61

61- 0

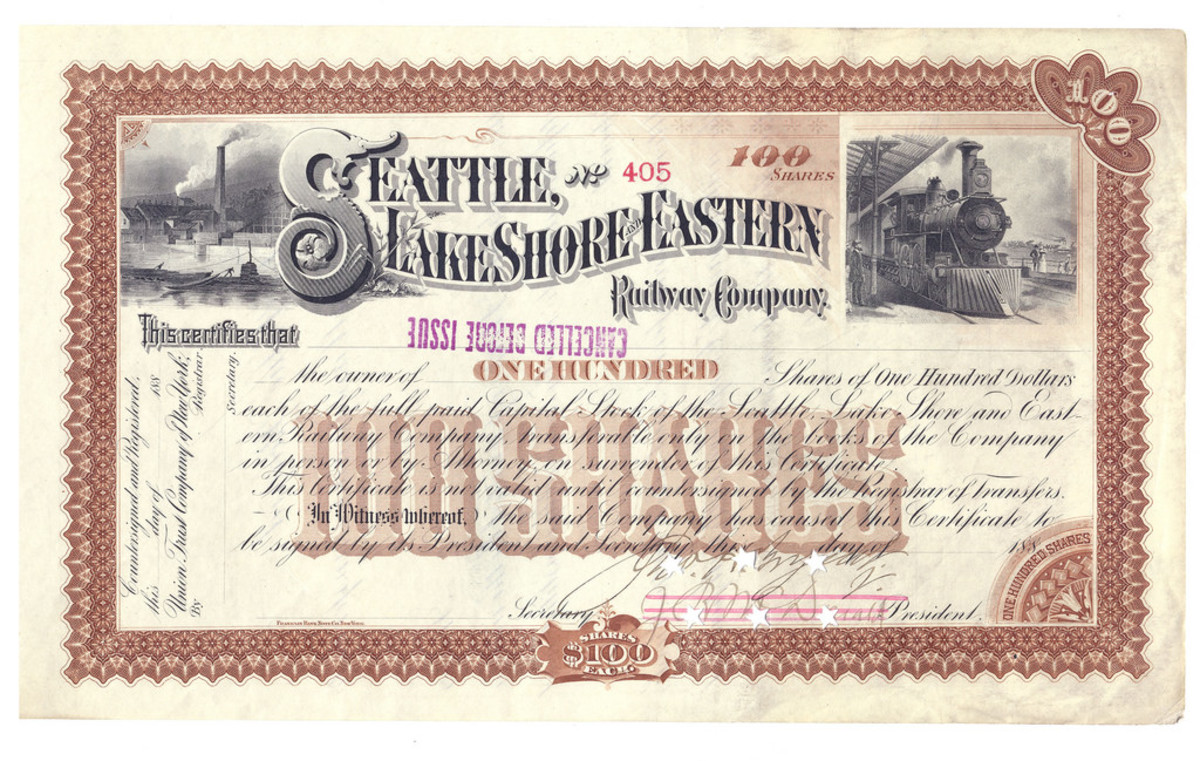

An Investor's Guide to the Different Classes of Stocks and Shares

This article will help you understand the different classes of shares in a company, how they differ and what they are used for.

- 1

3 Ways to Make Money on the Stock Market

Investing in the stock market can be bewildering. But the basics of how anyone makes money in stock and shares is simple. Keep these simple ideas in mind whenever you are thinking about investing in the stock market.

- 0

Don't Let Inflation Take Your Wealth: Learn Which Assets Can Protect You

Inflation means that even if you get your money back as expected, it may not buy as much as you thought. This issue is worse for some investments than for others.

- 0

How Investing in Shares Makes (or Loses) You Money

Investing in shares can make you money either by paying dividends or by the share price going up giving you a capital gain.

- 3

Want to Get the Most out of Your Investment Portfolio? Diversify It

Investing in different asset classes can help you reduce risk without reducing return and gives you tools to help you make your investment portfolio meet your goals.

