Vietnam FDI Outlook 2016

Introduction

According to the Vietnam General Statistics Office, in 2015, Vietnam’s GDP reached VND 4,192.9 trillion (approximately USD 199 billion), up 6.68% compared with 2014, the highest growth level in the five-year period. GDP per capita was estimated at VND 45.7 million, equivalent to USD 2,109, up USD 57 compared with 2014. Most domestic and foreign experts predicted that Vietnam’s economy had overcome the most difficult time and its economic outlook for 2016 was deemed very promising. As one of the brightest spots on the current world economic map, Vietnam is poised to experience robust growth in 2016 as well as welcome a surge in foreign direct investment inflow.

Global FDI prospects 2016

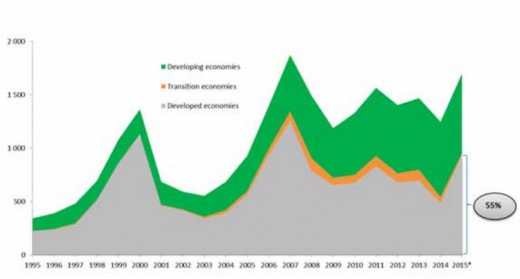

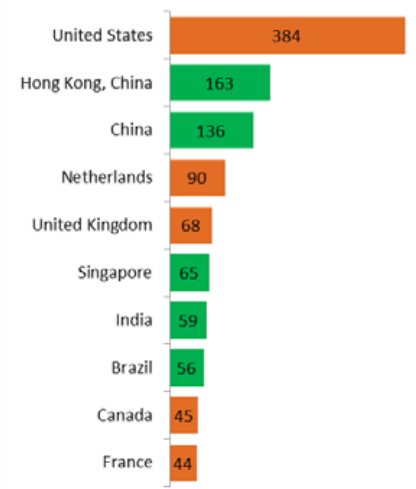

According to the Global Investment Trends Monitor report published by UNCTAD in January 2016, FDI flows increased by 36% in 2015 to reach about USD 1.7 trillion, the highest level since 2008[1]. In which, FDI flows into Asian countries stayed at USD 741 billion, up 5% as compared to that of 2014. Developing Asia accounted for one third of the total world FDI flows, the largest FDI recipient region in the world. Among top 10 host economies in 2015, developing countries made up half of the number of countries. One prominent trend in 2015 FDI flows was the rise in capital flows from cross-border mergers and acquisitions (M&A) activities with a total value of USD 643.7 billion, up 61.4% compared to that of 2014. Although the global FDI prospects for 2016 remain uncertain, continued economic growth and expansion reinforce investors and businesses’ confidence in starting and expanding their investment. According to IMF, global growth rate in 2016 is estimated at 3.6% with modest recovery of developed economies and reasonable growth of emerging and developing countries despite China’s anticipated economic slowdown[2]

Global FDI Inflows 1995 - 2015

Top ten FDI host economies in 2015

Vietnam FDI and Economic achievements in 2015

Overcoming many difficulties and challenges, Vietnam's economy in 2015 grew steadily with low inflation rate and rising exports, and was praised as "one of the rare bright spots of the Asian economy" by The Australia and New Zealand Banking Group (ANZ). ANZ also underscored that Vietnam would be one of the few economies unaffected by China’s economic slump.

Foreign direct investment inflows to Vietnam also achieved a new milestone, attracting USD 22.76 billion in total newly-registered and increased capital, up 12.5% compared with 2014. Especially, immediately after the new Law on Investment and Law on Enterprise took effect on July 1st, 2015, the number of newly-registered businesses jumped by 50-60% compared to the first half of the year. In 2015, more than 94,754 domestic businesses were established with the total registered capital of VND 601,000 billion, up 26.6% in terms of number of businesses and 39.1% in terms of registered capital. As the result of the implementation of the new laws which streamlined and simplified many administrative procedures and reduced bureaucracy, in 2015, the World Bank ranked Vietnam 90 out of 189 countries in its latest report on the ease of doing business globally, up from the 93rd position in 2014. Vietnam also ranked 68th, up two, in global competitiveness report for the year 2014-2015.

