Why do Federal Income Taxes get a Bum Rap?

FEDERAL INCOME TAXES DO A LOT OF GOOD BUT GET A BUM RAP INSTEAD. There is a myth generated by the Conservative propaganda machine that federal taxes are inherently bad, in fact, some want you to believe they are evil. They want you to believe that federal tax dollars do little good but line the pockets of donors or are wasted on helping those who can't help themselves(the "can't" is quickly reclassified to "won't" as soon as one case of fraud is found). There is this assertion that federal taxes can't create jobs; and the list goes on. I am here to tell you, all of these bumper-sticker, sound-bite, howlings regarding federal taxes are a bunch of b... malarkey!

There are many ways to debunk the Conservative's message and I will use three in this hub. But first, let me go over my standard pitch about taxes and their uses. Our government exists to fulfill the duties laid on it by the Preamble of the U.S. Constitution in its contract with the People of America. Among other things, it is to provide for the common Defense and the general Welfare, two items mentioned in both the Preamble and Section 8, Article 1. The body of the Constitution goes on to create the government and establish the mechanism by which it will operate. It also tells how Congress is to fund the government to carry out the Preamble's duties. It does so in Article 1, Section 8, Clause 1 - "... to lay and collect Taxes, Duties, Imposts, and Excises ...". Further, as a consequence of Section 8, and many other sections, Congress will pass laws in the furtherance of the goals of the Constitution and leave it to the Executive branch to implement and maintain them using the funding provided by Congress.

What these laws do is create a method by which certain goods and services, such as national defense or the Interstate Highway system, can be provided back to the People. In the end, what these goods and services will be are determined by the People through their elected Representatives. All of these goods and services, as well as the salaries of the federal employees hired to manage and provide the same are paid for through taxes levied on the citizenry and businesses of America; this is what your federal tax dollars are paying for, the goods and services You ordered the federal government to provide, along with the overhead costs that accompany such requirements, of course.

Case #1 - Buying the Next Generation Fighter (NGF) Aircraft

(For those of you who get bored with numbers, you might want to jump down to the bottom line and trust how I came to that conclusion.)

THE FIRST APPROACH I WILL TAKE IS THE SIMPLEST TO UNDERSTAND. the acquisition of common Defense. Everyone, I hope, agrees this is a function of the federal government and, so long as it is needed and not wasteful, should be funded via income tax revenue. Well this "simple" example debunks several of the Conservative myths, one being that "government doesn't create jobs"; Malarkey! (I am taken with that term, if you can't tell.) The federal government absolutely creates jobs both in the private and public sectors and here is how (hang in there).

Let us assume that the Threat has changed and the Air Force now needs a NGF to supplement its current fleet of fighter aircraft. Assume further the initial price tag for the first 200 of these beauties is going to be $120 billion over the 10-year development and production cycle. Where does this money come from?

For this, let's further assume for the moment the debt and deficit are zero while spending is status quo and all, even the most Right-wing Conservative, agree can't be cut any further. Consequently, with this set of constraints the $120 billion must either be borrowed or taxes must be raised; we hate deficits and debt, so the decision is to raise taxes, it is for national defense after all.

[ASIDE - why am I making all of these assumptions? I do it to help control for all of the variables except the one we are considering, taxes. By making these assumptions and holding them constant, I don't have to worry about any changes in them hiding the results I want to show you. This methodology works fine so long as the variables being held constant would have no effect on how all of the variables interact with each other, except for the magnitude of the results. But you might ask, is the situation I am setting up unrealistic? In this case it is not for America has experienced this many times before. Nevertheless, even if it were unrealistic and might not ever occur in real life, it doesn't make any difference for it is the sequence of events I want to show you, not any particular outcome.

So, let me make a couple more "simplifying" assumptions; 1) we are at "full-employment" with the unemployment rate somewhere around 4 - 5% and 2) economic growth is at the sustainable level of 3% - 3.5%/year. What these assumptions accomplish are to eliminate outside economic forces on what choices are made.