- 0

The Six Things You Need to Know About Your Investments

Don't get overwhelmed by information—focus on what you need to know about your investment assets. Here are six of the most important things.

- 0

Tips From an Examiner for Passing Written Exams

Doing well in exams takes intelligence, hard work and dedication - but also exam technique. Make the most of your hard work with these tips.

- 0

What Are Gilts, and Should I Invest In Them?

Gilts are UK Government bonds. They are very safe investments but have low returns. Some gilts are index-linked to protect investors from inflation risk.

- 0

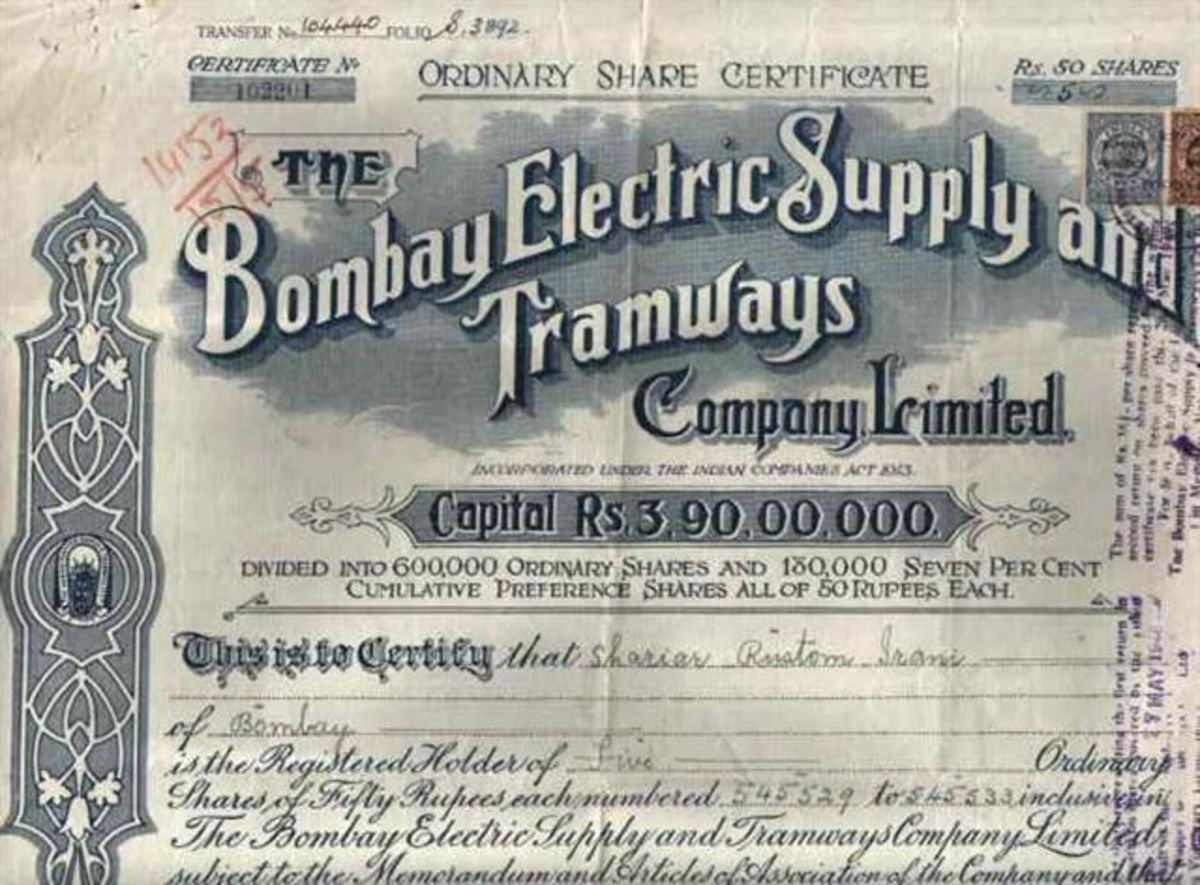

Are Preference Shares a Good Investment? The Pros and Cons

Preference shares (or preferred stock or 'prefs') are shares in a company that have a (usually) guaranteed dividend. They are, therefore, a hybrid similar to both shares and corporate bonds.

