Coal mining shares

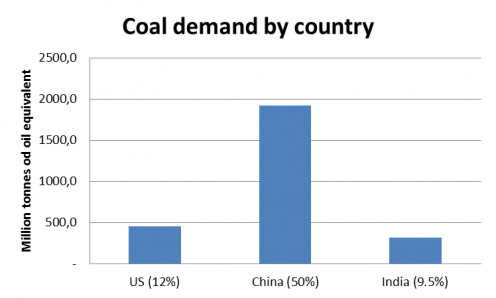

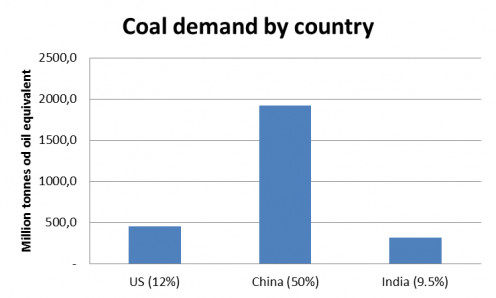

Figure 1. Major coal consumers in the world.

Figure 2. Major coal producers in the world.

ETF KOL

A contrarian investment – coal shares

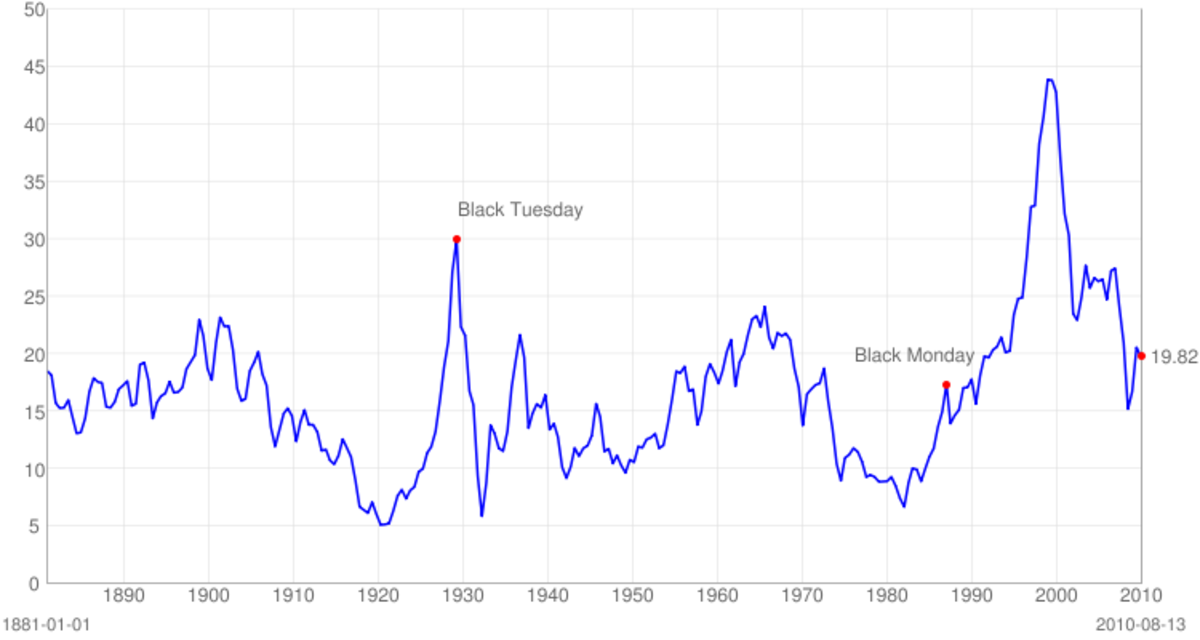

Have you ever considered buying something that has fallen sharply in price? People are happy to do this with consumer goods such as food and likewise. However for some reason they prefer not to do this with financial securities. When a stock has fallen significant in prices, investors tend to shy away from it. But then is exactly when investors should start considering investing in such an asset. Investors tend to be terrible market timers which buy assets at top prices and sell at bottom prices.

At the moment the coal industry is a hated sector. Coal prices have fallen sharply the recent years and coal plants have been blamed for polluting the environment with emissions. In some countries as Germany coal plants have been outcompeted by subsidized wind and solar power generation.

