes Payable Upon Disbursement

- $5,500 Annual Contribution Limit ($6,500 for those above 50 years of age)

Tips to Retire Early

- Tips to Retire Early

Retirement seems like a pipe dream to many Americans today. A large number of Americans have seen their level of retirement savings fall. Here are some tips to help you as you try to retire early.

When to Start Saving for Retirement

The time to start saving for retirement is yesterday--the earlier the better. The miracle of compound interest helps those who make relatively small contributions over a long period of time have a better financial standing than those who wait to make larger contributions at a later date.

For example, a simple savings calculator can show the power of compound interest. A worker who contributes the current maximum on an annual basis and then earns 8% interest compounded annually over the next 38 years (contributors can start to take out disbursements without penalty at age 59 1/2, hence the 38 years) will have over $1.3 million when they can start to take out their savings from an IRA.

In contrast, a person who waits until their kids are grown and starts saving at age 49, rather than age 21 will have only $92,000 saved. The total cost of the $1.2 million in terms of initial contributions would be a mere $154,000. Saving early and saving often has its benefits.

Those who have questions regarding the start-up of an IRA should contact their financial planner for more information and in regard to the tax ramifications of this action. Also, the book located in the capsule to the right is a good guide to retirement planning.