Equity Capital (earned capital and paid-in capital)

Introduction

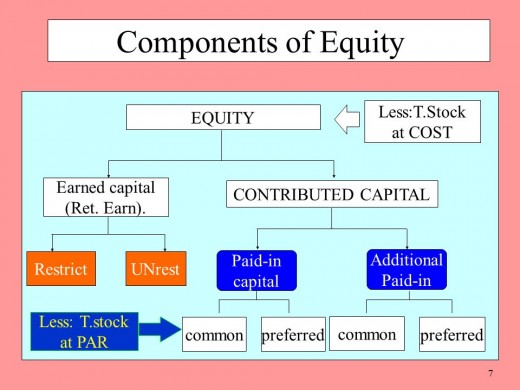

Equity capital comprises of two types of capital namely; earned capital and paid-in capital. Paid-in capital is the cash payment made by an investor for a particular ownership proportion in a company’s equity. On the other hand, earned capital refers to the capital a company has accumulated since it was started or just the actual returns of the company from its operations. These are always disclosed separately in the balance sheet equity section. This is mainly so because if they were compiled together, it would not reflect the actual amount of a company’s earnings being reinvested into a business. It can also taint the clear picture of how much new capital is being invested and how much capital is earned. It is, therefore, significant to split these two forms of capital to eliminate possible confusion about the sources of total owners’ equity. Separation of these two forms of capital is therefore of great concern when one talks about legal capital and any extra capital that is more than the face value of a share.

Components of equity capital

Reasons why it is essential to separate earned capital and paid-in capital

• Maintenance of Legal Capital: Legal capital refers to the par value of capital. It is often the base value of the paid-in capital. It helps in limiting dividend distributions so that it remains within the desired range of any extra paid-in capital and retained earnings.

• Measurement of Extra Paid-in Capital: Companies usually sell shares at a higher price than the face value of their stock. As a result, there is the creation of additional paid-in capital. Separation of the two forms of capital facilitates ease in the measurement of the level of capital growth. This extra capital gives an avenue that absorbs divided distributions as well as operation losses before they hit the legal capital level.

• Measuring Accumulated Income: Separation of these two forms of capital enables companies to track accumulated income over time. Thus, a company can alter its financing undertakings to accommodate the amount of retained earnings.

• Computing Dividend Distributions: These distributions reduce the volume of retained earnings. Therefore, companies may issue dividends over time in the case of excess retained earnings.

• It creates a reliable record that allows investors to understand how well the company is managing its capital.

• It makes it possible to track new capital from investors and any other capital generated from company profits.

Importance of different forms of capital

These two forms of capital are important in different ways. However, as an investor, one would place a higher preference on earned money rather than paid in capital. This is because the company’s ability to reinvest profit into a business is of greater importance than the sale of the same capital stock to new owners. Re-investment of business earnings to another company rather than the distribution of dividends to shareholders reflect a growth intention of an enterprise. It is through a detailed analysis of acquired capital that an investor can tell how the management operates the profits of the enterprise. Having said this, it is important that investors know how the company generates new capital because if there is a high population of investors in the market selling their stock, it shows a likelihood of a new investment gap that requires exploitation. In conclusion, although having data from both forms of capital is important; it is worth noting that earned wealth is superior when assessing a company’s potential for investment motives.

Conclusion

All investors who are profit conscious should consider earning as the core goal. An investor is faced with two forms of earnings, namely; basic and diluted earnings in which a rational decision should be made. Basic earnings refer to the proportion of profit compared to outstanding shares. It, therefore, enables owners to trace how much profit is earned about their ownership share. Unfortunately, basic earnings do not factor in essential elements like; stock options, warrants, and equity compensation. As a result, the amount of true earnings relating to ownership stake is reduced. Failure to consider the above elements makes these profits serve just as a guide to the overall performance, though there is no accurate representation of remuneration. On the other hand, diluted earnings paint a more precise image of equity ownership. Diluted earnings consider the above items in the overall equation. As a result; diluted earnings are more preferred as the best benchmark by investors. In case a company decides to liquidate assets, data given by diluted earnings is more reliable. This is contrary to basic earnings that lack essential data that investors require for them to understand fully a company’s earnings. In conclusion, an investor may use either basic or diluted earnings to check out how well a company is performing. In addition to this, they need to analyze critically every component of the shareholders’ equity and evaluate the most suitable investment alternative.