- HubPages»

- Business and Employment»

- Small Businesses & Entrepreneurs»

- Home-Based Businesses

Home-Based Business Funding: How to Sustain Money Flow

If you are eager about getting your home-based business off the ground, reaching customers, and maintaining smooth operations, you are going to need a funding source. Without sufficient funding, entrepreneurs will have trouble purchasing the essentials for setting up their personal niche.

Fixed and variable expenses, including administrative cost, insurance, inventory, shipping and receiving and marketing are a few expenses that must be financed, especially if a business expects to be competitive in the marketplace.

Some home-based business enthusiasts, including stock photographers, freelance writers, and private tutors can function on a small budget. According to Forbes, 44% of home-based businesses operate under $5,000 a year. Nevertheless, even for the small budget start-ups, private funders are waiting to lend assistance.

What to Do When You Need Funding

First, you should calculate your start-up cost and determine the ongoing budgetary expenses needed to operate and maintain your home-based business. You can use a spread sheet to record both fixed and variable costs. One-time costs should also be calculated, including the fee required to incorporate your company.

Next search for various grant or loan programs which are relevant to your home-based business and apply for funding.

In your search, you will discover several programs and services which offer to fund small businesses, including state and local programs, non-profit organization and a host of other options for financial assistance.

Grants and Loans

Because federal grants are supported by tax dollars, they are not available to start-ups. However, many state and local programs, as well as non-profit organizations, are willing to provide funds for relevant home-based business. If you are interested, contact these programs for the proper qualifications.

A Small Business Administration (SBA) loan is another option you may want to consider when searching for financial help. An SBA loan is not a traditional loan. In fact, SBA isn’t a loan but an agency which works with various loan programs specifically designed to help fund start-ups and homebased businesses.

SBA has a loan application checklist which lists the form and documents needed for qualification and for designing a funding package. Basic 7 (a) loans, Microprogram loans, and CAP Lines are some of SBA’s most popular monetary resources.

Other Funding Options

There are hundreds of other options for obtaining funding for your home-based business, including CrowdFunding services and Angel Investors or Venture Capitalist.

Multiple Funding Channels

Are Multiple Funding Sources Necessary for the Survival of Your Home-Based Business?

Angel Investors will provide funding if your small business has a high earning potential. However, because of the elevated risk of financing your start-up, they will most likely desire stake in the ownership of the company, especially in the operations and decision-making aspects.

The more you know about these optional services, the more opportunities you have for sustaining the necessary funding to keep your home-based business afloat. Some of these services include GoFundMe, Donor Perfect, Indiegogo, Golden Seeds, and angels den.

Things You’ll Need to Qualify for Funding

An Effective Business Plan

You must have an effective business if you want to the prospective lender to look in your direction. Without a legitimate vision and purpose for your home-based business, a banker or funding program will not take your serious. A business plan indicates order, direction, and purpose for your very existence in the marketplace.

