82

82- 0

Warren Buffett's Investment Wisdom: An Analysis of His 1962 BPL Letter

This article explores Warren Buffett's investment strategies through an analysis of his 1962 BPL Partnership letter. Learn about his unique approach to value creation, conservative investing philosophy, and the enduring relevance of his insights.

- 0

From Typewriters to Talking Machines: A Boomer's Guide to Understanding AI Language Models

Explore the world of AI Large Language Models (LLMs) in this comprehensive guide tailored for boomers - from understanding basics to its daily life applications.

- 0

Navigating Uncertainty: Proactive Thinking for Better Decision-Making and Risk Management

Discover how proactive thinking and asking 'What could have prevented this?' can transform decision-making and risk management. By harnessing the power of proactive thinking, we are better equipped to navigate our complex and uncertain world.

- 0

Copa Di Vino Update: "Shark Tank" Season 2, Episode 1 and Season 3, Episode 11

Explore the fascinating journey of Copa Di Vino on Shark Tank, its innovative wine packaging, and the aftermath of its bold refusal of a deal.

- 0

Uncovering Wisdom From Warren Buffet's 1961 BPL Letter: Essential Insights for Value Investors

Dive into Warren Buffett's 1961 BPL letter, exploring his unique investment categories, stance on diversification, and the power of compounding.

- 0

The Dwindling Attention Span in an Increasingly Complex World

Explore the irony of dwindling attention spans amidst growing global complexity, the crucial role of thought leaders, and our power to champion nuance in our world.

- 0

Unveiling the Secrets of Buffett's Partnership Letters: The Hidden Treasure of 1960

In this article, we will discover the secrets of Warren Buffett's early investment strategies through an analysis of his 1960 partnership letter. This letter offers timeless wisdom for modern investors.

- 0

Unearthing Wisdom From Warren Buffet's 1959 BPL Letter: Key Takeaways for Value Investors

This article examines some of the key takeaways from Warren Buffett's 1959 BPL letter. It offers valuable lessons for value investors on market indices, investment strategies, and more.

- 0

Lessons From Warren Buffett's 1958 BPL Letter: Undervalued Securities and Market Insights

This article examines Warren Buffett's 1958 BPL letter. It explores his insight into undervalued securities, intrinsic value, long-term prospects, market challenges, and the importance of being patient when investing.

- 0

How to Build a Market-Neutral Stock Portfolio: Profit in All Market Conditions

Discover how to build a market-neutral stock portfolio that will allow you to profit in all market conditions. We will examine stock selection, put-selling, and covered calls.

- 0

Understanding the Beige Book: A Snapshot of the Us Economy and Its Impact on Everyday Life

April 2023 Beige Book reveals mixed but stable US economic outlook, with modest growth in consumer spending, manufacturing, and nonfinancial services.

- 0

Advanced Put-Selling Strategies for Value Investors: Beyond the Basics

This article explores advanced put-selling strategies for value investors. It focuses on stock ownership, risk premium, and active management for higher returns.

- 0

Further Into the Future: Humans as Cells in a Global Organism

Discover how AI, LLMs, and evolving tech may lead to a future where humans lose individuality, forming a collective intelligence and consciousness.

- 0

The Idea Revolution: How AI and Large Language Models Are Transforming the Way We Think

Discover how LLMs are reshaping idea generation, altering human thought, and transforming problem-solving. Will originality survive the AI revolution?

- 0

Lessons from Warren Buffett's Letters: 1957 - Buffett Partnership Ltd. and the Foundations of Value Investing

Discover timeless investing lessons from Warren Buffett's 1957 BPL letter, highlighting key takeaways and insights that remain relevant today.

- 0

Redefining Communication: A World Beyond Conventional Language Skills

Discover how AI-mediated communication could revolutionize language, boost efficiency, and challenge human creativity. Will it make us less human?

- 0

A Glimpse Into 2030: LLMs, AI Conversations, and Implantable Technology

As Chat GPT and other LLMs start to take center stage, what does this mean for the next few years?

- 0

Options Strategies for Value Investors: Beyond Covered Calls

Discover how to enhance your value investing strategy with options beyond covered calls. Learn risk management, income generation, and portfolio synergy.

- 0

Stocks, Gold, Oil, and Houses: Market Capitalizations in Familiar Terms

Discover how market caps of stocks, gold, oil, & real estate have evolved over time, offering valuable insights into the ever-changing financial landscape.

- 0

Value Investing: Three Lists You Need to Keep

Learn to create 3 distinct lists that will help you track your stocks, so you'll know what to buy when the time comes.

- 0

The Only Passive Income Categories

Instead of a list of ideas, this categorization involves divergent thinking designed to get your creative juices flowing, from dividends to royalty streams and beyond.

- 0

Value Investors: How to Think About Growth

Value and growth aren't opposing sides of the market; they're both crucial determinants of future cash flows.

- 0

Buffett Principles: A Bird in the Hand

Warren Buffett and Aesop on the time value of money and some additional observations.

- 0

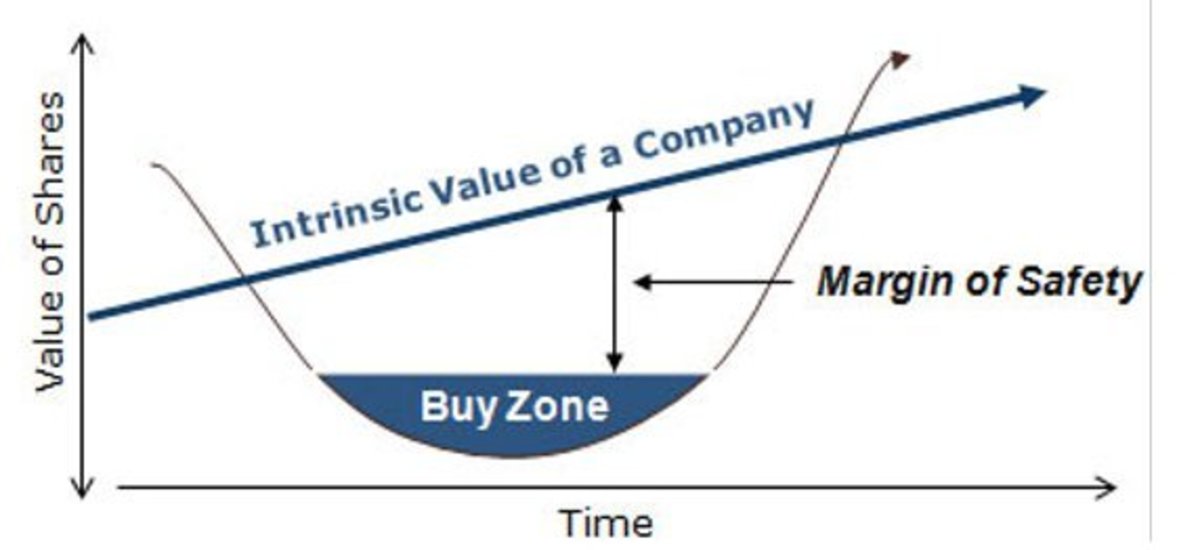

Buffett Principles: Margin of Safety

One of the core principles of modern value investing: the margin of safety.

