How to Organize your filing for your online selling records! Easy, inexpensive tips!

Introduction

After 12 years working in a corporate office where I wore many hats, from secretary to business manager, I've learned many easy tips for organizing office filing. Anyone from yourself to your office staff will have no trouble learning this easy system and maximizing productivity!

When you are working with paperwork, the key to successfully maximizing your productivity is to simplify your organizational structure and filing system.

These are some helpful tips I have found work really well to increasing productivity (ultimately profit) on any internet selling venue you use, even your own website.

Filing space and Storage ~ Determine what works best for you

- What space do you designate for filing? Is it a basket on your desk, an in-box in a bookcase, or some expandable files? I picked up a two-drawer file cabinet which suits my needs. In the top drawer I keep all of my files. The bottom drawer I keep mailing supplies and office supplies. I have my postage meter on top of the cabinet near my desk for quick weighing while I am typing my listings. I have a second expandable file on top of my desk near my printer for easy access. I keep a file folder labeled "daily sales". When I sell something, I print the item details page and put it in that folder until I can properly file it away in my records. This eliminates misplaced documents in the rushing around of packing and shipping.

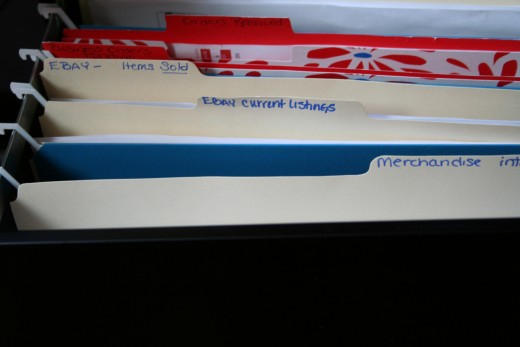

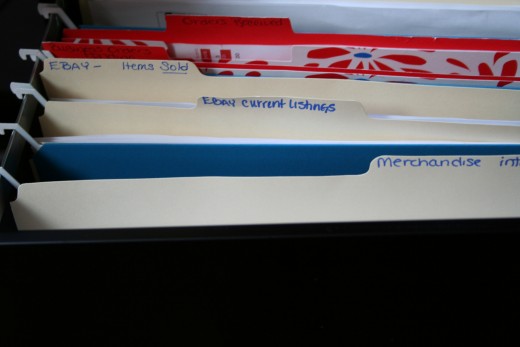

Tip! Use color-coded hanging files, file folders, or tabs!

If you sell on multiple venues, change the color of your folders or tabs to coordinate with your venue.

Basics of creating file folder headings

- Take note of what really matters. What kinds of files do you really need? Which files can be eliminated to streamline your filing system and to de-clutter your filing cabinet? Use these suggested file folder headings to customize your own filing cabinet:

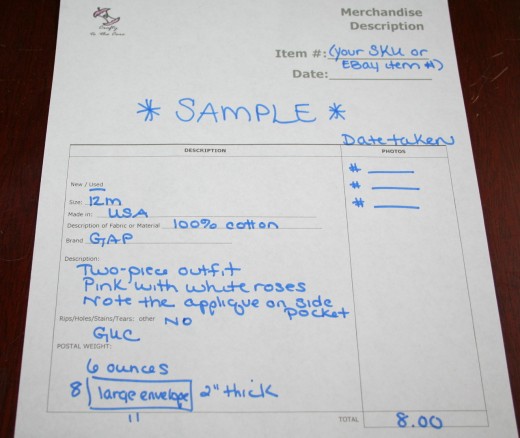

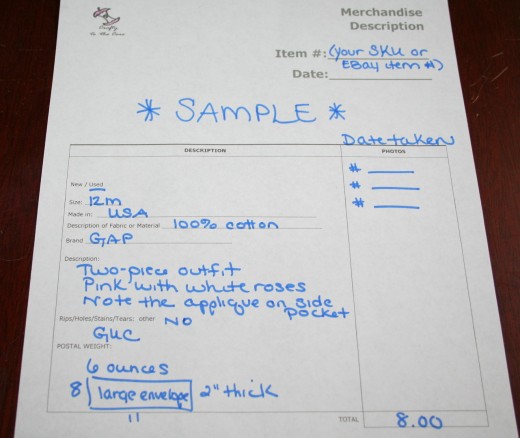

- Merchandise Intake Sheet ~ or ~ Merchandise Inventory Sheet. I use these for describing a product before I list one. It helps me visualize what I will type in to the listing format, and mention specific attributes. I note on this sheet what I don't want to forget to mention on the listing. Also, when you sell the item, save the merchandise inventory sheet with your records in case the item is returned or a buyer found a flaw in the item. You can use this sheet to refer back to the item to see if you made a mistake or how you could have described the item more accurately next time. Yes, it's extra time and effort, but it helps visualize the item you are describing and collecting the visual aspect of the item before you list it. Some people find that typing their information directly into a listing platform works better for them, but this extra step helps me sort out how I want to describe the item before I actually type it in the computer.

