If You Are Selling Your Used Car, Here's Why You Should Get All of Your Money up Front

You Are Not a Bank

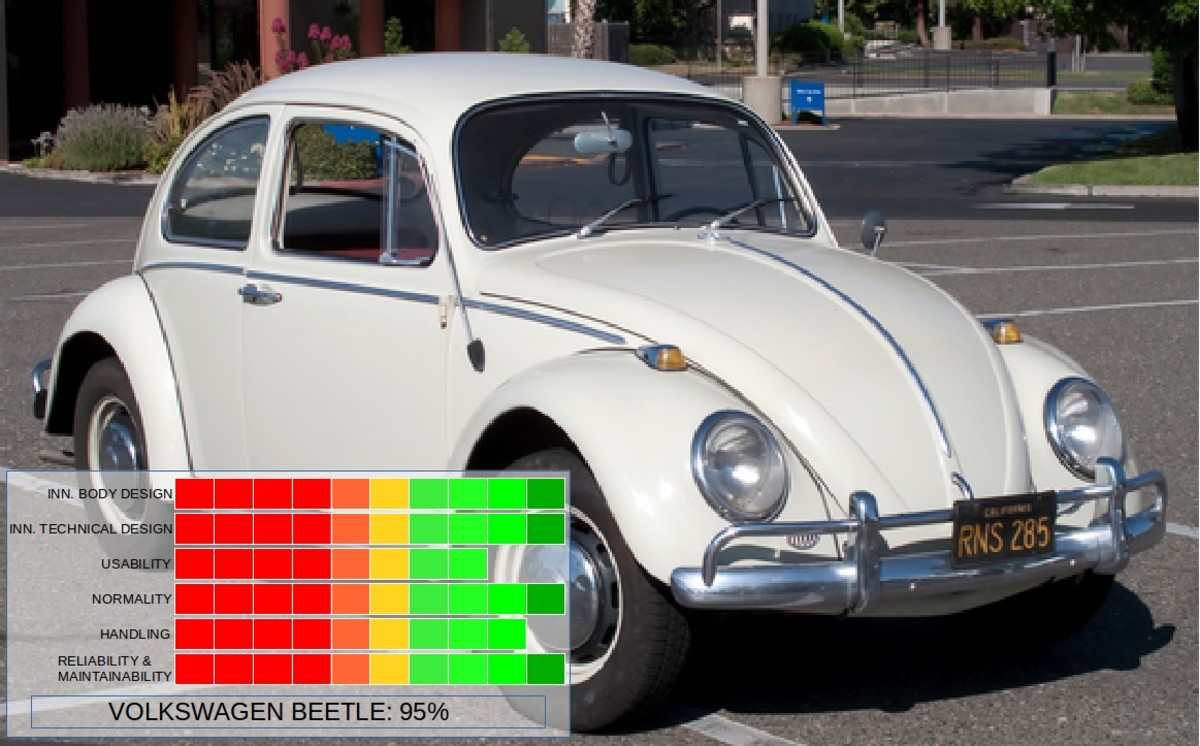

You decide to sell your used car for an upgrade. It’s had a few problems which you have fixed over the years. Now it’s about nine years old, still in fair to good condition, but not enough for you to invest anymore money. You decide to sell it or trade it in.

Friends and relatives get wind of it, and you are called upon to sell the car rather than trade it in at a dealership. You are reluctant because of the age of the vehicle, but you decide to sell it and use the money for your new car. One of your friends makes a good offer. It is higher than what you would get in a trade.

One problem; your friend doesn't have all the money right now. He asks if he can put some money down and make monthly payments. Here is when your problem begins. In case you don’t realize it, your buddy wants to treat you like a bank or credit union. He wants you to finance the car.

My advice is, if you are selling a car “as is”, never allow the buyer to take the car with a deposit and a payment plan for the balance. It doesn't matter if it’s your best friend, your cousin, niece, or your supervisor at your job. Why? What’s wrong with that? Here are some reasons why:

- Your friend may get parking tickets while driving it on the layaway plan. He doesn't tell you about them. However, because you still officially own the car, those tickets will be your responsibility, with interest and penalties added as time moves on

- Remember, you are selling a car that is about nine years old. You maintained it well, which is why your friend wants to buy it. He saw the care you took on it. Still, a nine-year old car will have future problems no one can anticipate. It is inevitable that if you allow your friend to drive the car while making payments, there will continue to be wear and tear placed on it

- While driving, your anticipated buyer may become aware of repairs needed on the car, such as brakes or tires. However, he or she fails to tell you about them. If the deal goes dead, you will have to make those repairs

- While in the anticipated buyer’s possession, the car will inevitably break down. It may need a water pump. Another time it may need an alternator. It may start to burn gas. You will have to pay for those repairs because you still own the car.

- What happens when the friend becomes reluctant to keep the car because it needs repairs? He will pay on the car in full for a couple of months. Then, the payments will be late, or you are given a partial payment. Then, he skips a month.

- When you call and ask when you will be paid, he will complain about the inconveniences he has because the car is always in the shop. When he has the car gas is expensive. He can’t pay you and his transportation costs, too. You will just have to be patient and wait for your money.

You remind your friend that wasn’t the original deal. The deal was that he would have the car paid in full in four months. No dealer would allow such a generous payment plan. They get their money up front.

Your friend is highly insulted that you are asking him to pay up. He will call you everything but a child of God. Originally grateful that his pal sold him the car, he now calls you money hungry. “How dare you want the rest of the money for this lemon you sold me?

Now you will have to pay to repossess your car, an unanticipated extra expense. You take back your car. A few weeks later you get a handful of unpaid parking tickets in the mail. You've been stiffed for the car, car repairs, and now parking tickets. You file a small claims case. One will win, and the friendship is irretrievably broken.

By the way, because your friend drove your car while making payments on it, he put added wear, tear, and mileage on the vehicle. You see some dings and scrapes that weren't there before. So now you can’t even ask for the same price you had offered your former friend.

When you sell a personal car, regardless to whom, get all the money up front. Tell everyone that is your firm policy. Put in writing that you are selling it “as is”, with no warranties included. Even if you agree to a payment plan, keep the caruntil all the payments are made. The friend doesn't own it until he’s paid for it in full. Don’t make any verbal agreements on the side

You are not a bank. If a friend or relative went to a used car dealer, the dealership would get all the money before they released it. If your friend could have gone to a bank or credit union and received a car loan, they wouldn't need to buy from you or someone else. So something is wrong with their cash flow.

Protect yourself and your investment

- Before you turn over the keys to your car, sell it “as is”, in writing

- Do not turn over title until you have all of your money, especially if it is a person you don't know

- If you decide to allow monthly payments while the customer drives the car, be specific as to how much money you expect each month, and what you will do if the monthly payments are not made on the day specified

Let the buyer have the car only after it is paid in full. It will save you a boatload of trouble, potential ill will, and legal funds.

This content is accurate and true to the best of the author’s knowledge and is not meant to substitute for formal and individualized advice from a qualified professional.

© 2011 Carolyn Gibson