Dead Capital

Interest Rates

The Economic Grapevine

It has been years since I last paid rapt attention to a recap of a day's trading events, mostly on the stock market. During my last years in school in the 1980s, university professors, at least in the arts, referred to our general economic situation as Late Capitalism. You could accept it conceptually, realistically, or tongue-in-cheek. There was madness in the markets, not unlike today. Back then you did not have to be a wizard to master the markets to make money and store it up. Of course, chances are you got the daily listings in newspapers, and watching, here and there, a few outspoken fund managers, on television, who were making tremendous percentage gains. Not a great many students in the arts, with whom I mingled, had the wherewithal to dabble in stocks. But a few had trust funds, or, perhaps, another source, and simply learned the basics, and later picked up on the rest. Charles Schwab always gave introductory lessons to small groups of wannabes. Offices were open to the public, replete with electronic ticker tape, and a lounge where you might or might not listen up, either to foolishness or wisdom, depending upon who was talking and about what.

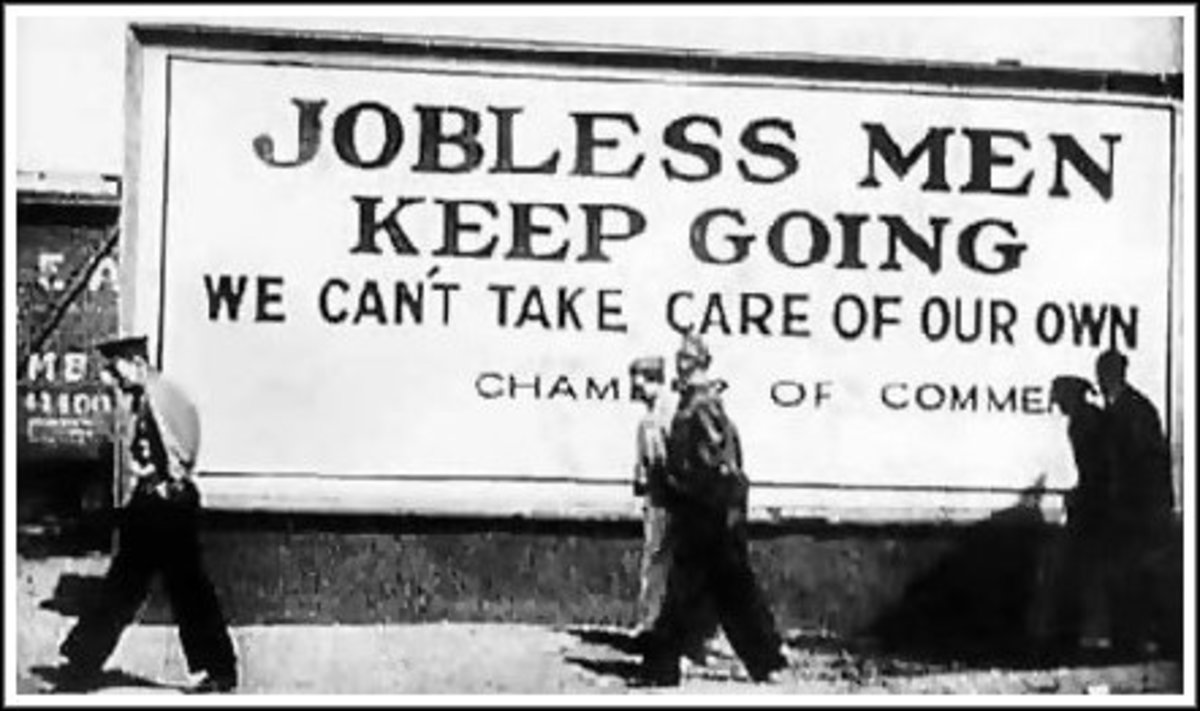

Some individuals think markets are casinos. They have their reasons. Others try, get disgusted, and drop out. But without investment, the economy would shrivel up and disappear. I grew up in Chicago. Driving around, tuned in to the AM radio, you got the current price of pork bellies and orange juice, whether you wanted it or not. Capitalism is a complex system. But it would not work at all without listed companies and anonymous investors. If everything were privatized, it would no longer be Capitalism. In fact, at the moment, nobody really knows if we even have a specific system any longer. Socialism entered in during the 1930s and never left. All I know is that it is not the same. I keep thinking that we have somehow constructed a new formulation I call Modern Feudalism -- sounding worse than it actually is. You can be a rich peasant, for instance, but underneath the heel of somebody or something you never see. I am fairly certain it is a reasonably correct assessment, though I lack the scientific means to argue on its behalf. The market is, generally speaking, up high. But it can go bust at the top, too. It does not have to come crashing down. It can just become absurd, which, without much to offer in the way of proof, I believe it has more than achieved. At 18,000, it is ridiculous, not sublime.

