Should Distressed Companies Retrench, Restructure, Reorganize, Turnaround – or All of the Above?

Companies that become financially distressed often turn to business turnaround consultants for expert advice, others try to fix things on their own. Understanding the different terms that apply can help you determine which is the best course of action for your business.

What is a distressed company (or financially distressed company)?

Investopedia defines a company as being in financial distress when they struggle or become unable to meet financial obligations, which could include payments to lenders, investors, landlords, vendors, suppliers and even employees, in the case of employee payroll and benefits expenses.

Companies in financial distress can take measures to reduce expenses, increase revenues, renegotiate financial obligations and so on. In other cases, financial distress is a temporary condition which can be remedied with a short term business loan or (as in the case of a payroll shortage) by using a factoring payroll loan to ensure cash reserves are adequate to cover obligations during a cyclical or seasonal cash flow lull.

What made the difference was a strong turnaround plan, dedicated people and a firm commitment from company leaders.

— Anne M. Mulcahy, Xerox CorporationWhat is a business turnaround strategy?

A business turnaround strategy is a plan that is tailored to the unique challenges and needs of a distressed company, often written by or with the assistance of a business turnaround consultant, and agreed-to by company leadership that details the measures that will be taken to reduce or eliminate financial distress.

A business turnaround strategy – or business turnaround plan – may encompass a few or many organizational elements, but will nearly always include:

- An executive narrative listing the specific objectives, company and market place description, estimates of market potential, company expertise and talent, what changes will occur, financial projects, how much capital will be needed and the anticipated return on investment

- A business summary which describes the industry, the company’s products or services and target markets, the company history, roles of key business leaders, explanation of what caused financial distress and short and long term goals of the company

