CEO Salaries

The salaries of Chief Executive Officers (CEOs) has been a major topic of discussion for many years. The average American income, determined by the US census bureau , for males and females above twenty-five years of age is "43,362". (Kulkarni, 2010). If we take that the average American income and multiply it by 500, we will get an outrageous number. It is insane to think that the "outrageous" number that I speak of is equal to the salary of many CEOs once we add in the money made off of stock options and other benefits. Let's examine some statistical research behind CEO salaries.

It was reported recently that in 2012, some chief executive officers made as much as 5,000 per hour for their services rendered (Microsoft, 2013). It has always been widely known that CEOs make major bucks; however, it is quite ridiculous exactly how much more we are referring to. CEO's make a whomping 350 times the amount that your average Joe makes throughout the year (Yahoo, 2013).

Statistics from 2009

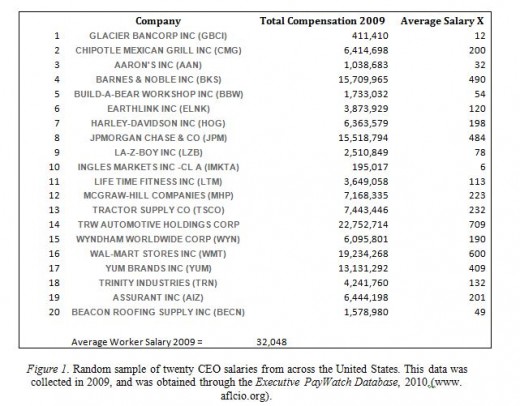

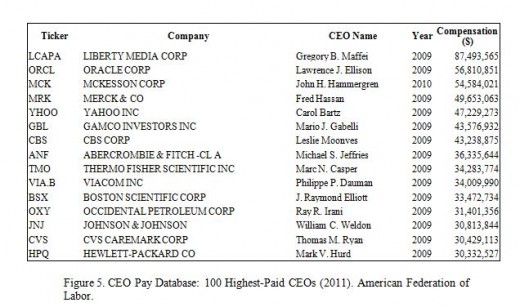

To accurately perform a statistical analysis of CEO salaries, a sample of CEO salaries is needed. This data can be found in the "Executive PayWatch Database", and is accessible through a website established by the American Federation of Labor (www.aflcio.org). Using this database, a sample size of twenty salaries has been randomly selected from the year 2009 for statistical testing (Figure 1 ). According to these salaries, taken from company's across the United States, the mean salary for CEOs in the US is $7,275,490. In many cases, the median gives us a more accurate figure. The median of this set of data comes to $6,229,690. Also, we can conclude from this data that the average CEO makes around 227 times the amount of the average American worker. The mode in this set of data is a little tougher to determine because one salary amount does not appear more than another.

Due to the large variance between the CEO salaries that we have gathered, it is important to examine the standard deviation, which allows is to see the amount of difference between the mean and the total collection (Figure 2). Using the mean and standard deviation, we are able to gain more precise results, as well as, it helps us create additional charts and graphs to show our figures with accuracy.

Mean: 7,275,490

Standard Deviation: 6,551,726

Variance (Standard deviation): 42,925,110,385,695

Population Standard deviation: 6,385,832

Variance(Population Standard deviation):866,410.

Figure 2. Statistical information based on Figure 1 sample of 20 CEO salaries obtained from the Executive PayWatch Database,(2010).

In 1970, CEO salary and bonus packages were typically about 700,000 - 25 times the average production worker salary; by 2000, CEO salaries had jumped to almost 2.2 million on average, 90 times the average salary of a worker" (CeCarlo, Scott, 2010). According to a study taken by Salary.com, the mean CEO salary today is $701,331, which is somewhat lower than it was back in 2000. However, if we refer back to our results using a sample of twenty random salaries, our results were 7,275,490. The huge difference in figures could be due to the small sample size that we are using. Also, our results are based only on large companies; the study done by Salary.com includes all company sizes. To get more detailed information, we would need to gather more specifics with a larger sample size of five hundred or more companies. With a larger sample size, our results will be more accurate with much less margin for errors.

