Financial Maturity and Your Leadership

Financial Mastery

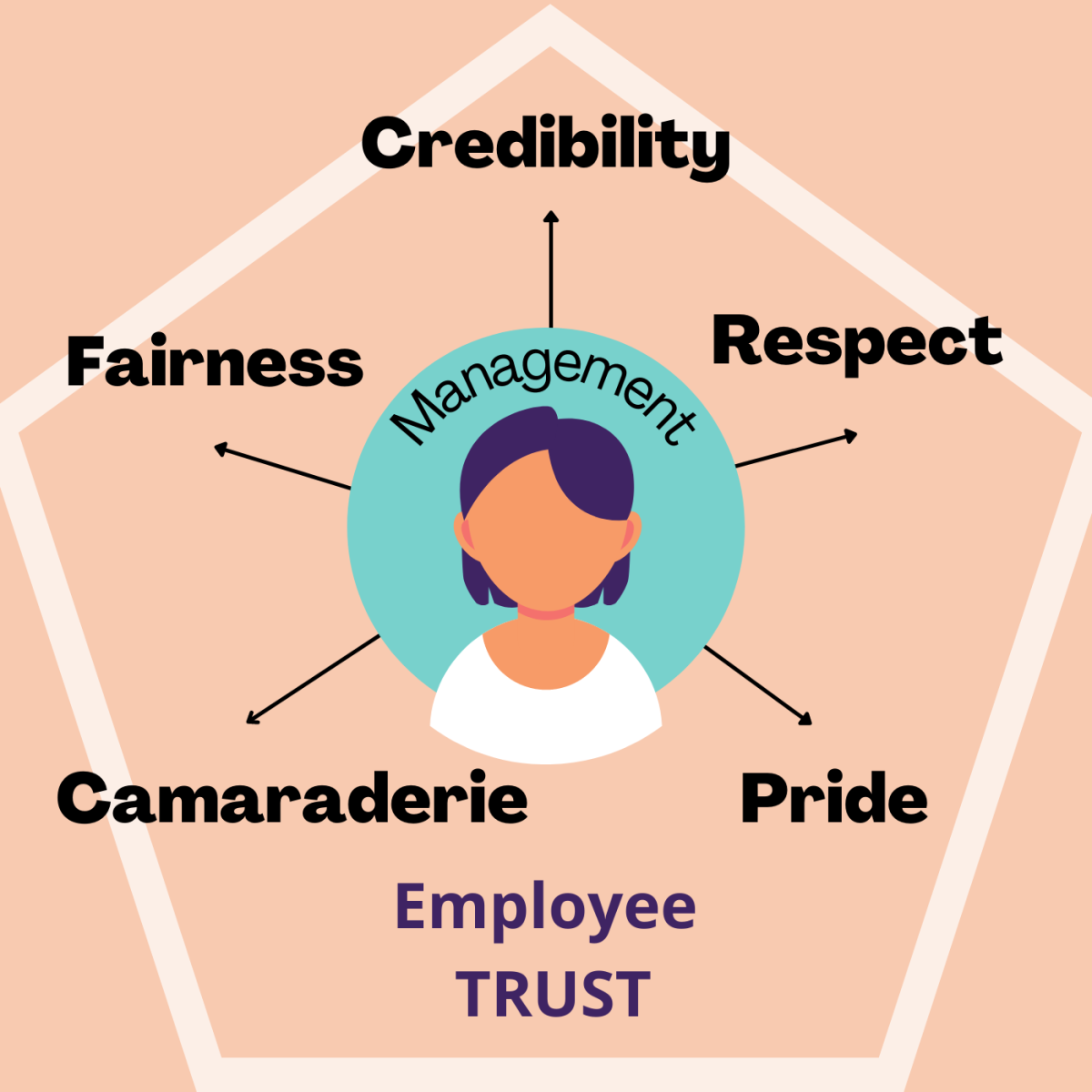

Undoubtedly as a leader people will always be looking up to you and watching you intently, not all the time, but when you’re in a public forum you can be sure to have at least one set of eyes on you. For this reason, the way we conduct ourselves in all areas of life affects the way people view you as a leader and the subsequent credibility you elicit. Financial success and competency is no area of exception. Think about it, do the leaders you admire emit a sound financial aura? This usually doesn’t just happen by chance, most successful leaders are successful with their finances as well but it takes work, discipline and self control in order to take charge of your finances and succeed. Thankfully there are principles and strategies you can apply independently that will allow you to take control of your finances, before you need to employ professional assistance.

The book The Richest Man in Babylon, by George Samuel Clason, was printed in 1926 and details wise financial advice through a collection of parables set in ancient Babylon. It is a book I read some 6 years ago, but 2 of the key financial principles they detail, have stuck with me and I still apply them up until this day. The thing about effective principles is that regardless of when they were created, they have a timeless application, meaning even is the principles were created centuries ago, if they are trailed and tested and produce good results, you can still apply them to your situation today and achieve similar results. View the 3min clip below to learn more about these principles.

These principles have the capacity to hold you in good stead; to grow your wealth and to help you avoid going into debt. Financial responsibility works hand in hand with assuming an effective leadership position and being able to go out into the world and achieve all you desire. Like your commitment to your job/role however, financial responsibility works in the same way, you need to work hard to succeed at it and be able to maintain a degree of self-discipline. Without these two elements, it is very challenging to advance your financial position, so work hard and work harder on yourself as well, because these are the lifestyle traits that will set you in good stead for a prosperous future. There is a lot to be said for keeping your house (financial affairs) in order. How is your house looking?