Covid-19 and the Logistics Industry

The Corona Pandemic has literarily brought the world to a standstill. As thousands of people battle this disease, millions more are suffering the effects of this deadly virus in other ways. Businesses are not able to function; offices are not operating. The worst is that people are not even able to leave their homes. Of all the industries, the logistics industry has been the hardest hit because of this pandemic.

The All India Motor Transport Congress reports that truck movement has reduced to 10% of the normal levels. Top logistics companies such as Mahindra Logistics, Future Supply Chain, Rivigo, Allcargo and more saw no cargo movement except for the essentials since the lockdown started. Even freight and courier service providers such as TCI Express, DHL, BlueDart, and FedEx have reported a huge drop in the numbers. It’s not just the logistics sector that is grappling with the situation, but also associated services such as warehouse, last-mile delivery, ports, and trucking.

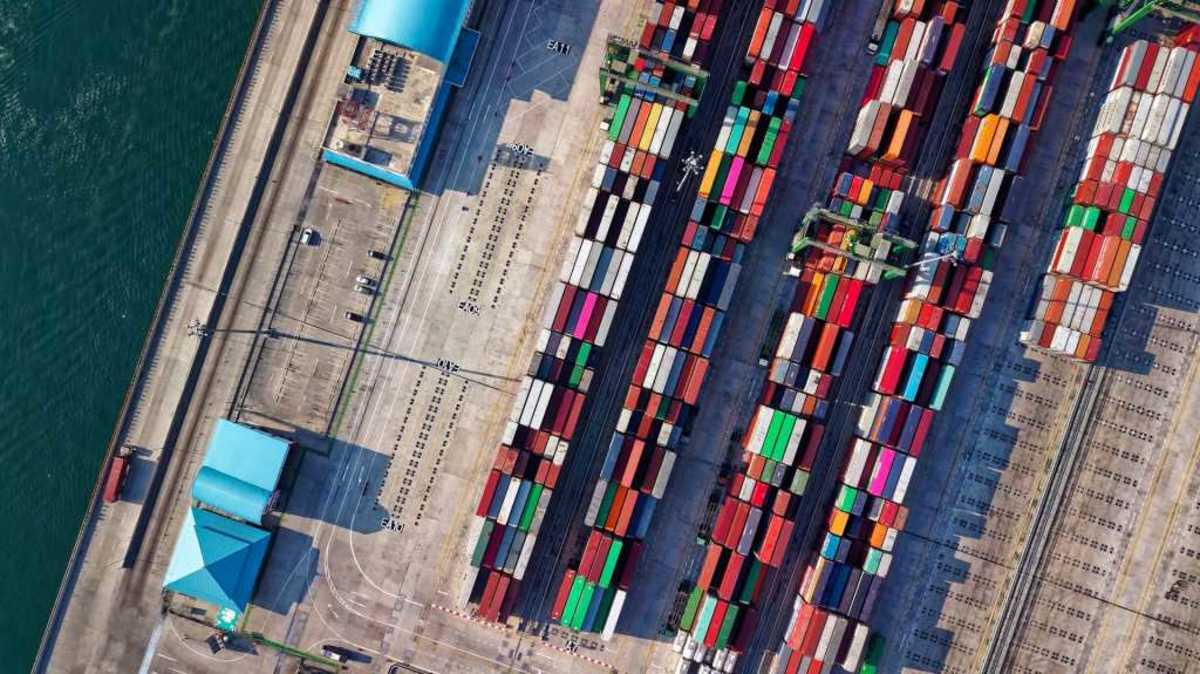

Effect of Corona on Cargo Shipping

According to a report by Edelweiss, a financial services company based in India, “Factoring in the demand shock and supply chain disruptions, we are cutting FY21/22E volume growth for Adani Ports to -2 per cent/11 per cent and Gujarat Pipavav Ports to -3 per cent/11 per cent (earlier 10 per cent each).” From December, the ports have been seeing a rapid downtrend in large-cargo movement. This is more because there is a significant reduction in the liquid cargo and container cargo movement since December 2019. The percentage of growth of cargo handling in the major ports in India is just around 0.82% for the FY 2020. The previous financial year saw a growth of around 2.9%

Drivers unable to work

There are 8 million drivers and 12 million helpers working in the trucking industry in India. Apart from the drivers and helpers, there are 30 million people directly working in the logistics industry. More than 150 million people indirectly earn from the logistics industry.