OK, with that established, let us look at what happens with your tax dollars as the federal government acquires this Next Generation Fighter. To do so, I will use accounting tools like Balance Sheets and Income Statements to show the flow of your cash dollars.

Cash Flow

OBVIOUSLY, THIS IS GOING TO BE a very simplified picture of what really happens, but I hope it will in sufficient detail to let you see what really goes on with your tax dollar.

YEAR 1: 1) Congress will appropriate money to the Air Force to design and produce the NGF and 2) taxes will be raised to pay for it, $12 billion.

I am going to represent this funding through a series of entries into my "accounting" books set up for both the Private sector and the Public sector. There will be two books (I am being very liberal with my terminology here), one for things that appear on a Balance Sheet (assets and liabilities) and one that appears on Income Statements (income and expenses).

APRIL 15, 2013: So, the first entry you will see is an "Expense" for the Private sector of $12 B and in "Income" for the Public sector of the same amount; these appear in the table labeled INCOME STATEMENT. You will also see a Decrease in the Private sector's Bank of $12 B with a similar increase in the Public sector's Bank (the US Treasury); this is in the table Labeled BALANCE SHEET.

JUNE 1, 2013: The AF establishes the NGF systems program office (SPO) at Wright-Patterson AFB from internal AF civilian and military resources to begin the process of organizing the development and procurement of the NGF. The SPO also starts procuring the supplies they need

JUNE 30, 2013: Payroll for SPO staff goes out but since the personnel are current AF resources, their salaries are already programmed for and not taken out of the new $12 B, but the supplies are. So let's make an entry for money spent on supplies and such until June 30, 2013.

AUGUST 1, 2013: At this point the SPO is far enough along to start hiring contractors to work in the SPO office to begin the initial planning of the Research and Development (R&D) effort for the NGF. These people, more than likely, will come from currently hired staff of the contractor, and not new hires from the economy; let's say 20 are hired at $80K each or $133K/month.

AUGUST 31, 2013: Time to pay the contractors and other expenses. Again, the government payroll is not counted as it was already programmed for using non-NGF tax dollars.

JANUARY 1, 2014: The SPO has an R&D plan and now it is time to put the R&D phase out for competition. To do this requires many more people to accomplish all of the documentation and analysis that goes on in a Source Selection. The SPO hires 20 new civilians and expands the contractor workforce by 80, which requires the contractor to go out on the street and hire. The government folk cost $70K each while the contractors still cost $80K. Between them, that is another $783K/mo plus the previous $133K and we get almost $1M/mo. Toss in another $1M for other expenses and that brings the total up to $2M/mo

JANUARY 31, 2014: Why don't we catch up on our accounting.

APRIL 15, 2014: New tax revenues are received and disbursed.

OCTOBER 31, 2014: Big source selections are like giving birth, long and painful. They may last from nine-months to over a year; ours ends at the end of October. We catch up on our accounting again.

NOVEMBER 1, 2014: The R&D contract for the NGF is let to Boeing Corp and Lockheed Martin for a total of $40 billion to be spent out over three-years and two-months: Boeing and Lockheed will make a 15% before-tax profit. The SPO doubles in size to manage the contract and is spending $10 million/mo.

DECEMBER 31, 2014: Let's make an accounting.

APRIL 15, 2015, 2016, 2017: New tax revenues are received.

DECEMBER 31, 2017: Let's make another accounting

JANUARY 1, 2018: The competing R&D designs are received and reviewed and after about one year, a winner is selected. Costs are incurred by each competing design team during this process as well as for the SPO. A total of $600 million is spent.

APRIL 15, 2018: New tax revenues are received.

JANUARY 1, 2019: Boeing Corp is announced the winner and a five-year production contract is awarded to produce 200 Next Generation Fighters at a cost of $80 billion or $400 million per aircraft (the F-22 was $150 million a copy in 2009$ for lots totalling 195)

APRIL 15, 2019, 2020, 2021, 2022: New tax revenues are received.

DECEMBER 31, 2023: Production and contract complete.