The Return of the 1930s?

Consumers and Shareholders

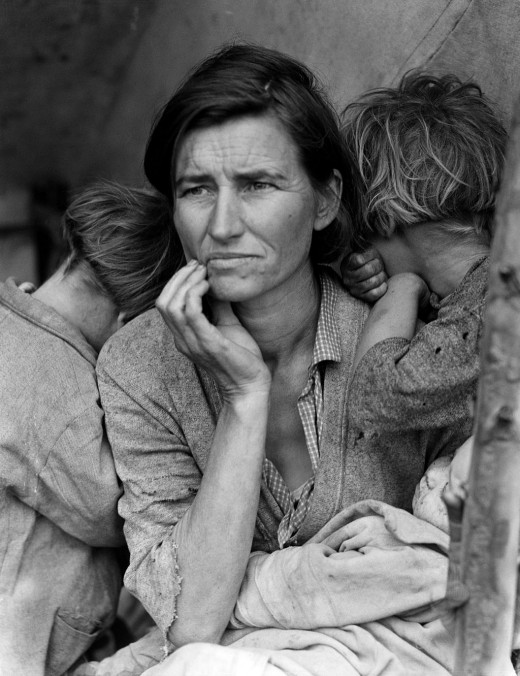

It is not hard to discern who holds the bottom of the economic stick. Has any ordinary person old enough to remember been more hammered by bankers and grocers alike? Tickets to baseball games? Comps? High interest savings accounts close to 1%? Then, in the marketplace, it is a double whammy. Astonishingly sizable grocery bills upon check out -- with consolatory coupons or game stickers to add insult to injury. What about technology, which provides invisible signals that have no determinable monetary value whatsoever? What exactly is the fair value of a gigabyte of memory? It is not for nothing that employees of AT&T and Comcast literally hide from the public, especially on telephones (which is a laugh). How about 12 or 16 ounces of a popular soft drink costing two dollars? The most famous franchise in history, which once told us we deserved a break, now rakes in close to ten dollars for almost any combo. How do these companies and institutions plan to keep sifting through our pockets? Won't they eventually come up empty -- as empty as our future pockets? They know the money is there now, otherwise they would not charge as much. But tomorrow is only a day away. With today's economic malaise, inflation alone will maintain priciness.

Bad as it is, the typical shareholder gets more soaked. Often a journalist will buy 10 - 20 shares in a stock only to receive the annual report and attend meetings. There is nothing wrong with or picayune about 10 or 20 shares, except that it is harder to leverage profits. Significant companies do not just make the news. They are the news. Read through a random stockholder voting ballot and chances are any action that might benefit the shareholder to the detriment of company hegemony will be adamantly advised against. Measures to compel a company to be "greener" are also routinely rejected. Shareholders are free to check either box, yes or no, but are asked, in bossy language, accompanied by guiding arrows, to vote no, then sign their names. This is far from the worst scenario, since it has long since become standardized. Nonetheless, there is too much resignation on behalf of shareholders, who possess relatively few shares individually to make a difference compared to the insider holdings. Thus, they simply vote their confidence in the superior judgment of corporate executives. We know how much they care.

This slipperiness has been going on forever. Brokers were and probably still are importuned in downturns, what's wrong with IBM? Coca-Cola? Johnson and Johnson? Exxon-Mobil? As though these "divinities" are immune to setbacks. Brokers will assure shareholders, usually with the familiar canard, that if Bristol-Myers Squibb, say, permanently tumbled from grace, it would mean the end of the USA. In other words, though I have merely touched upon the tip of the iceberg, shareholders are lied to, whereas shoppers, at least, are only over-charged. "Whatever the traffic will bear," was how the robber barrons of the railroad days put it. Rest assured, Americans can survive IBM, if they have to, as well as pay extra for organic food, if they want it. Moreover, what's good or bad for General Motors hardly affects the nation -- according to the old saying. Further, if funds own stocks at $500 a share, they often as not make out okay. It might be fixed; I could not say. Analysts might even claim they were "cheap" at the price. They have the kind of money needed to arrive at so extraordinary a conclusion. But there again, the shareholder often enough feels an unexplainable, mystical confidence in large cap funds, in addition to big name companies. There is, however, no law that says the same touted share, selling at $500 today, will not be worthless by tomorrow morning, prior to the 9:30 AM bell. Too late.

