Secret Games That Business Directors Play - Strategy And Politics

We all know that certain kinds of political behavior are not just something that happens for no reason. Political behavior is learned and forged in the fires of Business. Nothing inspires and “teaches” like Money and Power. Life in the board room can become a true battle of wits. And the people that learn most are business directors. There are several “types” of directors, just as there are types of politicians. Then there are the Games played by business directors. And what games they play! These games also apply in politics of most Governments of well-developed countries. I promise you have not read a hub like this before. Power play is not a topic often written about. Firstly there are 6 different types of Directors, then the 4 main kinds of Director Boards you can find in Business, and finally the amazing Games that Business Directors play. You will see the political analogies in all of these types listed here. Perhaps some of them will be familiar to you.

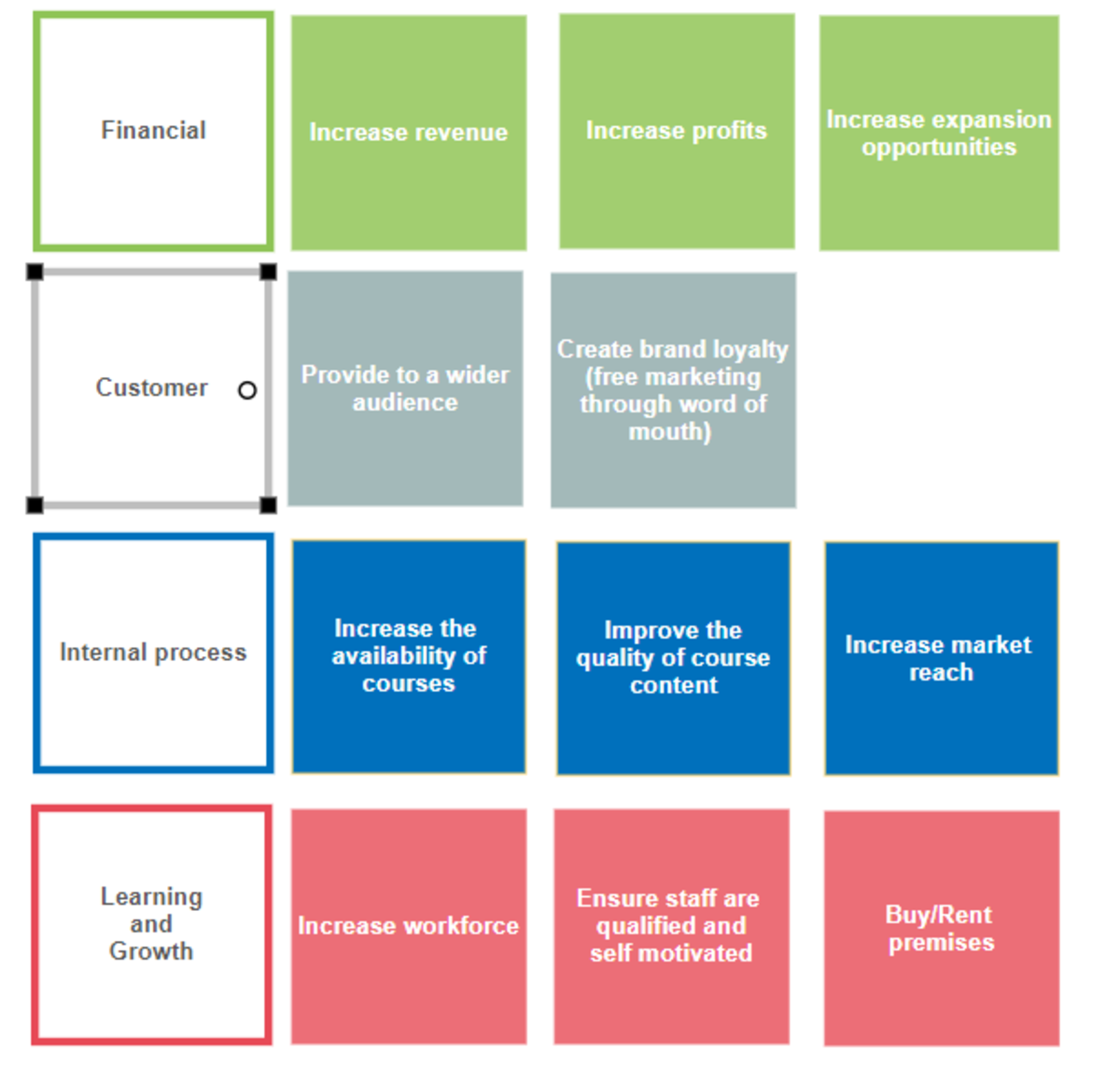

The 6 types of business Directors

1. Status Provider – this is a person appointed to the company more for the status they bring with them, rather than any contribution they can make. Whenever a company finds itself in dire straits and needs to calm markets or shareholder nerves, a Status Provider can help to calm nerves and restore confidence, provided the Provider has a reputation for Integrity.

