Demonetization And The Fight Against Fake Currency & Black Money

The Declaration

8th Nov'16 20:00 hrs, truly a historic moment in India's fight against the menace of counterfeit currency and black money. Narendra Modi, the prime minister of world's largest democracy and fastest growing economy, left 1.25 billion citizens clueless, declaring the 500 & 1000 rupee(₹) notes (the highest currency denomination) to be withdrawn as legal tender at the stroke of midnight. India woke up to 9/11 to be 'Modi'fied again while the world got 'Trump'ed. A revolutionary move this was, especially targeting the black money piling up in the country and simultaneously forcing the tax evaders and defaulters to come out and declare their undisclosed wealth. For a common man, this was a welcome move, simply because it was targeted against the corrupts and the perpetrators of various illegal activities in the country.

Though from the initial reaction it was hard to conceive if everyone was bedazzled or shell shocked. However, as the dust settled a little and more clarity peeped in, it was evident that there were more buyers than critics of Modi's decision. Surprisingly, a huge decision that was bound to impact 1.25 billion lives received overwhelming support and very rightly so. This decision was applauded as an effort to deal a severe blow if not a knockout punch to the corrupt politicians, businessmen, bureaucrats, money launders, brokers, hawala operators as well as the terrorist funders and the fake currency networks operating out of the neighboring nations.