A major drag on coal stocks have been a bearish sentiment in commodities since they topped out in 2011. China has definitely been a driving force in global markets. China is the world’s largest consumer of coal and exceeds US consumption about four times. Chinese coal imports have been on a tear since 2009 but peaked out in December 2012. Imports grew 1500% from 2008. Since then imports have stalled. Coal prices (chart below) have fallen to 2009 levels. Furthermore coal as an energy source has faced fierce competition from relatively cheap natural gas. The US has had excessive gas supply due to fracking and horizontal drilling. The cheap gas has enabled a switch in power generation away from coal to natural gas. However the natural gas market is also cyclical and prices have risen in 2014 to above 4 USD per mmBtu. In February 2014 prices even reached 6 USD per mmBtu.

In 2013 coal produced 39% of US power generation. To further incentivize a switch from natural gas to coal could be a sustained natural gas price of 5 USD per mmBtu. Currently there are no global markets for natural gas. Natural gas prices are around 16 USD per mmBtu in parts of Asia and 11 USD per mmBtu in Europe. Thus there is great potential for exports of abundant US natural gas.

On the consumption side, China is the dominant coal consumer (50%) followed by the US (12%) and India (9%) (see charts below).

On the production side, China is the dominant coal producer (47%) followed by the US (13%), Australia (7%), Indonesia (7%) and India (6%).

Both China and the US are both a dominant consumers and producers. India is also important on the supply and demand side.

The recent years coal share prices have fallen sharply. Heck, even some companies have gone into bankruptcy. Even a more diversified measure – an ETF of coal stocks Market Vectors Coal Fund (KOL) have fallen out of favor as shown below.

Currently the price sits close to levels observed in 2009. . The commodities sector exhibits a boom-bust cycle with periods with high prices followed by depressed prices. Post bust periods have seen prices gain 363% from 1979 to 1980 and 1597% gain from 2000 to 2008. Prior to 2000 prices had fallen 50%. Today’s setup looks similar to the last period. Currently KOL consists about 35 coal shares with the largest holdings including:

- Qr National Ltd (8.5%)

- China Shenhua Energy Co Ltd (8.2%)

- Consol Energy Inc (7.0%)

- Joy Global Inc (6.5%)

- Peabody Energy Corp (6.1%)

- United Tractors Tbk Pt (5.4%)

- Banpu Pcl (5.0%)

- Alliance Resource Partners Lp (4.9%)

- Alliance Holdings Gp Lp (4.7%)

KOL’s net expense ratio stands at a relatively low 0.59%. The price-earnings ratio for the holdings is around 13.6 while the price-book ratio is 1.1. The dividend yield is 2.6%.

However we need a catalyst for prices to move up. Everyone who wants to sell coal has already sold. Thus there is no one left to sell. This is usually when a bottom is formed and sets up the following phase for massive gains. Situations where things go from bas to less bad are a recipe for large gains.

As expected we observe a high level of correlation between the ETF KOL and coal prices.

Investors are in belief that coal has seen its best days. Big coal consumers have made efforts to move away from its use and leaving the market with no marginal buyer.

What catalysts could change investors’ belief? Firstly there have been changes in technology to improve emission reductions and consumer patterns where Chinese consumption could be replaced by Indian consumption. Secondly the best cure for low prices is low prices. Low prices drive surplus capacity to be shut down, eventually leading to rising prices. In some regions, mining costs are higher than current coal price. These mines will either stop production or go out of business, taking away surplus capacity from the market. Thirdly coal is still the world’s most preferred energy source and consumption grows about 2% annually and satisfies about half of the world’s energy consumption. Coal is also utilized in steel production and named metallurgical coal while coal utilized for power generation is named steam coal. Demand for both types is expected to increase some 60% over the next 20 years.

India’s coal industry is struggling to grow its domestic coal production due to corruption and bureaucracy. Conversely demand from the power sector is surging. According to the Central Electricity Authority (CEA) sources, out of the 100 power plants that the CEA monitors, 38 are left with only 7 days of coal and 20 plants are left with only 0 to 4 days of coal. Most of the coal is domestic. Thus extra coal must be imported at a high and accelerating rate. The latest numbers indicate that Indian coal imports were up 12% year on year in May. Electricity demand hit multi-year highs in many states over the last two months as temperatures soared. India has become the world's third-largest coal importer despite sitting on its fifth-biggest reserves of the commodity. If the trend continues one could see India surpass China as the prime coal importer in the next three-five years.

Figure 3. Development of the ETF KOL price from 2009 to date.

Figure 4. Historic coal price development from 2009 and onwards.