Income Statement

PRIVATE SECTOR

| INCOME

| EXPENSE

|

|---|---|---|

April 15, 2013

| $12 B

| |

June 30, 2013

| $0.0001 B

| |

August 31, 2013

| $0.001 B

| |

January 31, 2014

| $0.006 B

| |

April 15, 2014

| $12B

| |

October 31, 2014

| $0.018 B

| |

December 31, 2014

| $2.115 B

| $0.047 B

|

April 15, 2015, 2016, 2017

| $36 B

| |

December 31, 2017

| $37.076 B

| $0.853 B

|

April 15, 2018

| $12 B

| |

December 31, 2018

| $0.600 B

| |

April 15, 2019, 2020. 2021, 2022

| $48 B

| |

December 31, 2023

| $80.050

| $1.8 B

|

TOTALS

| $119.9 B

| $122.7

|

INCOME

| EXPENSE

| |

PUBLIC SECTOR

| ||

April 15, 2013

| $12 B

| |

June 30, 2013

| $0.0001 B

| |

August 31, 2013

| $0.001 B

| |

January 31, 2014

| $0.006 B

| |

April 15, 2014

| $12 B

| |

Ocotber 31, 2014

| $0.018 B

| |

December 31, 2014

| $0.047 B

| $2.115 B

|

April 15, 2015, 2016, 2017

| $36 B

| |

December 31, 2017

| $0.853 B

| $37.076 B

|

April 15, 2018

| $12 B

| |

December 31, 2018

| $0.600 B

| |

April 15, 2019, 2020. 2021, 2022

| $48 B

| |

December 31, 2023

| $1.8 B

| $80.050 B

|

TOTALS

| $122.7 B

| $119.9 B

|

TABLE 1

Balance Sheet

Private Sector "Bank"

| CASH IN

| CASH OUT

|

|---|---|---|

April 15, 2013

| $12 B

| |

June 30, 2013

| $0.0001 B

| |

August 31, 2013

| $0.001 B

| |

January 31, 2014

| $0.006 B

| |

April 15, 2014

| $12 B

| |

October 31, 2014

| $0.018 B

| |

December 31, 2014

| $2.115 B

| $0.047 B

|

April 15, 2015, 2016, 2017

| $36 B

| |

December 31, 2017

| $37.076 B

| $0.853 B

|

April 15, 2018

| $12 B

| |

December 31, 2018

| $0 006 B

| |

April 15, 2019. 2020, 2021, 2022

| $ 48 B

| |

December 31, 2023

| $80.05 B

| $1.8 B

|

CASH IN

| CASH OUT

| |

U.S. Treasury "Bank"

| ||

April 15, 2013

| $12 B

| |

June 30, 2013

| $0.0001 B

| |

August 31, 2013

| $0.001 B

| |

January 31, 2014

| $.006 B

| |

April 15, 2014

| $12 B

| |

October 31, 2014

| $0.018 B

| |

December 14, 2014

| $0.047 B

| $2.115 B

|

April 15, 2015, 2016, 2017

| $36 B

| |

December 31, 2017

| $0.853 B

| $37.076 B

|

April 15, 2018

| $12 B

| |

December 31, 2018

| $0.006B

| |

April 15, 2019. 2020, 2021, 2022

| $48 B

| |

December 31, 2023

| $1.8 B

| $80.05 B

|

TABLE 2

ALRIGHT, ONCE YOU WIPE YOUR EYES and are able to refocus, what did you observe? First, you might notice the two statements, the Income Statement and Balance Sheet, look identical; this is an artifact of the simplicity of my example. In real life, there is no comparison even though they are closely related, e.g., tax revenues (income statement) are deposited into the bank (balance sheet) and the like for there are so many other things going on that cloud the picture.

The next thing you might see is that Private Sector Income (the amount paid to contractors by the government) is equal to the $120 B tax bill that was originally planned, meaning all of the taxes paid into the Public Sector came back to the Private Sector. This is easy to see because of all of those constraints, assumptions, I levied at the beginning of this case. Even as you loosen those constraints, the process remains the same.