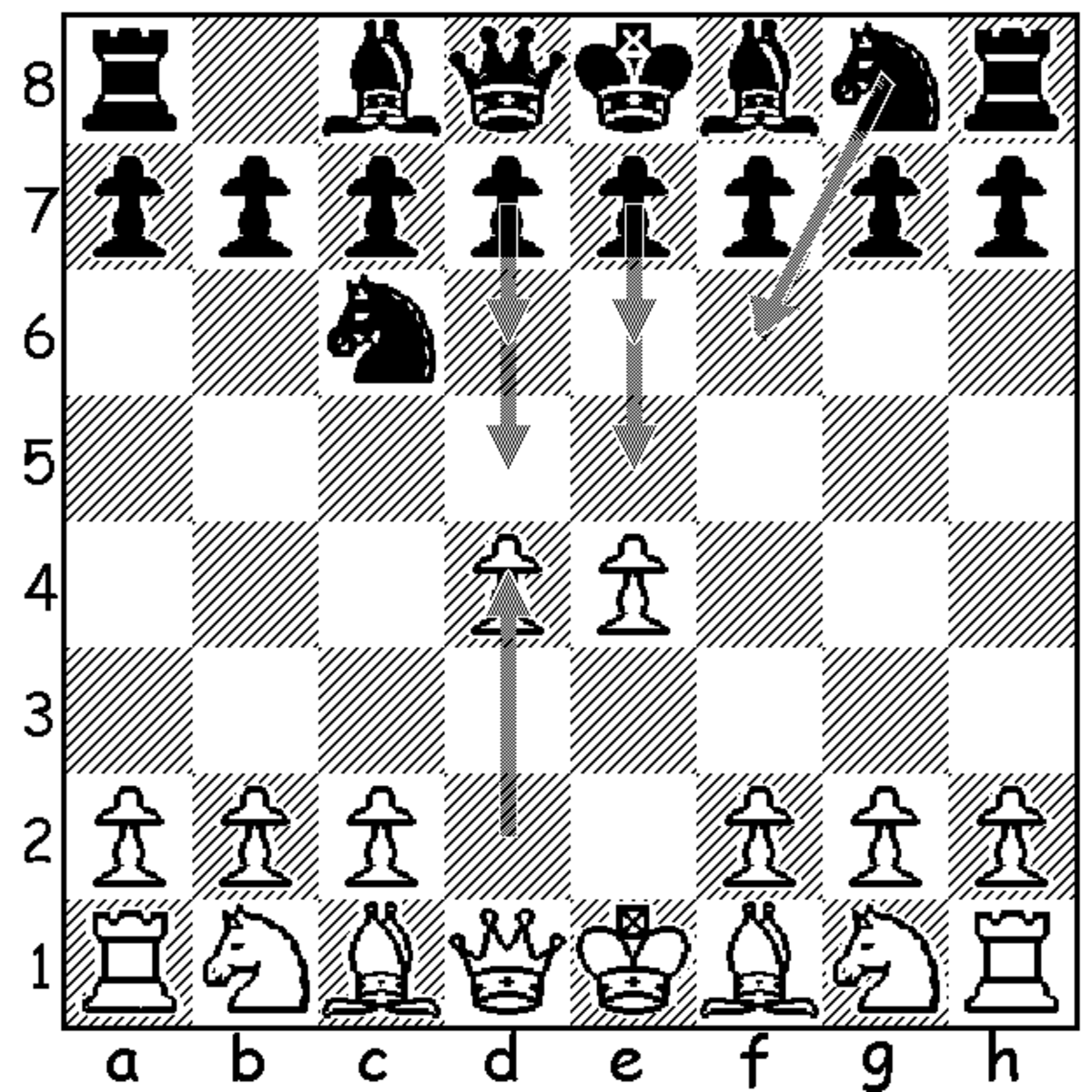

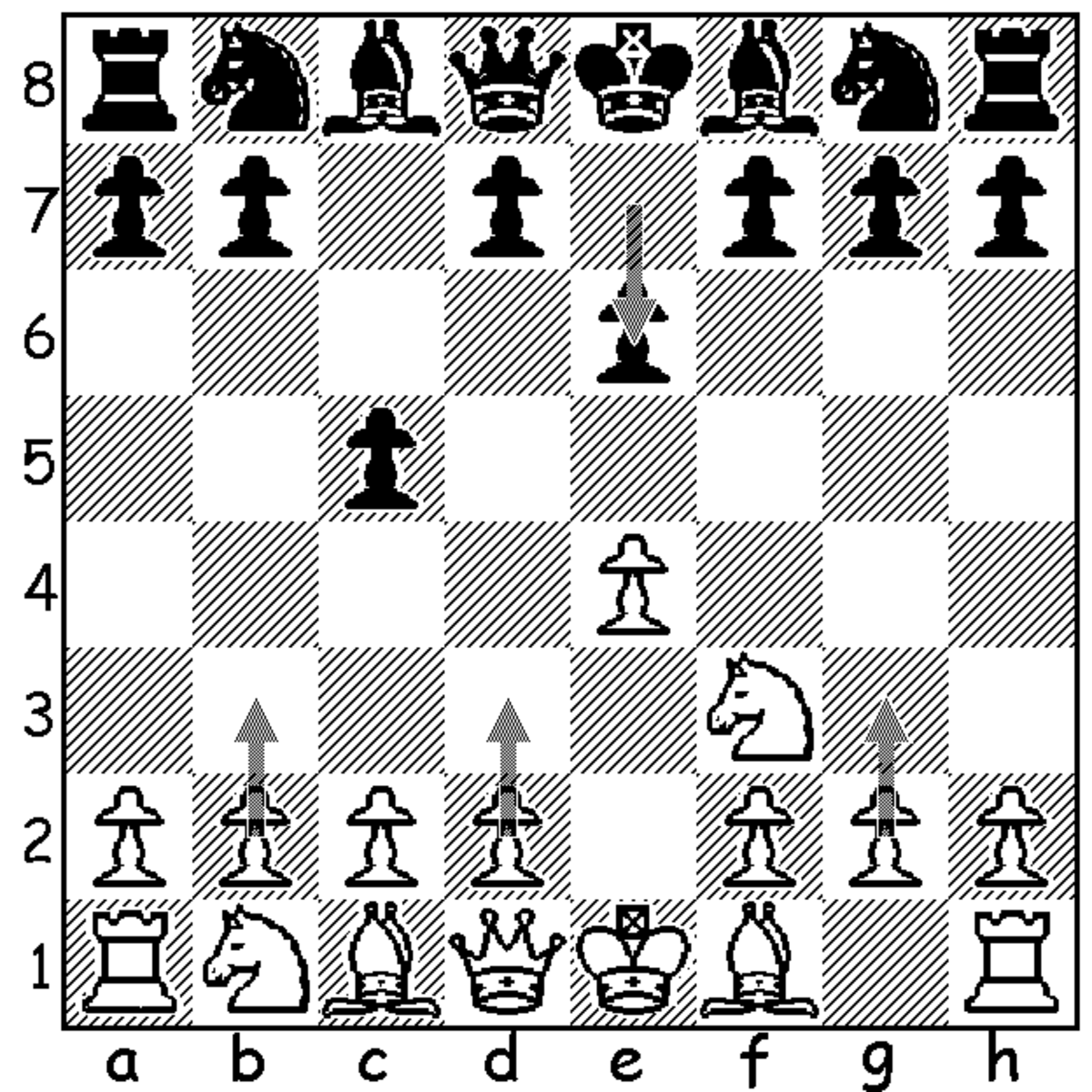

Demonetization History

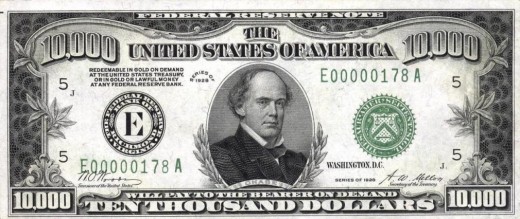

This is in fact not the first time that demonetization has taken place in India, but yes perhaps this time around it is undoubtedly the biggest ever clean-up exercise that has happened without any prior notice. Previously in January 1946 and later in January 1978, higher currency denominations including ₹1000, ₹5000 and the highest ever printed by RBI ₹10,000 were deemed illegal. However as these recommendations were made available in the public domain much prior to the pullout, they failed to yield the desired results.

Even if we were to broaden our horizon a little, we find that even some of strongest and largest economies of the world have undertaken demonetization at some point or are increasingly feeling the need to do so considering the increased influx of counterfeit currency and illegal activities that pose a serious threat to the economic framework of the country. For instance, in the US, the largest denomination currently is $100, after the Federal Reserve discontinued the $500, $1000, $5000 and $10000 bills back in 1969. In May 2016 the European Central Bank (ECB) announced the gradual withdrawal of €500 (₹36,000) by 2018. The immediate impact not on a single but at least 19 members of the European Union. According to ECB, the move is aimed at hampering cash transactions by terrorists, drug dealers, and money launderers. According to a Harvard study, in some circles, criminals refer to the note as a "Bin Laden," after the former leader of Al-Qaida, Osama Bin Laden. It isn't difficult to guess how important higher currency denominations are in this whole nexus of the elites, corrupts and the middlemen.