101 Years Ago: Garment Workers on Strike

So, Don't Invest

Good advice. There is much more to be said for than against honest work and a day's wage. It is just that the entire economy is somehow tied together. What is keeping the stock market afloat? Well, for one thing, low interest rates, which give ordinary people, who prefer to keep their money in the bank, rather than the stock market, cause to complain. They are being pressured to invest. Banks practically force their customers to spend, rather than save. It is almost as if banking has drawn an equivalent between savings and owning shares. Nothing could be further from the truth, though negative interest rates and money markets that "break the buck" testify to the opposite argument. Still, you are not saving by investing in any company, no matter how magnificent it looks on paper. What you are doing is speculating in Artificial Capitalism, despite, I must add, on a personal note, my own enjoyment of stock market popularizers on TV. Once, Ronald Reagan, after that notorious but forgotten dip of 508 points, driving the DJIA to 1,738, in 1987, said, or words to the effect, there was nothing wrong, adding, may the bulls run forever on Wall Street. I used to be of the same disposition. Most equity-minded gurus know that trends tend more toward the upside than down. The market did in fact recover very nicely. But conditions today are much more dangerous, regardless of those so-called "circuit breakers", than ever before.

There were, for the record, stock market investors who sold out before what became known as Black Monday. These were savvy players unmoved by the usual insanity that prevails on the Street. For example, technical analysis has often been more perceptive than fundamental analysis. The former concentrates on numbers plotted on graphs, together with patterns that repeat, presaging the same action time and again. The other highlights news events apart from mathematical factors. Those who were focused on the Advance-Decline Line, for instance, and other numerical indicators, noticed something going haywire, even if they could not say what. By the way, there are countless theories that compete with or exist alongside Dow Theory. The only caveat is to always keep in mind, none are foolproof. All are susceptible to failure. But what is wrong with Artificial Capitalism, if that is what it is? So far, nothing cataclysmic has transpired, outside sporadic, overhyped crises, and inevitable recessions, usually with soft landings. Nevertheless, there are warning signs, such as the National Debt, the Deficit, or dependency upon unpredictable (or predictable) foreigners. Careful scrutiny into how much and who holds our debt instruments -- bonds, mostly -- reveals a great deal. They act as political levers, so crucial are they. Nobel Prizes notwithstanding, nobody knows for certain how to repair a system we refuse to abandon although it is losing its luster.

Wall Street Versus Main Street?

How Do You View Them?