The third thing that might seem a bit odd, is the Private Sector actually paid more in taxes than the $120 B originally required. The reason for this is when the government paid the contractors to develop and produce the NGF, the contractors earned a profit, which, of course is taxable and comes back to the government for use elsewhere. I will come back to this later.

INDUSTRY LEVEL

| GOV'T/CONTRACTOR CONTRACTS

| LABOR EXP

| SUPPLY EXP

| PROFIT

| TAX OF PROFIT (20%)

| TAX ON INCOME (15%)

|

|---|---|---|---|---|---|---|

NGF CONTRACT

| $2.14 B

| $1.61 B

| $0.32

| $0.21 B

| $0.04 B

| $0.24

|

TIER 1

| $0.32 B

| $0.24 B

| $0.05

| $0.03 B

| $0.01 B

| $0.04

|

TIER 2

| $0.05 B

| $0.04 B

| $0.01

| $0.01

| ||

TIER 3

| $0.01 B

| $0.01 B

| ||||

TIER 4

| $0.001

| |||||

TOTAL

| ||||||

$1.90 B

| $0.24 B

| $0.05 B

| $0.29 B

|

TABLE 3

IN TABLE 3, I TRY TO EXPLAIN WHERE THE additional taxes came from. Table 3 can also be used to explain what some call the "economic multiplier" effect (although this effect is most noticeable when applied in cases where unemployment is high and economic growth is low.) What I am attempting to portray with all of these tables and numbers is the cash flow of your tax dollars.

In Table 3, the initial $2.14B of your tax dollars came from the 2013 and 2014 outlays seen in the first five rows in the Cash In column of Table 1 on the NGF program. The next two columns "spend" those dollars on labor and in the purchase of other goods and services; in this case, I assume, for chart purposes, that 65% is spent on labor and 25% on other goods and services; the remaining 10% is considered profit. Following that are two columns displaying the federal taxes collected on the profit (20%) and wages (15%) respectively. The next row, Tier 1, is the receiver of those funds spent on "other goods and services" by the original contractor; they, in turn, spent it on labor, goods and services, and profit. So it goes until the amount spent by a contractor on goods and services becomes too small to count.

Let's take a moment and rehearse.

- In the beginning, the gov't decided they needed the NGF

- Then, because the balanced budget amendment had been passed, Congress could not borrow the money, therefore they needed to increase revenues to pay for it.

- The only route for that is to raise taxes, so they got the 2/3 of each House to go along with the tax increase, because that is what the BBA required for new taxes (I really doubt we would fund the NGF under a BBA, you couldn't get enough consensus).

- Taxes are raised and revenue starts flowing in

- The NGF program is started and some of your tax dollars begin to be spent

- Where are your tax dollars spent? In the Private Sector as pay, e.g. the $2.14 B, the contractors and others received

- What does the Private Sector do with your tax dollars? They pay their employees (taxpayers) a wage, make a profit, and hire other Private Sector contractors who do the same.

- This process continues until 100% of your tax dollars are converted back into wages paid to the taxpayer or profits made by the Private Sector. (Notice the Totals in Table 3, the wages and profits equal the initial $2.14 B in taxpayer dollars spent by the NGF program office.

- Finally, those wages paid by your tax dollars (you paid yourself, in other words) and profits are taxed leading to increased revenues to the gov't.

- The gov't can then do three things with this new revenue, 1) pay down the debt, if there is any, 2) find something else to buy, thereby increasing demand directly, and/or 3) lower tax rates, thereby potentially increasing demand indirectly

Hopefully, with this review and Tables 1 and 3 you have a better understanding that, in the case where the government cannot borrow money to fund its programs (this works for all programs), two things happen that are obvious, 1) the taxpayer gets their money back and 2) the gov't gets new tax revenue over and above the original funding. This last result leads to several other, less obvious consequences, that necessarily follow.