Finance Minister Speaking On Demonetisation

RBI Addressing Media On Demonetization

Was Government Prepared?

A very pertinent question indeed, especially post considering that this abrupt currency withdrawal has somehow created a crisis situation - a government induced check on one's purchasing power and the utter chaos & struggle outside the banks and ATMs. Again, considering the impact this move was to create and the results that were expected to be fetched by the government this was more like a classified project until 8th Nov'16. Obviously releasing any information even on the preparatory grounds would have had compromised the entire mission. As per the PM's address, government had started working on the new currency denominations at least 6 months before and that too in utter secrecy. Reserve Bank of India (RBI) also worked on tight schedule for the design and additional security features to be embed on the new notes to be inducted. The end result being, making them counterfeit proof or at least too difficult to fake.

Consider the following:

- ₹500 and ₹1000 notes constitute the major chunk up cash flow up to 86% of currency in circulation and hence there is tremendous pressure on the nation’s banking system to replenish the cash. The same can be ascertained from the fact that more than 80 million transactions and an estimate +3 trillion rupees ($45 Billion) have been deposited in Indian banks within just the first week.

- We are less plastic and more of a cash based economy (up to 97%) which adds to the challenge.

- Despite fantabulous response during 'Jan Dhan Yojna' (an initiative allowing the rural sector especially the poor, take advantage of the banking system), a high percentage of villages still remain away from coverage of banking sector or are with minimalistic coverage.