- 0

Buffett Principles: Intrinsic Value

How Warren Buffett views the price of a company relative to what it's really worth, and how to use that when buying stocks.

- 0

How to Buy Stocks During High Inflation

A primer on what stocks to buy during rising and high inflation.

- 0

Buffett Principles: Don't Time the Market

How Warren Buffett thinks about jumping in and out of the market, and some sage advice on how to invest.

- 0

How to Survive a Bear Market in Stocks

A quick primer on things you can do before, during, and after a bear market.

- 0

Stock Investing and the Wisdom of the Crowd

How to use efficient market hypothesis (EMT) and the so-called "wisdom of the crowd" as a value investor.

- 0

How to Accumulate Wealth and Live Within Your Means

Accumulating wealth is always possible if you can accomplish these things.

- 0

3 Stock Market Crashes You May Never Have Heard Of

Russian rubles, lost decades, and the gold standard: here are three less-studied stock market crashes we can learn from today.

- 0

5 Things to Think About When Buying a Stock

Buying stocks with a plan, and a mostly clever baseball analogy.

- 0

Stocks: How to Catch a Falling Knife

If a stock is crashing in price, you might not want to buy it just yet.

- 0

Cigar Butts and Wonderful Businesses: A Quick Buffett Lesson

Buffett famously shifted his approach to value investing, but what did he leave behind?

- 0

Investing in Stocks with Geopolitical Risk

Navigating through the complex ways nations interact, and how that affects your portfolio in uncertain times.

- 0

Stocking Up: Manage Your Portfolio Like a Merchant

Thinking about your portfolio as though you're operating a convenience store may be a helpful thing to keep in mind.

- 0

Earnings Beat or Miss: What Does It All Mean?

Publicly-traded companies all report earnings, but what does it mean to have an earnings "miss" or "beat"? How can you use this to determine how a company is doing and whether it's a buy or a sell? Here's what you need to know.

- 0

3 Ways to Use Cash to Protect Your Portfolio From a Crash

"Cash is trash," except for when you really need it.

- 0

What Affects a Stock's Price?

Stocks go up and down, sometimes seemingly for no reason at all. Why do they behave the way they do? Here's some insight.

- 0

How to Get Stock Ideas

Trouble choosing stocks? Knowing whether to buy a stock or not is an incredible ability, but where do the ideas come from in the first place? Here's what you need to know.

- 0

Value Investing: Determining Your Discount Rate

How to calculate the discount rate to use when doing discounted cash flow (DCF) analysis of a stock.

- 0

"It's a Market of Stocks, Not a Stock Market": What Does It Mean?

Have you ever heard someone say "it's a market of stocks, not a stock market"? If you're confused by this statement, you're not alone. What does this classic common investing refrain mean? Here's a quick breakdown.

- 0

How to Invest in a Cyclical Stock

What is a cyclical stock? And why should you strategize differently when considering buying or selling one? Here are some answers from a value-oriented investor with a long-term view.

- 0

Why Do Stocks Go Down When the Fed Raises Interest Rates?

Why does the overnight lending rate have anything to do with the price of stocks in your portfolio? Here's the answer.

- 0

How to Create a Covered Call Portfolio

If you're interested in maximizing your returns and you have the bandwidth to sell covered calls, you can construct a conservative portfolio with better-than-average returns. Here's what you need to know about covered call portfolios.

- 0

First Rule of Investing: Don't Risk What You Have for What You Don’t Need

"Don't lose money" is a great rule, but there's one that's even more important for any investor to keep in mind: don't risk what you have for what you don't need. Here's what that means.

- 0

Macro, Technical, and Fundamentals: 3 Layers of Stock Valuation

Looking at the value of a stock through the lenses of macroeconomic conditions, technical indicators, and fundamental analysis can provide a much fuller picture for any value investor.

- 0

3 Ways to Conduct Stock Research

Due diligence is just one method you can use to learn about a particular stock.

- 0

3 Ways to Make Money From a Stock

Here are the three components that make up the return on any stock investment: capital appreciation, dividends, and options strategies.

- 0

3 Ways of Calculating a Stock's Intrinsic Value

When calculating intrinsic value, it can be helpful to have 3 probability-weighted, projected scenarios mapped out in order to dial in a specific number.

- 0

Covered Call: An Options Strategy for Value Investors

Value investing and options seem to go together like ice cream and thumbtacks. However, a covered call strategy can fit in extremely well with a catalyst-based value investing strategy. Here's what you need to know.

- 0

Stock Picking Using P/E Expansion and Contraction

Changes in P/E (price to equity) over time can factor into your valuation process and purchase decisions. Learn why this is important and how to use this information.

- 0

How to Use Cost Basis to Know When to Sell

Knowing when to sell can be one of the toughest decisions for a value investor. Here's a trick to help you monitor your portfolio for opportunities to exit.

- 0

Everything You Need to Know to Start Investing in Stocks

This article is a 30,000-foot view of the entire process of identifying, buying, selling, and managing a portfolio of self-picked stocks.

- 0

A 7-Point Stock-Buying Checklist for Value Investors

Use this 7-point checklist to confirm that your stock purchase decision is grounded in reality and facts.

- 2

3 Stock-Buying Mistakes to Avoid

"Avoid the downside, and the upside takes care of itself." Here are three of the most common mistakes investors make when buying stocks.

- 0

The Differences Between Risk, Volatility, & Uncertainty in Investing

Understanding the difference between a permanent loss of capital and temporary price fluctuation—and how uncertainty affects both—is crucial to becoming a market-beating investor.

