Problems with Taxing the Rich

The Rich are Different

March 11, 2008

Whenever the subject of government revenue shortfalls (i.e. deficits) comes up, politicians and their allies on the left immediately begin demanding that the needed funds be raised by increasing taxes on the rich. There is never any thought or talk about solving our economic problems by cutting government spending.

Targeting the rich has its advantages from a political standpoint. After all, the rich are a minority of the population, so ambitious politicians can afford to lose their votes and still win. Second, throughout history, the stoking of feelings of class envy and class hatred have always been a good tactic for ambitious politicians to use to gain their ends.

Envy and class warfare were central to Marxist politics and the history of the twentieth century is soaked with the blood of the victims of that politically directed hatred.

Rich Have More Assets Than Other People

However, there are a few problems with trying to satisfy the unlimited spending desires of the politicians running Washington by simply taxing the rich. These are in addition to the fact that no matter how much money Congress manages to extract from the American taxpayer it will never be enough to satisfy their addiction to spending money.

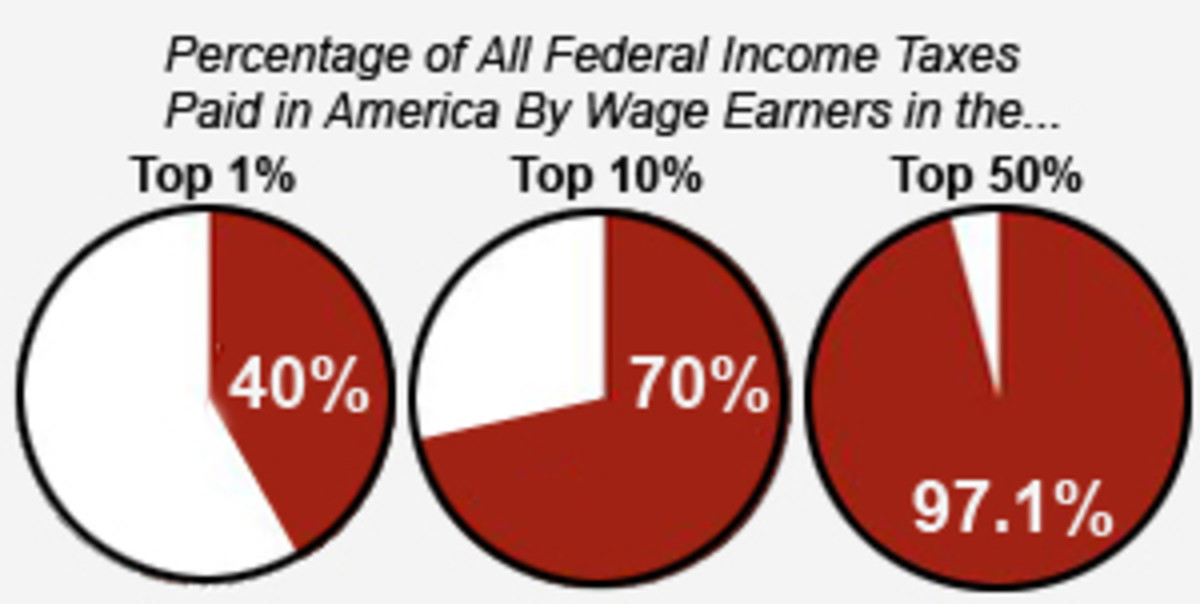

According to Internal Revenue Service (IRS) data for the year 2005, the top 1% of tax payers, which one would assume includes the richest of the rich, provided 39.38% of total income taxes paid that year.

Expanding this to include the top 10% of taxpayers we find that this larger group paid 70.30% of that year's taxes. While one can debate whether or not this share of total taxes paid by the rich is fair, it is defiantly a large share of the taxes paid. And,while the rich may be able to afford more, they do not have unlimited income which means that there is a limit to the amount that can be collected from them. Robin Hood style fiscal policy has its limits.