- From bank's perspective they not only lack proper arrangements to handle such a massive scale transition but there's also manpower crunch and logistic issues

- The new notes are 26% smaller in dimension and hence some 200,000 atms across the country need to be reconfigured both at the site and at backend to equip them to dispense the newly introduced currency. The exercise may take anything between 2-3 weeks. Though some banks especially public sector have already expedited the process and started dispensing the new notes

- Despite the daily withdrawal limits at atms, they run dry within a few hours. Their dispensing capacity from an original ₹5,000,000 has come down to ₹1,000,000 due to lack of higher denomination currency. So an atm that was originally being refilled with cash in probably 3 or more days now has a 3-4 hour window. Plus the load is never ending

So if we consider the above basics, from an effective change management perspective one can easily conclude that not all aspects were thoroughly considered. While the deposit/exchange window would last till 30th Dec 2016 but one cannot expect much of a change in the current situation at the banks unless contingency measures are expedited. Cases of violence are still controlled however some disturbing reports of casualties due to unaccounted factors are being reported. Loss of even a single life whether or not it is directly related to the current state of affairs must be taken in cognizance by the government, they just can't brush it under the carpet. A lot of politicians, intelligentsia, think tanks and media houses are also indirectly instigating people with inflammatory remarks, it's essential people exercise restraint and not invite more trouble.

Well thought out move perhaps but well planned, definately not! It would have been great if our politicians whether ruling or opposition and their cadre would have come out on the street and supported the cause instead of taking credits or indulging in mud-slinging!!

Once all atm machines are configured things would ease out a bit. Need of the hour is for people to maintain calm, exercise restraint and support the initiative, foot-falls if any should be highlighted too. Avoid visiting banks and atms unless its really urgent thereby helping the needy ones. While in queues cooperate and make way for senior citizens and specially abled folks and the needy ones!

Have Your Say..

What are your views on withdrawal of 500 and 1000 Rupee notes?

The Other Side Story

A much-needed reform, however, will it change the status quo, only time will tell. One thing for sure though the black marketers have been caught pants down with this move. They are desperate and trying to fix in their black money somehow somewhere. Post demonetization the govt also announced that deposits in savings account beyond a sum of ₹250,000($3,800) and current account of a person beyond ₹1,250,000 ($18,385) will also call for income tax inquiries along with 30% tax and a 200% penalty and that's what has added to the woes of the block. This shadow or the parallel economy where black money provides the much-needed liquidity has suddenly gone frozen. Seeing the reaction of opposition parties including those that once proclaimed themselves as crusaders of the fight against black money and corruption, it's not difficult to ascertain they are all in a fix - 'can't throw the illegal cash out neither can swallow it'. Upcoming elections in major states and scarcity of finances are further infuriating them.

But then as they say we Indians always work our way out, since time immemorial we have banked on our indigenous technology called 'Jugaad' (solution for every problem) and that is what's happening currently as well. In fact, it began moments after PM's address on the 8th of Nov'16. Few are highlighted below:

➤Jewellers in several parts of the country stayed open late post the announcement. In Zaveri Bazaar, Mumbai, alone an estimated 250 kg of gold, worth an estimated 750 million rupees was sold within a few hours of the ban. Sting operations carried out by media in Rajasthan and other states revealed that the practice is still at large with old money being actively converted into gold at 30 to 65 percent extra, above the existing rate.

Government and Income tax department has certainly taken this into cognizance and is tightening the noose around the defaulters, apart from income tax-raids, cctv footage and sale record of those under suspicion are also being investigated.

➤Another case was that of the sudden spike in the booking of railway tickets, especially for longest routes. Anil Kumar Saxena, the spokesman for Indian Railways, said ticket purchases for first class, air-conditioned compartments, the most expensive category, had surged.

"We usually sell about 2,000 tickets every day," he said. The day after the demonetization measures were announced, that rose to 27,000". A number of passengers booked return tickets for their families in upper classes that amounted to nearly ₹1 lakh. Saxena added.

Officials took note of this sudden spike and apprised the government and authorities post which notification was issued by railway ministry stating, for refund amount reaching ₹10,000 or above, the Railways will only transfer the amount to the customer's bank account and the person will be required to furnish account details for receiving the money while cancelling the ticket.

➤The other scheme, perhaps the most commonly observed, is recruiting labours, rickshaw-pullers, and other low wage earners on a commission basis to stand in the queues for daily exchanges and possibly at multiple banks through the day. Poor or people below the poverty line who have recently opened their bank accounts under 'Jan Dhan Yojana' are also being deployed to deposit funds in their account allowing them to keep some percentage of the deposits and return the rest. Some bank employees and middlemen and also using multiple fake ids to divert cash for a few elites, bureaucrats, politicians or anyone willing to pay extra.