- 0

How to Know What Stocks to Buy and When to Buy Them

Using subtraction instead of addition and maintaining a margin of safety can help you to follow Buffett's famed rule number one: Never lose money. His second rule is don't forget rule number one.

- 0

How to Calculate a Terminal Value For a Stock

Discounted Cash Flow (DCF) valuation has only two components, at its core: the cash the business produces for you (discounted back to what it's worth today), and what you could sell the business (or assets) for at some future time. This is all about the latter.

- 0

How Physics Taught Me About Stock Investing

The lessons from quantum mechanics and relativity have a great deal to teach a thoughtful investor. Here are some of the key lessons I've taken from the world of physics.

- 0

3 Great Market-Beating Superinvestors

Seth Klarman, Howard Marks, and Mohnish Pabrai are three of the 21st century's greatest value investors. This article discusses some of their main concepts and explains where to learn more about all three of them.

- 0

How to Merge Short-Term and Long-Term Investing Strategies

Switching mindsets between long and short-term investing and trading can allow you to preserve your gains while maintaining a value-investing philosophy.

- 0

Peter Lynch's Famous Numbers for Stocks

"One Up on Wall Street" gave investors in the 1990s a great deal to think about. Here are some of Peter Lynch's most important criteria for buying and selling stocks.

- 0

How to Build and Maintain a Stock Portfolio in 3 Simple Steps

If you're overwhelmed by the prospect of building a portfolio from scratch and don't know where to start, this simple, three-step process might help.

- 1

What's a Good Dividend Payout Ratio?

Dividend growth investing? It's really important to understand how to read this metric.

- 0

Cynicism: The Number One Threat To Democracy

How to participate in democracy in order to ensure that democracy itself continues to exist.

- 0

An Active Roth IRA Strategy for Value Investors

If you're interested in individual stock picking, a Roth IRA is a must-have, especially if you're likely to be very active.

- 0

A Smart Portfolio Strategy for the Intelligent Value Investor

Demystifying what to do with your stock portfolio can be difficult. Here are some incredibly simple rules to follow to help ensure that you maintain a diversified, value-oriented portfolio that performs better than the market over time.

- 0

How to Set Goals as a Small Business Owner

I've run two businesses for nearly two decades, and over the course of those 20 or so years, I've made many, many mistakes when it comes to goal-setting. In this article, I share what has worked and what hasn't.

- 0

Inflation Ahead: What to Know as a Stock Investor

This article offers a quick primer on the good, the bad, and the ugly of inflation as it pertains to buying and selling stocks.

- 0

Stock Valuation: A Short Primer

This article provides a brief introduction to the various components of a company's valuation.

- 0

Preparing for a "Lost Decade" in Stocks

Dollar-cost averaging into the S&P 500 might not work out as well as you think over the next decade or two. Here are some important things to think about when it comes to building a portfolio that will be successful in the long term.

- 0

How to Use Dividend Growth Investing to Earn Passive Income

If your main goal is to grow a passive income stream, dividend-growth investing may be your best bet. Here are some basics.

- 0

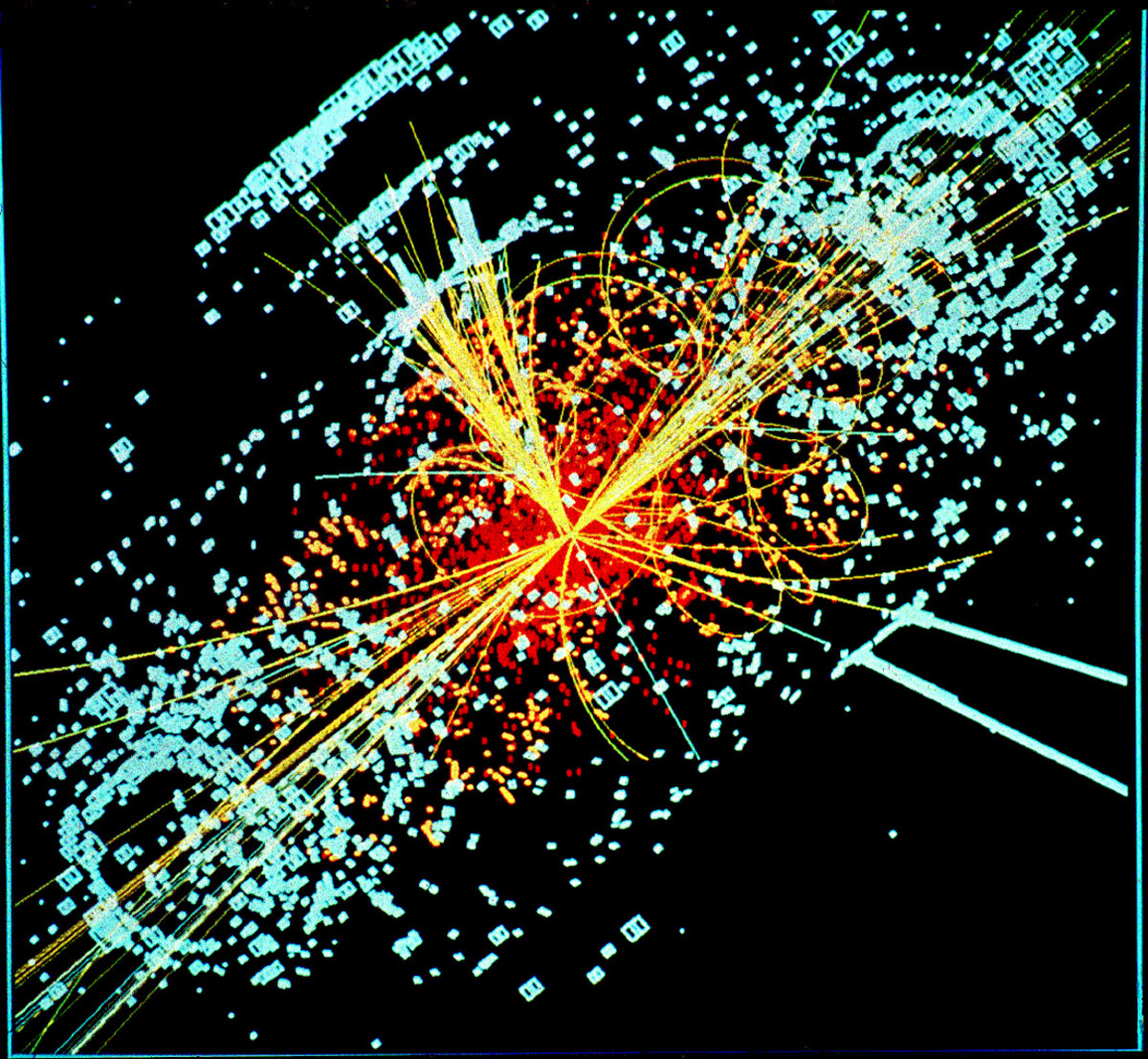

How to Invest in Stocks Like a Scientist

Take the mystery out of stock investing by measuring your results and challenging your assumptions like a scientist.