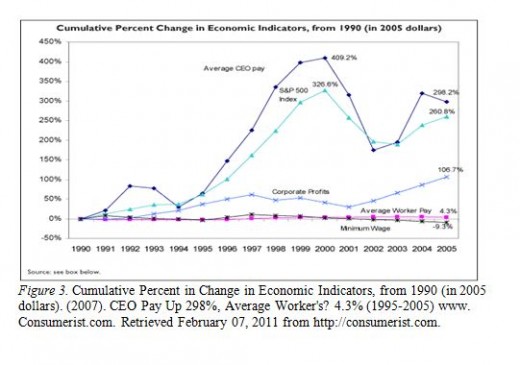

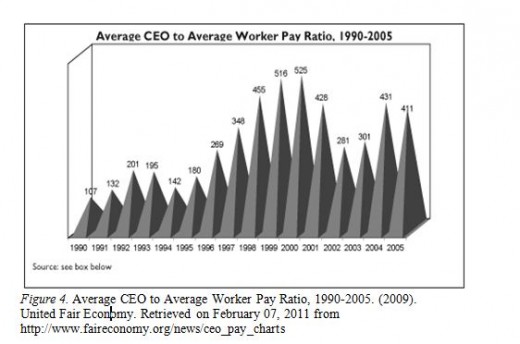

In the charts below (Figure 3), we have a study that was taken with information from 1990 until 2005, and (Figure 4) results of the average CEO to worker ratio from 1990-2005. In Figure 3, we compare the rise and fall in average CEO pay, corporate profits, average worker pay, and the S&P 500 index (stocks). As we can see, the average worker's pay has increased by only 4.3% when CEO salary has been doing leaps with increases of up to four hundred percent. In Figure 4, we can examine how the increase in pay compared to company size dies out at a certain number. It only pays to be bigger to a certain degree. Once a company has acquired so many employees due to growth and success, their pay begins to dwindle with the increased size.

It would seem that the government would do something to monitor and control the amount of income that is allowed to be relinquished to the executives in these organizations. However, I think they showed us their "solutions" back in 2008 when the bailout, now known as the Emergency Economic Stabilization Act, occurred. It is remembered as the time our government gave billions and billions of our money away so that some well known CEOs could get bonuses and spa treatments. It started when the banks' claimed that they were going under due to the failing housing market and bad loans. Through the Troubled Asset Relief Program (TARP), more than $700 billion went to the financial intuitions'. Unfortunately, the homeowners still owed money for the houses that the government just paid for because instead of giving the money to the homeowners so that they could pay off the banks and restore their financial situation, they gave it directly to the banks. Apparently, the banks felt the reason to celebrate their double victory, and some of the CEOs are still in the spotlight due to their lavish spending and heavy compensations. CEO salary has been a popular topic of discussion ever since the bailout. Many feel that is not realistic to have such a gap in pay between average workers and top executives.

Chief Executive Officers (CEOs) are in a pay class of their own, and it is still a mystery what they do that justifies millions of dollars each year. That is too much money for anyone, especially when there are starving people in the streets and hardworking American families that work hard forty-sixty hours a week to bring home one fourth of the salary. Unless a CEO can spin gold from hey, there is nothing they can do that deserves that much more than everyone else. In most cases, the hard work is done by the people underneath the leader. Now, I am not stating that a good leader does not deserve to be paid well; however, I feel that many people in high positions and in the government have become overrun with greed. The government does nothing to stop the chaos because that same greed is instilled in them. The American Constitution and the system that was developed decades ago was meant to be carried out with honesty, and integrity. People who care about the people and not just their own status and gain. The astonishing pay rates of some of the top one hundred CEOs is completely mind boggling (Figure 5 ).

Upon researching the statistical information related to CEO salaries, it does not make since to see someone making eighty-ninety million a year. The stocks and other benefits that CEOs get should be considered in their total pay. Especially, if the "benefits" are only available to CEOs and other top members of the company. It is a set up established for CEOs by CEOs. The statistics show that there really is no cap on these figures; however, they do seem to go along with company size, success, and net worth.

References

Bowerman, B. L., O'Connell, R. T., Orris, J. B., and Murphree, E. (2010). Essentials of Business Statistics (3rd ed.). New York, NY: McGraw-Hill. ISBN: 9780073373683

Kulkarni, Arjun (2010). Average American Income. Retrieved Saturday February 05, 2011 from http://www.buzzle.com/articles/average-american-income.html

(2010). Executive PayWatch Database. Retrieved February 07, 2011 from http://www.aflcio.org/corporatewatch/paywatch/ceou/index.cfm

(2010). Salary Wizard. Retrieved February 07, 2011 from http://www1.salary.com/Chief-Executive-Officer-salary.html

(2007). CEO Pay Up 298%, Average Worker's? 4.3% (1995-2005). Retrieved February 07, 2011 from http://consumerist.com/2007/04/ceo-pay-up-298-average-workers-43-1995-2005.html