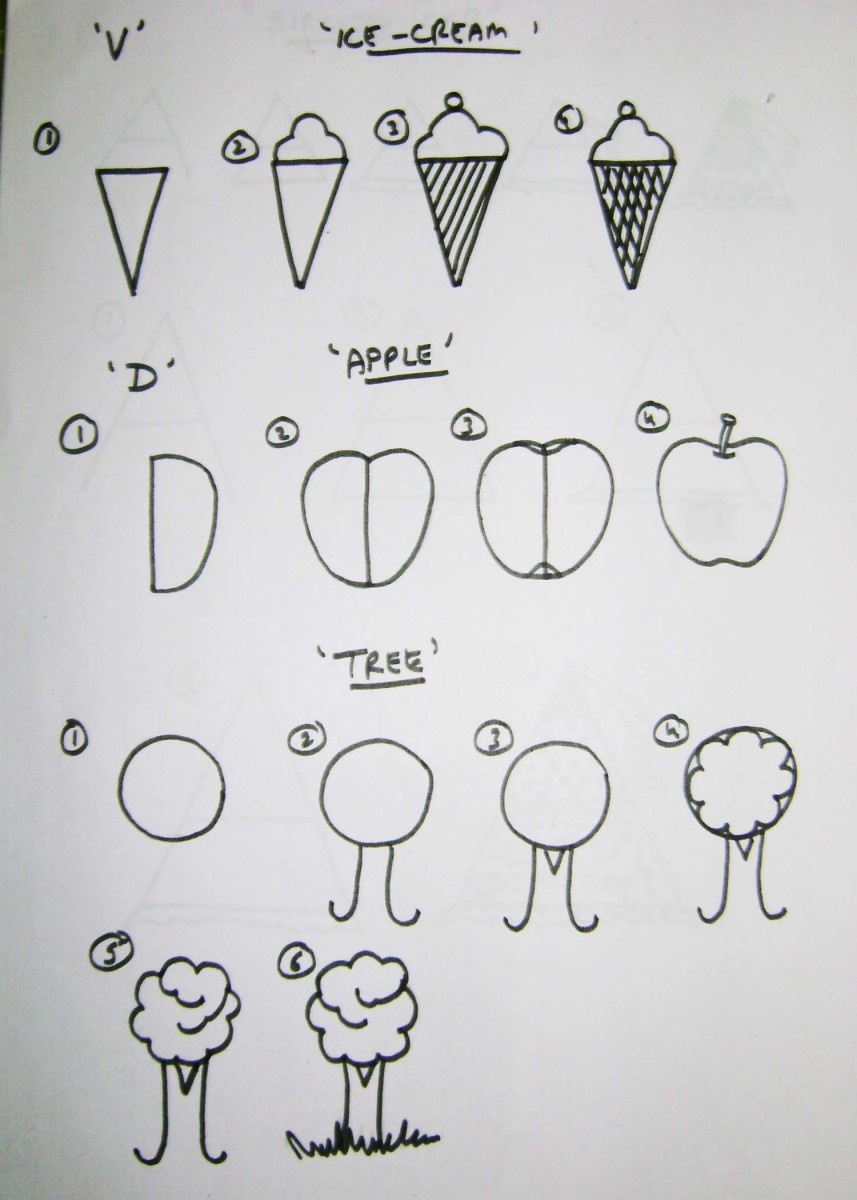

An Effective business plan should include:

- Summery

- Mission an objective

- Products or services

- Market and competition

- Marketing strategy

- Operation plan

- Overall schedule

- Financial productions and requirements

Most Significant Financial Documents and Information

Lenders want to know where the money is going. Presenting essential financial documents and information will help lenders determine how much your home-based business is worth and the amount of funding for which you qualify.

Important financial documents should include a balance sheet, income statement and a cash flow statement if possible.

Lenders also need information about your credit history, such as account numbers, outstanding bankcard balances, credit cards and other possible loans.

In addition to these financial forms and data, you need to present all three copies of your credit report: including Equifax, Experian, and Trans Union.

The more information you submit regarding your financial situation, the more quickly the lender can assess your credit worthiness.

Not all funding programs will require such indebt information regarding your financial health. However, the more honest you are about how you manage money, the more secure they will feel in lending or giving the money you need.

Once a program has gotten all the necessary documents needed to determine your qualifications you will be informed of the amount of funding you will receive.

What to do Next?

Once your business is up and running and you are reaching your target audience and making a small profit, what should you do with your earnings.

To Re-invest or Not to Re-invest

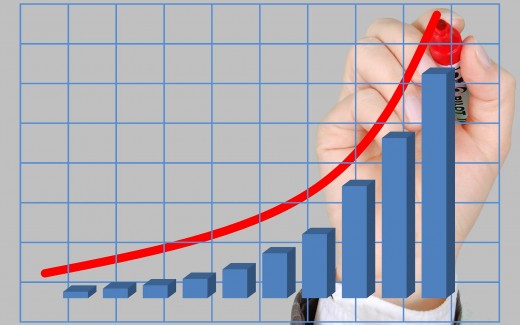

What should a home-based business entrepreneur do with his or her cash earnings? A clever idea is to re-invest it back into the business. The value of your business will increase when you strategically make reinvestments in areas which are weak.

Upgrading work space, office equipment, computer software, communication systems, inventory, and marketing strategies will go a long way in bolstering your growth in the marketplace.

By re-investing your cash earnings back into your business, you sustain the flow of money going out and coming in. The more reinvestments you make the more your earnings will compound and the more financially healthy and sustainable your home-based business will become.

The Bottom Line

To effectively start and become known, a business needs money. Funding for your home-based business is available if it is legitimate. However, funding doesn’t come easily. You must be willing to search for it and rub elbows with several programs. Sometimes discovering the right foundation is time-consuming.

You may get turned down a few times before you find a foundation willing to support your dream. Nevertheless, if you refuse to give up and keep searching and connecting with funding program, your dream of own a home-based business will eventually become a reality.