Stock Market Corrections: How Good News Can Mean a Loss for You

Everyone probably knows that the stock market is a volatile place; billions of dollars can be gained or lost in any given day. Winning the stock market game is really a combination of several things. In addition to having a sound investment strategy (and a little bit of luck), investors need to pay close attention to what is happening in the business world around them.

Many small-time investors will use the standard news media outlets to stay informed about the companies that they are investing in. In general, this is a good idea, however there are many pitfalls that can result from doing this. Among other things, one major pitfall of relying on the news is that sometimes a stock price can actually drop significantly in value immediately after good news about a company is announced. Some examples of stock devaluing news could be record profit announcements, introduction of a new and highly anticipated product, or even a publication about a change in staffing. Many of my business friends have suffered losses due to this exact situation in the past. So exactly how and why does this happen and can it be prevented (e.g. could a savvy investor predict drop in price and avoid a loss)?

Investors' Perception

An investor's perception of the current and future conditions in the market can play a significant role in the price of a stock. A stock’s price rises when investors believe that a company is going to generate a profit. It falls when investors believe losses will occur. Essentially, the stock prices are really in indicator of what investors' believe will happen in the future. It's the investor's expectations of future prices that really impact what happens in the market.

Sometimes when good news is reported it is often falls just short of the projections (i.e. below investor expectations). When this happens, a market correction occurs and the price drops to account for the fact that expectations were higher than what was reported. If a company's revenues and profits do not meet investor expectations, then the stock's value should go down.

Market Manipulation

While investor perceptions clearly impact the marketplace, there is sometimes a little bit of market manipulation afoot. Take the following scenario for example:

First, an investor who wishes to make a profit on business’s rise in value needs to get in on the action before the value rises and good news is reported. Once good news of huge profits is reported (which is often coincident with a peak stock price) a flood of new investors will arrive to buy. Intuitively, this should cause the price to increase but in many cases the opposite actually happens. Essentially, the savvy investors (ones who already own the stock) can manipulate the market by selling at a high rate within hours of hearing the good news. This mass sell off of stock causes the price to drop (as supply exceeds demand) and the unsuspecting buyers that eagerly jumped on the bandwagon too early experience an immediate loss.

While market manipulation is possible, the most likely reason that a stock's price will dip after the onset of good news is investors' expectations.

Real Life Examples of This Phenomenon

Short Term Losses - Apple (NASDAQ:AAPL)

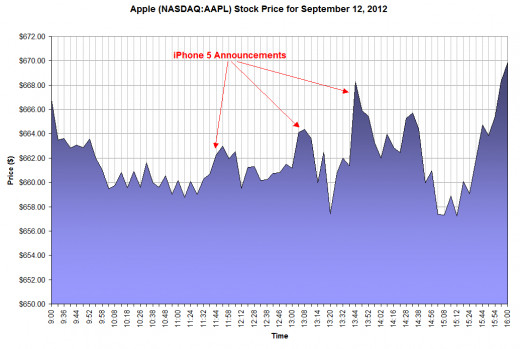

On September 12, 2012 apple's stock opened at $666.85. By midday the average price was around $664. At around this time apple did a press release officially unveiling the new iPhone5. The stock prices that coincided with the news releases from the various major media outlets were at short term highs. In the hour that followed each announcement, the prices fell - sometimes by as much as $5 per share. Within 2 hours of the announcement period, the stock had plummeted in value to just $657.32.

Fortunately for investors, Apple's stock quickly rose again to close at $669.79. By the close of the next day, Apple's stock had set a new record high. It's interesting to see how the value initially dropped after the announcement before it began to rise again later on.

This phenomenon has also been documented for the other great products that Apple has. For more information about Apple's price fluctuations, check out this great article about how iPhone announcements impact Apple's Stock.

Long Term Losses - Google (NASDAQ:GOOG)

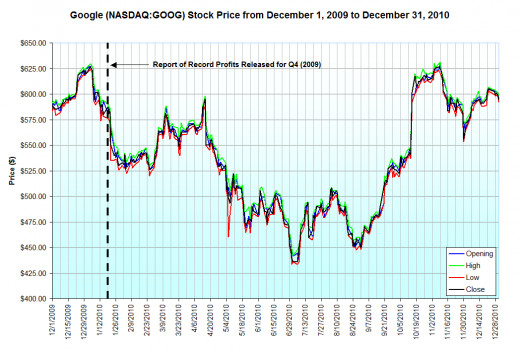

A more poignantly visible example of this phenomenon occurred with Google's stock in early 2010. On January 21st Google reported record breaking profits for the 4th quarter of 2009 yet its stock prices fell after this news. The stock price opened that day at $583.44 and plummeted to $572.25 shortly after the news was reported. By the end of the day the stock's value was reported to be $582.98. However, in the months that followed, Google's stock value continued to tumble downward like a roller-coaster without brakes. At times, Google's price even fell as low as $433.63 per share - that's a loss of almost $150 per share in just a few months time! It wasn't until October of 2010 that the stock's value finally returned to pre-news levels. The graph below shows Google's stock value from December 1st, 2009 to December 31st, 2010.

As a side note, further analysis of the market, investor perceptions, and news reports would be needed to determine if there were other factors that contributed the Google's nine month loss of value.

An Uncertain Future - Ford (NYSE:F)

In 2011 Ford announced that it had earned $6.6 billion, or $1.66 per share in 2010, more than double the $2.7 billion it made in 2009. That was the most it's made since 1999, when it earned $7.2 billion. However, the stock market responded to this announcement by sending prices downward by more than 13%.

A Self Fulfilling Prophecy?

Can this sometimes strange situation in the market be avoided and prevented? Probably not. Financial reporting is done on a quarterly basis and there is an expectation that the market will behave a certain way when the actual performance of a stock is above or below the projections. Many investors know that hot stocks are volatile, popular, and subject to large variations in price in short periods of time. Market fluctuations can sometimes be attributed to "a self fulfilling prophecy" rather than just market manipulation on the part of investors. Like many investors will tell you, the stock market is just as much about having business knowledge as it is about having knowledge about how populations make decisions and behave as a whole.

Good News Isn't Always Bad

Sometimes when good news is announced, the stock's value does not take a dip. Let's take a look at Google (NASDAQ:GOOG) again: At the end of the day on September 5th, 2012 Google unveiled 3 new phones that would be up for sale in the near future. On September 6th, the stock price opened at $685.96 and rose steadily to close at $699.40. In this case no appreciable dip in stock value occurred when the announcement was made. It's likely that this was partly due to the late afternoon timing of the announcement.

In the case of Apple, the announcement of the iPhone 5 eventually lead to a record stock value - however, this did not occur until the next day.

What Can We Learn From This?

I have always heard that it’s best to invest in individual stocks4-6 weeks prior to the end of a quarter when the actual profits will be reported and compared to the market projections and expectations. If you already own the stock, it may be best to sell right at the onset of good news if you want to avoid a short term loss. However, when you see the value drop steeply don't panic - the drop in value is usually only temporary and in no time the price will be back up to pre-news value. Over the long term good news will generally relate to an overall increase in stock value.

Another key talking point here is that it should be clear that it is not a good idea to buy individual stocks. Having a diversified portfolio is the best way to go. The more you diversify, the lower your risk is of experiencing a loss is.