2. The Wise Man – this is a Director who will bring with him or her - accumulated wisdom and knowledge and a wealth of previous or current experience that will relate to problems and any issues facing the Business. They are renowned for being good problem solvers. This person is usually highly respected by fellow directors, although some caution must be observed as accumulated wisdom can be a negative factor in a fast changing world.

3. The Specialist – a wonderful counterpoint to the Wise Man mentioned above. Very popular nowadays is the trend for businesses to have to develop or improve new ideas and practices in adapting to new markets and responding to challenges in their Business. This non-executive director will be appointed by the company for their specialist knowledge of a technology, market, particular function or area. In order to be useful – a Specialist has to constantly stay on top of their game, and bone up on their area of specialization. For the Top Performers, the efforts can be financially well worth it.

4. The Contact Person or Networker – this kind of person will have vital and useful connections to the right organizations and people. Usually it is retired senior executives who land these plum jobs, and often civil servants and yes even politicians are involved, for example in Banking.

5. The Sage – or Window to the World of Business. Yet another kind of Business or Board Director with relevant insight and information vital for market opportunities, industry developments, new technologies, etc. Often non-executive directors, these directors also are useful to the business only as long as they stay ahead of their game and are connected to their sources.

6. The Father or Figurehead – this director represents the business at all functions like trade and industry gatherings, strategy think tanks, and public commissions. These people will often represent or guide the business in media matters and have a media role.

Even though these positions here are directors,

they can just as easily be political figures – so similarity will be apparent.

(These titles are British, and may have different names in other countries or

jurisdictions.)

The 4 types of Director Board.

1. The Country club board – a well-established kind of group of directors,

these are concerned with mostly interpersonal relations and with board matters

usually coming in second place. They are a curious throwback to old school

business or family businesses, especially in the UK, but can be found in many countries

and cultures. We all know perhaps at least one family run business or

establishment that fits this description. Meeting almost entirely follow a set

tradition and tradition is valued, while innovation can be discouraged. So not

a place for fancy-minded young idealists! Tea and cricket anyone?

2. The Rubber Stamp board – a sharply contrasting board style to the above, these boards give scant regard for traditions or conventions or tasks of the board or interpersonal relationships among people. Their meetings are mostly a formality and I seldom have seen minutes ever taken at such meetings, if indeed ever. It can also be the case that some types of companies have what are called “letter-box” offshore companies or businesses, not properly or formally registered businesses. These businesses might be in tax-havens or tax-exempt dominions and one individual – a director – will make all decisions and rubber-stamp everything. It might also follow that any key personalities in the business will network frequently and so decisions will be taken in the management context.

3. The Professional Board – more like how it ought to be – these kinds of boards show more consideration for the boards work and the directors’ interpersonal relationships. A professional board of directors will have sound solid leadership always from the chair. There will often be robust and tough discussion in here and mutual understanding and respect. These boards are my personal favourite, as they get the most work done.

4. The Representative Board – not a very impressive set up in my opinion – these boards place more importance and emphasis on tasks of the board than on board relationships. They often have directors spending more focus on certain vested interests and stakeholders and they behave rather like some kinds of parliaments of diverse interests. Issues often become politicised in here, so board discussions become intense heated debates, and quite adversarial. Thankfully I have never seen any blood spilled in any such meetings. The balance and basis of power is always paramount in this style of board meeting.

There are different names for these kinds of meeting and some other titles are not very flattering. Many people identify such meetings and styles as being synonymous with most kinds of political groupings and group behaviors. There are always certain personal interests with some people.

However the kind of games that Directors get up to are now listed here. They give a more fuller flavor to the gamut of director shenanigans that take place. You would be forgiven for thinking directors are serious, rational and analytical in mind, but often they are anything but! Their behavior can range from outright political intent to intense personal rivalry to power plays of all kinds. Here they are...

Propaganda – the dissemination of information to support some purpose or cause and usually done in conjunction with stock markets, shareholders or financial institutions rather than board level meetings or business. Regulatory bodies will often act against such events if propaganda gets too excessive or outlandish or too false. However it does happen. However, light-touch regulation means people rarely get prosecuted for false claims.

Coalition building – coalitions are formed outside the boardroom for purposes of getting mutual support inside the boardroom. This is another version of Log Rolling. Log Rolling is when one director like “Harry” will off the record – support director “Tom” in return for mutual support when it will come to matters of interest to Harry. Directors often have positions and relations of dependency on other individuals and they can influence outcomes.

