mutual funds investing

A mutual fund investing is the act of buying the shares of mutual funds with the hope of making returns in excess of stock index. A stock index is a combination of stock prices – blue chip and penny stock- that would be used to measure stock market.

WHAT IS AN IDEAL MUTUAL FUND?

BUY MUTUAL FUNDS BOOKS ONLINE

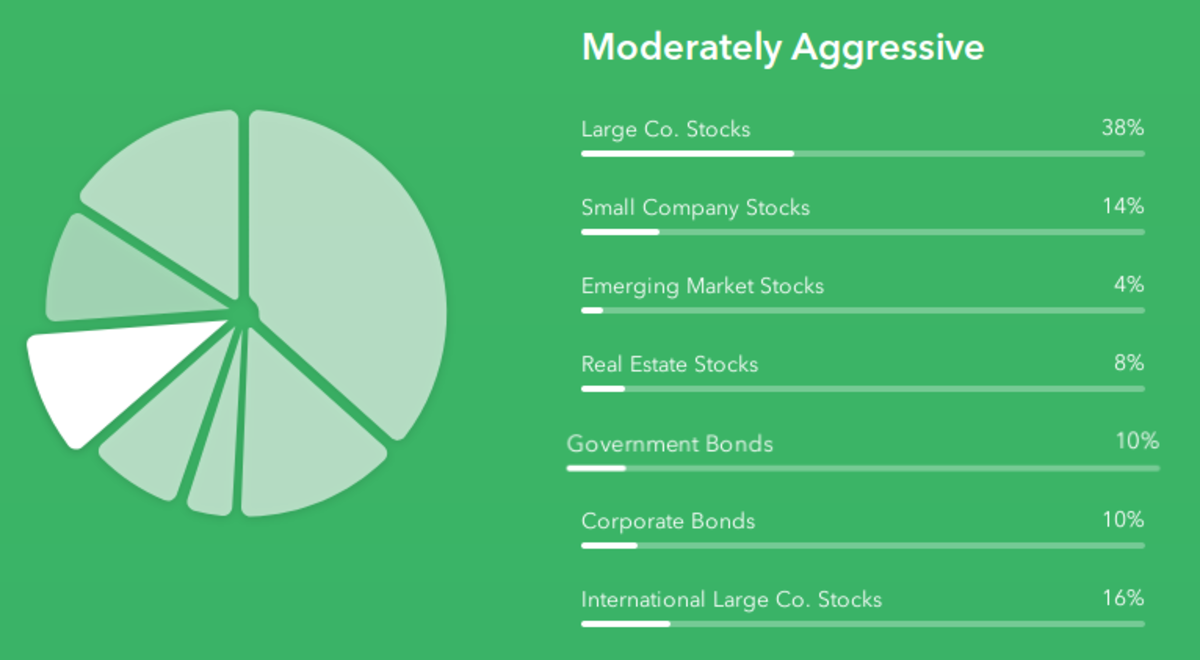

An ideal investment portfolio should comprise of mutual funds stock, real estate, commodity, metals (gold, and silver), etc. Asset allocation techniques should be used to appropriately distribute funds among competing assets. The importance of mutual funds one of which is diversification cannot be overemphasized.

As important as it is to have a mutual fund share in your investment portfolio, it is most important to have good understanding of what a mutual fund is. This hub is written to explain what a mutual fund is, describe the operations of mutual fund, point out the benefits of buying a mutual fund share and state the risks associated with mutual funds.

WHAT IS A MUTUAL FUND?

A mutual fund is an investment company that collects people’s money in exchange for the mutual funds company’s shares and subsequently invests in securities. Investing in mutual fund is an easy way of achieving diversification- even when investing relatively small money.

Unlike manufacturing companies and service companies that invest in inventories, equipment, and buildings, mutual funds companies invest in common shares, corporate bonds / debentures, and government securities. There are mutual funds companies that specialize in a particular sector; these are called special mutual funds.

SOME EXAMPLES OF SPECIAL FUNDS

- Futures funds (commodity funds): this is a kind of mutual fund that specializes in trading futures contracts.

- Hedge funds: this is a type of mutual fund in which positions are potentially taken in a broad variety of instruments, often including short positions, and often but not always associated with highly speculative trading.

