Why Do Gas And Oil Prices Seem To Go Up And Down? How Does Production Impact Fuel Price Changes?

The Mystery of the Cost of Gas

The price of gas is all over the place. One day it is $3.40 a gallon and the next it is $3.99. Over a month it can double in price. A few months later it falls down in price just as quickly. The news mentions natural disasters, politics, bomb threats, regulation, oil spills, and whatever else is trendy. The truth of the matter is that it is a commodity that is traded on a global scale. Let's explore what that means and what my theory is to why the price of gas spikes periodically.

How Gas Is Produced

Gas starts out as crude oil. This oil is buried miles underground. The oil is pumped out of the ground. This is known as crude oil. Crude oil is then refined and made into petroleum gas, naptha, gasoline, kerosene, diesel distillate, fuel oil, lubricating oil, and other residuals. It is used in solvents, plastics, fuels, paints, feedstock, asphalt, and fertilizers. Each barrel of oil can produce 19.2 gallons of gasoline. Gas is made into different octanes and also processed for each state so that it meets that state's fuel economy and clean air standards. Once this is done, the finished product is shipped out.

Where Does Oil Come From?

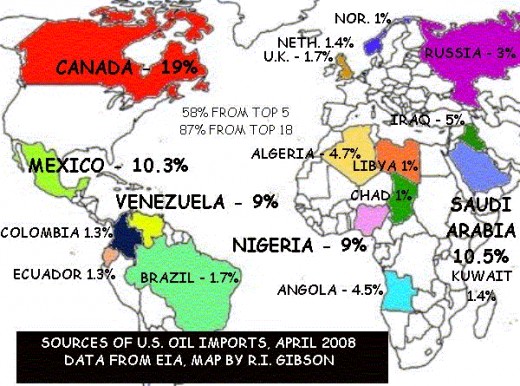

The United States both imports and exports oil and refined oil products. As of March 2012, the United States is the world's third largest oil producing country. As of 2008, the United States exported around 19,000 barrels of crude oil a day. This oil is mostly sent to Canada to be refined and then brought back into the United States as a finished product. The United States also exports over 1 millions barrels a day of refined products. The United States uses more oil than it produces. It makes up this difference by importing crude oil from other countries. Most of the additional oil that is imported comes from Canada.

Top 10 Oil Producing Countries

According to the EIA, these are the top ten oil producing countries as of July 2014, in order:

- Saudi Arabia

- The United States

- Russia

- China

- Canada

- Iran

- The United Arab Emirates

- Iraq

- Mexico

- Kuwait

Top 10 U.S. Oil Importers

According to the U.S. Energy Information Administration, as of March 2012, these are the top ten countries from which the United States imports oil:

- Canada

- Saudi Arabia

- Mexico

- Venezuela

- Nigeria

- Colombia

- Iraq

- Ecuador

- Angola

- Russia

Components Of Gas Prices

The drilling, processing, and transportation all play into the price of gasoline. Other things that go into gas prices are taxes, price of crude oil, labor to make different mixes for different parts of the country, supply and demand, natural and political disasters, public worry and concern, price of crude oil, the deficit, refinery capacity, the futures markets, and problems in other countries. All of these factors have to be looked at when prices of gasoline go up or down. Another complication is that one also has to consider inflation. $3.99 in 1970 is a lot different from $3.99 now in 2012. If the gas prices in 1981 are adjusted for inflation, they become $3.11 a gallon!

Interesting Facts About Gas Prices

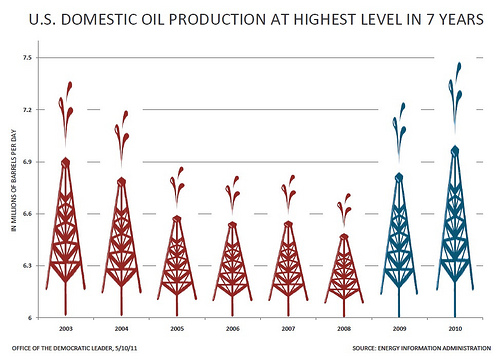

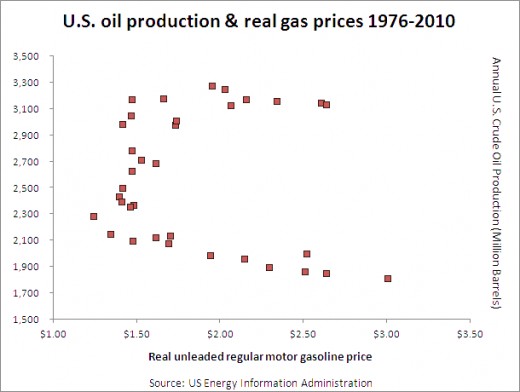

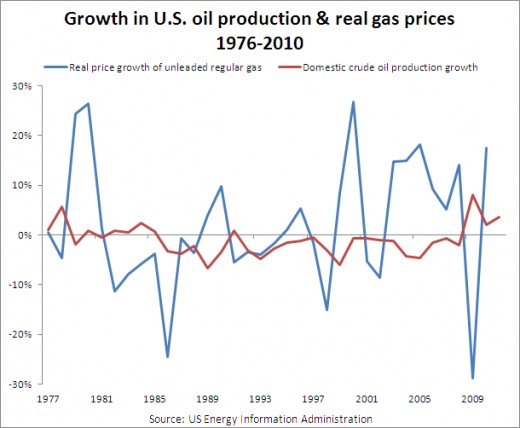

- United States oil production has no effect on gas prices. Sometimes the U.S. increases production and prices go up. Other times, the prices go down. The same with decreases in production. See the charts to the right from Blog of the Century by Benjamin Landy. The article is no longer posted, but the data is still interesting.