- 0

How to Not Lose Money in the Stock Market

If you minimize the downside of your portfolio, the upside will often take care of itself. Focus on the downside!

- 0

How to Automate Your Stock Investing

There's a better way to rewire your brain so that your investing habits are automatically implemented into your stock research, buying, and selling routing.

- 0

Helpful Resources for Value-Investing Research

This article provides a compendium of resources you can use to research value-investing strategies, including YouTube channels, books, blogs, newsletters, and more.

- 0

How to Be an Effective Business Owner (or Investor)

What's the most important thing to measure in business? Answer: your overall effectiveness.

- 0

Value Investing: Styles and Techniques

Different strategies and styles of value investing, including dividend growth, cigar butts, and contrarianism.

- 0

What Is Contrarian Investing?

Here is a definition of contrarian investing, by way of showcasing 5 different types of contrarianism in the investing world.

- 0

Jiu Jitsu and Economics

Several lessons from economics can apply to Brazilian Jiu Jitsu, and vice versa. Here are some of the main lessons that carry across both disciplines.

- 2

Stock Investing and Trading: Tending the Garden

Having the discipline to stick to a plan is crucial for knowing when to sell your stocks.

- 0

How I Buy and Sell Stocks (My Investment Journey)

This article outlines my personal strategy for buying and selling stocks. I practice value investing and use risk management, following the lead of great investors and learning from my own experiences.

- 0

Gamestop Explained: Short Squeeze, Reddit Vs. Hedge Funds

The 2021 Gamestop Short Squeeze initiated by Reddit followers on the WallStBets forum explained, along with ideas about long term implications.

- 0

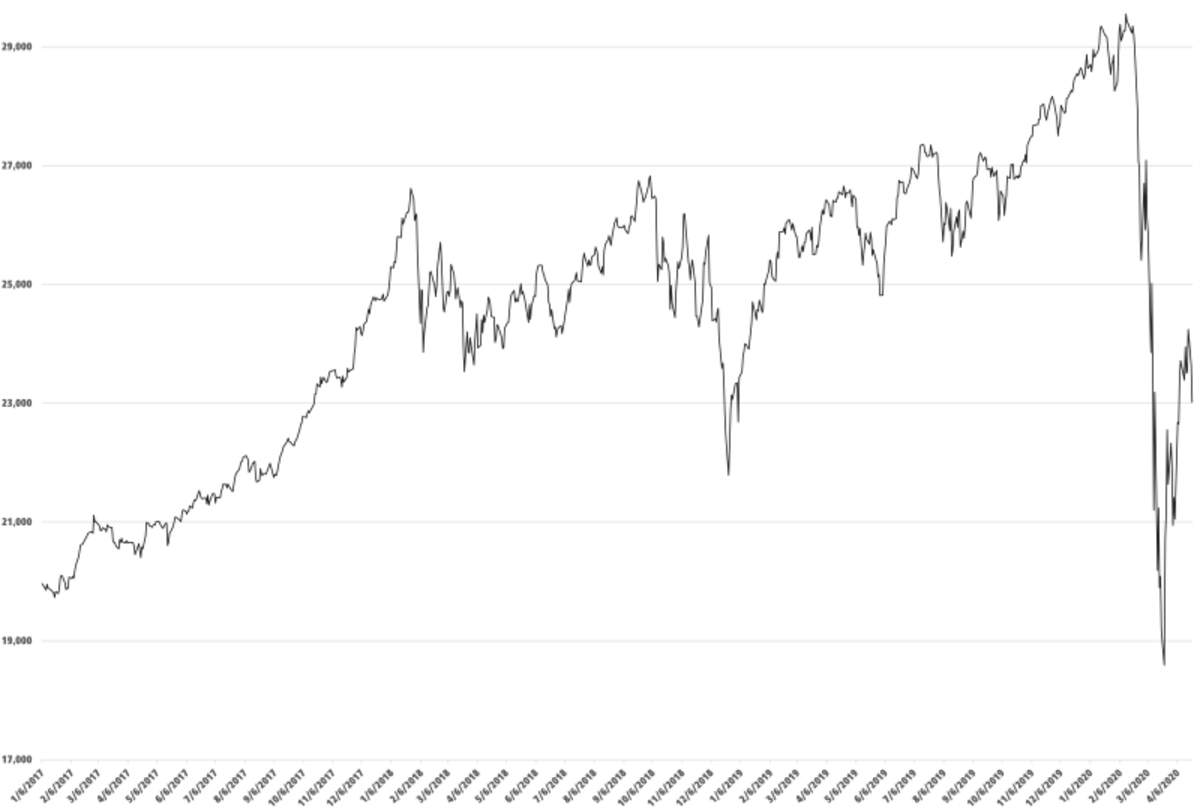

April 2020: Investing at the Bottom

Finding lessons with my mentor during the rock bottom of the stock market, April 2020, in a trial by fire.

- 0

Buying Stocks at the Beginning of a Crash: Lessons from 2020

A look back at conversations with one of my investing mentors right as the covid crash of 2020 was beginning, including the lead-up to it in February.

- 0

Berkshire Hathaway: Ironically, the Ultimate Speculation

The irony is not lost on me: the Oracle of Omaha frequently talks about the correlation between "owner's earnings" and value, but Berkshire Hathaway has yet to ever pay a dividend.

- 0

Conversations: A Beginner's Guide to Value Investing and Portfolio Management: Introduction

A recently minted value investor jumps into the fray during one of the market's most volatile periods, with some coaching from 20-year vet whose main emphasis is risk management with some tangential knowledge of different investment accounts, products, and diversification factors.