Scaremongering – another insidious idea where all emphasis is placed on the “downside” of a board or business decision or plan. This is the “glass half empty” routine where directors talk down the bench rather than up, so as to cast doubt about something in order to kill it or have a proposal turned down or voted against. This is pretty rampant in business and politics has its own analogies too.

Cronyism – the process of supporting one director’s interests despite not being in the board’s or company’s interest. Shareholders are also often hard done by in this case. Some people allege that cronyism is a pestilence in companies in parts of Asia. I beg to differ. It happens everywhere. If it is possible for a thing to happen, then it will happen. (Murphy’s Law.)

Spinning – a recent term used to describe a distorted or skewed view about something to make it more favourable and get a more favourable outcome – usually in the interest of the spinner. In business spinning can happen at board or shareholder level or in the media, which is especially prone to spinning since it thrives on news. Spinning has been around since forever, and it’s an art in its own right. The best kind of spin is that which never appears to be spin in the first place.

Snowing – wait, didn’t we just have this recently? No, this kind of snowing is the business kind of “snowing” where directors or other executives will bury an outsider or opposing director or exec with tons of information and data, thus overwhelming them and confusing them – mostly as a kind of “misdirection”. An inverted form of evasion. Doing the opposite of evading so as to seem like one is being helpful or complying with something, when in fact not wanting to comply one little bit! It happens and it is a game some business directors love playing.

Window dressing – a game practiced by directors which creates a great “show” externally for all concerned, but usually concealing something that others don’t want you to know about or see. For instance, financial institutions making out that the books and accounts are just fantastic, five minutes from sheer hell breaking out! Everybody say Bear Stearns or Lehman Brothers. (That reminds me, I must change those curtains in the apartment...)

Empire building – this is misuse of special privilege or access to people or information for the purposes of furthering one’s position, (or that of the group) to gain more power, control or acquisition of resources or territories or rights over organizational territory. It can take many forms. This is one of the more dangerous games played in business, involving conquests and battles, and even intrigue! In business or politics, this is rampant and happens everywhere.

The Half-truth – a wonderfully insidious and clever game where a business director or exec may not be entirely lying – but will tell a half truth, and give one side of the story during the course of business proceedings.

The half truth can be helped along if the right co-conspirator obliges by not asking the right question to help divulge or reveal the other half of the truth, which they both want to bury or hide. Now that’s team work.

Divide and Conquer – a old dirty game or system of having one person playing two people against each other, so as to achieve an entirely different personal or business gain or aim. In politics or business, you will find this game always being played. Perhaps this is the oldest human game of all when it comes to politics and business.

A note on divide and conquer – it is usually done for reasons of power or control or influence. The simplest and easiest way to divide is to create fear in a specified group. The fear leads to rampant uncertainty, the more the better, and then at the right moment simply step in and offer salvation or hope in some way or form. We can all think of a great number of examples of this in many areas. It takes a certain kind of person to be good at this or have the stomach for it. (There are other forms of divide and conquer too.)

Suboptimization – this is perhaps less well known and happens when a director or exec in the business supports a part of the organisation but to the detriment of the firm as a whole entity. Sadly tunnel vision can happen to some directors as they get too closely involved in some special area, and this short-sightedness might be because the person in question might be personally affected by an outcome. This game has other names too.

Rival camps – this is where opposing groups form in a board of directors or business persons, and they become opposing factions and engage in conflict for power or control. Rival camps can get nasty. We have all seen the movies that had board-room coups and grand-standing as part of the seemingly common day to day hell that happens in the board room. This game is weird and can entail spies, insiders and double agents. Business can be such fun. (They never tell you this in college.)

Deal making – don’t forget this game where compromise is the order of the day and so 2 or more directors will work behind the scenes and agree on a deal so as to get closure on something. It has its bad and good uses. I hear divorce settlements fare well in these matters too sometimes.

So these are the main games that most business people in the boardroom will get up to. It is culturally preferred in some societies to avoid ever publicly admitting to such things, and saving face can factor hugely in some cultures. In Japan they say “business is war”, and so games can take on a certain significance.

I stress here that many of these games also get played out in the political arena. If some of what you have read here reminds you of today's news headlines in politics, just remember you saw the explanations to some of those games here in my hub.

I hope you have found this article on Hub Pages stimulating and absorbing. We like to cover these less traveled roads in knowledge and wisdom. Feel free to comment and let me know if you liked it. And feel free to tweet it or vote it via Facebook. Perhaps some of your friends might want to take notes...

I must thank a good Japanese friend for help and suggestions in this hub page. Many thanks to you, my friend. “Konichiwa.”

Copyright (c) 2011 to 2014 Cassy Mantis / Cheeky Girl. All rights reserved.