Gov't Spending Does Create Demand

AND, THEREFORE, JOBS. Unlike the propaganda from the Right, government spending absolutely creates jobs in the private sector. This is most easily seen in the NGF case where the gov't decides to keep the new tax revenue and build a surplus.

At some point, since tax rates aren't being lowered, the surplus must be spent for it is not good too accumulate too much wealth (in my hubs on Economics 101 for the Political Junkie, you will see why). Let's say the decision is made to build a monorail system from New York City to Washington D.C. Like the NGF, the Department of Transportation will establish some sort of program office to oversee the program and begin the work of turning the dream into reality.

But, what must they do to accomplish this feat? Hire private sector contractors, don't you see. All of this new work for which the federal government hires the private sector creates demand, not only with the primary contractors, but for those who supply them and those who supply the suppliers. To meet demand, if it is significant, businesses generally must hire more workers to meet it, ipso facto, the government has created jobs by spending tax dollars.

But what if there is no surplus, yet the People want the monorail built anyway. One of two things must happen to pay for it, 1) raise taxes or 2) borrow from domestic and foreign sources. In the former case, either the additional money comes from savings or, if a person has no savings, then the standard of living goes down; in the second case, all of the money comes from domestic or foreign savings. In either case, the money is returned to the economy in the form of increased demand for the goods and services needed to complete the monorail. And when the dust settles, the dollars have either ended up 1) in the hands of workers as pay, 2) business owners as profits, 3) government coffers as new taxes collected, and 4) in the hands of investors as return of principle plus interest, if the money was borrowed.

In the latter case, things get more complicated, for unless the government is running a profit-making monorail (a very rare occurrence indeed) there is little to repay the loan and interest with, isn't there, since virtually all of the money ultimately ended up as wages, profits, and taxes, there isn't much left to repay the loans, let alone pay interest. So, what's to be done; why increase economic growth, raise taxes, cut government spending, or some combination of all three; that is the only way to reduce government debt, of course; which is why the government should be tread very carefully in assuming debt.

Federal Taxes Pays For Needed National Infrastructure and Services

WITHOUT FEDERAL TAXES, THE FOLLOWING ARE SOME OF THINGS which would not be available to the American people at all or yet :

- Army, Navy, Air Force, Marines, and Coast Guard (common defense)

- The Interstate Highway system (common defense)

- An integrated Air Traffic Control system (common defense)

- The Internet (common defense)

- Cell phones, Ipads, or anything else made with microtechnology

- National Parks (general Welfare)

- Clean lakes, somewhat clean air, and similar things

- A nation of forests (general Welfare)

- A somewhat drug-free transportation system (down from around 10% positives in 1986 to 4% today) general Welfare)

- Response to natural disasters, beyond the resources of the State (genera; Welfare)

- Federal Court system (establish Justice)

- a cohesive national foreign policy (common defense, general Welfare)

- and the list goes on and on

Some items on the list our obvious, such as our national defense. at least two might be challenged by a few as abridging State prerogatives, that being the response to natural disasters and National Forests. I left of this lest, although they would certainly be on my personal list, are the various social welfare programs like Social Security, Veterans Benefits, and the like. These are hot button services which a significant portion of our population does not believe the Federal government should be involved.

Others you might find surprising like iPads, the Internet, and their ilk. The Internet was a government funded operation to help conduct government funded research (and yes. Vice President Gore did help by pushing for funding when he was a Senator); it existed at least two decades before the public became aware of it in the early 1980s. Cell phones, iPads and similar devices which rely on super miniaturization of the electronic components likewise came from original technology developed by government laboratories or private labs under contract to the government to such government programs as the Space Program. (The transistor, however, the first true step toward miniaturization, came from Bell Lab's in one of their few basic research projects.)

The point, of course, is that the majority of what you take for granted in your material life today has, at its source, federal tax dollars behind it. Absent that, you might still be living back in the 1920's when the federal government actually did ignore the general welfare of its citizenry, save for national defense (save for the efforts of President Theodore Roosevelt).

