Business Strategy: A Company Analysis of the External Environment

The performance of a company is affected by external factors like the economy, demographics, social values, and technological changes. The factors in a company’s macro-environment which have the largest strategy impact relates to the company’s environment, the industry, competition, buyer relations, and supplier relations. To do a company’s analysis of its external environment, a company needs to do an industry analysis on dominant economic characteristics, an industry’s competitive forces, the driving forces of the industry, the market positions of the industry’s rivals, the strategic moves of rivals, key success factors, and the industry’s outlook on future profitability.

A Strategic Plan involving a Company’s External Environment

The Industry’s Dominant Economic Characteristics

Identification of the industry’s dominant economic characteristics is important for analyzing a company’s industry and preparing a proper competitive analysis of their environment. Understanding the economic characteristics provides an overview of the industry and provides an understanding of the different kinds of strategic moves that the industry members are likely to use.

Examples of Economic Characteristics:

• Market size and growth rate

|

• Scope of competitive rivalry

|

• Number of buyers and rivals

|

• A competitive analysis of the geographic scope

|

• Degree of product differentiation

|

• Technological changes and innovations

|

• Economies of scale

|

• Capacity utilization

|

• Industry profitability

|

• Learning and experience curves

|

• Degrees of vertical integration

|

• Supply and Demand Conditions

|

• Product innovation and characteristics

|

• Ease of entry/exit in the industry

|

The Industry’s Competitive Forces

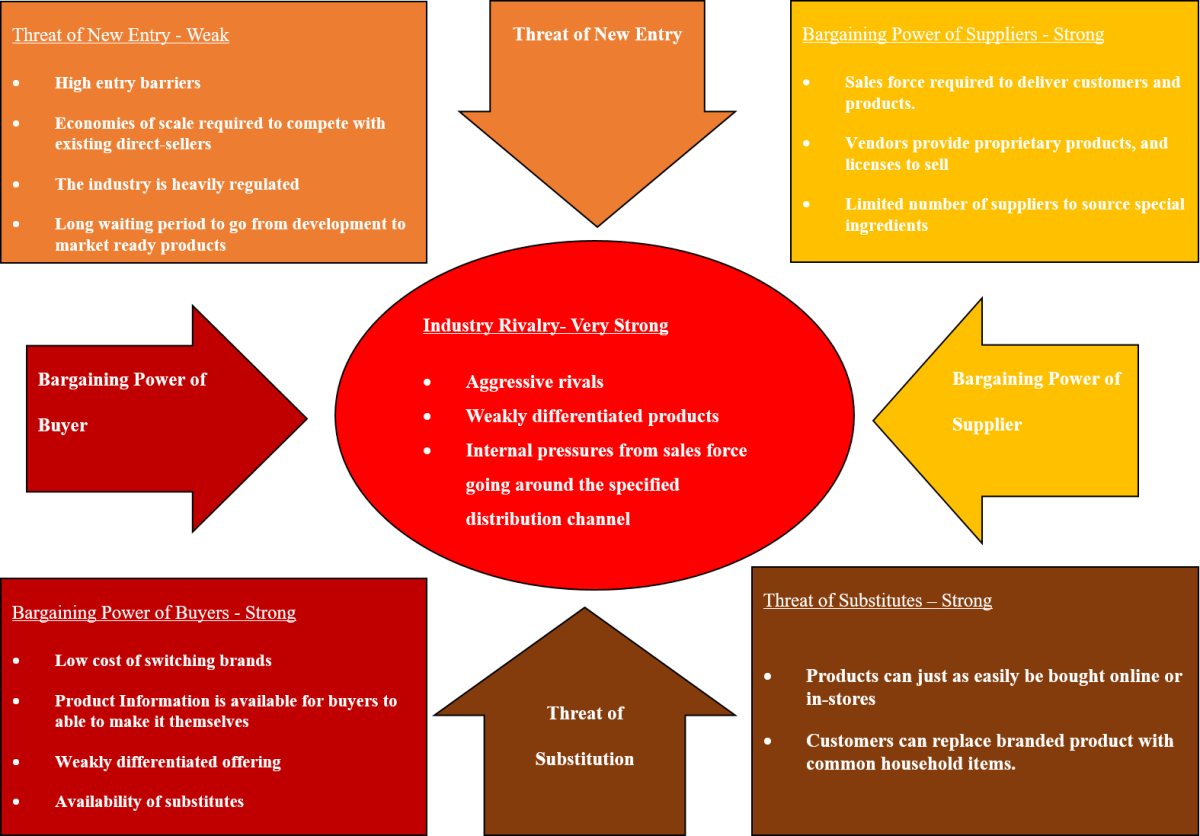

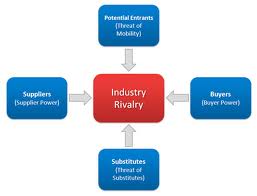

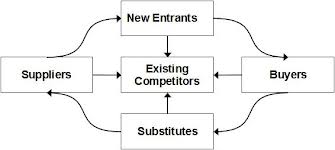

After analyzing the dominant economic characteristics, a company needs to do an industry analysis and a corporate strategy analysis. Before making important strategic decisions, a company should use Porter’s Five Forces Model to do a competitive industry analysis. The following five factors act together to determine the nature of a competitive analysis in an industry.

1. The Threat of New Entrants to a Market

This can be a big risk to existing companies, but due to the barriers of entry, existing companies have some advantages. The fear of new entrants is that if they move into the industry they will gain market share and rivalry will increase. Also, if the industry has low entry barriers, it is easier for new entrants to enter the market. The upside is that if there are high entry barriers, it is difficult for new entrants to enter the market.

Barriers to Entry for New Entrants:

- Investment cost

- High customer loyalty

- Scarcity of resources

- Economies of scale available to existing companies

- Incentives for using a particular buyer

- Government policies, regulations, and legal policies

- Tariffs and international trade restrictions

- Product differentiation (existing loyalty to major brands)

- High capital requirements or a strong capital base