Beside keeping restriction on the withdrawal, deposit and exchange limits, RBI is monitoring the daily trends. It won't be an exaggeration to say that there's a whole war room created. Time to time RBI is issuing guidelines to all the banks, notifying them about the 'Standard Operating Procedure'. Latest one, bank to only entertain their own customers moving forth, the last being use of indelible ink on customers who successfully exchange their own, decommissioned ₹500 and ₹1,000 notes starting 16th Nov. Additionally banks have been advised to ensure customers submit a copy of PAN card for any cash deposit exceeding ₹50,000, if the PAN is not already seeded with the account. Trying to curtail the queues RBI has further reduced the currency exchange limit to ₹2,000 which was earlier raised to ₹4,500.

➤ Religious trusts, places of worship as well as NGOs are also fast catching up as a hotbed of both donations as well as investments. Hundi (Deposit-box) collection at the Tirumala Tirupati Devasthanams (TTD), considered the richest temple trust in India, stands at a little over 200 Million rupees since ₹1000 and ₹500 notes were demonetised last week." Similar spiking numbers have been reported by several major trusts.

The Income Tax department has issued notices to hundreds of charitable and religious organisations in the country enjoying tax-exemptions to inform it about their cash balances as of November 8. The department has asked these institutions to submit their records of cash donations as of March 31 till November 8. The department will scrutinise these documents and details sent to it after December 30.

➤ Not just this, some more clarity in terms of loop holes in our taxation system became evident when a Bihar state based businessman was nabbed with 35 Million Rupees in old currency, that were being carried to the North eastern state of Nagaland on a chartered flight. The obvious reason being that this was black money but it being transported this far was owing to the fact that members of tribes living in Nagaland, Manipur, Tripura, Arunachal Pradesh, Mizoram and the Assam hill tracts are, by law, exempt from tax on income earned within the region. In essence, this means there is no concept of unaccounted-for wealth or black money. For the insurgent groups that indulge in extortion, loot and organising strikes(bandhs) to fund terrorism in the region, this would undoubtedly be used as an opportunity to convert their cash chunks which are anywhere beyond hundreds of million and not just them but several politicians and businesses have suddenly found a new tax-free paradise for parking black money.

Government is yet to take cognizance of this and to counter this move will not be easy as it would demand changes in taxation laws! Needless to mention that our banking system is also becoming increasingly complicit and only time will tell how the government would make amend there.

How about...

Amidst all this crazy chaos, the humanity definitely had something to gain. A lot of good samaritans countrywide are proactively coming out on the streets helping their fellow-countrymen exhausted in queues with refreshments and even completing the relevant paperwork for those that cannot read&write. Much appreciated gesture especially when they are devoid of self-interest and come exactly when there is an urgent need.

The Road Ahead

All in all, this is a tough move, probably a risky one too, but for the greater good as it seems so far. The sudden removal and replenishment of 86% (nearly ₹14 trillion) of the entire currency in circulation and that too with India being predominantly a cash based economy (97%) adds to the intensity of the challenge making it four-fold. And yet there's more to it, the real fight for the government authorities only begins post the deadline ends with the dawn of the new year. Perhaps not just another scare-tactics if we do recall the Income Declaration (IDS 2016) amnesty scheme, the government had then clearly warned of repercussions for tax evasion and black money hoarding. And now it came with this shocker!

Though how much of an impact this will have on black money is yet hard to predict and will only be pre-judging the situation especially considering the fact that this is such a deep rooted problem. Yes! Of course, it will not eradicate black money from the country right away at least not so soon, many stringent measures are required from the government in that direction beginning with action on the huge chunk of cash stashed in safe havens abroad. Stronger laws to handle the money laundering and hawala practices. It would also be interesting to see how the government deals with those that have or are illegally converting the banned currency into jewellery, gold, foreign exchange etc and are actively hoodwinking the system by abusing the loopholes or finding loopholes in the counter measures that the government is introducing or planning to bring forth in the future.

