Shariah Based Islamic Insurance an Introduction

Takaful Introduction

MAQASID E SHARIAH

The Objectives of Shari'ah

Many jurists have tried to explain the aims and objectives of Shari'ah upon which it is established. Among these the outstanding figures are the Malikite Abu Ishaq al-Shatibi, the Shafite al-'Izz ibn 'Abd aI-Salam, and the Hanbalite Ibn Qayyim al-Jawiziyyah.

.1. Definition of Maqasid AI-Shari'ah

Maqasid al-Shari'ah that is, the objectives of Shari'ah can be defined as below:

· Maqasid al-Shari'ah comprises those benefits/welfare/advantages for which Allah has revealed His Shari'ah.

· Maqasid al-Shari'ah aims at the attainment of good, welfare, advantage, benefits, etcetera, and warding off evil, injury, loss, etcetera, for the creatures. (All this in Arabic terminology can be stated as Masalih al-'Ibad.)

Shari'ah aims at the welfare of the people in this life and in the life hereafter, and for this purpose it has advised the people to adopt such means and measures suggested by it (Shari'ah) as may result in advantage benefit/well-being to them and may ward off evil/injury/loss, etcetera, from them, not only in this world but also in the world hereafter. Same is the philosophy behind His commands and the worships prescribed for His creatures.

.2. Classification of Maqasid AI-Shari'ah

Provisions of Shari'ah aim at protecting its objectives. Objectives or Maqasid al-Shari'ah can be classified as under:

- Daruriyyah

- Hajiyyah

- Tahsiniyyah

Shari'ah Approves of Good and Forbids Bad:

Appreciates Ease and Shuns Unnecessary Hardships

Allah has created both "good" and "bad". Good results in goodness of man, and bad yields badness for him. Good leads to Allah's pleasure and bad leads to His anger. Man has been enjoined upon to do good and avoid bad for seeking Allah's pleasure, but he has been advised to adopt ease and shun unnecessary things for this purpose. Allah has not put any obligation upon man which is beyond his scope. Says the Holy Qur'an: Allah does not take a soul beyond his scope.

"He hath chosen you and hath not laid upon you in religion any hardship. The Holy Qur'an has stated one of the purposes of the prophecy of the Prophet (SAW) in these words: "He will enjoin upon them which are right and forbid them which is wrong. He will make lawful for them all good things and prohibit for them all the bad things; and He will relieve them of their burden and the fetters that they used to wear (7:157)

Aims of Shari'ah Unchangeable

The aims and objectives of Shari'ah are everlasting and unchangeable. They are set by Allah and their application or interpretation is not left to the sweet will of any person or class. These aims relate to both the worldly life and the life hereafter; and to take them only for the worldly benefits at the cost of the hereafter life's benefits is prohibited and condemned. However, Shari'ah is considerate in case of darurah (necessity) and hardships.

Shari'ah has set priority order for the worldly and religious affairs and the people have been enjoined upon to follow this priority order, and they are not allowed to apply their whims while following either of the two. Shari'ah has prohibited the use of some goods as well as the indulgence in certain economic activities, though sometimes or even always their use or practice may yield economic fruits or progress. Similarly Shari'ah has permitted and sometimes required the use of certain things or the initiative of certain economic activities, though apparently they do not yield such fruits as the prohibited things do. The philosophy behind the permission or prohibition of certain goods or economic activities is known to Allah (SWT). However, some of its parts have been revealed by Him and explained by The Prophet (SAW). In all such commandments, Shari'ah ensures ease and it has permitted the ease of unlawful and prohibited goods and activities in case of necessity (darurah). In this connection, in addition to the verses quoted earlier, the following references are note-worthy: "Allah desireth for you ease; He does not desireth hardship for you." (2:158)

"Allah would make the burden light for you, for man was created weak." (4:28)

The Prophet (SAW) says: "/ have been sent with easy and practicable Shari'ah."

.3. Objective of Takaful

The main objective of takaful is to diversify the risk among the members. In a practical sense, the main difference in this area between conventional insurance and takaful is that in insurance the Risk is transferred to the insurer while in takaful the Risk is shared mutually by the members of the common Takaful Fund under the takaful scheme.

Takaful can be visualised as a method of joint guarantee among participants against loss and damage that may be inflicted upon any of them (Fisher, 2002). The members of the group agree to guarantee jointly that if any of them suffer a catastrophe, will receive a certain amount of money to meet the loss and damage.

Support social solidarity.

Help protect the community from the negative impact of adverse circumstances.

Improve quality of life through the peace of mind that comes from security.

Save and invest money through a shared system that distributes profit on premiums (subscriptions/contributions) invested by policyholders on an annual basis.

.4. Basis of Takaful

"… a system based on solidarity, peace of mind and mutual protection which provides mutual financial and other forms of aid to Members {of the group} in case of specific need, whereby Members mutually agree to contribute monies to support this common goal." [O. Fisher]

“The basic fundamentals underlying the Takaful concept are very similar to cooperative and mutual principles, to the extent that the co-operative and mutual model is one that is accepted under Islamic Law."

Notwithstanding the belief in God and Qadha-o-Qadr (the Divine Decree and the Will of God), The Holy Qur’an exhorts the individual to assist one another and to take precautions in order to minimise potential misfortune, losses or injury from unfortunate events. Although takaful has very old origins, the word takaful is a modern day usage. There references to sharing of risk and mutuality in The Holy Qur’an and the Hadith (record of the teachings and sayings of Prophet Muhammad pbuh) however, takaful, the way it is transacted today, is based on the secondary source of Islamic jurisprudence – Ijtihad (the process of making a decision by independent interpretation of the legal sources, The Holy Qur'an and the Sunnah - the traditions and practices of Prophet Muhammad).