- 0

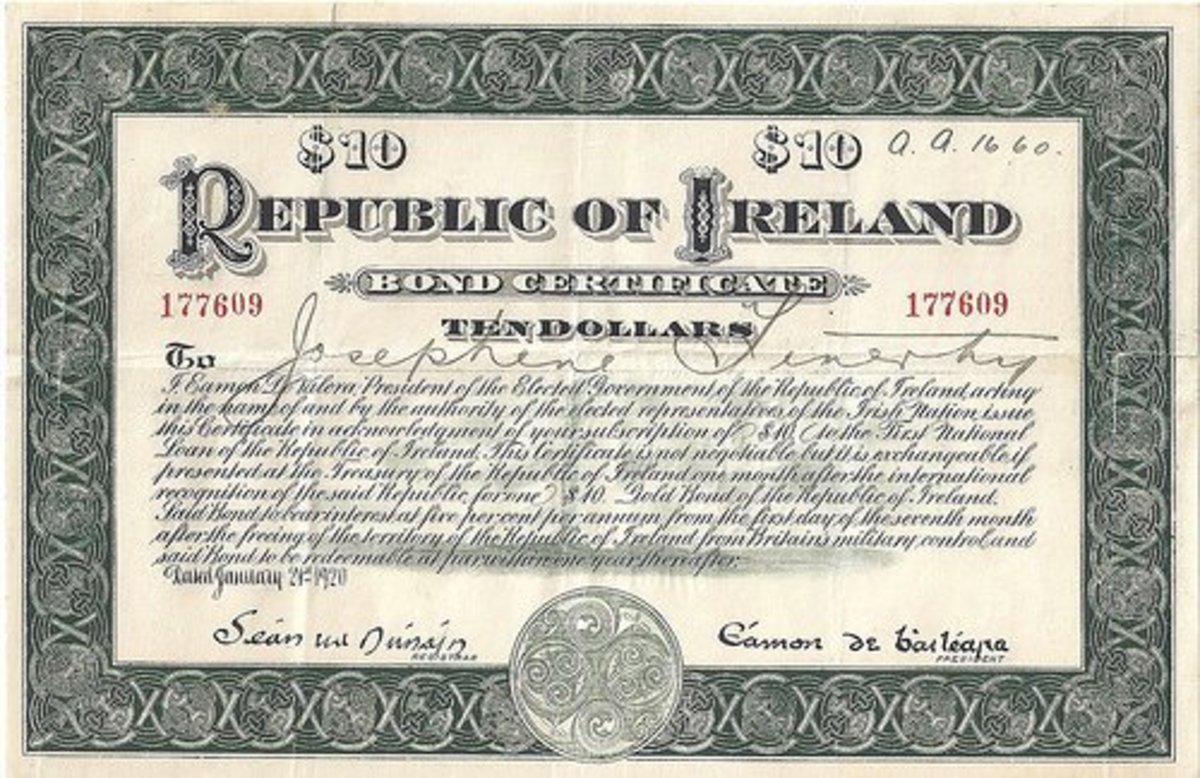

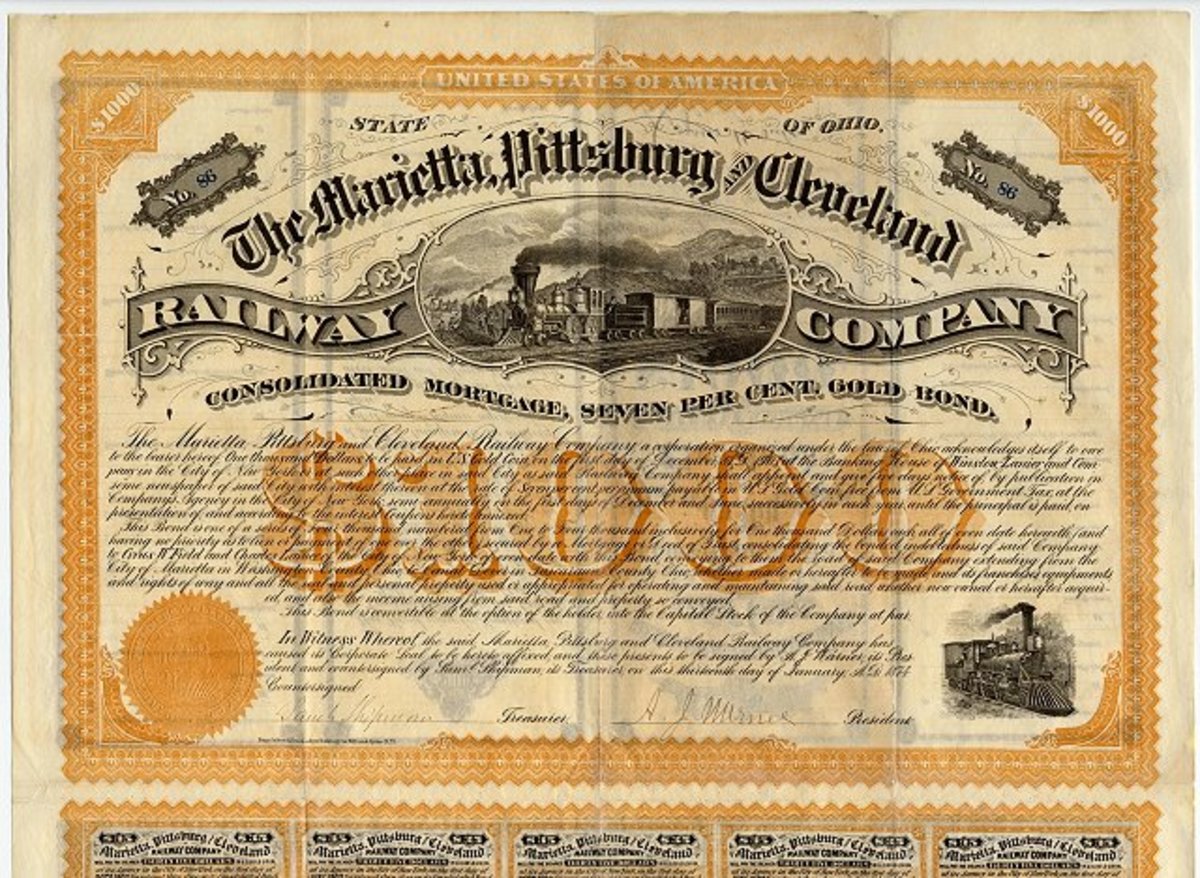

What's the Difference Between Investing in the Bonds (or Debt) Versus the Shares (or Equity) of a Company?

The differences between buying bonds or shares: what risks you are taking, what return you can expect, and how you will get paid.

- 1

9 Features That Make a Good Financial Model

Many areas of life and work are now affected by long term financial models. Modelling areas can affect millions of people and cost billions so it is important models are designed well.

- 0

What Is the Difference Between a Bond Coupon and Bond Yield?

Not sure about the difference between bond coupons and bond yields? The coupon is the regular payment of interest as a percentage of the face value. The yield is the effective return for a given bond price.

- 2

Does Higher Risk Always Mean Higher Returns? Are Lower-Yielding Investments Safer?

Investments with higher expected returns come with more risk, and safer investments generally pay less. Understanding this and how much risk you are willing to take is important in managing your investments.

- 1

The Difference Between Tax Avoidance, Tax Evasion and Tax Planning? One of Them Is Illegal!

Explains the difference between tax planning (legal), tax evasion (illegal), tax avoidance (somewhere in between), and the risks involved.

- 6

Investment Income vs. Capital Gains: Which Is Better?

What is the difference between investment income and capital gains? After all, they are both ways of getting a return on your investment. This article explains the difference and why it matters.

