What is Considered a Very Good Credit Score Range?

The average consumer wants to fall into a good credit score range, but unfortunately many don’t. Having a good credit score is very important in today’s world, in fact our survival could depend on it. In times of financial crisis, those with low credit scores could be locked out of the credit pool. This could have disastrous consequences in times of emergency, for obvious reasons. Fortunately credit scores can be improved if they are at the low end of the scale, and it doesn't take much time or effort to do so. It does require discipline however, but a concentrated effort could see your credit rating rise to a decent level.

The average credit score in America is around 720, but most scores fall in the 620-750 range. That figure varies according to geographic location however, and the average score could vary by as much as 50 points from one state to another. Additionally, your credit score with one credit bureau could be above average, while being lower than the average with another.The average credit score range in the USA is calculated by factoring in scores from all three of the major credit bureaus – Experian, Equifax, and Trans Union.

An individual’s score will be different at each credit bureau, as they will all have information from different creditors. A person’ score might be 710 at Experian, 660 at Equifax, and 690 at Trans Union. Creditors use the average score however, which is determined by dividing the sum of all three individual scores by three - the number of credit bureaus. In this case the person’s score would be 686, much better than their lowest score of 660.Consequently the individual's credit score stays out of the poor range it would have fallen into if the lowest score was used.

The absolute poor credit score range is between 350 and 500. As credit scores range between 300 and 850, below 500 is considered an exceptionally bad score, though it is rare for anyone to fall into that category.There are measures you can take to ensure that, not only does your credit score not fall into that below average range, but that it rises to a healthy level.

Understanding What Is A Good Credit Score Range

The Best Ways to Improve Credit Scores

There is no single best way to improve credit scores; it is rather a combination of actions that needs to be implemented. These actions are proven methods of improving credit ratings, and applying them virtually guarantees improving your credit worthiness. It is a fairly simple process, and all that one needs is a bit of practicality and discipline.

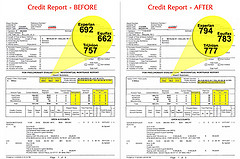

The first thing you need to do is find out what your credit report contains. By consulting your credit report you can look for mistakes or misinformation that might be affecting your rating. Mistakes are one of the major negative influences on a person’s credit score. Sometimes a creditor will report a bill as unpaid or an account overdue when it is not. Another scenario is that they forget to report to the credit bureau when you pay off any outstanding debts.

Removing mistakes from your credit record could improve your credit score by as much as 100 points almost overnight, and doing so is the best way to increase a credit score quickly.

Another benefit of studying your credit report is that you can look for trends or the repetition of certain behaviors that you can correct. Staying on top of bad habits such as paying bills late will improve your credit rating and keep it that way. Your bill payment history accounts for 35% of your credit score, so keeping your accounts current will prop your score up.

The length of your credit history accounts for another 30% of your credit score. Unfortunately there is not much to do to change that unless you have no history at all. If you have no credit history, it is wise to begin one. Open a credit card account and only charge what you can pay off in full every month. This method is one of the most effective ways to raise a credit rating in a relatively short period of time.

Where to Get Your Credit Score

There are two equally reputable websites where you can order your credit report and score.. The first is Annualcreditreport.com which is operated by the three major credit bureaus. You must first order your credit report, and only after you have received it in the mail can you request a copy of your credit score.

The other website is FICO.com. FICO (Fair Isaac Corporation) is the company that first implemented the credit score, and on their website you can gain instant access. You must first sign up for a Free 10 day trial of some of their software, but if you remember to cancel before the 10 days are up, your credit score is free. The credit score you get from FICO will actually be from one of the three credit agencies, Eqifax, TransUnion or Experian, but access is instant and the score is bona fide.

Do You Know Your Credit Score?