Let's abolish income tax?

Why Pay Tax?

Income tax was first charged in Britain by William Pitt the Younger in December 1798 to pay for weapons and equipment for the Napoleonic Wars. Pitt's new 'concept' of income tax began at a levy of 2 old pence in the pound (0.83%) on incomes over £60 (about £50,000 now) and increased up to a maximum of 2shillings (10%) on incomes of over £200.

Pitt wanted the new tax to raise £10 million, but in 1799 he got just over £6 million.

Over the next few years taxation was abolished and re introduced as wars started and finished, but within 50 years it was pretty much a done deal that whoever ran the government was going to take a chunk of your income to pay for their largess and military muscle.

What is patently obvious is that wars are bad for our pockets, but irresistible to politicians and power hungry military men. Maggie Thatcher used her war (The Falklands) to secure victory in an election, when defeat looked inevitable, G W Bush did the same, wars are good news for politicians but expensive for us.

What's the alternative?

Obviously in a modern super state we run expensive projects; hospitals, schools, welfare systems and the military, let's not forget the military!

It is obvious from the pie chart right that the military take the majority of tax raised, in fact 54% in the profile shown!

Let's not discuss (in this hub) the validity of this fact, our discussion is taxation and how to raise it, not what it's spent upon.

What is the answer to raising tax...

Is where we are taking this article, you see I have long believed that if we stopped taking money from your income, and shifted taxation into a two tier system, we would improve and get more control over taxation.

Raise a tax levy.

The government know exactly how much tax they need to raise, to achieve what they want to do each year, they also know how many people there are in the country, so why not simply divide expenditure by population and set a tax levy?

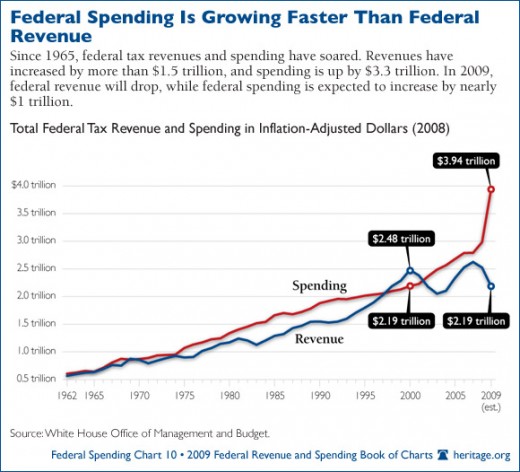

According to current figures that would be about $13,000 per head in the USA, in order for the 300 million citizens to meet the 4 trillion (that's 12 zeros) expenditure envisaged by that country.

So a family of four would be set a tax levy of $52,000 to be paid.

Patently this would horrify any family of four with only two wage earners at best, however isn't this the 'equality' that people constantly bleat about.

I knew from early age that 'equality' was nonsense, you don't need to be a mathematician to work out that when you divide all of the wealth of the world between all of the people, everyone has too little to do anything with.

I would reckon that each one of us would have about $1,500 each in a fair division, remembering that 90% of the world have 5% of the assets, whereas we super rich (and that includes you if you can read this in the comfort of your own home) make up 10 % of the world and have 95% of the goodies. It's even worse when you realise that the top 1% of the world actually have 80% of our 95%.... (where is my gun?).

But the cold reality is that IF we made an equal distribution of all assets in the world, then in a short time some people would have many times more than they initially received by carrying out trading, and others would be without any cash again, though they may have a flat screen TV !

Some people will always 'rise to the top' of any dunghill and come out smelling of roses.

Others can be placed on the top of the same dunghill and will sink to the bottom, no matter what.

Tax Levy - Indirect Tax paid = Balance

Currently you pay some tax by direct taxation and most by indirect taxation and you have no idea how much the total amount is as a percentage of your total income.

Now the total tax spend MUST come from somewhere, so if the idea of your tax bill being $13,000 per head per year is of concern to you, then you should realise that if YOU are not paying that amount, SOMEBODY ELSE IS paying your shortfall.

Surely in an 'equal' society each individual paying their own share of the expenditure is just and correct isn't it?

Tax only really affects working people, those who are 'entrepreneurs' (that fabulous word that GWB classically stated "The French don't even have a word for', tend to escape some taxation, whereas the 'movers and shakers' pay next to nothing by basing their money where people don't try to take it from them.

Money makes money.

Now let's examine how moving taxation to 100% indirect taxation would benefit society.

With indirect taxation ALL tax is raised from expenditure, not income, therefore those who spend more, pay more.

Therefore nobody feels robbed when their pay check shows them working for the state for the first six months of the year.

As this taxation would also have logical level changes, some items would be no tax, some low tax and so on through to luxury tax on the highest level.

Taxation would be collected either:

- At the point of either first sale (for good manufactured in the country)

- At the point first entry for imported goods.