- 3

3 Warren Buffett Quotes Explained

We will examine three of Warren Buffett's most insightful quotes used to explain the investing landscape.

- 0

Bombas Update: Shark Tank Season 6, Episode 1

Update on how Bombas from Shark Tank Season 6, Episode 1 has done since airing on the show, whether the deal went through, and how they're doing today.

- 2

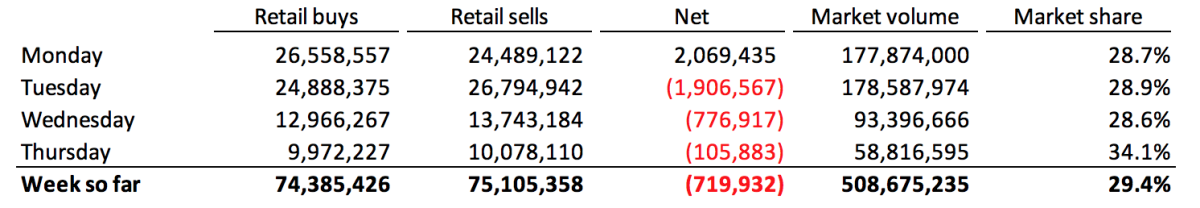

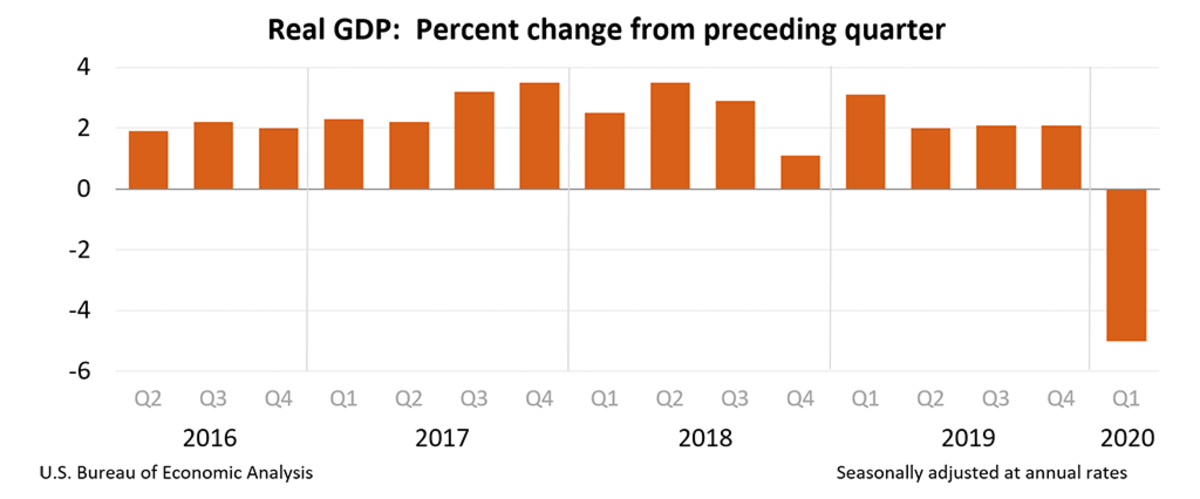

Why Is the Stock Market Going Up If the Economy is Going Down?

Why is the stock market going up during bad economic times? Great question, and maybe not as insane as it might seem at first glance.

- 0

Voyage Air Guitar Update: Shark Tank Season 1, Episode 3

Update on how Voyage Air Guitar from Shark Tank Season 1, Episode 3 has done since airing on the show, whether the deal went through, and how they're doing today.

- 0

The Paint Brush Cover Update: Shark Tank Season 5, Episode 22

Update on how The Paint Brush Cover from Shark Tank Season 5, Episode 22 has done since airing on the show, whether the deal went through, and how they're doing today.

- 0

Rugged Maniac Update: Shark Tank Season 5, Episode 22

Update on how Rugged Maniac from Shark Tank Season 5, Episode 22 has done since airing on the show, whether the deal went through, and how they're doing today.

- 0

Ava The Elephant Update: Shark Tank Season 1, Episode 1

Update on how Ava the Elephant from Shark Tank Season 1, Episode 1 has done since airing on the show, whether the deal went through, and how they're doing today.

- 0

Breathometer Updtate: Shark Tank Season 5, Episode 2

Update on how Breathomoeter from Shark Tank Season 5, Episode 2 has done since airing on the show, whether the deal went through, and how they're doing today.

- 0

FiberFix Update: Shark Tank Season 5, Episode 6

Update on how FiberFix from Shark Tank Season 5, Episode 6 has done since airing on the show, whether the deal went through, and how they're doing today.

- 0

U-Lace Update: Shark Tank Season 5, Episode 19

Update on how U-Lace from Shark Tank Season 5, Episode 19 has done since airing on the show, whether the deal went through, and how they're doing today.

- 0

Hamboards Update: Shark Tank Season 5, Episode 4

Update on how Hamboards from Shark Tank Season 5, Episode 4 has done since airing on the show, whether the deal went through, and how they're doing today.

- 0

LockerBones Update: Shark Tank Season 5, Episode 14

Update on how Lockerbones from Shark Tank Season 5, Episode 14 has done since airing on the show, whether the deal went through, and how they're doing today.

- 0

The Stock Market Is Like a Wave, Kind Of

Four analogies that aptly (hopefully) describe the stock market, so you can better understand how to invest.

- 0

Rapid Ramen Cooker Update: Shark Tank Season 5, Episode 3

Update on how Rapid Ramen Cooker from Shark Tank Season 5, Episode 3 has done since airing on the show, whether the deal went through, and how they're doing today.

- 0

The Freeloader Child Seat Backpack Update: Shark Tank Season 5, Episode 3

Update on how The Freeloader kids' backpack from Shark Tank Season 5, Episode 3 has done since airing on the show, whether the deal went through, and how they're doing today.

- 0

Mr. Tod's Pie Factory Update: "Shark Tank" Season 1, Episode 1

Update on how Mr. Tod's Pie Factory has done since airing on the show "Shark Tank."

- 2

The 10 Commandments of Running a Business

Learn 10 simple rules to follow for running a business!

- 2

What Is "Grey Goo"?

