naturgal gas

US natural gas price outlook and equities

Figure 1 shows the price development of us natural gas prices. Natural gas prices slipped below 3 USD per mmBtu in 2009 and below 3.5 USD per mmBtu last summer. Currently it is just below 4.5 USD per mmBtu. Natural gas prices have risen after the Japanese nuclear accident.

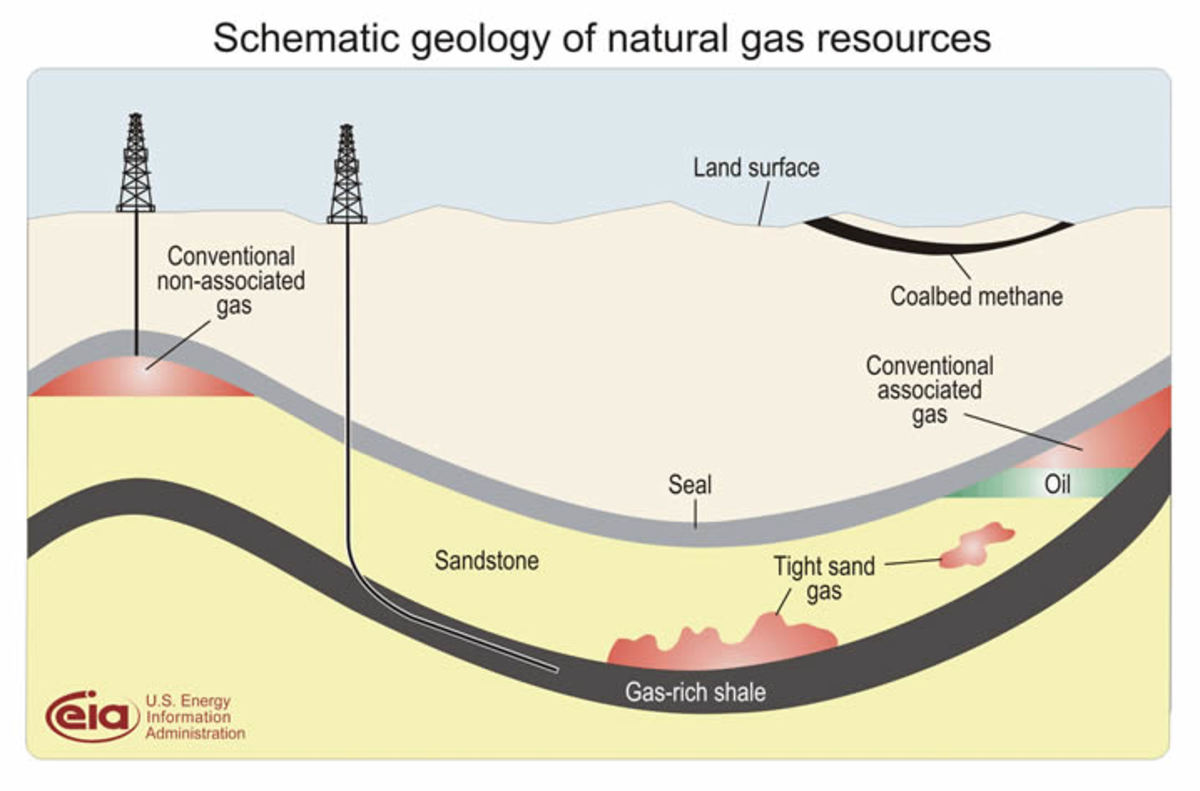

The destruction of several Japanese nuclear power plants including infrastructure and a possible full decommissioning of 7 German nuclear plants have created an additional demand for natural gas. Japan will also have an increased demand for liquefied natural gas (LNG) for power generation. Global LNG transport volume has been increasing and a European spot market has been able to challenge the conventional pipeline prices from Russia. New drilling technologies have extracted a large amount natural gas in the US. From 2003 to 2008 natural gas broadly traded in a range 6-8 USD. The new supply of gas has caused the prices to drop to 3-4 USD. The US also plans to turn excess shale gas into LNG export. China has five receiving LNG terminals at various stages of completion. Japan has also expanded existing LNG terminals. Globally natural gas is a key source for electricity generation and industry purposes. Natural gas power plants have higher efficiency and shorter construction time than comparable power generation technologies. Moreover it emits less carbon dioxide than coal in power generation. Furthermore natural gas can potentially be used to fuel cars and trucks. Finally China and India have increased their imports of gas substantially the recent years and the trend is likely to continue.

At the current market prices natural gas stands out as one of the cheapest energy sources. Commodities have a cyclical nature and thus we can expect prices to rise.

Excellent share plays on natural gas is oil (and gas) major Statoil and Golar LNG, both denoted on Oslo stock exchange. Statoil also has a high dividend yield, around 4%. Both shares trade above their 50, 100 and 200 moving averages (Figure 2 and Figure 3). In the short term some caution is warranted for Golar LNG as the RSI stands around 70.

Figure 1. US natural gas price development.

Figure 2. Share price development for Statoil.

Figure 3. Share price development for Golar LNG.