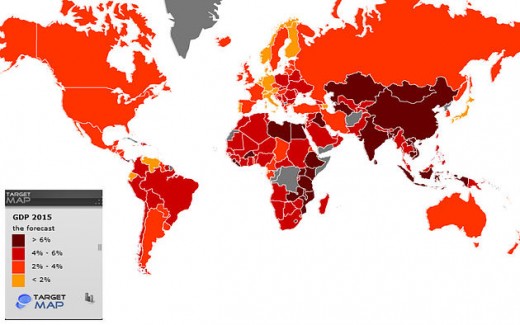

World GDP Map in 2015

Vietnam 2016 FDI attraction prospects

According to Asian Development Bank, Vietnam will maintain strong growth momentum and continue to enjoy a high growth rate of 6.6% in 2016[3]. Steady inflows of FDI into various services and manufacturing sectors will boost exports, create more jobs and improve income per capita which leads to solid domestic consumption growth and customer confidence improvement. Experts at HSBC Global predicted that over the period 2016-2020, driving by a rise in skilled labor force, improved openness to trade and macroeconomic stability, Vietnam’s exports can increase by 11% with machinery, ICT equipment, textiles and woods accounting for the largest proportion of growth. The Vietnam National Financial Supervisory Commission anticipated that disbursed foreign direct investment was forecast to reach USD 13.5 billion in 2016, up from USD 13.2 billion in 2015. Foreign investors are finding Vietnam increasingly lucrative and planning to start their new projects in Vietnam in 2016, while many existing investors express their intent to expand their presence in Vietnam. 2016 seems to offer Vietnam an unprecedented opportunity to attract FDI for the following reasons:

Do you think 2016 is a good year to invest in Vietnam?

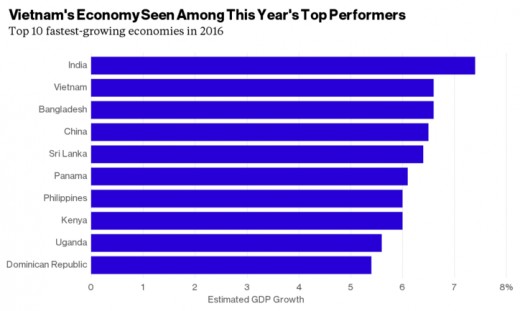

Forecast GDP growth in 2016

Signing of Trans-Pacific Partnership (TPP) and various FTAs

On February 4th, 2016, the TPP Agreement was signed among 12 countries member in New Zealand, concluding one of the most important and comprehensive free trade agreements in history. TPP expressed its stated goal as "promote economic growth; support the creation and retention of jobs; enhance innovation, productivity and competitiveness; raise living standards; reduce poverty in our countries; and promote transparency, good governance, and enhanced labor and environmental protections”. Although all member countries are certain to benefit from the deal, Vietnam is believed to be the biggest winner with much of the gains, especially initially, coming from producing and exporting garments and footwares to the United States. Vietnam has already witnessed a wave of FDI projects in textiles and related sectors in anticipation of the TPP.

At the end of 2015 and 2016, Vietnam’s FTA with strategic partners including South Korea and Eurasian Economic Union took effect, opening the gate for Vietnamese businesses to access South Korean market and Eurasian market. A research by Thangavelu and Findlay (2011) suggested that there is a positive relationship between joining in multilateral agreements and increasing FDI inflows in the Asia – Pacific Region[4]. FTAs are also believed to drive small and medium businesses’ growth by reducing trade costs and risks associated with exports, and open new markets for them. Besides, TPP and FTAs would speed up economic and political reforms, restructuring the economy, increasing transparency, and enhancing the business environment to ensure the stable long-term growth.