ONE COULD GO IN AND ON WITH OTHER EXAMPLES of the benefits of a national tax, be it a federal income tax or national sales tax. The point is, you get what you pay for, And, if you don't want to pay for a functional society that is pleasant to live and get around in, where one has an equal opportunity to succeed so long as they try and work hard, regardless of which state you travel to, then keep fighting for lower and lower taxes or no taxes at all. But if you do want the things states can't or won't provide, then you have to provide for them through your taxes.

Further, if you have a myopic view that a strong common defense is simple having a core military infrastructure ready to accept ready, willing, and able cannon fodder (the way it was prior to 1945), then keep taxes very low. Or, if you are one that believes that in order to protect America's national security interests you need in addition to a strong standing Army, Navy, and Air Force you also have to have an America that is better educated than the rest of the world in all 50 states, more technologically advanced than our major potential enemies, at least as healthy as everybody else, and a population where 3/4 of it isn't living paycheck by paycheck or worse then you have to be willing to to pay for it with higher taxes and a system that is more progressive than it is today or that the right-side of the aisle wants.

While I am on a roll, if you want a strong Nation, the one the Constitution had in mind, rather than 50 weak States, then you best start sending representatives to Congress who have the needs of America uppermost in their mind rather than the state from which they come or their personal ideological principle (do you hear me John Boehner and Chuck Schumer? Please bring back the Tip O'Neil's and Bob Dole's)

To drive home the point, there are simply things the federal government must do, which costs lots of money, to make that happen because states either can't or won't do themselves. e,g,, such as provide adequate schooling for all of their children, desegregate their schools, clean up their environment, provide for the poor and sick, the list goes on. Even before there was a Constitution or a free America, it was patently obvious the could rarely row together for a common cause when, after the initial enthusiasm, they decided to fight the Revolution on theiir own and in large part stopped giving the Continental Congress the funding to prosecute the war. Thanks to the States, it took loans from foreign countries and wealthy financiers (which would happen more than once in our history).along with military intervention from France to carry the day.

After a few national patriots from most of the States figured out a strong central government, with the authority to tax was needed, the Articles of Confederation was replaced with the Constitution. Even with a general taxing authority that could raise money through direct taxes, excise/import taxes and loans, it ended up not being enough; national disasters, wars, and expansion are expensive, you know. Until economists figured out free-trade was a better way to do business for all, the original authority worked well and the federal government ended up with surpluses a few times; having the odd problem of figuring out what to do with it. Some argued spending it, God-forbid, on infrastructure, but they generally lost.

