Curing the Terminally Ill United States Tax System: Flat Tax and Fair Tax Proposals

The popular saying that nothing is certain except death and taxes fails to recognize that, while people can't halt the inevitable onslaught of mortality, citizens of a free national certainly have the right to investigate and reform their tax system. In recent years, income taxes—and the powerful federal government agency, the Internal Revenue Service that oversees them—have been placed under a microscope for closer examination. If income taxes can be compared to a terminal illness, then maybe 2014 is the year when Americans need to biopsy their taxes. By taking a scalpel to the taxation process and removing the malignant growths, a healthy tax system can be restored.

Did you know that we are tripled taxed on Social Security/Medicare?

1) when payroll taxes are initially withheld;

2) when those withheld payroll taxes are counted as part of the taxable base for income tax purposes; and

3) when the promised benefits are finally received.

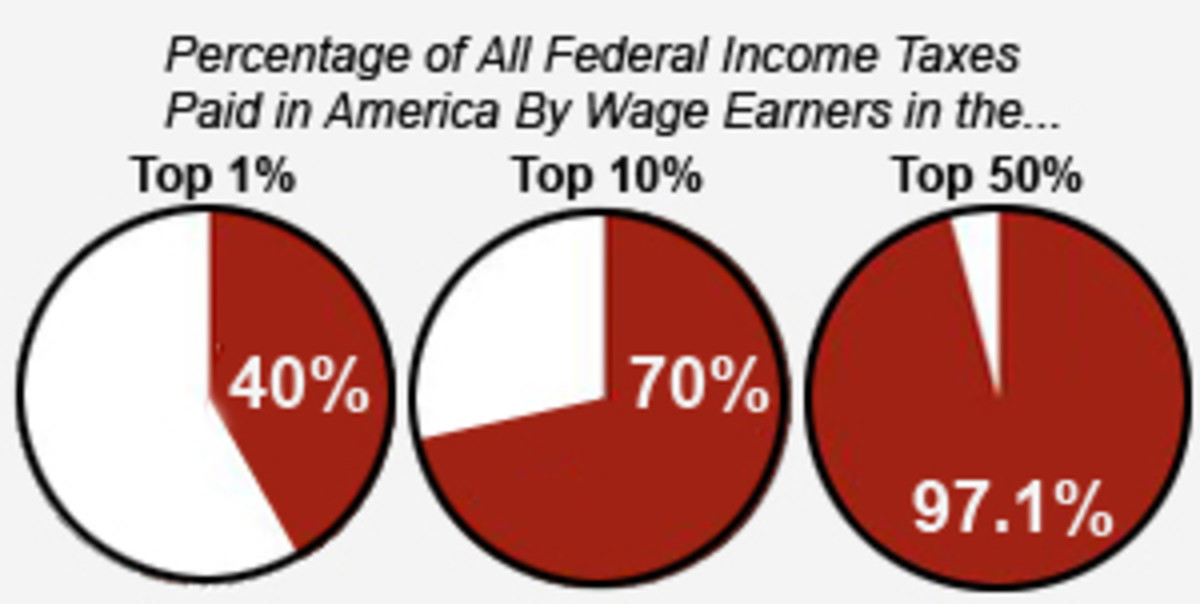

While it may seem to be a daunting task, news headlines in recent years have accelerated the impetus toward change. Americans who are concerned about the nation's tax system have an added reason to distrust the Internal Revenue Service after the 2013 revelation that the IRS was targeting both conservative and liberal political groups that had applied for tax-exempt status. During a time when citizens are increasingly alarmed by the invasiveness of the federal government and the all-seeing eye of the National Security Agency, this news evoked outrage. But the encroachment of the IRS and the perception that the federal government is already too eager to reach into taxpayers’ pockets has generated a vigorous movement for tax reform. The taxation system itself, with six federal income tax brackets that range from 10-35 percent, is severely flawed: the Internal Revenue Code contains more than three million words; and the income tax return process takes an average of 26.5 hours of preparation on the part of the average American.