Further, the old cliche about the rich being different is true when it comes to income. What distinguishes the rich from the rest of us is not so much the fact that they have high incomes (most do, but many are also like the Federal Government where their debts exceed their incomes no matter how much they earn) but by the fact that they have more assets or wealth than the rest of us.

Income Tax Applies to Income, Not Wealth

However, the income tax taxes income, not wealth. So a wealthy person with no income would not pay any income tax. The fact that wealthy people have past savings from which they can support themselves means that they can reduce their tax burden by simply reducing their income, a strategy that is generally not available to the rest of us.

The rich also have other options that can reduce income for income tax purposes which the rest of us don't have as well as being able to afford to hire armies of accountants and tax lawyers (the cost of which is deductible from income for tax purposes) to find more ways for them to reduce their tax burden.

While most middle and lower income individuals receive income in cash and need that cash to pay their living expenses, wealthy people can afford to take income in other forms such as stock options, equity or other non-cash forms.

Stock options and other equity type investments are taxed eventually, but that does not happen until the option is exercised or equity sold that the proceeds become taxable. Having this choice not only allows the wealthy person to avoid paying taxes on these things now but also enables them to choose when to cash in and incur the tax. That can be a time when taxes are lower or their other income is lower, both of which will result in their having to pay less taxes.

To Raise Needed Funds, President Clinton's Tax on Rich Started With Incomes of $33,000 Per Year

As a result, in order to raise the funds needed with a tax on the rich the definition of rich has to be stretched to include a large chunk of the middle class. Empirical evidence to support this statement comes from the soak the rich tax that Bill Clinton promised in his 1996 campaign.

During the campaign Clinton and his supporters promised that a tax on the rich would be sufficient to fund their ambitious spending programs. Of course candidate Clinton and his supporters never bothered to define what they meant by rich.

However, during the Vice Presidential debate that year, then Vice President Dan Quayle argued that the tax would have to hit incomes as low as $35,000 in order to generate the desired revenues. His opponent, Senator Al Gore, scoffed at this as did his supporters in the left wing media.

When Clinton and Gore won and got the Democratic controlled Congress to enact the tax they were able to prove the former Vice President wrong - sort of. The tax actually applied to people with annual incomes starting at $33,000 and above rather than stopping at $35,000 as then Vice President Quayle had claimed.

Taxes on Rich Usually Hurt the Poor and Middle Class

Even when taxes are carefully crafted to only include the real rich, there can be a nasty surprise for the middle class and the nation as happened with the Carter Administration's tax on yachts.

After whipping up the publics' emotions with their usual class warfare rhetoric (remember candidate Carter's campaign against the so-called three martini lunch deduction?) President Carter and his Democrat controlled Congress enacted a stiff tax on the purchase of yachts.

Given that only the super rich can afford a yacht, this should have been the ideal tax on the rich. But the Carter Administration overlooked two things.

First, the rich, like everyone else, hate to waste money.

Second, and more important, while only the rich buy yachts, it is middle class workers who build yachts.

As a result of the tax, most rich people did one of two things in that they either made do with last year's yacht or purchased a new one abroad where the tax did not apply.

In doing so, the small American yacht industry was destroyed (one New Jersey town whose economy was totally dependent on yacht building faced economic disaster) and associated jobs and income tax revenues (unemployed people generally pay little or no income tax) were lost.

This little episode only served to further weaken the nation's economy which, as a result of the misguided Keynesian taxing and spending policies of the Nixon and Carter administrations, was struggling under the dual burden of double digit inflation AND double digit unemployment.

The yacht tax fiasco, which even if it had been successful, was never projected to generate significant revenue. It was instead, driven more by a desire to punish the rich for their success than to raise revenue.

However, the yacht tax is a clear demonstration of the truth of former President Regan's observation that Washington doesn't solve our problems, it IS the problem.