Grey Goo for Dummies: a Layman's Breakdown of the Realities of the Nanotechnology "Worst Case" Scenario

- 2

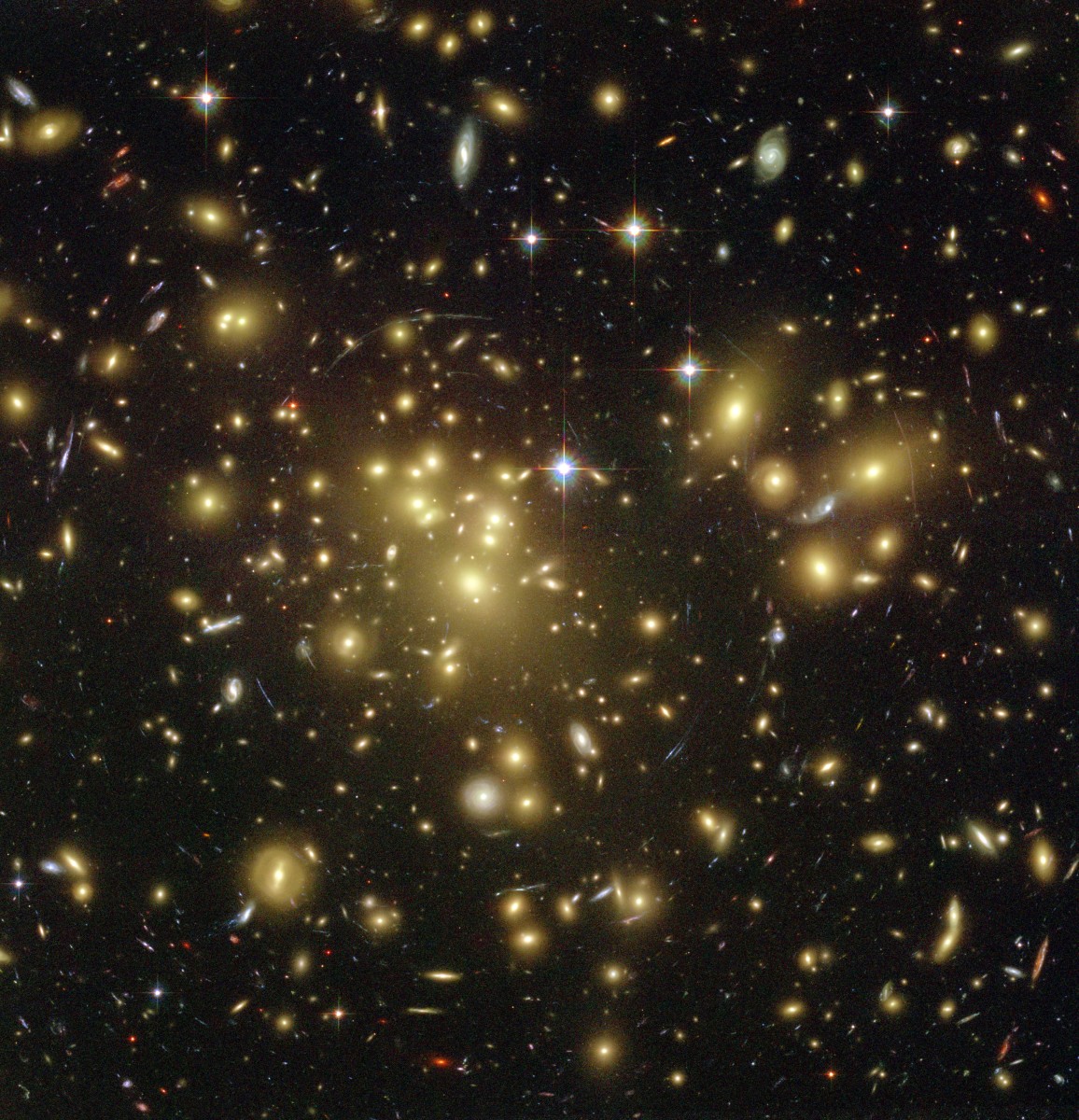

The Bouncing Universe

Want to have your mind blown as you're falling asleep? Consider the cyclic model of the universe, in which everything is annihilated periodically, only to be created once again anew.

- 10

The Higgs Boson (for Dummies Like Me)

What the heck is the Higgs boson, and what's the Higgs field? This will be a lot easier to understand than you might think, and at the very least, you'll be able to sleep easier!

- 10

Is the Universe Like "the Matrix"?

Is it possible that we're living in a simulated universe? It might be more conceivable than you think. Here's why!

- 18

When Will the Technological Singularity Happen?

Perhaps transhumanists (or "singularitarians") are asking the wrong questions. Maybe we shouldn't be asking when the technological singularity will happen, but rather how long it has been happening.