2.

Current listings. I file my merchandise intake sheets in a folder titled Current Listings once the item is listed. When an item sells, I pull my merchandise intake sheet from this folder. So this folder also becomes useful in order to double-check your current listings. You can keep track of what you have listed by going through the folder to make sure what you have listed is really what is showing in your active listings.

3.

Items sold. When I sell an item, I print a confirmation page or item detail sheet (whichever the venue calls it). I take the correlating merchandise intake sheet, staple it to the confirmation page I print after a transaction is complete, and then I put it in this folder. (Tip! I also set up an Excel spreadsheets with information about the sold item to use for tax purposes.) Why go through all of this trouble? It serves several purposes. First, this will help you keep track of sold items. Some people do not like a lot of paper around and rather keep everything on the computer. I personally like to store my records in this fashion to have it on hand quickly when referring back to an item. It also helps to keep track of items that are being returned. Then if you choose to relist a returned item, you can easily refer back to the information in this folder to relist the item without having to start all over again. It also serves to help you decide what merchandise is good for you to sell. If you have no filing system now, this system will help you keep track of what your best sellers are. You can look back in this folder and see what your customers prefer most by item, color, season, etc. You can start visualizing trends easier when you have the information in a folder that you can quickly look back at and determine what will help your business the most in the future! Of course spreadsheets are always great options too!

4.

Business Orders Pending. If you buy from other vendors to resell, or if you buy office products such as shipping supplies from online vendors, this file will help you keep track of those orders that you place. Once the order is placed, print a copy from your computer and put it in the file. I bought some printed file folders with large red and white flowers to keep these records separate from my selling transactions. That way when I look for them in my filing cabinet they stand out by the printed folders.

5.

Business Orders Received. Referring to #4 above, when you receive your shipment and confirm it's all there, put your order confirmation and the packing slip for the items you received in this folder. This will help keep your orders organized for several reasons including taking these expenses as tax deductions ~ and ~ keeping track of what you ordered so you don't have to remember everything or wade through time-consuming emails to find out where you ordered something if you want to re-order it in the future.

Other File Folder Headings

I also use other folder headings such as IRS, Logo, Business checking, manuals for equipment (i.e., cash register, printers, scanners, copiers, postage scales, etc.). You can customize any file folder heading to suit your business needs. These are just some suggestions for streamlining your filing efforts which are time-consuming and can cut in to your business profits.

Simplify your organizational structure

- Keep your organization consistent. If you use more than one online venue, makes sure you color-code your file folders, the hanging folders, or the tabs to keep everything separate, but use the same headings for each! Use the venue in the title of the file folder headings. As long as you are using the same HEADINGS, everyone can follow and understand this system. It's very simple and easy to use. Keeping the headings simple is the most effective way to home in on filing skills for all staff.

- Use color-coded hanging files or tabs. I found some really inexpensive hanging files that were actually color coded and hung lower so the heading of the file folders stand out. This will eliminate confusion when searcing for items sold from three or four venues if you have the files color-coded and properly labeled.

- Train all office staff, including having a checklist handy for new hires. As simple as this sounds, it works. Repetition sticks. People remember how to do something when they have to do it the same way every time and when they are bound by a checklist hanging in their work space.

- Keep separate files for refunds and sales that qualify for your state taxes.

- I keep a red folder labeled "refunds" on my desk. This will help keep track of what items were returned or refunded and how much in refunds I processed through the year. It will also help you figure out if a product you are selling is really worth it. For instance, if you had a lot of returns on a particular novelty item, then it might be time to stop selling that item. (One time I had found a vendor selling seasonal novelty putty. I bought a case to resell in custom themed baskets. To my surprise, even though it was an inexpensive item, customers were complaining about the putty saying it was dried out. After the first few refunds, I was able to pull the listings and take the item out of my baskets and find a different vendor with a different product. It's crucial to keep track of this information, especially if you have a lot of items for sale.)

- I keep a blue folder on my desk labeled with the state I live in. My business is registered to collect tax in my state. So any sale I make to a customer in my state, I have to report it and pay the tax on a quarterly tax report. So, come the end of each quarter, I can grab the file quickly and have the information at my finger tips instead of trying to wade through hundreds of records to find out which customers bought from me who live in my state. This will be most important if you live in a state in which you need to pay tax to multiple authorities. In the event you need to pay tax to every state you sell to, you can either have a file labeled for each state ahead of time to keep track of each state sales, or you can create an excel spreadsheet and remember to input the information in to that after every transaction.

Conclusion

Whether you are a small seller working alone or a larger seller with employees, the key is to streamline filing to make it as easy and simple as possible for anyone to learn and remember. Starting with the basics, a filing drawer and some labeled file folders will help you have access to filing papers without the back-log of papers strewn around your work area at the threat of being misplaced.

I hope you find these tips useful in maximizing your productivity!

Up next: Organizing your Inventory

Next, I will show you simple and effective ways for organizing your inventory for an online-based business! Stay tuned!