- Learning curves

- High fixed costs

- Patents and proprietary knowledge

- Ease in distribution or access to distribution

- Customer switching costs

- Cost and resource disadvantages not related to the scale of operations

- Access to inputs

- Access to suppliers or restricted distribution channels

- Expected retaliation by established companies

- The ability and desire of rivals to launch vigorous initiatives to block new entrants

- Absolute cost advantage

2. Bargaining Power of Suppliers

The bargaining power of suppliers depends on how much suppliers are able to sell items they supply to their industry and the nature of the supplier-seller relationship. Industries are dependent on suppliers. Suppliers can exercise power, such as selling items at a higher price, squeezing industry profits.

The Strength of Supplier Bargaining Power

- Companies pay significant costs if they have to switch to different suppliers.

- If needed supplies needed are scarce

- If customers are powerful; the product is easy to distinguish and loyal customers are reluctant to switch

- If a supplier is exceptional; if they have a variety of supplies with excellent quality, performance, or value.

- There are no or few substitute resources available

- Very small amount of large suppliers available

The Weakness of Supplier Bargaining Power

- Companies can switch suppliers easily because of the prices

- Companies can easily buy the supplies from others, because they are standardized

- Weak customers

- New suppliers enter the market or alternatives offer good substitutes

Having a Good Relationship between a Company and its Seller

- Can reduce inventory costs

- Can speed the availability of their products

- Can enhance the quality of the items being supplied

- Can squeeze out important cost savings for the company and the seller

The Determinants of the Supply Power

- Uniqueness of the product supplied; if the product that is important to the company and no substitutes suppliers are in a powerful position

- The number and size of firms supplying the needs; a few large suppliers can project more power over market prices that many smaller suppliers each with a small market share. Therefore, there are very few suppliers of a particular product, and the product is extremely important to buyers – something they cannot do without.

- The importance of volume to supplier

- Differentiation of inputs and the impact of inputs on cost or differentiation

- Competitive for the resource from other industries – if there is great competition, the supplier is in a stronger position; the presence of substitute inputs.

- The threat of forward integration

- Supplier concentration

- Cost of switching to alternatives – a company may be loyal to particular suppliers. For example, if certain components or resources are designed into their production processes. To change the supplier may mean changing a significant part of production. So, switching to another competitive product is very costly. Also, the switching costs of firms in the industry.

- Cost relative to total purchases in industry

- The supplying industry has a higher profitability than the buyer industry.

