How To Get Finance Service Without Bank Loans For Small To Mid-sized Businesses Development-Online Factoring

When Banks Say No Factors Say Yes To Financing

Small Business Development is more than hiring and great service, you have to have the needed capital to grow and compete. Just imagine having a business that has the clientele, and account receivables but no credit line or room for payroll?

Many small or midsized businesses will fail before they have reached their full potential because they don't have the proper knowledge about creative finances.

There are different ways to get more capital when you need it that your haven't thought of or if banks will not give you a loan because of various reasons.

Why Would Finance Factors Give Money When Banks Won't?

Many companies in the service industry do not have the credit or assets a bank needs for collateral, however factoring companies look at the credit of the receivables to qualify the company for factoring or other financing strategy. Of course these businesses should have been in operation for several years already.

- No Credit

- No Real Estate

Why Small Or Midsized Businesses Need Money

- payroll

- supplies

- operation expenses

- machinery/equipment

- large orders

Those are only a few reasons why these businesses need a large sum of cash. The main reason is that without this capital they can go out of business.

Small (Midsized) Business Financing Options

- commercial loans

- investor

- credit card advances

- hard money lenders

- purchase order financing

There may be ways to get the capital you need but going into more debt is certainly not an option for some. Making the wrong move can land you even further into debt without production. There is a business call factoring that is not quite a loan but is parallel to a loan.

What Is A Factoring Program?

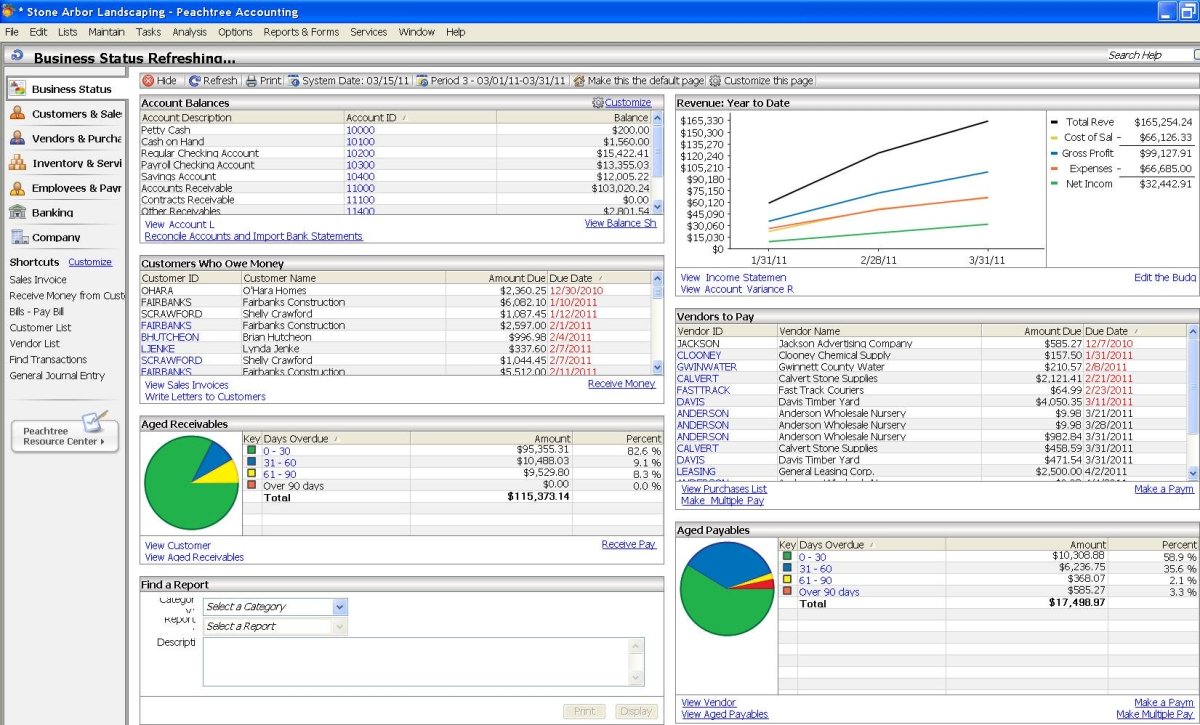

A Factoring program is when your accounts receivables, equipment, credit card sells etc are purchased at a discount for cash over a specific amount of time. This is not a loan this is call factoring. This practice is practiced all over the world, but many smaller companies have not heard of this alternative method of financing and have lost their businesses due to lack of funds.

Factoring is the easiest way for a small or midsized company tio receive needed capital. They are not restricted by the same banking and government rules and regulations as lending companies. Some see factoring as the most logical choice for a steady stream of income for their business that would otherwise close down with funding.

What Type Of Businesses Use Factoring For Cash Flow

Many companies all over the globe have been using factoring for operating cash. Companies realize they never have to struggle for loans as long as they have business coming in. The service industry businesses such as:

- corporate dry cleaning

- lawn care

- construction supplier

- medical suppliers

- airplane parts suppliers

- office supply companies

These companies can rely on a steady steam of income for payroll,supplies and business expenses etc by their own terms even when a bank says no to a loan.

How Much Does It Cost For Factoring Transaction?

A service provider or manufacturing business such as yourself are likely to use factoring as a way to get cash for your business. Fees are about 5% of invoices.

How Does Factoring Work?

- You can find a factoring company as easy as going to your search engine. Most factoring companies have an online website that will allow you to feel out a form for your particular need to submit.

- You will then wait about 24 to 48 hours for a CFC Commercial Factoring Consultant to give you a quote.

- Contract is sent upon acceptance.

- Acceptance contract is signed and forwarded back to factoring company.

- You then send outstanding invoices to factoring contract It can take approximately 24hrs or 2 to 6 days depending on company and your situation. Certain funding can take weeks.

- Receive your cash. Remember this is not a loan.Run your business!

What Type Of Questions Will A Commercial Factoring Consultant Ask?

- What are your current loans? Name of lender? Loan amount?

- What type of financing does your business require?

- What type of financing does your business require? There are numerous financing needs such as accounts receivables, inventory finance, import-export trade finance, equipment leasing etc

- What is your companies average monthly sales?

- What is the number of your active customers?

You have just been introduced to factoring. This method of finance is not new and has saved many small , midsized and large businesses stay afloat as well as pay their employees. This is the global way to do business. There are businesses that use this method for years as an on going money supply.

Putting your business further in debt, cutting paychecks,downsizing or closing your business doesn't have to be. Research a factoring business finance service and submit your information, that may very well turn your company into the mega business it should be. Many do use factoring services on a monthly basis. So can you.

Hub

How Commercial Business Finance Can Survive With Asset Based Lending Find out how Asset Based Lending can help commercial and service business survive in this economy like other have been doing for years. Don't allow your business to fail.