How to Short Gold

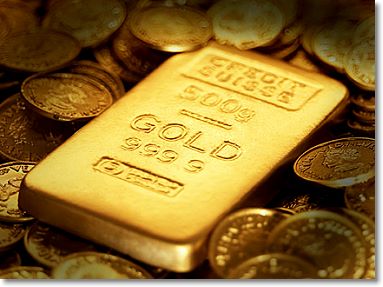

Last I checked, the price for an ounce of gold was $1,405.72 per ounce and it seems to be going ever upward. Late night infomercials tout the value of owning gold in a tough economy as a means to establish financial security. The gold collection business is booming from profits that it has made due to the high price. It seems a new kind of gold rush has enveloped the nation.

Yet, with all the hoopla surrounding gold; one has to wonder, is gold just another bubble? Will the price of gold collapse suddenly? Here I will assume that this is a very real possibility. Moreover, I will show you the various ways in which you can take advantage of gold's collapse. The techniques to hedge gold's collapse will vary based on risk, but expect them to be thorough.

The Current Climate

Gold is currently near the highest price per ounce that it has ever been, and this is not necessarily a bad thing. Records show that the price of gold has more or less continually risen for the past three centuries. This does make gold an attractive physical asset to hold, especially when the state of the economy seems uncertain. Yet, the current rise in gold prices should raise a few eyebrows.

Gold prices usually rise during times of economic inflation. The reasoning goes that since the fiat currency loses value under inflation conditions; people look towards gold as a form of stable currency since the government can't make more of it and it is generally finite. As we all know, the economy is now going through a period of persistent deflation. Prices are not rising, thus making the value of hard currency less. Instead, with the collapse of the housing market, nations around the world are trying to lessen the value of their currency in order to compete better in the global marketplace. The lowering of currency values is giving a boost, not only to gold prices but prices of rare and precious metals worldwide.

Geopolitical news is also playing a role in the rise of gold prices. In the aftermath of the the housing meltdown, governments the world over are embarking on unprecedented levels of stimulus spending and investment. This had led to serious worries that we could be moving to a period of widespread hyperinflation; making gold look like an attractive in investment option. Moreover, worries about the collapse of certain regional economies (namely the eurozone), have shaken confidence in an already shaky currency market.

Furthermore, I believe that bubble mentality is also giving a boost to gold prices. As the tech and the housing bubble has clearly shown us; when many people are presented with the opportunity for quick cash, they seize on the opportunity en masse. (Even if it seems too good to be true.) This is no different.

Still not convinced that you should short gold, fine. Then allow me to present a few reasons why I think gold may fall and fall hard.

Reasons Why Gold Can And Will Fall

By now I hope you understand. The rise in gold prices is a result of fearful uncertainty and opportunism. The reason that gold will fall sooner or later is because the world's economies are stabilizing and we are not going off a precipice. Increasingly, people are beginning to realize this and this will ultimately prove to be a gold investors flaw.

First of all, while it may take time, the world's economies (and their corresponding currencies) are returning to their pre-housing bubble health. All the data shows that we have avoided a disastrous depression by the skin of our teeth. Even the Euro whose viability was being questioned over the past few months has consistently outperformed the dollar over than same period. Developing nations, whose economies are still growing at breathtaking speeds, are making new investments in developed nations and vice versa.

Another thing to consider, as one "expert" told me a week ago, is the current political climate. Now that the Republicans will run the House of Representatives come January; this could/most certainly will lead to political gridlock within the federal government. Consequently, many experts think that political gridlock may be good for the growth of assets like stocks. Also, they believe it will help curb the potentially hazardous spending of the Obama administration.

How To Short Gold

When attempting to short gold (profit from gold's decline; there are a number of options, each based on how much risk your willing to take on. Here I list them consecutively starting with Exchange Traded Notes (ETNs), Exchange Traded Funds (ETFs), and lastly options.

Exchange Traded Notes (ETN's)

- ETNs are unsecured debt obligations, and they chiefly depend on the issuers ability to pay. Here are some strategies based on ETN's.

Buy Either: DZZ DEUTSCHE BK AG LDN BRH PS GOLD DS ETN or : DGZ DEUTSCHE BK AG LDN BRH PS GOLD SH ETN. - Both of these ETNs seek to provide return on the inverse of the current gold index.

Exchange Traded Funds (ETFs.)

-ETFs are popular options for the average investor who more likely than not, doesn't know the first thing about trading options. These funds take a small commission fee, and in return they trade options based on a particular strategy. Here are some strategies based on ETFs.

Short (GLD) - GLD is one of the the most popular gold-based ETFs right now. Shorting it will definitely bring in some moolah. Yet, be forewarned, simply shorting GLD will open you as the investor to unlimited risk.

Buy (GLL, DGZ, DZZ) - This is fairly popular ETF that seeks to give investors the inverse of whatever the current gold price index is.

Options

-Options are special financial instruments that concern the buying and/or selling of a particular asset at a reference price during a specific time frame. Using options there are literally hundreds of pheasible ways to profit from gold's decline. As I mentioned before, you can short (GLD), Long (GLL), use Naked Puts, the list goes on. Of course, without the requisite expertise, using options can be ruinous to the average investor's financial health. (I am also an average investor.)

Of course, many of these investment mechanisms are being created and or rehatched daily. So below I've provided links to sites that dutifully follow the progression of gold investments.

Reference Links

- Is It Time to Short Gold With ETFs? | ETF Trends

Once again, gold has surged to a record high as the U.S. dollar weakens. As the prices climb, more skeptics are asking the question: is now the time to short - GuruFocus - How To Short Gold Safely

- How to Short Gold - If You Dare - Seeking Alpha