What's The Difference Between A Car Loan And Auto Leasing?

Auto Finance - Auto Loans vs. Auto Leasing

What is the difference between auto loans and auto leasing? Having worked in car sales for a dozen years, I frequently encountered confusion and misconception when it comes to financing a new or used car.

With a variety of auto financing options available to car buyers, I'd like to take a closer look at the more common forms of auto finance and hopefully help bewildered buyers to make better informed decisions.

Types of Auto Financing

Who finances what and how?

Generally speaking, whenever someone purchases a new or pre-owned car and doesn't put the whole purchase price in cash on the car dealer's table, some form of auto financing will bridge the gap between downpayment and total acquisition cost.

Auto financing often gets confused with auto leasing. These two are different in that a lease is technically not a loan for a purchase. Auto leasing is more like a long term rental, where the lessee pays the leasing company monthly rent for the usage of the car.

Formal Auto loans and leases are available from a variety of sources. From conventional and online banks, to dealer financing, manufacturer financing, and credit unions.

Auto Loan Basics

It is a common misconception that an advertised monthly car payment of $99 is a better deal than, say a $250 payment.

Money is a commodity on the market, and as such costs more or less the same in terms of interest rates, within a few fractional price points. So why do lender's offers differ so much?

Several factors influence the rate that the lender will charge you for the loan. It is important to know these factors if you want to be able to determine if you are really getting a good deal.

The prevalent prime rate is one factor that no lender has control over. So this is the starting point of the calculation. Here are some of the most common factors that can vary from one lender or dealership to another:

- The purchase price of the car. Well, this seems obvious. A $50,000 sticker price will have a higher monthly payment than a $20,000 car.

- The manufacturer rebate. Now this has a lot of potential uses, and this is also where it gets confusing.

Most car models will get some amount of incentive, sometimes referred to as cash back. Will the whole amount be factored into the loan? This could be either as a downpayment to reduce the loan amount, or as a "rate-buydown" to lower the interest rate. Or will a portion be used to offset registration fees and/or taxes? It is a good idea to know beforehand what official incentives and rebates are currently available. Do your research online to save time.

- Your downpayment. This could be a chunk of cash plopped on the dealer's table, or the value of you old car, if you trade it in. More on trade-ins later.

- Your credit score. It's no secret, your credit score plays an important role in determining how much car loan amount you qualify for and the interest rates the lenders will charge you.

Before you even hit the showrooms you should have a good idea about what your credit score, or FICO score, says about your credit worthiness. If you don't know your scores now is the time to find out.

- The duration of the loan.

- A loan for 24 months will have a higher monthly payment than a 60-month loan. Yet the shorter loan would be "cheaper" overall. First, because the interest rates for shorter loans are generally lower, and second, because, well, you will be paying interest for a shorter period of time. Makes sense, doesn't it?

Another interesting fact is that during the entire duration of the loan the ratio of principal (amortization) and interest is not distributed equally. This means that in the beginning, a greater portion of your payment will be allotted for interest and fees. The principal, which pays off (amortizes) the loan amount, will be small at first, and then increase the closer you get to the end of the agreed term.

Normally, this shouldn't concern you much, but it will gain importance if, for some reason, the loan gets terminated before it's due date. The earlier this happens, the greater the risk that the car's market value is less than the amount owed, especially if you bought the car brand new and financed more than 80%.

You may have heard the sad fact that a new car loses 20 - 25% of its value the moment you drive it off the dealer's lot. But it might take you 2 years before you paid down 20% of your principal loan amount. You could find yourself in the uncomfortable position of being indebted to the lender.

Having an insurance which covers the new car price in case of a major accident or theft during the entire first year helps greatly to reduce this risk.

Auto Leasing Basics

If a low monthly car payment is your goal you will come across auto leasing offers. The payments are usually lower than auto financing rates because you generally do not pay off the entire purchase price.

When you lease a car you are renting it for the agreed period of time from the leasing company. They will purchase the car of your choice and then lease it back to you.

It is possible to calculate very attractive sounding monthly payments that can be adjusted up or down in many different ways. Generally, you will have to pay a big chunk up front. Then, the car's residual (remaining) value at the end of the lease period is estimated. Since this value depends largely on the mileage, you will be limited to a certain amount of miles either per year or overall. Once you exceed this limit you will be charged either per mile or per 100 or 1000 miles.