According to the Indian Foundation of Transport Research and Training (IFTRT), more than 50% trucks are off the road because the drivers are not available. While the foundation says 50% trucks are off the road, the owners of logistics companies give different numbers. The founder of Mavyn Digital Trucking, Sachin Haritash says that nearly 98% of his truck drivers are off the road. While talking about the same thing, Gazal Kalra, the co-founder of Rivigo says that 70 to 80% of his truck drivers are not on the job.

Most of the drivers have gone to their native because of the lockdown. They didn’t have any work and no scope of income. So, they decided to go back to their native. As people are not allowed to leave their district or zones, the drivers are not able to report back to duty. There is also the problem of non-availability of public transportation. Another problem was faced by truck drivers carrying non-essential commodities. These drivers are caught in the city borders. So, now they are not able to enter the city or go back to the warehouse. Even sadder, is that they won’t even be able to go back home! Sharing his view on this situation, Gazal Kalra said that “If it's a matter of 2-3 days, drivers could have managed, but here we are talking about three weeks. With little money on them, and roadside food joints and dhabas closed -- their only lifeline, why should drivers risk their lives being on the road?”

Last Mile Delivery

COVID-19 has drastically affected the last-mile delivery. A report by Business Today states that the top food delivery businesses saw a 60% drop in orders. The drop in orders is not the only problem. The food delivery businesses need to work with minimal staff as people movement is not allowed in most areas. The second problem is the shortage of supply goods. Even in cases where there are people to deliver the food, the route becomes the problem. Due to the Corona pandemic, the government has quarantined red zone areas and blocked movement in many roads. Because of all this, the delivery person may have to take a longer route, which can cause delays in the deliveries.

The courier sector last-mile delivery has also been facing similar problems. Large e-commerce players like Amazon and Flipkart are also finding it difficult to make the last-mile delivery. In fact, they had closed home delivery to red zone areas for safety reasons.

Issues in Loading/Unloading

Loading and unloading goods is a labour-intensive task. With the Corona virus locking people in their homes, logistics companies are finding it very difficult to find labourers. Also, there are restrictions in people movement as well as the number of people who can travel in a vehicle. All these restrictions are adversely affecting the logistics industry.

Woe of the Fleet Owners

WheelsEye, a logistics platform analysed over 3 lakh trucks and 30,000 fleet owners. Their survey found that the fleet owners are the most affected by the Corona lockdown. In fact, nearly 62.50% of the fleet owners have decided to stop all work because of less demand and to ensure the safety of the drivers. The study also found that the average run has dropped from 140 kilometres per day to less than 10 kilometres per day.

Also, more than 90% of fleet owners in India fall under the Small Feet Owners (SFO) category. This means they probably have around 5 vehicles. These SFO’s don’t have any standard runs, but operate based on demand. They will have contacts with small business that use their trucks for transportation. Now, with the lockdown, these small players are at a standstill.

Prasad Sreeram of Cogos said “Few of the organised fleet owners are looking at utilising moratorium, but are not sure if the liabilities could be cleared if the recovery spreads to multiple quarters.” If the situation continues, then the logistics sector will be more seriously hit. Huge logistics companies may have backup and government authorization to carry essential supplies. Small time owners will not have the same, which further affects their operations.

A further problem for the fleet owners is managing the EMI’s even as they are not making any income. WheelsEye’s survey found that 96% of the surveyed 200 fleet owners were more about paying their EMIs.

A possible solution?

The founder & CEO of logistics intelligence platform LogisticsNow, Raj Saxena suggests using technology to overcome some basic issues. He suggests using electronic passes that can be transferred via mobile phones to the drivers. These passes can also be tagged with the Aadhar cards. So, drivers reporting to duty or returning from duty can use the passes. Specific passes can also be generated when the trucks are carrying goods or coming back after unloading goods.

Another workable solution is to create “driver clusters”. Drivers and cleaners in a particular district or state can be asked to work in their districts, irrespective of the logistics organisation. This solution, though workable, needs a lot of administrative support and cooperation of all the fleet owners.