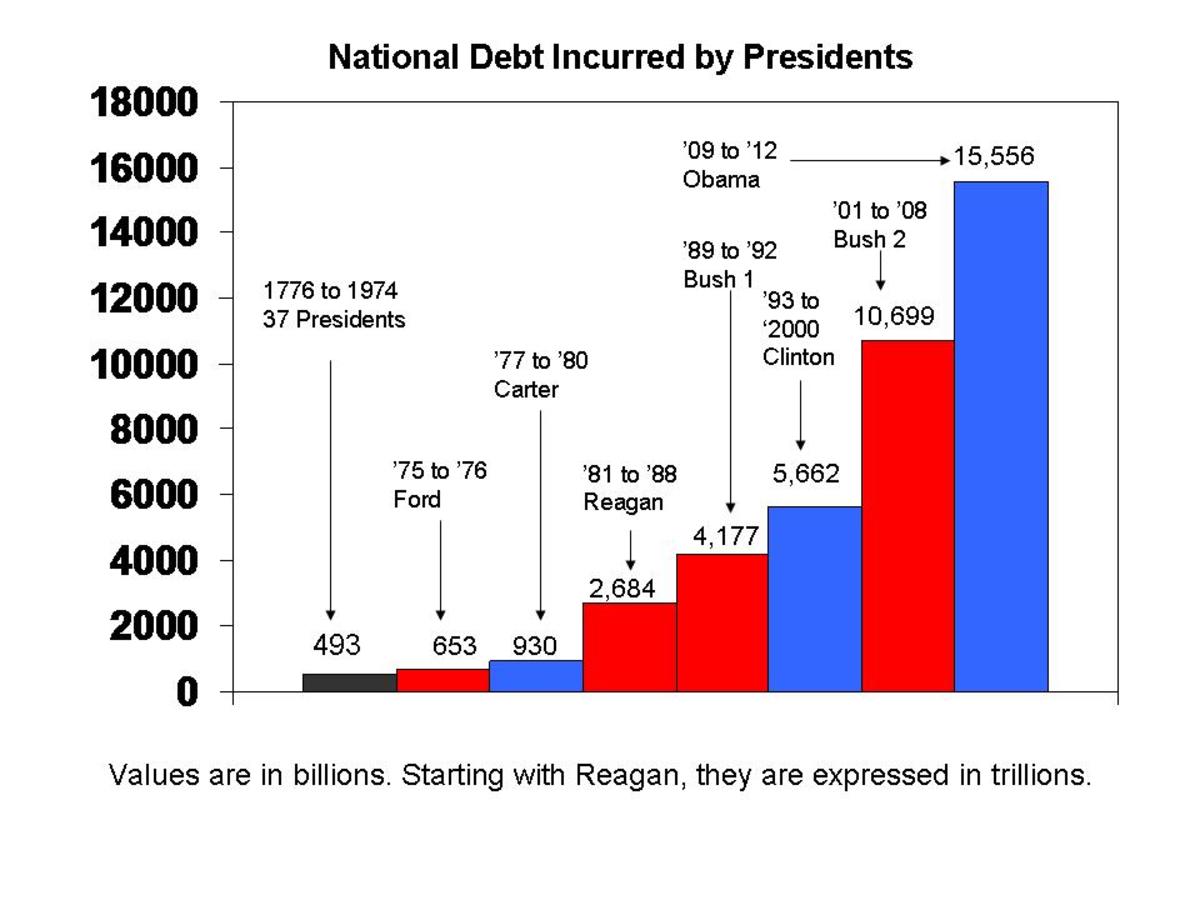

Once the excise tax stopped being a good source of revenue, and alternative was needed so in 1913 the government finally turned to a general income tax; which was challenged, but nevertheless made part of the Constitution with the 16th Amendment. It was made progressive because, in 1913, income inequality was at one of its local highs (it has been surpassed today) and a progressive income tax is one of the more effective ways to mitigate the "rich-get-richer, poor-get-poorer" effect of laissez-faire capitalism. That system has successfully been under assault in America since the 1980s leading to:

- a reemergence of income and wealth distribution inequality (not the only reason of course)

- underfunding of critical federal functions (ones that the states won't or can't do on a consistent basis across all 50 states) such as:

- - our military

- - our food inspection

- - interstate infrastructure

- - basic research

- - air traffic controllers

- - upgrade of air traffic control systems

- - rural development

- - border patrols

- - embassy security

- - oversight offices like my old AF Cost Analysis Agency which sought to keep contractors honest, cut down on FWA (fraud, waste, and abuse), and save money; which, in our heydey, we did to the tune of at least a few hundreds of millions of dollars a year as a minimum. (my program alone (google AFTOC-Belford) saved and estimated 3 to 5 times its cost each year)

- - military procurement oversight (not that it was much good in the first place, but now it is worse)

- assistance to the starving

- and the list goes on

This is the world one side of the aisle thinks we should be living in and believe even now too much money is being spent on these things and other things because they are pushing for even lower federal taxes. I, of course, believe they are absolutely wrong. And this is not an esoteric discussion for there is no doubt in my mind that if they get their way, America will go the way of the Roman Empire without ever having been an empire (thankfully).

OK, Now Your Turn to Vent

What Do You Think About Federal Taxes (sorry about the complexity)

DEMOGRAPHIC QUESTION 1

Do you political lean to the

DEMOGRAPHIC QUESTION 2

Are you

DEMOGRAPHIC QUESTION 3

Are you

© 2014 Scott Belford