If you are a commuter in one of the large metro areas chances are that the advertised mileage of 10 or 15k per year is not enough! If you know this beforehand you might want to consider negotiating a higher yearly or total mileage allowance.

The difference between purchase price, minus down payment and residual value is the portion that you will be paying off during the lease term. Together with a calculated "leasing fee" which includes interest and profit margin for the leasing company.

You should also be aware that the condition of our car will be assessed at the end of the lease. If there are any damages or excessive wear and tear you will most probably be charged for the repairs.

Make sure you will be disclosed what the residual value for your car will be, and if you have the option to purchase your car for this value at the end of the lease term. A fair leasing company will give you this option.

Car Financing and Your Bargaining Power

Get your car loan before you go out to buy a new car

You may have heard that cash buyers are in a better position when it comes to negotiating the best deal for your new car. That is partially true. When the dealer doesn't have to buy down your interest rate or subsidize your down payment chances are, he's more open to giving you a plain old-fashioned discount or throw in some extras to sweeten the deal.

However, you can still negotiate the price of your new car like a cash buyer even if you are planning to finance it with an auto loan. The key is getting pre-approved with an independent direct lender. You'll have their check in hand the next day and can now negotiate like a cash buyer.

The Cost of Trade-ins

A closer look at trading in your old car

If you trade in your old car with your dealer, chances are you are missing out. Especially if you are driving a hard bargain on your new car, the dealership will calculate your trade as a regular business decision. Buy it cheap, make it pretty, sell it for as much as possible.

If you take it upon yourself to find a buyer for your old car you will most definitely have a couple of hundred, if not a thousand or two, more $$ in your pocket.

It can be a hassle though, and many people gladly sacrifice the potential profit in exchange for the convenience. Consult the Kelley Blue Book or similar, and compare the trade-in value to the private party sale price to get an idea of what your possible profit or loss might be.

If your old car is in really bad shape, or not worth a whole lot for whatever reason, you might also want to consider donating it to a charity. They will usually pick it up for free and issue you a receipt for your tax returns.

Auto Finance and Taxes

There's just no escaping them

When you finance a car you are essentially purchasing it and therefore will be required to pay sales tax on the entire purchase price. Your monthly payments will not be subject to sales tax anymore.

During a lease it will be up to the leasing company to pay the sales tax since they are officially the buyer. However, you will be required to pay tax on every monthly payment.

This is an important factor when you compare advertised monthly payments!

Buying A Car With Less Than Perfect Credit

Further up in Auto Loan Basics we discussed how your credit score plays an important part in the calculation of your auto loan rates. Let's say you obtained your FICO scores and know for a fact that your credit score is bad, really bad. In this case, your chances of getting a new car financed are slim, at best.

So, does it mean you can't buy a car if your credit it bad? Certainly not. There are quite a few lenders who specialize in bad credit situations.

Car Buying Tips For The Rest Of Us - A small investment can save big bucks!

If the knowledge in this book could save you just 1% on your next $25,000 car purchase, would it be worth it? You bet...

What is a Car Title Loan?

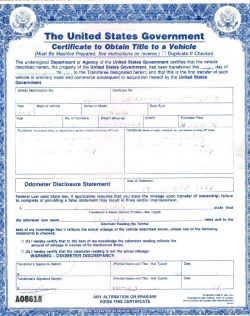

A car title loan, sometimes just referred to as title loan, is a secured loan where the borrower provides their car as security (collateral) for the lender. If the borrower defaults on the loan, the lender may take possession of the vehicle. Since the title loan poses a lower risk than an unsecured loan the borrower might obtain a more favorable interest rate than he could get on an unsecured loan.

Generally, the maximum loan amount will be around 50% of the car's resale value. The loans are typically short-term, and tend to carry a comparatively high interest rates. They are commonly used mostly by subprime borrowers with few alternatives. In addition to verifying the borrower's collateral, many lenders verify that the borrower is employed or has some other source of regular income. The lenders do not generally consider the borrower's credit score. In this sense, title loans are broadly similar to the (typically unsecured) payday loans, and sometimes offered by the same non-bank lenders.

As you can see, these types of loans are not typically used to finance the purchase of a car. They're more comparable to raising some fast cash by pawning a valuable asset at the pawn shop.