- Managed funds: this is a situation whereby arrangement is made to allow commodity trading advisors to have access to funds for the purpose of trading futures contracts for a client. This is often time structured as private arrangements, futures funds and commodity pools.

MUTUAL FUNDS BOOKS FOR SALE

EXCHANGE-TRADED FUNDS

Exchange-traded funds (ETFs) are new generation of mutual funds that are publicly traded on the floors of many well established stock exchanges. ETFs are unique type of mutual fund whose shares are traded in a manner similar to the shares of an individual shares.

One of the advantages of ETF over traditional mutual fund is the fact that exchange-traded funds are priced more than once per day, which makes it possible for ETFs to reflect the price of the underlying stocks.

Again, other than the regular brokerage commission to buy and sell the shares, ETFS have no other charges like; sales fees and redemption fees which make it have low operating expenses.

OPERATIONS OF MUTUAL FUNDS

By investing in mutual funds, you simply place your money in the hands of professional portfolio managers. The duty of the fund manager /portfolio manager is to scout for undervalued stocks/shares invest in and sell over valued stocks.

You pay certain amount of money to the professional investment managers as you don’t expect them to give away their most valuable asset -time- for free. You will pay an annual fee to the fund manager which is calculated based on the value of the assets managed by the fund. The typical range of annual fee changed by most mutual funds is 0.5% to 2.01% of the total assets managed by the fund.

The accepted practice is for the management fee to be deducted from the mutual funds income thereby resulting to a reduced return that will subsequently be distributed to the shareholders of the fund. It is from this management fee / annual fees that; salaries, rent, overhead, etc are paid from.

Some funds still require that their shareholders pay additional fee to cover distribution cost. This is called a 12b – 1 fee. Make sure you read the terms of service (TOS) before buying into a mutual fund.

Majority of the mutual funds charge investors a sales fee called a ‘load’. A load is levied to provide compensation or commission to the salespersons who sell the funds shares to the investors. This sales fee typically range from 3% - 7% of the amount that you invest in a fund.

The value of the mutual fund (share price) of a mutual fund is determined by dividing the mutual funds outstanding share by the total market value of all the shares the fund has invested in. this is technically called the funds net asset value (NAV). For example, suppose a mutual fund invests in four common stocks and the market value of the stocks are:

- 100 units x $4 = $400

- 50 units x $2 = $100

- 110 units x $2 = $220

- 40 units x $3 = $120

$840

If the number of the outstanding share of the mutual fund is 100 shares, then the net asset value of the fund is $840/100 = $8.4 per share. Note that this illustration is made simple for you to understand the concept of NAV. Mutual funds in practice hold hundreds of thousands stocks in their portfolio. The funds NAV increase when the market value of the shares in her portfolio increases when the market value of the shares in her portfolio increases and vice versa.

Some mutual funds limit their investments to certain prescribed industries – e.g. ethical funds green funds, religious funds, etc. The only problem with these kinds of specialized funds is that the benefits of diversification are not fully tapped into. The basic idea of diversification is to reduce the volatility and variability of returns caused by industry specific variables- like seasonal variation. In technical term, one of the benefits of diversification is to reduce unsystematic risk.

BENEFITS OF MUTUAL FUNDS

- Reduction in risk

- Requires little capital (money) to reduce risk

- Stability of returns

- Relieves us of monitoring stress

- We leverage on the expertise of professional traders

Risks of investing in mutual funds

- Additional cost of annual fee

- Mutual fund may collapse

- Manager may not be competent

- May not have liquid market – except for ETFs

Like I have said before, make sure you invest some time to read up the TOS of the mutual funds and read up other materials on mutual funds like the ones displayed in this hub (the right side) before buying into any mutual fund.

Mutual funds investing / investment in mutual funds can help achieve your investment goal which you must have sat down to discuss with your financial planner but only when your investment goal and that of the mutual fund is reasonably aligned. Above, do not forget the place of financial management in your overall portfolio.

WARNING! NEVER ATTEMPT TO TIME THE MARKET, UNLESS YOU ARE A PROFESSIONAL TRADER, EVEN PROFESSIONAL TRADERS FAIL. INVEST GRADUALLY OVER A LONGER PERIOD I.E SPREAD YOUR INVESTMENT!

Best of luck in your mutual fund investing!