Globalization's Effect on Accounting Education

Globalization has shaped the world in what we know it is today. It is the way in which businesses, technologies, and people interact and share ideas around the world. It helps shape our economy and free trade among different countries. Because of advances in technology over the years, globalization is constantly changing, which directly affects accounting. This is especially important to an accounting student because these changes can impact what they need to learn. Globalization impacts accounting education in many ways: the shifting of GAAP towards IFRS, trade and exchange rates, and accounting scandals. All of these changes directly impact what college accounting students learn in their accounting courses.

GAAP vs. IFRS

A major change that globalization has made in accounting is the shifting of GAAP towards IFRS. Currently GAAP, generally accepted accounting principles is what accountants turn to as their guidelines. In general GAAP is more rule based and IFRS, International Financial Reporting Standards, is more principle based. Here, globalization is taking place because many accounting professionals are in favor of adopting IFRS to the United States for consistency. By having only one set of global standards, it makes it easier for accountants to be more knowledgeable of these standards, instead of having to familiarize themselves with two sets of standards. “Global standards should result in the reduction of costs and increased efficiency through standardization of information systems, elimination of wasteful international reconciliations, audit efficiencies, and synergies in the education and training of accounting professionals”. (“Impact on Accounting Education”, 2016) By standardizing the system, it makes the profession on the same page as a whole and helps make audits more efficient and effective.

Accounting students are being taught both GAAP and IFRS in their courses due to this likely adoption of IFRS in the United States. Because IFRS is more principle based, there is more room for interpretation. This requires students to be more knowledgeable about the subject and use their better judgement. Many accounting students go the public accounting route and work for one of the big accounting firms. The big four accounting firms: Deloitte, PWC, E&Y, and KPMG, audit some of the biggest global corporations in the world. This makes it imperative accounting professionals understand IFRS. For those who choose to go the industry route, knowing IFRS is just as important because many of these corporations are global.

Trade and Exchange Rates- Yuan to USD

Trade and exchange rates throughout the world are directly impacted by globalization, and it is important for accounting students to understand how these trends work. Take China for example. Currently one Chinese Yuan is the equivalent to .15 of a US dollar. The Yuan has dropped about 6% against 13 currencies, including the dollar, yen, and euro, in the past six months. Due to the announcement of the UK leaving the European Union contributed to the devalue of the Yuan. Two weeks after this decision, the Yuan weakened 1.6% against the US dollar. (“Wall Street Journal”, 2016) There is a huge correlation between the Chinese Yuan and the US dollar. According to the Wall Street Journal, when the dollar weakened the Public Bank of China anchored the Yuan to the dollar, which the let the yuan fall against the other basket of currencies.

The exchange rate between the US dollar and Yuan has a major impact on consumers. When the Yuan weakens against the dollar, imports from China are cheaper, which keeps the price of goods made in China low for consumers in the United States. A stronger Yuan could have a harm to businesses here in the United States who outsource jobs overseas. This is because any income generated in China loses value and is sent back to the US, therefore lowering earnings for US companies.