- 9

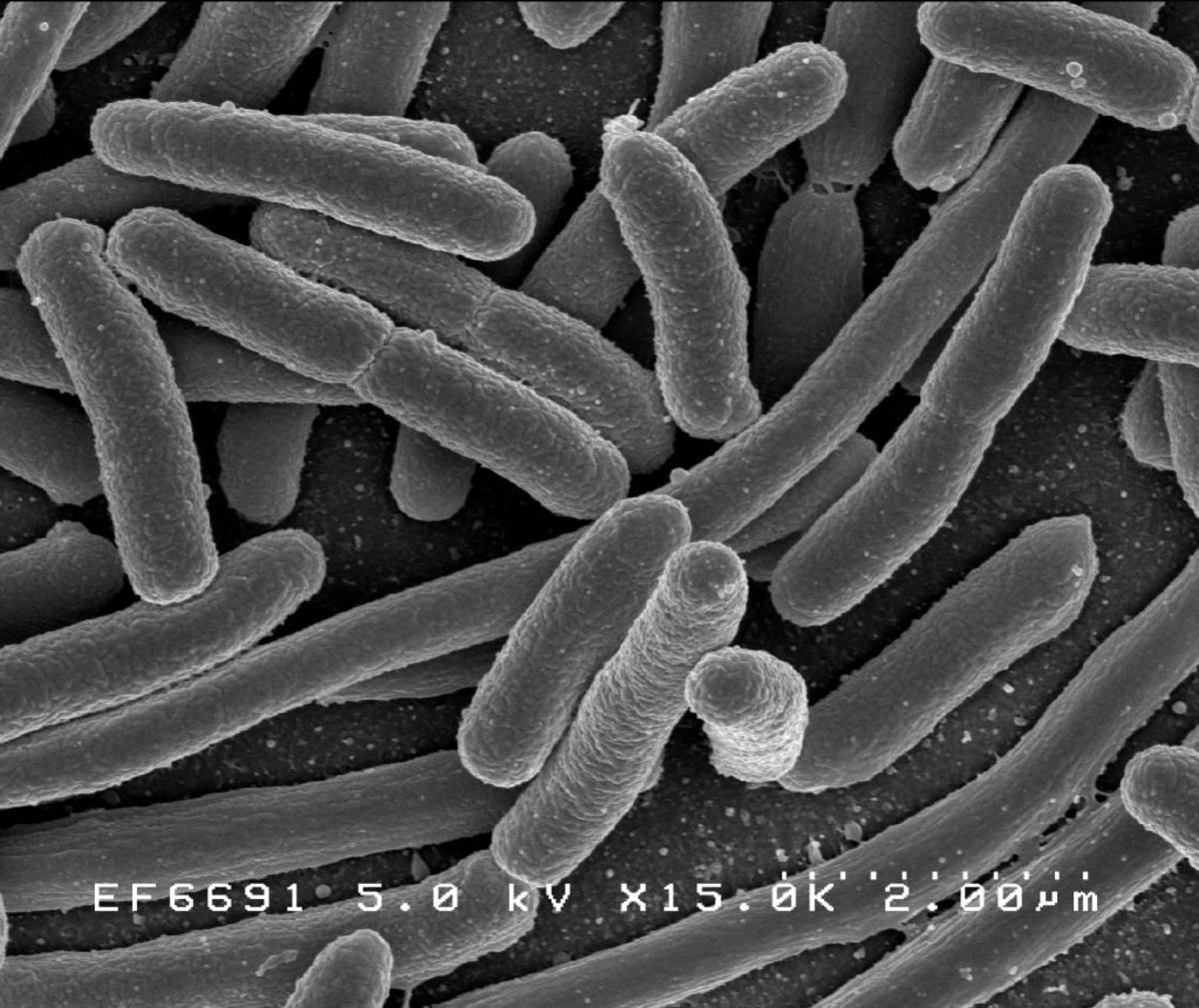

What Is Nanotechnology or "Nanotech"?

Nanotechnology is not a complicated notion, but it sure can sound fancy. If you've heard about it but you'd like to learn a little more, here's a quick primer on nanotech.

- 2

Empty Space for Dummies Like Me

Gazing out in wonder at the immensity of the universe, or peering within at the scale of the atomic particles, it's important to note that it's almost all empty space.

- 4

What Should You Know Before Flying for the First Time?

Sitting at the airport, I looked around and was startled to realize I was far better prepared than almost everyone for every step of the journey. Here are things I do differently than most.

- 14

Why is Gravity Called "The Weak Force"?

Sort of a "Physics for Dummies" look at the force of gravity. What makes it so "weak" when we obviously feel its powerful effects every day? Doesn't gravity dominate the universe?

- 16

A Conversation on Consciousness: Futurism and Philosophy

Consciousness uploading, the dualism problem, and a wild philosophical and scientific discussion of things to come as the technological singularity approaches.

- 5

3 Cardinal Rules to Staying Healthy After 40

This is the plan that has worked really well for me. I am over the age of 40, and I continue to remain very active.

- 39

How to Start Using Passive Income

My own personal experiences with earning passive income thus far, and where I'd like to head in the near (and far) future

- 18

How I Quit Drinking, Changed My Habits, and Became More Productive

More than a decade ago, I quit drinking. Over the course of the last five years, I've increased my productivity dramatically, accomplishing business and personal goals galore. Here's how I did it.

- 0

How to Keep Ringworm, Staph & MRSA Away From a BJJ Gym

You can contract nasty skin infections, including ringworm, staph, and MRSA, while training in Brazilian Jiu-Jitsu. Here's how to protect yourself.

- 9

How to Help Rescue Dogs if You Can't Adopt

Do you have a big heart for our four-legged furry friends and want to improve the quality of a dog's life? Here are three ways you can make a huge impact even if you can't adopt.

- 9

How to Save Money When You're Broke

Saving money isn't easy. Whether you're interested in investing for the future, or just to have some money put away for a "rainy day" or emergency, saving money when you don't have much can be tough. Here are some tips.

- 26

In 100 Years, Artificial Wombs Will Make Pregnancy Look Barbaric

We've seen enormous progress that has changed our mentality about the way we live. Could childbirth be next?

- 2

What Net Neutrality Means in an Accelerating World

The issue of Net Neutrality threatens to change the very nature of the Internet away from an individual-empowering one to "Big Brother" of Orwell's 1984 or from Apple's Macintosh commercial from 84.

- 15

Is Exponential Acceleration Part of Evolution?

Where are we going, and how did we get here? These are the two most important questions we can ask ourselves as a species, and here are some speculative answers based on today's best evidence.

- 11

Nostalgia, Alf, and the Not So Good Old Days

We look back with nostalgia on the 1980s right now, and during the 80s, we looked back on the 50s. But how good were these times? Let's take a slightly closer look at the big picture.