Suppliers provide the inputs the company needs. Bargaining power of suppliers is the potential of the suppliers to increase the price of inputs or the costs of industry in other ways. Strong suppliers can extract profits out of an industry by increasing costs of firms in the industry. Supplier’s products have a few substitutes. Strong suppliers’ products are unique. They have a high switching cost. Their product is an important input to buyer’s product. They pose credible threat of forward integration. Buyers are not significant to strong suppliers. In this way, they are regarded as a threat.

3. Buyer Bargaining Power

Buyers refer to the customers who finally consume the product or services. Bargaining power of buyers refer to the potential of buyers to bargain down the prices charged by the firms in the industry or to increase the firms cost in the industry by demanding better quality and services on the products. The power of buyers is the impact that customers have on a producing industry. They have full information about the product and the market. Rather, they focus on quality products. This poses a credible threat of backward integration. Bargaining power is how much pressure customers can place on an industry.

Determinants of a Buyer-Seller Relationship or Customer Bargaining Power

- Whether buyers have a great amount of bargaining leverage to obtain price concessions and other favorable terms

- The art of switching – customers that are tied into using a supplier’s products are less likely to switch because there would be costs involved

- The number of customers – the smaller the number, the greater their power

- The customers’ size of their order – the larger the volume, the greater their power

- The extent and importance of the relationship, turning into a strategic partnership, in the industry

- The number of companies offering the product – the smaller the alternatives, the less opportunity customers have to shop around

- The threat of integrating backwards – if customers pose a threat of integrating backwards they will enjoy more power

Buyer Bargaining Power

- If buyers’ costs of switching to competing brands or substitutes are relatively low

- Buyer volume

- If the number of buyers is small of if a customer is very important to a seller - A small number of buyers

- If the buyer demand is weak

- The product is not extremely important to the buyer; they can do without it for a period of time

- Buyer information

- Brand identity

- If buyers are well-informed about sellers’ products, prices, and costs

- Purchases large values

- Price sensitivity – customers are price sensitive

- Switching to another competitive product is simple

- If buyers pose a credible threat of integrating backward into the business of sellers

- Not all buyers of an industry’s product have equal degrees of bargaining power with sellers

- Bargaining leverage

Customers Value Having a Strong Amount of Bargaining Power

- There are only a few buyers with significant market share

- They possess a credible backward integration threat – that is they threaten to buy the producing company or its rivals

- The distribution of purchases or if the product is standardized

- Can threaten to buy producing firm or rival

- They find it easy and inexpensive to switch to alternative suppliers

- The customers purchase a large proportion of output of an industry

- They can choose from a wide range of supplying companies

Basically, customers can use their bargaining power to lower prices, or increase the required quantity for the same price, reducing profits in an industry. When buyer power is strong, the relationship to the producing industry is near to what an economist terms a monosony. A monosony is a market where there are many suppliers and one buyer. This allows the buyer to set the price.

4. The Threat of Substitute Products

This threat occurs when a product or service’s demand is affected by the price change of a substitute product or service. Substitute products or services refer to those having the ability to satisfy customer needs effectively. The fewer amount of substitutes, the greater the opportunity for the industry to raise their prices and earn greater profits. A product’s price elasticity is affected by substitute products or services. The lower the price of substitutes, the more intense the competitive pressure posed by a substitute product. If there is a threat of substitute products, a company needs to improve the performance of their products or services by reducing costs, prices, and by differentiation.

Dependants of Substitute Products

- If substitutes are easily available and attractively priced

- Customer loyalty

- Buyer inclination to substitute

- The willingness of customers to switch

- If buyers view substitutes as comparable or better in quality, performance, and price.

- Price and performance trade-off of substitutes

- The similarity of the substitutes

- If substitutes are similar, it can be viewed in the same light as a new entrant

- The extent to which the price and performance of the substitute can match the industry’s products or services

- If the costs that buyers have in switching to the substitutes are high or low.

5. The Rivalry among Competing Sellers

The strongest of the five competitive forces is usually rivalry. The threat of rivalry describes the intensity of competition between existing companies in an industry. It is the competitive struggle for market share between companies in an industry. A company should strive to create its strategy in a way that gives it a competitive edge and a competitive advantage over its rivals. Intense rivalry can cause price wars, investments in new products or improvements on existing products, and/or intense promotion. All of these activities increase costs and lower profits.

