Fixing the Broken Banking System

Introduction

Is anyone concerned about the current banking system in America? It seems obvious to me that something is amiss and yet no one else in government or industry seems to be concerned. Ever since the financial crisis of 2008, our banking system has been on life support. Seven years after the crisis, it does not seem like it is getting better. In my opinion, if we don't restore the banking system, the rest of our financial system will never be safe and sound.

-Jan. 2015

The Elephant in the Room

The main problem with our banking is the extremely low interest rate. The interest rate is what controls the velocity of money. When money is circulating in the economy, everything works. When the money is stagnant, it is destructive. I'm reminded of the song in the Disney movie "Mary Poppins". The song "Fidelity Fiduciary Bank" is one of my favorite tune in the Mary Poppins movie. It paints a picture for Jane and Michael of the importance of savings. It also explains to the novice what a bank does and how money invested in the bank will bring about prosperity. I wish everyone could take that lesson and contrast it to what we have today.

Fidelity Fiduciary Bank

How a Bank Should Works

This is economics 101. A bank is an institution that take savings deposits from the public and in turn gives loans for buying a house or car or starting a business. It makes a profit by the difference of interest rates it charges the lenders and the interest it pays to the depositors. That's the simple explanation. Of course the bank has other investment vehicles such as CDs and it provides additional services such as issuing certified checks and provide safe deposit boxes etc. Banks in general makes lots of money. For example, back in the old days, 1970s, it use to charges 5-8% for a car loan and it pays out 4-6% as interests. The difference of 1 or 2% pays for all the expenses and provided a good profit. That was the way it works for most of the years of my life -60 years.

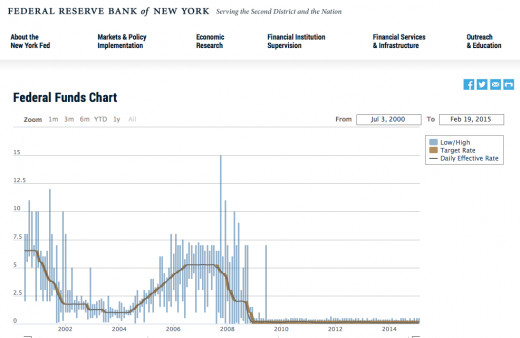

What happened that changed this simple winning formula? The Federal Reserve who sets the guide for all interest rates decided to make the rates close to 0%. This was done because of it's misguided attempt to fight the last recession. With all the QE strategies, it is just a fancy word for printing money. By flooding the market with paper money or credit, it cheapens the value and therefore drove down the interest rate.

Graph of interest rate (2000-2015)

Why is very low interest rate bad?

The interest rates always fluctuate from day to day and year to year. It follows a normal economic cycle. Economies has a cycle of growth and recession from time to time. That is perfectly normal. What is abnormal is for the Federal Reserve to arbitrarily set the interest rate to a very low number. Here are a few consequences of a low interest rate.

- It is a disincentive to save money.

- It hurts the fix income folks who are older and may rely on savings for retirement.

- It discourages banks from giving loans.

- It forces people to make more risky investments in order to get a bigger return.

- It benefits the government who are the biggest debtor and can repay its debt with less money.

- It slows the velocity of money and lead to less commerce.

Who is Responsible and How to Fix It

I realize the financial system is very complex. There are many smart people working on solutions both in government and in Academia. There are many different schools of thought as to what direction our country should take to correct the current crisis. My simple approach is to deal with the fundamentals. My belief is when the fundamentals are sound, the system will work it self out. I come from the Milton Friedman wing of the economic divide. I believe in free markets as the best solution to wealth and prosperity. The government's roll should be minimal and to oversee a fair system and to prevent abuses and punish the lawbreakers. It is clear to me that the Federal Reserve is the problem here. It must reverse course and stop the QE "Quantitive Easing" and restore the interest rate to a reasonable level. This will go a long way to solving our banking crisis.

What Can We Do?

It is one thing to identify or complain about a situation. Most of the time, we don't have any control on what is happening. In politics, we can exercise our preferences by voting. In the case of the Federal Reserve, we don't have a voting option. There is only the arena of public opinion. First, we can educate our friends and neighbors about the problem. Second, we can initiate a petition to change the behavior of certain groups. Recently, I started a petition on Stand United. This is an organization to do just that. Please visit my petition and sign if you agree with me.

Related Links

- Fidelity Fiduciary Bank Lyrics — | from Mary Poppins

LYRICS to Fidelity Fiduciary Bank by from Mary Poppins Soundtrack. Mr. Dawes Sr, Mr. Banks and Bankers: If you invest your tuppence Wisely in the bank Safe and sound Soon that tuppence, Safely invested in the bank, Wil - TheMint.org - Fun For Kids - How Banks Work

- Federal Reserve System - Wikipedia, the free encyclopedia

- QE and ultra-low interest rates: Distributional effects and risks | McKinsey & Company

Ultra-low interest rates, in part as a result of central-bank policies since 2007, have had a very different distributional impact on governments, corporations, financial institutions, and households. A McKinsey Global Institute article.