Who is to blame for the United States of America's financial collapse in 2008?

Are we close to another Great Depression?

2008 is ending. And it cannot end any sooner to the (perceived) relief of many Americans. The United States of America, still dubbed and, perhaps, appropriately so as the richest country in the world, is in a financial mess. A $700 billion dollar bailout plan has to be instituted so that American banks do not fold and credit remain fluid. Additionally, the Big 3 carmakers recently received their highly needed bailout funds or they'll face a Chapter 11 bankruptcy and layoff more workers. Of course, not to be overlooked, hundreds of thousands of Americans were laid off just as Christmas approaches (Bloomberg) because of the tightening credit crisis. Some even say that we're past a recession and nearing an economic depression, not unlike the Great Depression in the early 1930's.

Rightly so, the biggest questions in everybody's mind are financial concerns. Aside from "where am I going to get the money to pay next month's bills?", we are also interested in determining who are the responsible party or parties for the economic mess that we're in.

First, a pespective: this financial collapse is mainly tied to the bursting bubble of the housing market. But who's to blame? Below are some theories, allegations, and discussions I gathered from online sources, talkshows, newspapers, news, and general day-to-day conversation. At the end you can voice out your opinion in the feedback section.

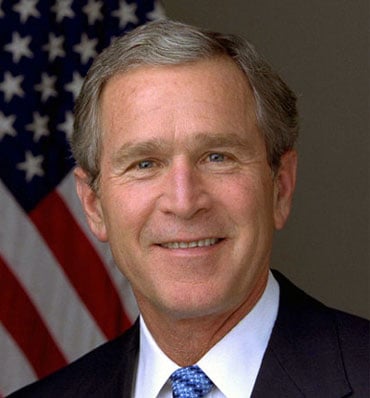

Is George Bush to Blame for the Recession?

Why he's to blame:

- Cost of the Iraq War. Americans were always split on the Iraq War. It was never a war that the country resoundedly supported despite 9/11. Without neglecting the cost in lives, the Iraq War has cost Americans over $580 billion to date (Dec '08). The monthly figure President-elect Obama quoted during his recent presidential campaign was $10 billion a month. That's a lot of money that could be used domestically.

- Runaway deficit. The deficit soared under President Bush beginning at "$3.4 trillion when he took office in 2001 to $10.6 trillion now," Reuters. The largest in US history.

- No economic policy. This is seldom mentioned, but in the eight years that George Bush was in office, he did not implement any longterm economic policy that would produce jobs in the US.

Why he's not to blame:

- Economy was already sliding down (dotcom bubble) when he became president.

- He inherited one of the economic policies blamed for the 2008 credit collapse, the Gramm-Leach-Bliley Act.

- As an admitted believer of the "free market", perhaps President Bush chose the laissez-faire approach to give the market an opportunity to bounce on its own. The collapse towards the end of 2008 forced him and the Feds to provide bailout plans to the ailing banking and automobile industries.

- 9/11. The security of the United States became top priority which demanded his full attention. Since 9/11, there have been no terrorist attacks in US soil.

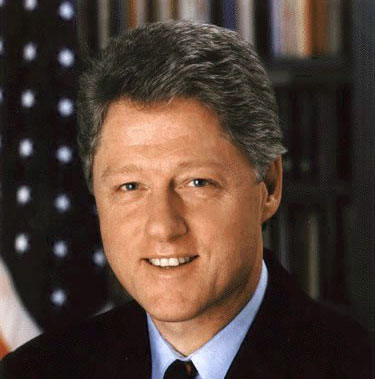

Does Bill Clinton have any role in the financial collapse?

Why he's to blame:

- Policies that lessened the loan restrictions. Bill Clinton instituted relaxed standards in home loans so that more minorities and/or lower class income individuals may qualify to buy homes.

- Signed the Gramm-Leach-Bliley Act into law. In 1999, Bill Clinton signed into law the Gramm-Leached-Bliley Act ended the separation of investment and commercial banks that was implemented after the Great Depression. The GLB Act effectively ended regulation over some banking practices.

