The Health Care bill and the IRS

Can IRS pull a rabbit out its hat?

Assumptions?

There has been a lot misinformation put out by both sides of the Congressional Isles on the issue of expected cost of enforcement of the Health Care reform bill. Some on the right say the IRS will have to hire 16,500 new employees to enforce the mandates in the Health Care Reform Act of 2010. Supporters for the bill, say that it will not hire that many and it won't expand the powers of the IRS and these are just numbers based on assumptions not facts.

First let’s look at what the IRS said.

The law does make individuals subject to a tax, starting in 2014, if they fail to obtain health insurance coverage Douglas Shulman said, IRS Commissioner.

The IRS will have insurance companies will issue forms certifying that individuals have coverage that meets the federal mandate, we expect to get a simple form, that we won’t look behind, that says this person has acceptable health coverage," Shulman said.

A form similar to the ones that lenders use to verify the amount of interest someone has paid on their home mortgage.

In any case, the in the Health Care bill (on page 131) specifically prohibits the IRS from using the liens and levies commonly used to collect money owed by delinquent taxpayers, and rules out any criminal penalties for individuals who refuse to pay the tax or those who don’t obtain coverage.

That doesn’t leave a lot for IRS enforcers to do.

Now let’s break this down a little. The first sentence admits there is a new tax. The IRS is the enforcing agency of all of the United States Federal Tax Laws.

The IRS will have forms to issue. Someone will have to

process all these forms, if every person is required to participate, that means,

approximately 200,000,000 forms. They will have to hire people just for

processing these forms. This means also, every time a new person is born in the U.S., a new form to be filled out, processed and so forth.

A simple Form? When was the last time you saw a simple form

from the IRS? The simple form will contain personal information, Social

Security number, Name, Address and date of birth, if it gets in the wrong

hands, then what? What about the forms the doctors will have to fill out? Do you think they will be simple? The forms for providing service under the Health Care Bill have yet to be exposed, but if they are anything like the income tax forms, we may all be in trouble. The income tax was

supposed to a simple form when first presented to the American public. The

income tax code now stands at over 8,000 pages, the form may be simple, but, understanding how to fill it out isn't. The best part of this is that

even if you ask the IRS for help on a tax question and they get it wrong, you

are still liable. Also, when the income tax law was passed,

politicians promised the public that it would never exceed 7%, six years later,

70%. What is to keep politician from expanding rules on health care?

The IRS is prohibited from placing liens and no criminal charges? Then how does the IRS plan to enforce the new law? Will they call your mom and tell on you? I don’t think so. No matter what the bill say’s at this point, it can always be revised. How many times has the income tax been revised? If revenue numbers and form counts is not what is expected by the Federal Government, then what is to stop them from increasing collection powers of the IRS to achieve their goals?

That doesn’t leave much to do? When public servants in the IRS are facing layoffs because of lack of work, look for new regulations. Stricter enforcement will be first on the list, create revenue to save your job. This happens on all levels of government, local jurisdictions will increase law enforcement of speeding tickets and running stop signs if revenue goals are behind. Don’t even try to convince that it doesn’t happen.

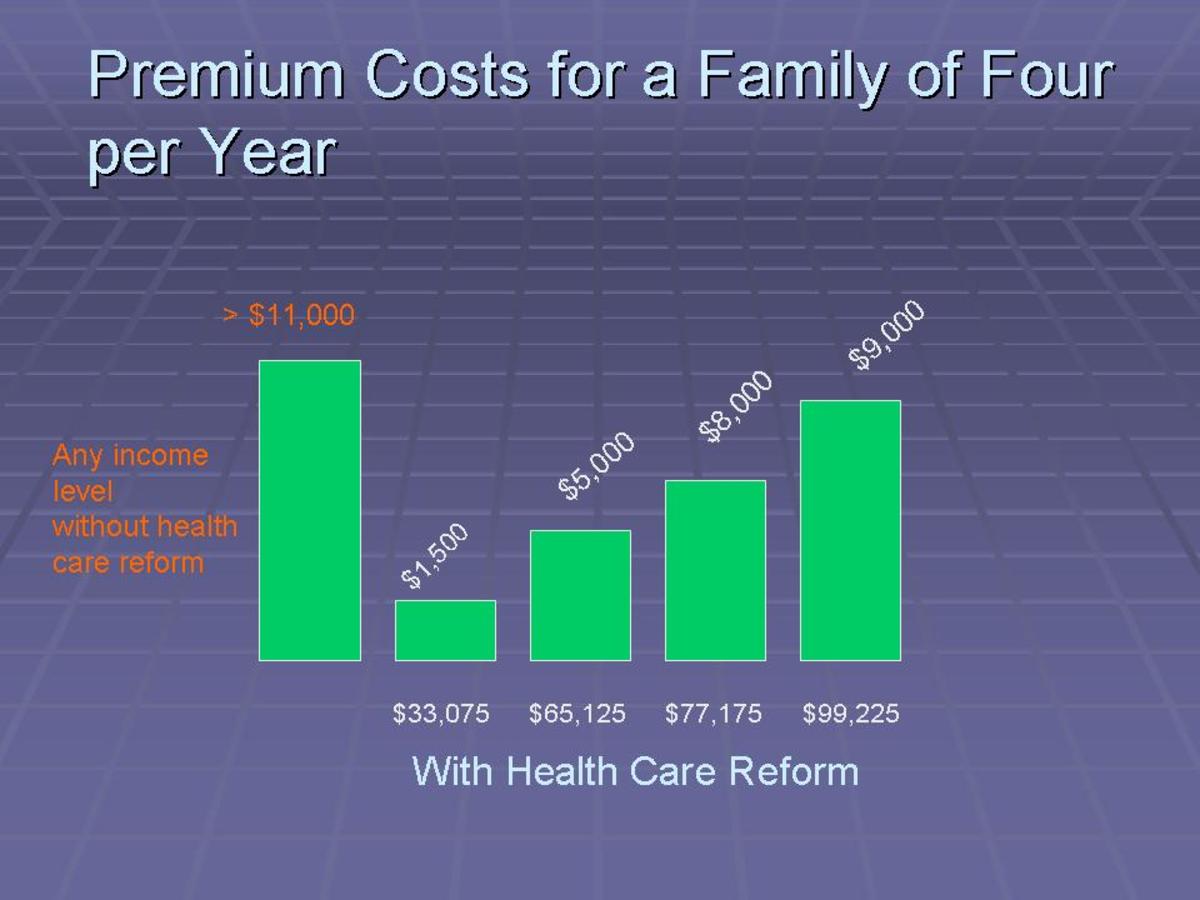

Ok, so maybe the IRS won’t need 16,500 employees the first year. But what about the second, the third or in 2014 when the new tax takes affect? You can’t tell me that they won’t hire more people, they have no choice. When the government grows, no matter what branch, it cost tax dollars. Without the tax revenue government can’t survive. Without tax revenue for the health care reform it won’t survive. This is just an added tax on top of an already tax burdened society. The middle class again will pay for this program, just as they do Social Security and the Medicare system. Will this system be run anymore efficiently than the others? If it ran by bureaucrats, there is no way that is going to happen. As long as a politician can pick and choose what part of such a big system to support or disavow, the partisan politics will find a new dividing ground. The arguments already exist in congress now; they will only grow bigger and more devises over time.

Believe what you want about the IRS and the health care bill. I will refer to history and base my assumptions on what the government has done it the past. After all, isn’t all assumptions base off past performance? Ask your stock broker that question when he tells you where to put what money you have left.