One thing is evident that the suddenness of this move will definitely act as a deterrent to black marketers in the future. It will go a long way in limiting the circulation of black money as well. The immediate effect, a certain one would be culminating the fake currency in circulation thereby thwarting the funding of terrorist groups both from outside the borders and the insurgents' groups inside, including those in the North East region as well as the ones along the Bihar-Chattisgarh-Orissa belt and further down. In the longer run, the government aims to also move the economy from increasingly being cash based to cashless, creating a more fair system where taxation also eases with a wider reach. A cashless economy seems to be the way forward however in a country where every transaction is more or less cash based this transition too seems like a mammoth task. Terming the move to demonetize high-value notes as "masterstroke", industry body Confederation of Indian Industry (CII) said it expects the economy to emerge much stronger after a short period of some pain when it adjusts to the sudden withdrawal of cash. CII in a statement said the prevalence of cash use has also made India prone to high inflation, adding corruption and excessive cash use tends to erode the purchasing power of money. Prime Minister Modi has also warned that he would wreck more havoc on the black money camp and that the next step in his war on “black money” and corruption would be a crackdown on benami (unregistered) properties. A herculean challenge lies ahead of government is this transition period of currency replacement as things don't seem to be as smooth as they were expected.

Change is inevitable, only time will tell how this somewhat chaotic situation will end. It certainly cannot and shouldn't fail. The citizens are acting responsible despite hardship and playing their part well, now the ball is in government's court. What they make of it is totally upon how they take it from here. It's a democracy we live in and I am sure the government is also well aware of it. Whether demonetization is hailed or becomes a speed-breaker on road to 2019 is all in the government's hand.

The Fallout

So demonetization finally happened and it's already been eight months as of today (Sep 1st, 2017) since India stepped into the post demonetization era. Although it hasn't been a considerable time to gauge the outcome, still in light of the plentiful detractors of this exhausting exercise, it's of paramount importance to discuss the same.

The RBI in its Annual Report for 2016-17, released earlier this week, made the following observations:

- ₹165 Billion out of the total ₹15.44 Trillion of the old high denomination notes have not returned into the banking system. This implies that 98.6% of the demonetized currency came back into the system.

- 256,324 pieces of ₹1000 as counterfeit which is just about 0.0035% of the total count and 317,567 pieces of old ₹500 were detected as counterfeit.

- The data further revealed that there were 6,326 million pieces of ₹1,000 in circulation as on March-end 2016. In 2016-2017, another 925 million pieces were supplied in the system by the printing presses. Only 89 million ₹1,000 banknotes were never returned after the demonetization exercise which is precisely 1.2% of the total count.

Finance Minister Arun Jaitley, defended the move stating "the fact that money got deposited in banks does not mean that all of it is legitimate money. "It's nobody's case that black money has been completely eliminated after demonetization. Coupled with GST, demonetization will give a significant boost to direct tax revenues as many people have come under the tax net."

While the former Finance Minister P Chidambaram reiterated that the whole exercise was nothing but a failure. He said he was wondering if demonetization was a scheme designed to convert black money into white.

The tall claims made by the government as of now seems to have fallen flat. Undoubtedly the government throughout has kept shifting the goal post and even as the RBI numbers tell an otherwise story, no acknowledgment whatsoever has been observed from the governments' end. Here's a quick summary:

- As far as flushing out black money goes, it's anybody's guess that the move was an epic fail considering most of the money returned back into the system. All is not lost though and the positives to look forward would be if the government will the help the Income Tax department is able to frisk through the illegitimate transactions and identify the black cash. But that certainly would be a daunting task

- The economy as it has been severely impacted beginning the last quarter of 2016. FY 2017 has kicked off with a 5.7 Growth Rate which is perhaps the lowest in the last 3 years. Again a time bound recovery with the right noises made is very much achievable

- Was the terror financing and counterfeit currency curtailed? Perhaps not, as we witnessed increased unrest in the Kashmir valley and even Naxal and Maoist activities too were observed. The fake currency already started flowing in from neighboring countries (Nepal, Pakistan and Bangladesh) even before the exercise was completed and the trend continues.

- In terms of increasing the tax base, there has been some considerable upward movement an that as of now is definitely one positive aspect of the whole exercise

- The country has also witnessed awareness and to some extent trust in the digital mode of payments. Road to less-cash economy though still is far off reach and much more streamlined efforts are needed