Why he's not to blame:

- Balanced budget. During his terms, he balanced the budget and actually had a financial surplus while leaving office. The USA was in great financial shape. Campaign promises in 2000 were about how to put the surpluses to good use.

- A bustling economy. Under Bill Clinton, the economy was in such great shape that more Americans ought to be in a home they own. Hence, the policy to relax lending for affordable homes was justified.

Is the Fed Chaiman, Alan Greenspan, at fault for the recession?

Why he's to blame:

- Kept interest rates low even when inflation was running rampant. The Federal Reserve controls the discount rate which is the rate banks receive when borrowing from the Federal Reserve. To spur the economy, the Feds lower the rate to encourage borrowing to put more money in the market. When there's too much money as evident by higher prices or inflation, the Feds increase the discount rate to discourage borrowing. Alan Greenspan kept the discount rates low until through most of his tenure in the 2000's.

- Encouraged the practice of financing homes with adjustable rate mortgages (ARMs) in 2004, USAToday.com. In that article, Greenspan was quoted that "American consumers might benefit if lenders provided greater mortgage product alternatives to the traditional fixed-rate mortgage." Of course, many homeowners defaulted when their ARM period began it's variable phase.

Why he's not to blame:

- Keeping the interest rates low was the best policy to spur the economy after 9/11. Many real estate investment gurus circa 2003 proudly stated that the country would have been in a recession if it wasn't for the rise of the real estate market.

Can the Republicans be blamed for the US financial downturn?

Why they're to blame:

- Pushing for deregulation. Systematic repeal over time of "New Deal" policies from FDR days. New Deal policies were implemented to prevent another Great Depression. As a result of deregulation, there was little or no oversight over the practices of the banking industry.

Are the Democrats to blame in the financial collapse?

Why they're to blame:

- Protected Freddie Mac and Fannie Mae from an independent agency to be formed under the Bush Administration. The Democrats opted to keep the oversight within Congress and the Department of Housing and Urban Development.

- Supported the lending policies implemented by the Clinton administration that relaxed the standards for loan qualification.

Are Wall Street execs, bankers, and mortgage lenders responsible for the financial collapse?

Why are they to blame:

- Greed. That's too easy and obvious. There's gotta be more..

- At the Wall Street level, the irresponsible use of Credit Default Swaps (CDS), Newsweek, to free up money for more bad loans instead of holding them in reserve. Also, using derivative and risky investment instruments such as options, short sells, and CDS.

- Banks and mortgage brokers were alleged to practice predatory lending as there was a free-for-all to write loans to anybody with a heartbeat (as described by a real estate agent friend of mine), including people who could not afford a home. Additionally, they were alleged to prey on homeowners with traditional fixed 30 year loans and refinancing them into adjustable mortgage loans (ARMs). The practice often focused on the very narrow monthly payment versus the long term cost of the loan. Also, for repeat business, they refinanced the ARM loan within a couple of years, before the fixed period ended. These practices effectively prolonged the years in which homeowners remain in debt. But paid the mortgage broker handsomely in commissions.

Can overzealous consumers be blamed for the recession?

Why they're to blame:

- Greed. Again a big factor...

- Borrowers overleveraged themselves when they bought homes that they cannot afford. Stated income application, originally intended for self-employeds and small business owners who often could not document steady income, became the primary lending means for buyers who could only afford a low monthly. Hence, minimum payment loans or pick-a-payment loans were popular. No downpayment? No problem. Take out two loans commonly called "80/20 loans".

- Property flipping. Often seen on TV as another get rich quick scheme. Around 2003, amateur investors sought alternative investments that were deemed safer than the stock market. The Dotcom had just burst and many were still soured from the losses. The low interest rates, courtesy of the Feds, gave investors opportunities in the real estate market never seen before, and likely not to be seen again for a long while. As a result, it was not unheard of for an investor to buy a property, own it for six months, and sell it at near-double the price he or she paid. Throughout the US, house-flipping became an investment phenomenon. Of course, the first movers were the ones who made the money. Those who bought properties in 2006 or later with hopes to sell them were left holding the bag and are now in foreclosure.