Tax would be collected on the anticipated gross sale price, i.e. if the manufactured item was first sold at $100, and the anticipated gross sale price was (say) $500 (allowing for the moves needed between manufacturer and consumer)with a tax rate of 20%, then the manufacturer would sell the item at $200 ($100 cost + $100 tax) and pass the tax directly to the tax offices AS PART OF THE TRANSACTION. No monthly accounting, no three monthly audit, just a direct bank transfer as soon as the funds hit the account.

All the other links in the supply chain have NO tax returns to make, being in possession of a valid tax paid certificate from the manufacturer.

The tax office receives it's tax faster, there is no chance for the value added tax to disappear down the line of suppliers, the whole supply chain saves paperwork and accounting proceedures that cost fortunes to run and the end user pays no more tax than the government has set for that item.

The item may be a low tax rate, say a basic washing machine at 10% taxation, or a luxury washing machine at say 50% taxation, it is then up to the individual which item they buy.

The rich man can buy a basic item and the poor man can buy the luxury one, both pay the same tax share.

When all your income is available to you, then YOU can manage your accounts and the feel good factor would be large.

How do we fit indirect taxation in with the tax levy we need to pay?

Well the consumer keeps all their receipts, because each receipt contains details of the amount of tax paid, and these amounts will be off settable against your tax levy amount.

If the consumer paid by credit or charge card, the amount of tax paid would (or could) be credited against their tax levy instantly, and they could see at any time how their tax bill was progressing. People paying cash would still need to make a physical return, presenting receipts for a tax credit.

Of course big spenders who ended up paying more than their quota of the tax levy would lose some, but a record could be kept, and if they were tax deficient in other years some percentage could be accredited to their tax levy account. The excess collected this way will offset the shortages accrued by people who just don't spend enough.

If someone had a short fall, then the tax authorities would be entitled to request that they paid the balance of their tax levy, but obviously where the person or family could show they were unable to pay due to poverty, this would be cancelled by the authorities.

Likewise charitable donations will be offset, making charitable gifting a suitable way for people who spend little to pay their taxes without giving it to the government, if that makes them feel better!

Where there is a short fall in indirect taxation raised, we simply rebalance the figures by adjusting the various sales levels: i.e. if lower priced basic items have suddenly become more sought after, raise the level, but make it possible for anybody who was recognised as below the poverty level to get instant rebates at point of purchase, with a special 'credit card' which repaid the rebate back to their card, allowing them instant access to the money.

Defrauding the system would be virtually impossible, as the tax is paid at source and major manufacturers are unlikely to be selling their goods in the black economy, besides which every item would have a RFID tag which allowed verification that tax had been paid.

What about smuggling?

Again, as point of entry would be the other way tax was collected, then whatever was imported would have the tax paid at the border.

Importers would bring in a shipment of goods from (say) China and each item on the manifest would have a tax value, which the importer would pay on entry.

This would discourage imports and therefore encourage local manufacturers to accommodate a newly revived market that needed filling, creating jobs.

Established importers would be able to move the tax payment point from entry to first sale, but individuals and small traders would need to pay on entry. This would stop many smaller operators, but then again the under capitalised are those most liable to go out of business and leave debts to the tax authorities, so it would be self regulating and bankers would be able to provide the required credit to cover import taxation until reliable trader status had been established with the authorities.

In 'open border' Europe people buying a car in (say) Belgium for cost reasons, and moving the vehicle to the UK, would either pay taxation on entry, if they required to keep the car in the UK, or be given a period to do so, after which the car would need to be removed from the country, or confiscated by the authorities. The tax payable would be the difference between the tax paid in the other state, and the tax due in the receiving state.

The best benefit is...

We would need less tax men, because most of the tax payments would be automatically paid to the revenue, so; much less paperwork, fewer tax officers and less intrusion into our lives.

The idea of an army of bureaucrats needing to find jobs that created wealth rather than take it away from people (and give 54% to the war machine) is extra appealing and would cheer up most taxpayers immediately!

We cannot avoid the obvious fact that tax is needed to pay for the society we choose to live within. The problem to date is that the tax system is cumbersome, bureaucratic and unfair, in that; if you are rich enough to pay fancy advisers, you pay much less than normal folk in percentile terms on profits made.

Corporate tax is another matter (and maybe another hub?) but generally I would choose to again drop corporate profit tax as it stands, and encourage more businesses to set up in a country where taxation for business was based upon an equation of how many people were employed (and at what payment rates) than on the profit declared.

But again, as most business involves the sale of good or services, I'd make it point of sale based. Our modern computer society and banking system can easily be made to accommodate instant cash transfer of a set percentage amount from any and all transactions made electronically, which account for the vast majority of transactions.

Yes cash will still thrive in the black econnomy, but then the black economy will always thrive in any society, some people just function better that way and don't fit into our moulds.

But at least the black economists will be paying tax on what they spend.