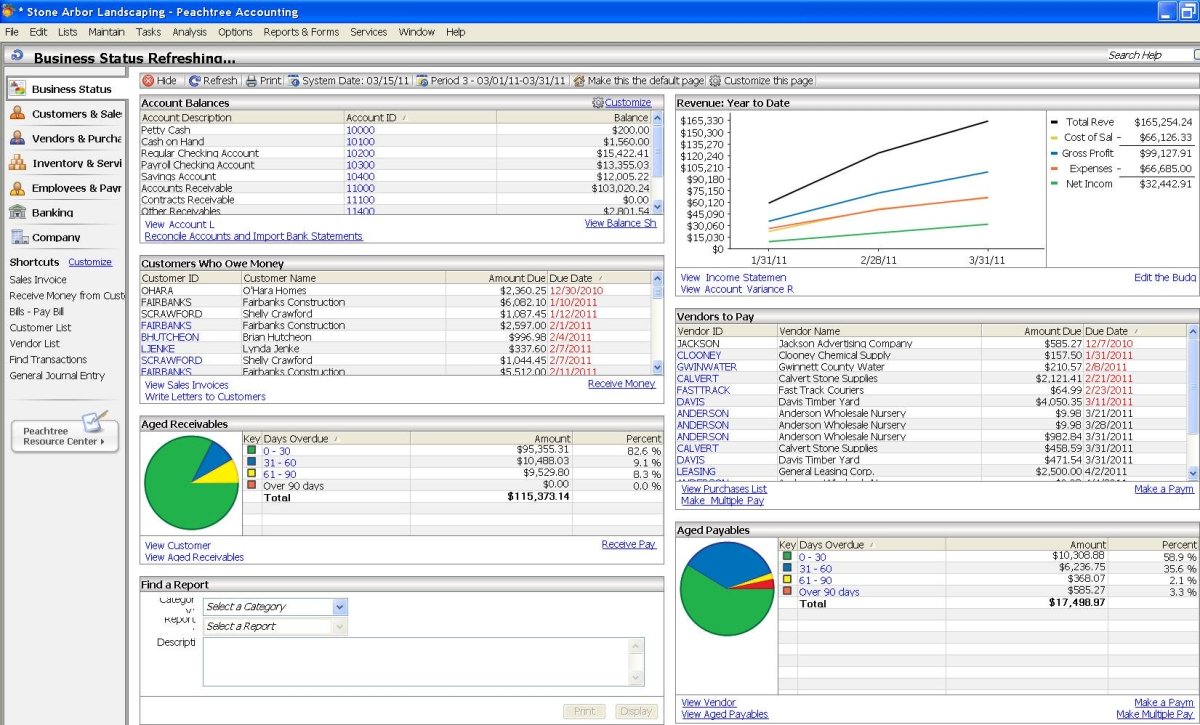

By understanding these trends, an accounting student is able to understand how the economy works. An auditor or a book keeper need to understand exchange rates if their client or company completes a transaction with an entity in another country. This could affect the recording of a journal entry or directly affect the financial statements. An international tax accountant needs to understand exchange rates. By converting foreign currency to US currency, they are able to compute the correct amount of taxable income on a business or individual’s return which could affect the amount of the tax liability or refund. An auditor, bookkeeper, and tax professional all need to learn the exchange rates and trends.

Fraud Scandals- Enron

Ethics and globalization go hand and hand. Changes and fraud scandals in the accounting world are essential for an accounting student to learn. One of the largest accounting fraud scandals of all time was the Enron scandal. The Enron scandal caused the company to go bankrupt and led to the fall of one of the largest accounting firms in the world, Arthur Andersen. This made the ‘Big Five’ Accounting firms become what we know as the ‘Big Four’ Accounting Firms today. Enron deceived the world by hiding billions of dollars in debt with the help of accounting loopholes and special purpose entities. Their auditor Arthur Anderson was found guilty of destroying documents. Billions of dollars were lost in investments and pensions for shareholders and employees.

Although this was a US corporation, it had major effects on how the accounting world is today. After the Enron scandal, the Sarbanes Oxley Act (SOX) was enacted. SOX increased the consequences for altering or destroying financial records to mislead investors. Also, SOX created the Public Company Accounting Oversight Board, which helps sets provisions for the idea of auditor independence. It is important that accounting students understand how a public accounting firm cannot provide consulting and audit services to a client. This is the idea of auditor independence. Many people say the Enron scandal helps supports the idea of adopting IFRS in the United States. “Pacter sees the saga as an argument for principles-based standards (such as IFRS) rather than rules-based standards (such as U.S. Generally Accepted Accounting Principles). “Enron followed the letter but not the spirit of the rule regarding subsidiaries, and thus balance sheet liabilities”. (“GAA Accounting,”2016) An accountant should always be ethical. By understanding events in globalization and the ethics behind these fraud scandals, accounting students learn how and why accounting policies are constantly changing.

Globalization has a huge impact on our economy and it is important that accounting students understand this. By people sharing ideas, business models, and trading we are able to stay connected with the world and make the world a better place. It directly impacts accounting policies and the accounting profession. It is essential every accounting student understands how changes in globalization such as the possible adoption of GAAP vs. IFRS, trade and exchange rates, and accounting scandals impact the accounting profession and what accounting students learn. Whether an accounting student is going into public or private accounting, they need to understand how the global economy works.