Flat Tax

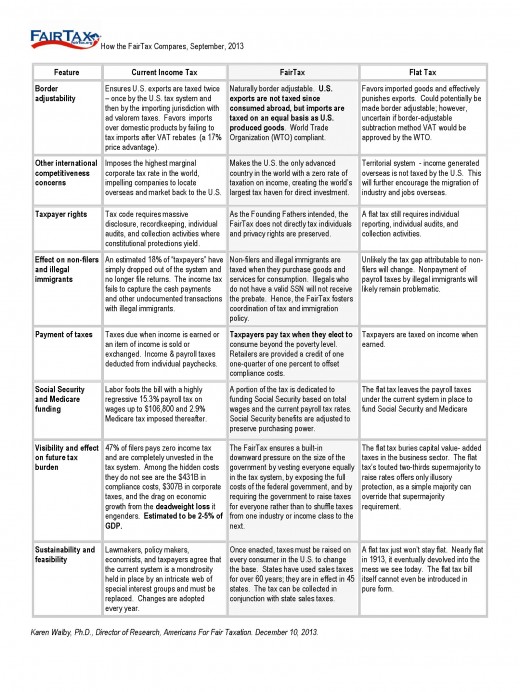

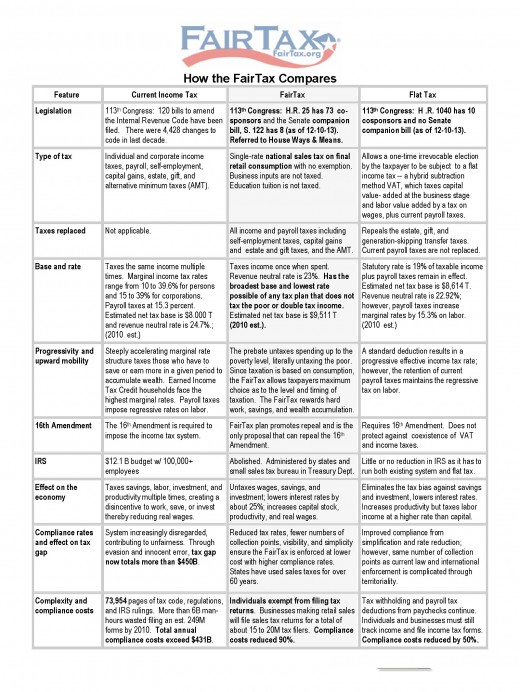

Conservatives and liberals alike agree that a change is long overdue. The two most prominent suggestions are to adopt either a flat tax or a fair tax.

A flat tax, which is supported by FreedomWorks, an advocacy group of six million which supports less government, lower taxes, and increased economic freedom, personal liberty and free markets. They like the simplicity of the flat tax, which would tax all Americans at the same rate, regardless of whether their income was $100,000 or $20,000. The flat tax only taxes earned income; money that comes from sources such as dividends, interest on savings, or capital gains would not be taxed, which FreedomWorks believes would encourage investment.

As FreedomWorks describes the reform, the tax code would no longer include loopholes for special interest groups. The postcard-sized tax form would take an average of five minutes to fill out and file. It's worth noting that although the federal government imposes a progressive tax, seven American states already tax their households at a single rate; these states include Pennsylvania, Massachusetts, Illinois, Indiana, Michigan and Utah.

Fair Tax Act

In 2003, the Fair Tax Act was created by the Americans for Fair Taxation. This Act would get rid of the Internal Revenue Service. The 16th Amendment would have to be repealed. Instead of personal and corporate income taxes, Social Security and Medicare taxes, estate, gift, capital gains, self-employment and alternative minimum taxes, a federal sales tax of 23 percent would be imposed.

Fair tax advocates also find inspiration in the idea of having a simplified code with which to work. Their proposal to Congress is outlined in 132 pages; in comparison, the current code that takes up 60,000 pages. With the fair tax, the income tax is gone, and the money that you earn is the money that you see in your paycheck.

Because you pay the tax as you purchase items, you determine how much you'll be paying: if you spend less, you pay less in taxes. With a fair tax, loopholes that play to the advantage of those with higher incomes are no longer an open-all-hours playground for people who have managed to use the tax system to support their extravagance. The playground is closed. Instead of being taxed on every dollar earned, Americans would be taxed on every dollar spent.

How the Prebate Works

In order to counteract the financial hardship that a 23 percent sales tax would inflict on the poor, a low-income family of four would receive a “prebate” that’s the equivalent of 23% of the poverty level, or $525 per month.

Which one do you like?

Fair tax proponents believe that the country would financially benefit from this reform because the increase in consumer spending that would develop because workers hold onto their pay would create an increase in productivity, jobs, GDP and wages.

As Americans become more invested in the different tax options, the federal government would do well to remember that it was the simmering resentment against British taxation that inspired our colonial ancestors to rise up against tyranny.

You may also be interested in:

- April 15: What Does Your Government Owe You?

Americans spend six billion hours every year in the process of preparing their taxes--filing, saving and sorting their receipts, meeting with lawyers and tax accountants, not to mention being audited. - The Call for an Article V Convention of the States | Shrinking Government News Watch

- We the People: Yes, That Means You!

Did you know that the Constitution’s Article V was designed to protect Americans against a federal government that has expanded its power at the expense of the states?

![Obama's General Motors [GM] Tarp Bailout - The Untold Details Obama's General Motors [GM] Tarp Bailout - The Untold Details](https://images.saymedia-content.com/.image/t_share/MTc0MTU0NDA1OTcxNzY1MTE2/obama-general-motors-gm-tarp-bailout-untold-details.jpg)