- 1

Is It a Good Idea to Commute Some of Your Pension for a Cash Lump Sum?

What does cash commutation mean? When can you commute your pension into cash? Here's an explanation of the process and the various times you can turn your retirement pension into cash.

- 2

Is It Worth Taking the Maximum Tax-Free Lump Sum (Pension Commencement Lump Sum) From Your Pension Scheme?

Should you take the maximum tax-free cash lump sum (pension commencement lump sum) from your pension scheme? Unfortunately, it is not always a good deal. This article gives some things to think about.

- 0

Investing in Gold: The Pros and Cons

The case for and against investing in gold. It can be a store of value, but it doesn't earn an income itself. Is it good insurance against inflation? Will it carry on going up forever?

- 0

What Is Passive Investing? Pros and Cons vs. Active Investment

What active and passive investment strategies are, and whether one is always better than the other.

- 3

The basics of pensions - how a pension plan works

The basics of pensions - how sacing now can provide an income in retirement. Pension provision in general terms.

- 60

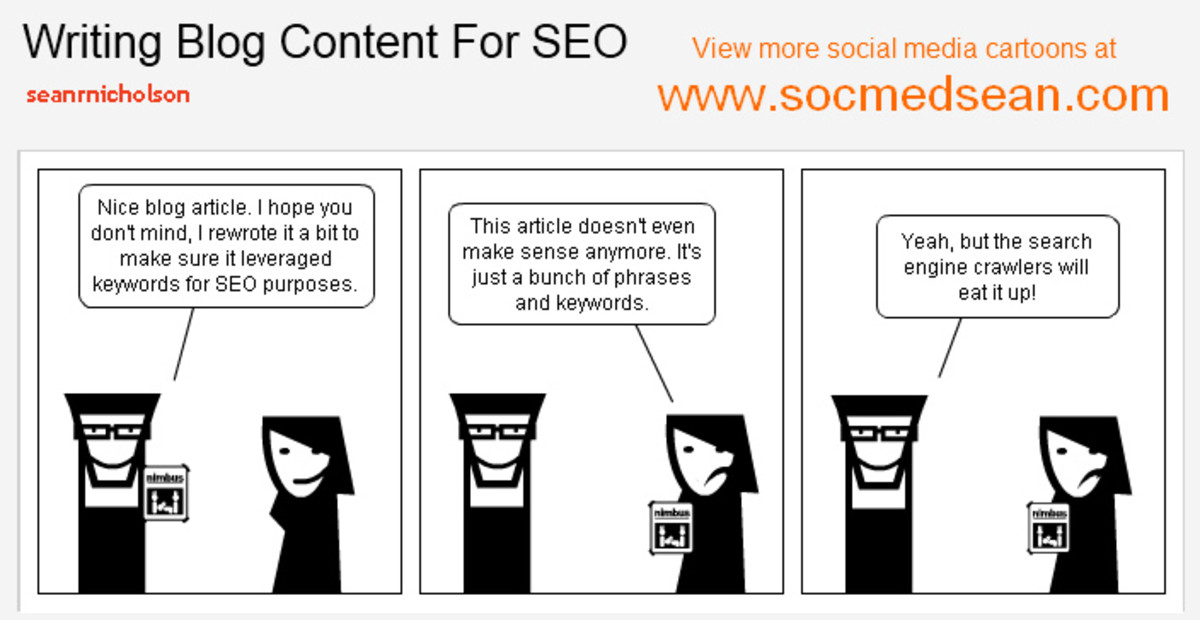

How can I get more traffic to my hubs on Hubpages? What is the best way to drive pageviews?

Tips for driving traffic to your hubpages.com hubs. Discussion of how to write well for search engines without trying to cheat them.

- 7

Is It Worth Investing in Stocks and Shares? Pros and Cons

A brief explanation of stocks and shares, how they work and what their good and bad points are for investors.

- 0

Is It Worth Investing in Corporate Bonds? Pros and Cons

This article contains a brief explanation of corporate bonds and their good and bad points for retail investors.