Types of Rivalry

Types of Rivalry

Brutal

| Competition is mutually destructive to profitability

|

Fierce

| Profit margins of the industry are squeezed

|

Normal

| The industry earns acceptable profits

|

Weak

| Companies are satisfied and do not try to steal customers away from one another

|

- Competition offers fresh actions to boost their products or services

- Exit barriers

- Amount of fixed costs

- Storage costs

- Switching costs

- A large amount of rivalry around the same size, where there is no dominant company

- The industry is equal in size and capacity

- Industry concentration

- Whether the market is slow-growing or fast-growing

- A competitive analysis of the number of rivals in the market

- Industry analysis in regards to competitive forces

- Fixed costs and value added

- The cost structure of the industry

- Market size and growth prospects

- Little differentiation between rivalry’s products and services

- Supply and demand

- The presence of global customers

- Product differentiation and brand loyalty

- The power of buyers and the availability of substitutes

- A company’s market position

- A diversity of rivals

- A mature industry with very little growth; companies can only grow by stealing customers away from their rivals

- Companies outside the industry build market share

Competitive Moves a Company Can Take

- Price changes

- Creatively using channels of distribution

- Improving product differentiation

- Exploiting relationships with suppliers

Industry Driving Forces

Driving forces are forces outside the company that cause a change in the company’s strategy. Industry conditions change because important driving forces drive the competition. Driving forces are the major underlying causes of change in industry and competitive conditions. It is important to determine how driving forces will affect profitability. Managers need to understand if any strategy changes are needed due to driving forces.

Common Driving Forces

- Advances in technology

- Changes in the industry growth rate

- Increasing globalization of the industry

- Changes in customers and how they use the company’s products or services

- Market innovations

- Buyer demographics

- The entry or exit of other companies

- Product innovation

- Changes in cost and efficiency

- Government regulation changes

- Customer preferences for differentiated products

- Reductions in business risk

- Changes in society

The Market Positions of the Industry’s Rivals

A strategic group is a mix of industry rivals who have similar competitive approaches and market positions. It is often helpful to create a strategic group map. The most important aspect of these maps has to do with identifying which competitors are similarly positioned and thus close rivals and who are distant rivals. The closer strategic rival groups are to each other on the map, the stronger the cross-group competitive rivalry tends to be. However, not all positions on the map are equally attractive. Driving forces may favor some strategic rival groups and hurt others, and competitive pressures may cause the profit potential of different rival group to vary.

The Strategic Moves of Rivals

Examining rivals’ previous behavior and preferences provides a valuable asset in anticipating what moves rivals are likely to make next and out-competiting them in the marketplace.

Ways to Predict the Next Moves of Industry Rivals

- Which rivals plan to make strategic changes

- Where rivals are entering in terms of geographic markets

- Trends in their new product or service launches or marketing promotions

- Whether the rival will expand their products or enter new markets

Key Success Factors

Key success factors are parts of a company’s strategy, including product and service attributes, competitive capabilities, and/or intangible assets with the best impact on the upcoming success for a company in the marketplace. To identify an industry’s key success factors, a company should consider: (1) What product characteristics are most important?, (2) What does the company need to be successful?, and (3) Are there any competitive disadvantages the company needs to be aware of?

Common Key Success Factors

- Scale economies

- Distributors

- Breadth of product line and selection

- A talented workforce

- Costs that meet the expectations of customers

- Technological expertise

- Ability to improve production processes

- Quality control

- High labor productivity

- Low costs

- Ability to make products customized to buyer specifications

- Direct sales capabilities

- Well-known and well-respected brand

- Fast, accurate technical assistance

- Design expertise

- Excellent customer service

- Effective advertising

- Patent protection

- Convenient location

- Supply chain management capabilities

The Industry’s Outlook on Future Profitability

The profitability of an industry depends on the degree of fit between a company’s competitive capabilities and the industry’s key success factors.

Factors to Determine if an Industry offers a Company Strong Prospects for Success

- Driving forces

- Key success factors

- Competitor analysis

- Industry analysis

Conclusion

The success of a company is affected by external factors. A company analysis must be done to examine a company’s external environment, a company must look over economic characteristics, competitive forces, driving forces, the market positions of rivals, the strategic moves of rivals, key success factors, and the industry’s outlook on future profitability.