What gives an option contract value

An option contract is not a stock.

It does not behave like a stock.

It does not really even always follow the stock.

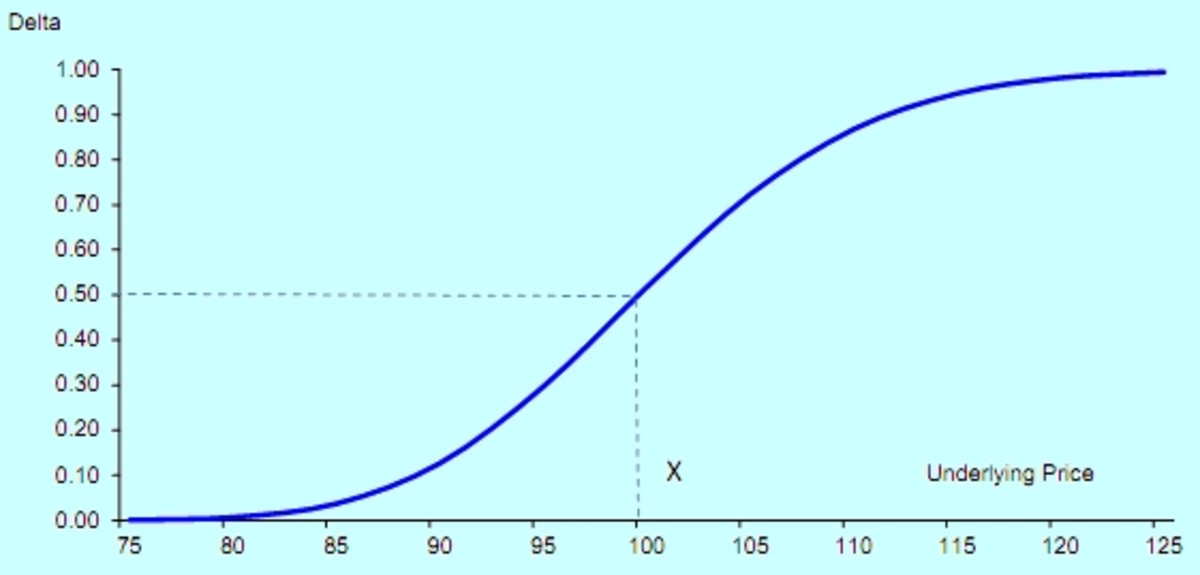

One of the first keys to trading options is to understand how an option is valued. An option contract is valued by a model that was developed by Fisher Black, Robert Merton, and Myron Sholes. This is known as the Black-Sholes model. There are some assumptions that are made in the derivation of the Black-Sholes model that are considered flawed. It is, however, a widely used model and is the basis for many other stochastics that are used by market makers to make the option market. These are defined by option Greeks which are the basic elements of pricing options.

I will get into the Greeks in later posts. What I really want to do is to show generally how we can derive the value and really figure out what an option contract is. Even some people who have traded options for awhile really don't have a sense of how value is created in options. So lets explore them but first lets get some basic definitions out of the way.

An option contract is a right not a physical ownership of a stock.

An option contract is a wasting asset. It has an expiration at which time the right of the contract does not exist any more.

Call: The holder of a call contract has the right to buy the underlying stock for a set price (Strike price) for a set period of time.

Put: The holder of a put contract has the right to sell the underlying stock for a set price (Strike price) for a set period of time.

There are four elements of the price of an option that I will explore and they are:

Intrinsic value

Time value

Volatility (actual)

Volatility implied....Or implied volatility

Due to the nature of implied volatility and the length of the discussion I am going to save the discussion for implied volatility for another post.

Intrinsic value: Intrinsic value is the value of an option contract if we exercised the right it allows. If we hold a call that has a strike price of $40.00 and the stock is at $45.00, we would have the right to buy the stock for $40.00. We would be able to buy the stock for $5.00 less than it is worth. The intrinsic value would therefore be $5.00. The converse would be true for a put. If we held a put contract with a strike price of $40.00 and the stock was at $35.00 we would be able to sell the stock for $5.00 more than it is worth.....So this put contract would have an intrinsic value of $5.00.

Time value: Time value is nothing more than the value that is given to an option contract due to the time that is left until expiration. It should be obvious to everyone that an options contract with a long time left until it expires is going to be worth more than an option with a short time to expiration.

Actual volatility(Statistical volatility): If a stock is likely to move up or down by a great deal, the option contract will be more likely to gain value. An options contract is a highly leveraged instrument and a large movement will create a highly leveraged gain or loss. A stock with a higher statistical volatility will have an option with a higher value than a stock with a lower statistical volatility.

Okay we now see that an options contract is actually a some of a few different elements that create its value. All these values are interdependent but for now think of these as distinct values that are additive in making the value of an option. While there are more elements, this should give someone insight into what creates the basic value of an option. I am saving the most important for another post. That is implied volatility. I am quickly going to define it as the pricing element of the option that is created by demand. Now that we have defined some general descriptions of options, we can progress to more advanced discusions. Options are not that hard to understand once someone has an idea of the basic elements that create value in options. The unfortunate thing is most people never really develop an understanding of options before they start trading. I hope that this basic introductory series will get you through the will help you better understand how an options contract is priced.

Please note: Option trading can be a very risky. One has to have an understanding of options and the equity that the option underlies before they start trading. This post is not an endorsement for trading options and is for educational and entertainment purposes only.