Changes in manufacturing landscape

Unlike other sectors, despite occasional fluctuations, FDI inflows in the production and manufacturing sectors show an overall increasing trend over time, accounting for 57.5% of total FDI inflows into Vietnam in 2015. In recent years, perceiving China’s rising labor cost, economic slowdown, and political instability, many foreign investors start planning to move their production and businesses out of China, and Vietnam, with its improving labor quality at relatively low cost and close proximity to China, is an ideal candidate. According to a research by Standard Chartered Bank conducted between February and March 2015, among 290 participating Hong Kong and Taiwanese investors who operated in mainland China, 36 per cent of respondents who wished to move their manufacturing facilities out of China expressed that they would choose Vietnam as their new investment destination.

Vietnam FDI components

M&A activities

The year 2015 witnessed a boom in M&A activities in Vietnam with 341 deals with a total value of USD 5.2 billion, ranking 20th in the global M&A market. Foreign investment made up 66% of total M&A activities in Vietnam, indicating foreign investors’ interest in Vietnam’s market. In 2016, M&A activities are expected to expand further due to the implementation of the newly amended Law on Investment 2014 which reduces administrative procedures for M&A activities. In addition, the newly amended Law on Enterprises 2014 also elaborates on the provision on the merger and acquisition of businesses and facilitates M&A activities by removing various barriers. Especially, Decree No 60/2015/ND-CP dated June 26th, 2015 providing guidance on a number of articles in the Law on Securities removes the 49% cap on foreign ownership of public companies, allowing foreign investors greater access to the Vietnamese stock market. According to Bloomberg, Vietnam’s M&A market will definitely set a new record for the year 2016[5].

Hi-tech booming and start-ups opportunities

With a population of more than 90 million and a median age of about 30, Vietnamese population is of golden age structure, full of energetic, dynamic and ambitious young people. With enhanced economic conditions, easier access to information and a greater degree of individual freedom, Vietnam’s millenniums and generation Z are very creative and apt to learn new skills and technologies. The intense concentration of young people creates good vibe and lays the ground for interactions, idea-sharing and cooperation among these people, accumulating to plausible start-ups ideas. Seeing opportunities from this underserved market, many venture capital funds start making move to invest in Vietnam. For example, Silicon Valley's 500 Startups has just announced its commitment to dedicate USD 10 million target fund to make 100-150 investments into Vietnam-connected startups.

Challenges

For Vietnamese workers and businesses, 2016 does not just promise roses and success, it also comes with challenges that need to be addressed and overcome to reap good results. As Vietnam opens its border to allow further integration, influx of foreign workers and businesses will swamp into Vietnam and compete with local people for jobs. In light of this new situation, Vietnamese labors and companies must improve their productivity and equip themselves with appropriate skills and knowledge to maintain their competitive edge. In addition, increasing economic activities will inevitably place a strain on the environment; therefore, stricter environmental rules must be established and properly enforced. In addition, since some cities such as Ho Chi Minh City, Hanoi and their satellite cities, Danang, etc, are poised to benefit more from the new opportunities than other places, regional income inequality is likely to grow and need to be carefully monitor to reduce its adverse impact on the country’s overall social and political stability.

Vietnam's emerging economy

References

(1) UNCTAD, Global Investment Trends Monitor, January, 21st, 2016

(2) http://www.imf.org/external/pubs/ft/weo/2016/update/01/

(3) http://www.adb.org/countries/viet-nam/economy

(4) Thangavelu, S. M. and C. Findlay (2011), ‘The Impact of Free Trade Agreements on Foreign Direct Investment in the Asia-Pasific Region’, in Findlay, C. (ed.), ASEAN+1 FTAs and Global Value Chains in East Asia. ERIA Research Project Report 2010-29, Jakarta: ERIA. pp.112-131.

(5)http://www.bloomberg.com/news/videos/2016-01-13/vietnam-m-a-forecast-to-hit-record