FOREIGN DIRECT INVESTMENT AND INDIAN RETAIL SECTOR

THE GREAT DEBATE

Indian economy was developing at a snail’s space after independence owing to rigid controls and regulations. Right up to the early 90’s the overall growth had been abysmally low. Manufacturing industries were crushed by severe bureaucratic controls, which clipped the wings of Indian industry. There was paucity of capital, technology and best practices.

REFORMS

The first wave of reform was initiated in 1991 which freed the private sector from the shackles of bureaucracy. Many sectors were opened up, but a few were still out of bound for any FDI (Foreign Direct Investment). One sector were no reforms were initiated was the potentially huge Indian retail. The first step in lifting controls on FDI in retail was in October 2006. But these reforms were basically to the benefit of single brand retailers. As a result of this, multi nationals like Reebok and Louis Vuitton made their first cautious entry into the Indian market. Multiple brand retail was however not welcome. One of the persistent demands on policy makers had been to lift this restriction and open up multi brand retail. The Indian government in 2012 decided to open up multi brand retail sector to foreign direct investment despite vehement opposition to.

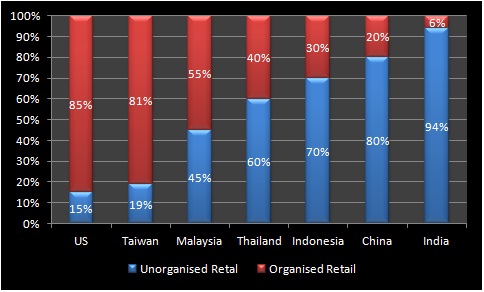

CHARACATERISTICS OF INDIAN RETAIL SECTOR

The traditional retailing sector in India is presently dominated by small retailers popularly known as ‘KIRANA STORES’. Nearly 95% of the retail sector comprise of local small scale retailers who operate on low-cost-and-size format. This has resulted in fragmentation as a result of which it has no access to Capital and technology. The potential of retail sector is largely due to the emergence of a big and affluent middle class. Modern retail therefore has a mere 5 percent presence in the retail sector which is expected to quadruple over the next 20 per cent years. This implies that the small retailer would still be having an 80% share of the market and in terms of business volume it is expected to rise from $ 500 million to $ 500 billion.

ADVANTAGES OF FDI

The spin-offs of this would be the modernization of retail sector. Innovations like vendor management inventory systems, reduction in wastage, sophisticated inputs like high yield varieties of seeds for farmers and improved warehousing facilities which are hitherto available only in developed countries would be made available in India. This is also bound to generate employment both in the skilled and semi skilled category. Presently the retail sector faces an acute shortage of man power. In anticipation of the growth of this sector several training institutes have come up. Another beneficiary of the entry of big retailers is expected to be the growth of medium and small scale enterprises. This is because big retailers in order to retain their independence from FMCG brands would switch to suppliers in the medium and small enterprise sector. They can buy the products from these MSM’s and sell it under their own brand names. This practice which is known as middleman branding is widespread in developed economies.

DISADVANTAGES OF FDI

Despite these loud claims the opposition to the entry of FDI is equally vociferous. Many are of the view, that this opening up of the retail sector is not bound to trigger the benefits as claimed by its advocates. Those who oppose these reforms base their arguments on the following:

They believe that even in the United States farmers have benefited not from the big retail companies but for federal subsidies. For example, the farm bill in 2008 had set aside $ 307 billion for agriculture for the next five years. Their point is that if the big retail companies are sufficient to support US agriculture what is the need for the US federal subsidies.

Their next argument is that studies in the US have shown that net income of farmers has come down from 70% in the early 20th century to less than 4% in 2005. The reason for this is the proliferation of other middle men like standardizers, quality controllers, certification agencies, packaging consultants etc... Who corner the profit which traditionally went to the farmer. This forces the farmer to survive on federal subsidies.

Opponents of FDI also point to the fate of small traders in Mexico and South East Asian economies. Supporters of FDI had always banked on the best practices that can be introduced in these developing economies. But the flip side is that it has given rise to pernicious practices too. For example, a New York Times Expose reported that Wal-Mart captured nearly 50% of Mexico’s retail market in 10 years and that its Mexican subsidiary was subject to an internal enquiry following allegations of bribery.

In South East Asia too, the entry of big retailers had resulted in adversely affecting small retail traders. Indonesia, Thailand and even Japan were forced to bring in new zoning laws and size regulation in order to protect the interest of small retailers.

The market is big, and the stakes high. Would FDI in Indian retail sector be beneficial will be a hotly debated issue for quite some time.

![Women in Short Skirts Are [Insert Opinion Here] Women in Short Skirts Are [Insert Opinion Here]](https://images.saymedia-content.com/.image/t_share/MTk5MTk2NjE2MjQ5Mzg2Mzk4/women-in-short-skirts.png)