UN Secretary General at NYSE 2006

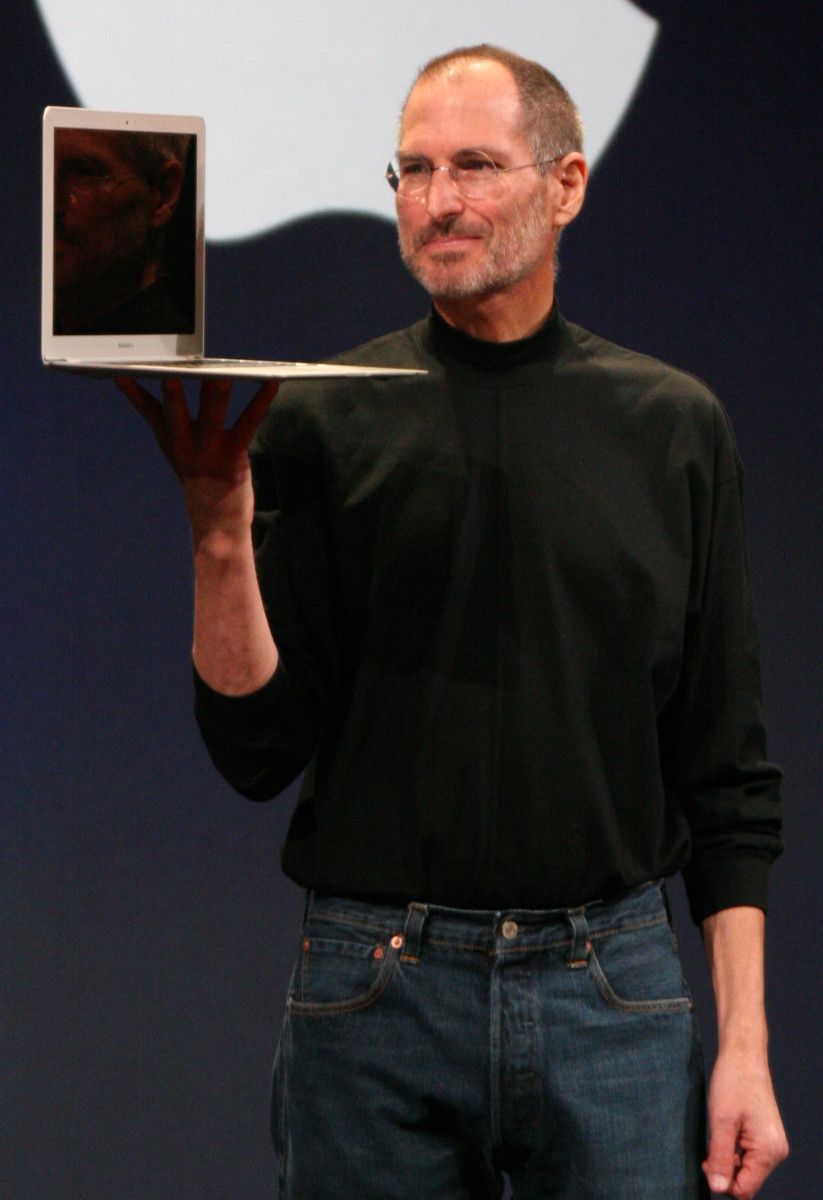

Artificial is Better Than Dead

Now we know that Communism is not going to succeed Capitalism. I am not really saying much, except that radical Islam means to fill the gap. Only consider how long we can continue with patterns that make no sense. Take plumbers who will not cross your home threshold without you forking over eighty dollars. Why not $800 or $8,000? How about substantial CDs that, after a half year, pay seventy-five cents? I tell myself, that's seventy-five cents more than Jesus ever paid an apostle. But my sarcasm will not solve a rather annoying lack of reward for savings. I own two relevant books dealing with the current state of affairs, one by Thomas Piketty, Capital in the Twenty-First Century, another by Robert B. Reich, Saving Capitalism. The former is a perfect example of French intellectualism, replete with incomprehensible equations and charts, direct from the Left Bank. In his summation, Piketty voices concern over the ultimate distribution of wealth. It is hard to do 700 pages justice in a phrase or two, but he argues that discrepancies in allocation and return on capital are dangerous. Reich's subtitle, "For the Many, Not the Few," posits a desirable outcome. Still, I would opt more for a grim, new, unavoidable form of retroactive feudalism, comprised not of Lords and Ladies, but CEOs. Their words are golden. From yogurt toppings to aeronautical innovations, they are authoritative. Need proof? They have the best automobiles, jets, yachts, haircuts, and, most importantly, public relations. On a more serious note, they command the flow of consumer as well as corporate spending. Remember, this is theoretical feudalism, post-traditional Capitalism, in which money, not labor, or station in life, is the critical element. Fealty also manifests itself differently, from discretionary purchases (not service in a Crusade) to multi-billion dollar government contracts.

Personally, I think we are in for it. I make no prediction regarding the election. It is already unsafe to take sides. Tempers flare: trust me. Dead Capital, if it ever happens, will be immediately identifiable. We will then have no choice but to do as told, which is the case in large swaths of the world. Once our sense of humor goes, the jig is up. Word on the street -- some streets, at any rate -- is that we might have to use our own plaster, shingles, floors, gutters, and siding to keep warm or cook food we either grow or hunt for. My terminology might not be exact, but Adam Smith's Capital in Wealth of Nations is not 2016's. You have to give me at least that. Reich puts it more rationally in his chapter on "The Threat to Capitalism". Polls indicate less and less belief in the system, whatever you call it, by common, decent, hard-working people. One hears a lot worse outside the pages of a book.