- In mid-2008 oil costs soared to nearly $150/barrel. Gas prices were close to $4.00/gallon. Currently, on march 29, 2012, Wolfram|Alpha has a barrel of oil costing $105. Gas is almost $4.00/gallon. The gas prices are nearly the same as 2008 even though oil is now $44/barrel less!

- Oil production has increased while Obama has been in office.

- While gas prices have spiked, reaching record highs, both U.S. and world oil use are down. Increasing fuel efficiency in cars, record high gas prices, an emphasis on local business and farming, and a weak economy have all decreased U.S. demand for oil. The 2011 Japan earthquake and tsunami wiped out Japan's infrastructure and further decreased the world's appetite for oil. Despite this, prices are UP.

- In 2005, the United States imported 60% of its oil. In 2010 this number was down to 45%. This change was do to both an increase in oil production and a decrease in oil consumption.

The Bread And Milk Theory To Gas Prices

U.S. oil production doesn't impact gas prices, U.S. gas usage only has a slight impact on gas prices, oil prices don't even always seem to matter. Based on this information, what is a reasonable explanation?

Let me start with a story that isn't gas related. Every time there is a big winter storm predicted, stores around here get mobbed. Everyone runs out to refill prescriptions, buy bottled water, flashlights, batteries, milk, diapers, toilet paper... the basic necessities of life. 99% of the time a winter storm means 3" of snow. There may be some snarled roads for a while but it is a rare case when the weather closes stores for days on end. People don't necessarily need to go on a store raid, but it makes them feel secure. It also has the added benefit that if disaster were to occur, the people who stockpiles would be ready. They could use their water and toilet paper happily or even barter it to get other needed supplies that they forgot about. Supplies bring peace of mind, necessary items in an emergency, and possibly a workable currency to use in an emergency. This mad rush is always made much worse when every radio and television station are broadcasting the eminent doom of the city from the white death.

You may have noticed that gas prices go up whenever there is a natural disaster (think hurricane Katrina), fear of a horrid storm in an area that produces or refines oil, concerns of political unrest, or another national or international news headline bonanza. These fears often never come to pass or will affect only a small portion of oil production or refining. So, why do they significantly raise gas prices?

Think back to my snowstorm example. Individuals react to news headlines by hoarding supplies for possible use or barter. Companies handle themselves in a similar manner.

Where individuals need bottled water and diapers, companies need fuel to move or produce goods. When a company hears that there may be any possibility of a fuel shortage or significant raise in fuel costs, that company will react by stockpiling. For example, an airline hears that there may be a war between Iran and Israel. This war can possibly disrupt oil supplies from the Middle East. The Middle East contains the world's second largest producer and the United State's second largest importer of oil, Saudi Arabia. If Saudi Arabia is unable to distribute oil, oil prices will go up and there is a possibility of an oil shortage. The airline will either have to cope with the risk of higher fairs and reduced flights or the airline can take another route: stockpile. While prices are low, the airline will purchase contracts to oil and gasoline. A contract (the future's market) guarantees that that airline owns the oil as soon as it is pumped out of the ground. Buying lots of oil BEFORE an oil or gas crisis allows the airline to feel secure and ensures that they buy the fuel at a lower price than they expect it to be in the future. If the prices go up substantially or the supply dwindles, the airline can also choose to sell the oil to make a profit which can then be used in other areas of the company. In other words, when the media sounds a panic alarm, companies buy up oil whether they need it or not. This lowers the supply of fuel, raises demand, and raises the prices of the fuel. This in turn leads to other places thinking that oil would be a good investment as prices are increasing rapidly. Speculators will jump in thinking they can make a quick buck. This decreases the supply and raises demand even further. Also, as gas price increases often go up in tandem with inflation (prices go up as high oil prices means things cost more to produce) investors will often buy oil futures as a way to offset the negative effects of inflation. Prices go up even further.

In other words, social and media panic causes companies to buy staples for use or trade and thus raises the cost of gas. Companies buy oil and gas where individuals focus on milk, water, toilet paper, and diapers.

In Conclusion

I believe that gas prices go up for the same reasons that stores have bare shelves before a storm. This does not mean I favor one political party's view or the other. I see this as a non-political issue. There are plenty of political arguments that we could get into, but, those are for another hub. I just wanted to present an alternate view to why gas prices fluctuate and provide you with something for your brain to mull over.

Resources Referenced

- Why Are Gas Prices Rising?

- Gibson Consulting Geology, Geophysics, and Educational Tourism

- Production > Oil statistics - countries compared worldwide - NationMaster

- Crude Oil and Total Petroleum Imports Top 15 Countries

- Petroleum - Wolfram|Alpha

- HowStuffWorks: How Oil Refining Works

- Has President Obama increased drilling? We FuelFact it

- Obama Sets Gas Prices? Just Another G.O.P. Myth - NYTimes.com

- Ad attacks Obama on gas prices with faulty logic - US News and World Report