Business Financing with Personal Funds

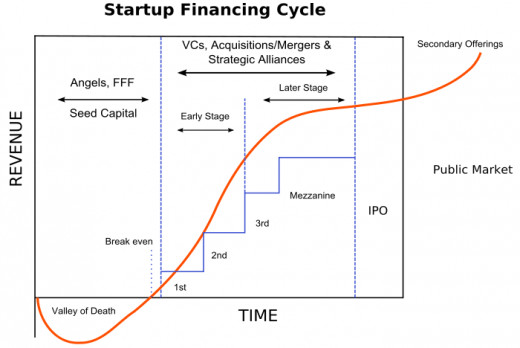

The Business Cycle And Financing

Business Financing With Personal Funds

Personal funds are a common way to finance or start a small business. It comes with many risks and could possibly ruin your credit. I do not recommend starting a business with personal funds unless you can truly afford it. If financing your business puts you, your family, your home or your credit in jeopardy it is not a good choice. If your business idea or plan is viable you should be able to find financing from a better source, such as a bank or angel investor.

Financing Your Business

More than three quarters of American businesses are classified as small businesses, that is businesses with less than 100 employees. These businesses make up more than half of our total Gross Domestic Product. A very popular way to start up these small businesses is with personal funds. Although it is the easiest and one of the most common ways to fund a business startup it is not always the best way. By using your personal funds to start a small business you may be putting yourself and the business at risk. Your personal funds may not be enough to get the business started and operational. Using your personal funds to get the business started may also put you in a position where you can not get other forms of financing. If the business fails your personal finances will be severely damaged and could take many years to repair.

Financing Your Business With Bank Loans

Bank loans are the most popular form of small business investment after using personal money. Bank loans are easily accessible, if not easily obtained, and can be found at local bank branches around the world. In order to get a bank loan to finance a small business you will need a good business plan with profit/loss projections and some collateral. Banks are not likely to give unsecured loans to the average person so be prepared to put up some form of security when applying.

The Small Business Administration is a great source of information on bank loans, their requirements and sources. The SBA is not a lender itself but does sponsor loans and grants from banks and other government agencies.

Bank loans are an especially flexible source of business financing. The funds can come in the form of cash or lines of credit. The money can be used for anything the business needs from payroll to supplies, marketing, bills and expansions. The bad thing about bank loans is that they have to be repaid. Banks are in the business of loaning money for profit and are very forgiving when it comes to repayment. If your business should fail you will still be liable for your business loans. Banks are usually first in line when it comes to reclaiming equity from failed businesses.

Private Equity And Financing Your Business

Private Equity is a great way to finance a small business. Private equity can come in many forms including angel investment and venture capital. Basically, private equity is any source of business financing that comes from a private source. This is usually a private equity fund or could be the privately held funds of one or more individuals. There are many source of private equity and even more ways to use the money for financing a business.

- Angel Investment - This is the simplest form of private equity. Angel investment is also know as seed money. This is the money used by individuals or newly formed businesses to set up operations, prove out an idea or pay for initial supplies. Angel investment is the money that gets businesses started. It can come from family, friends or wealthy people in your community. Angel investment is also available through investment groups and can be found on the internet. Because angel investment comes at such an early stage in the business cycle it usually takes a large portion of ownership.

- Venture Capital - This is the next step up on the private equity ladder. Venture capital is private equity money that invests in risky businesses that are already operational but have not yet proven their ability to compete and be profitable on a large scale basis. The venture capital investment is meant to help the company develop new products, expand markets or growth. Venture capital evolved as an investment strategy during the technology boom of the '70's and 80's and is usually associated with technology companies. These days venture capital will invest in any type of business provided there is a chance of profiting. Because venture capital invests in businesses that are already operational it does not take as big a cut of the company as angel investment.

- Private Equity - This is all the other forms of private equity investment. This investment comes from large private equity funds and is for large, well established businesses to expand, build infrastructure or make the transition to public ownership.

Private equity also includes the LBO, what was once known as a hostile takeover. The LBO, or leveraged buy out, is a business investment strategy in which the private equity fund buys enough shares of stock to gain controlling interest in a company.At this point the fund can install new board members and affect the overall operation of the business. In the old days it was done on the sly as a way to buy a company that was not actually for sale. Now, because of new regulations, private equity funds usually have permission to buy controlling interests before they begin the LBO process.

How Private Equity Works

Private equity makes money by buying businesses, investing in them, and then selling them for a profit. Because of this strategy private equity is not the best solution for all business owners.

Franchise Your Business Expansion

Franchising A Business

Franchising is a popular way for small business owners to finance their businesses and business expansions. It is a way for business owners to limit costs and raise money while expanding their business.

Franchising has been around for over 100 years. It started in the mid to late 1800's but really gained popularity as a business investment strategy following WWII. At that time the economy was growing very rapidly and many businesses were in need of investment. There were also thousands of able bodied military personnel in need of jobs, careers and business opportunities. Franchising emerged as a win-win scenario for both sides of the deal and is still popular today. There are franchises in every neighborhood, community and town in America. Some well known names include McDonald's, Subway and The FedEx Store.

What Is A Franchise?

A franchise is a business where a franchisor sells business plans, marketing and other business specific items to a franchisee. What this means in practice is that the franchisee buys a ready made business with business plans, marketing and other suppor from the franchisor. The franchisee operates the business location but they own it together and share in the profit. The franchisee and franchisor benefit in many ways from this deal.

Benefits Of Franchising

- Franchisees get a proven business. There is much less risk to starting a business when you know it works. Franchising skips the start-up and trial phases of business. When buying a franchise be sure to do the due diligence and make sure that the parent company is sound.

- Lower Costs. Starting a new franchise is much less expensive than starting a comparable new business. With a franchise the costs are limited for franchisees because part of the expense is put up by the franchisor, not to mention the time and cost savings gained from using a proven model instead of having to build a business from scratch. Costs are also limited for the franchisor because part of the costs are put up by the franchisee.

- Increased Profitability. Franchises can become operational and profitable much quicker than a completely new business. The lag time between start-up and profitability is cut by significant amounts, saving more time and money.