- 6

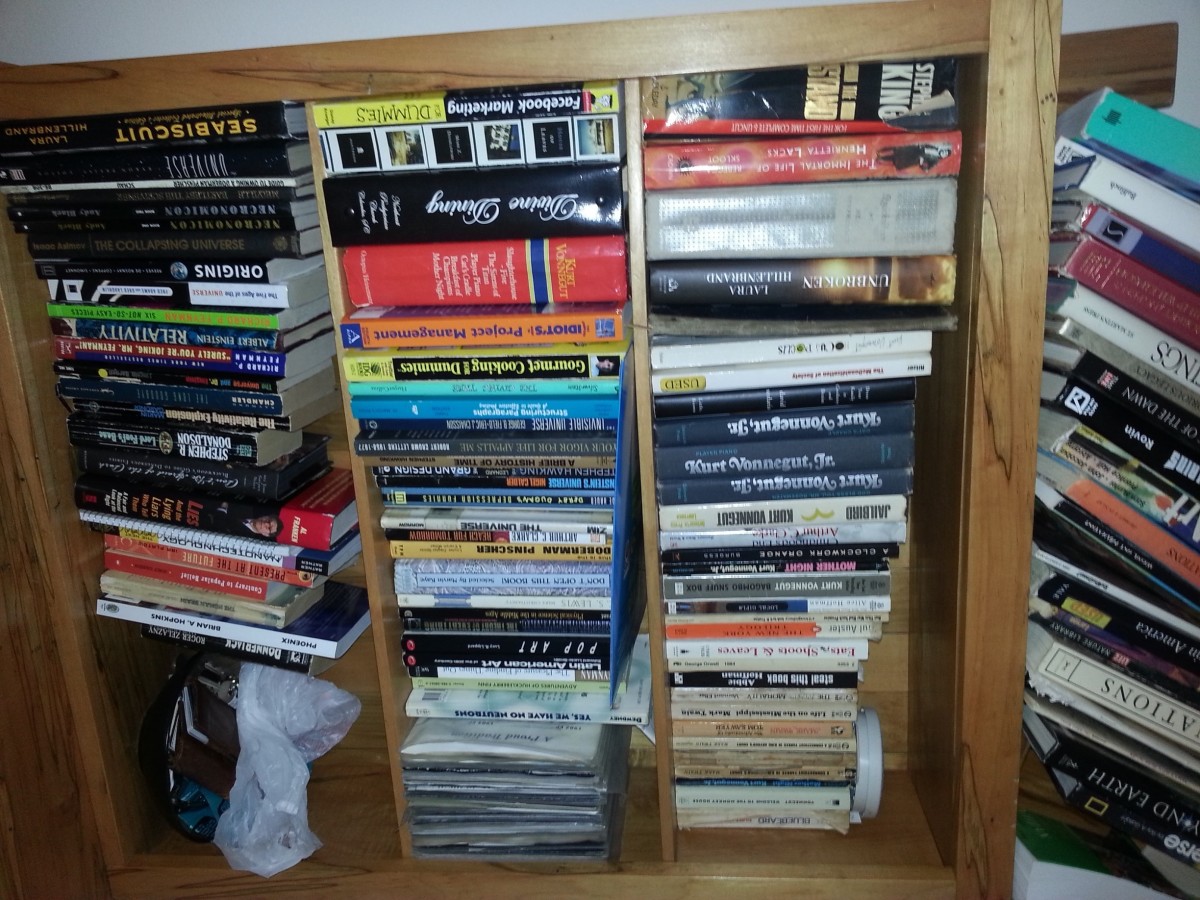

Five Books about Big History

My nonfiction reading list has been all over the place the last few years, from history to how social systems operate, to nanotechnology and beyond. The really important ones have common traits.

- 4

10 Things Being in a Punk Band Taught Me

There are certain "life hacks" that you have to experience out of necessity in order to learn, and being in a punk rock band in the late 90s was a great, if brief, experience.

- 30

Transhumanism: The Next Step in Becoming Human?

Exploring transhumanism's journey and implications, the piece asserts humanity's evolution is rooted in technological innovation. It urges embracing our tech-enhanced future.

- 7

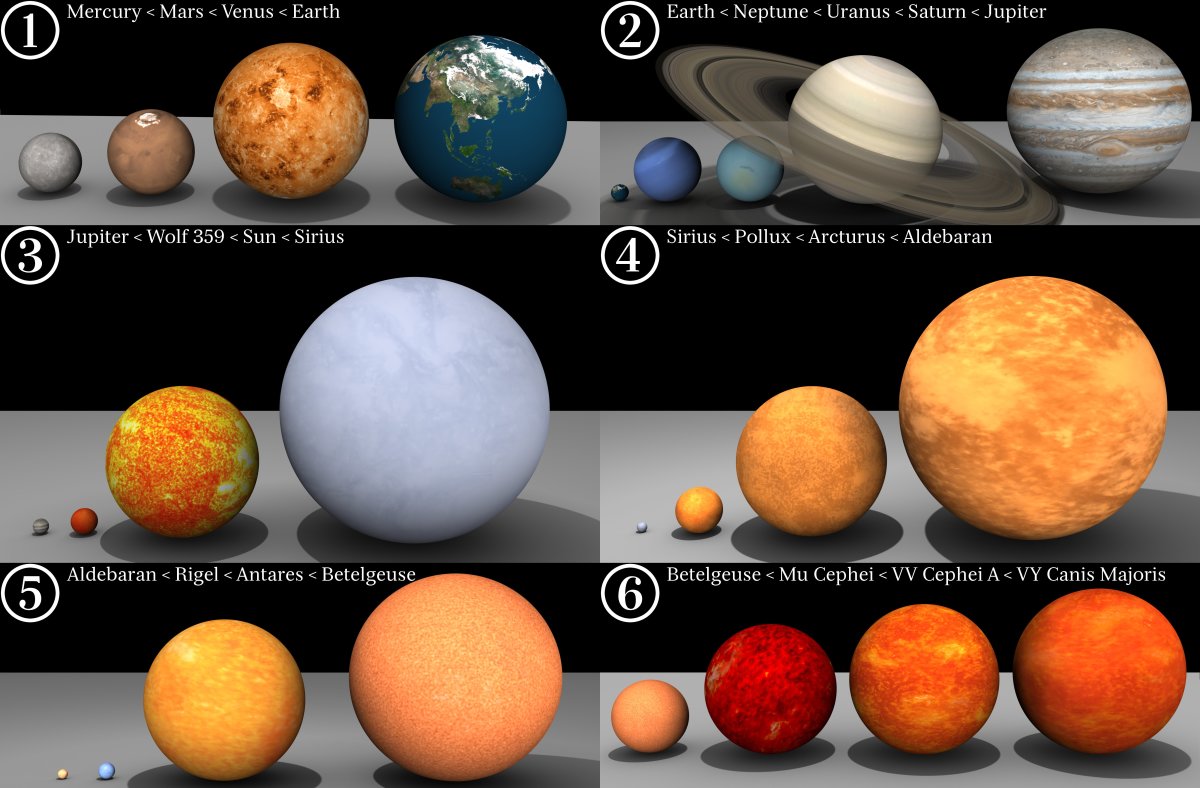

How Big is the Solar System?

Ever have a hard time falling asleep at night, but don't want to turn on the lights to do some reading? If you enjoy thinking about the universe, these thought experiments will blow your mind.