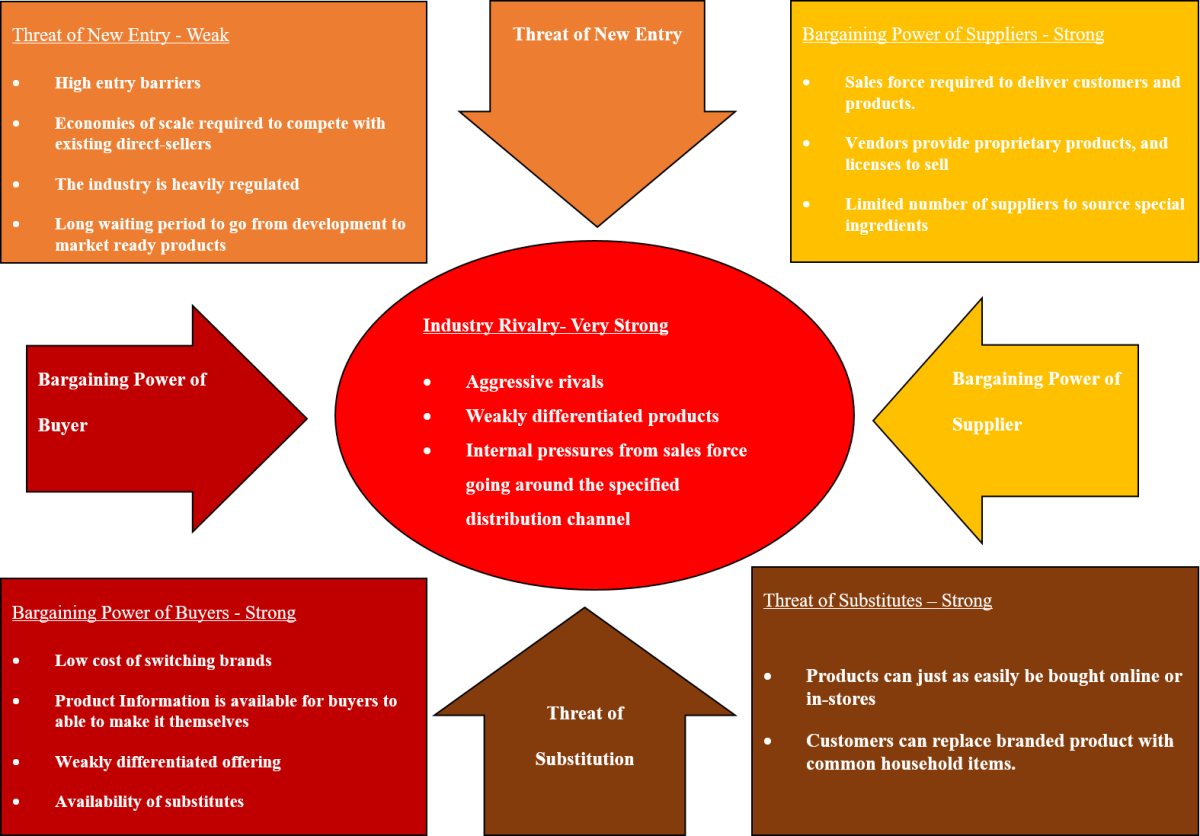

- A marketplace analysis which describes current market demand, potential to be profitable, current customer base, potential new customers, current marketing and advertising, and competitor analysis (often presented as a matrix using SWOT analysis)

- A positioning statement including brand, product and service differentials, unique selling propositions, proposed marketing and advertising strategies and tactics

- A business change proposal which describes facility, equipment and staff capabilities and needs, and what needs to be changed to ensure that company objectives, short and long term goals will be achieved

It’s worth noting that the business turnaround strategy looks a lot like a traditional business or marketing plan; however, remember that it’s just as likely that as much or more effort will be made to reduce and eliminate operational costs and inefficiencies as will be directed toward adding new products or services or expanding marketing and advertising costs.

In other words, while a traditional business plan is often laid out to describe how a company will be expanding their marketing and advertising and adding new products and services, in a business turnaround plan, a large part of the effort will go toward eliminating goods or services which are not (or cannot be made to be) profitable, reducing personnel, reducing the cost of goods sold, eliminating purchase of supplies that aren’t necessary to operations, and so on.

What is a business turnaround consultant (or business turnaround expert)?

Business turnaround consultants are individuals (or companies) with expertise in business analysis and turnaround tactics that can help a company reduce or eliminate financial distress. They are usually hired by business leaders, but sometimes are called in by a company’s board of directors or key investors. In fact, one of the first priorities for a business turnaround consultant is to ensure that company leaders are committed to the process and willing to enact recommended changes. Without the support of the business’s owner, CEO and management, turnaround efforts are not likely to be embraced, take root and produce the results desired.

What is retrenchment (or a business retrenchment strategy)?

Turnaround business consultants may recommend a retrenchment strategy, which is in effect any strategy that helps a business cut expenses by reducing its size or diversity, such as eliminating or selling off non-core divisions. By eliminating less profitable aspects of the business, it can be stabilized and focus on profit centers within the business that can help it regain financial footing and grow.

What is restructuring?

Another strategy that business turnaround experts might recommend is business restructuring. While retrenchment refers to changes that affect the size or diversity of a business, restructuring refers to strategies like debt consolidation or making significant modifications to a company’s operations (such as selling off assets) or corporate structure (such as cutting payroll expenses).

What is reorganization?

Business reorganization involves making changes to a company’s internal makeup, such as reducing the number of managers within a company by reorganizing its departments, changing the leadership hierarchy, identifying work which could be outsourced to save money, or consolidating departments that have overlapping or closely related responsibilities. A business reorganization is often performed specifically in order to cut payroll costs and related expenses, like benefits premiums, payroll taxes, workers compensation fees, etc.

Understanding the tactics that can be used at a micro level to make small adjustments to cut costs, improve efficiency, speed up cash flow and gain market share may even preclude the need for a business to deploy solutions on a large – and often public – stage.

Take these ideas into account the next time you meet with your company’s managers or board of directors for the purposes of drafting or revising your organization’s long range plan. The corrective actions that might apply when a business experiences severe financial distress may sound drastic, but in reality, many business leaders make decisions like these on a smaller scale throughout the life of their business.

What's Your Take on Business Consultants?

Have you ever worked with a business consultant on any of the following:

© 2016 Elizabeth Kraus