The basis of the Takaful System is not to profit but to uphold the principle of "bear ye one another's burden." Therefore, the characteristic feature of Islamic insurance is that it is not based on profit making motive self-help through cooperation. Mutual assistance amongst members of a tribe was not originally a commercial transaction and contained no profit or gain at the expense of others. Rather, it evolved as a social institution: to mitigate the burden of an individual by dividing it among his fellow members (group persons) or tribe. In contrast, most modern insurance (even mutual stock insurance entities, but not mutual associations) is a capitalist-based commercial enterprise, where losses are projected in advance and funds (premiums) allocated to risks to cover them. Premiums are paid in line with such projections of risk.

“Indeed, the basic difference between the Islamic and conventional conceptions of insurance is one of perspective, not economics. From a conventional perspective, insurance appears as set of bilateral contracts that transfer risk for the benefit of the individuals who choose to make that contract. From an Islamic perspective, however, insurance appears as an institution that reduces or eliminates risk for the benefit of social group. Importantly, the institutions that result from either the conventional or Islamic conception can also be described within the framework of the other: an Islamic insurance company is an institution that individuals use to shed risk, just as a conventional company is a way that a group shares risk”. (Vogel & Hays 1998, p152) Some examples of the basis that are mentioned in The Holy Qur’an and the Hadithare:

v Basis of Co-operation:

“Help ye one another in righteousness and piety … ” [The Qur’an 5:2]

“Allah will always help His servant for as long as he helps others.” (Narrated by Islamic scholar Abu Daud: 817-888)

v Basis of Shared Responsibility:

The place of relationships and feelings of people with faith, between each other, is just like the body; when one of its parts is afflicted with pain, then the rest of the body will be affected (narrated by Islamic scholars Bukhari 810-870 and Muslim Ibn al- Hajjaj .821-875)

v Basis of Mutual Protection:

Nobody will enter Paradise if he does not protect his neighbour who is in distress. (Narrated by Islamic scholar Ahmad bin Hanbal -780 - 855)

It is important to emphasise that all economic activity including the fundamental Shari’ah principles governing contracts in general must conform to the Shari’ah. These include:

1. The subject matter of the contract should not be unlawful in Islam.

2. The intended objectives of the contract should not be contradictory to principles of the Shari’ah.

3. The contract should be free from the following elements:

(i) Maysir/Qimar (Gambling),

(ii) Gharar (absolute or high degree of uncertainty),

(iii) Ghaban-e-Fāhish (Exploitative, Exorbitant price or rate of profit)

(iv) Ikrah (Coercion)

4. The participants to the contract agree co-operate actively for their common good.

5. Every participant the contract pays a contribution in order to help those who need assistance.

6. The contract should not aim at deriving undue advantage for one participant at the expense of the other participants.

.1. Elements of Gharar, Maysir and Riba in Insurance Contracts

As a single contract, insurance violates riba and gharar rules. One party pays cash premiums in return for the promise of the other party to pay a cash sum on the occurrence of a contingent future event. So viewed, it also resembles a bet (maysir). Moreover, most insurance companies invest their premiums in interest-bearing investments forbidden by the Shari’ah (Islamic Law and Finance: Frank E Vogel and Samuel L Hayes III, 2006).

v Gharar

v Maysir

v Riba

Growth and Rise of Takaful

Present Market Status

o Emerging Opportunities in Islamic Insurance

Contrasts and Synergies

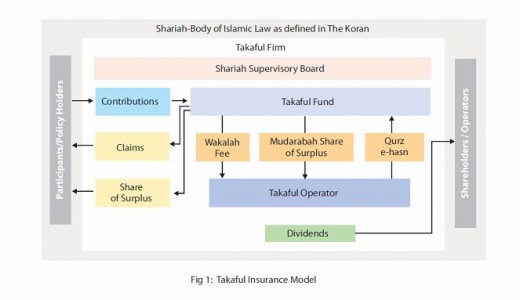

In the Wakalah model, insurance providers are assured of a fixed share of contributions as revenue while the Mudharabah model encourages efficient underwriting and investments for generating surplus funds, of which insurers receive a share. There also exists a hybrid model which combines the principles of both Al-Mudharabah and Al-Wakalah models. Here the agent who is the Takaful intermediary receives both a predetermined share of the contributions paid by policy holders in the form of Wakalah fees as well a share of the profits generated from investment activities of the Takaful fund. Under the Waqf model, agents make an initial contribution to a Waqf fund. An additional contribution collected from policy holders of the fund helps meet contingencies. Here also the underwriting agent receives a Wakalah fee and the surplus funds remaining after settlement of all outstanding claims, are distributed to the policy holders. Implementation models of Takaful vary across companies and markets; the primary reason being that Sharia provides a guideline for the way the insurance business is conducted as opposed to strictures. The interpretation of the Sharia may vary slightly depending on the views and beliefs of those comprising the Sharia Supervisory Board.

o Re-takaful or Islamic Reinsurance Model

Reinsurance of the Takaful business on Islamic principles is known as Retakaful. Due to the acute shortage of Retakaful insurers in the market, for now, Sharia scholars allow existing operators to reinsure using conventional principles. Takaful companies also actively promote co-insurance with their competitors to supplement their underwriting capacity. Additionally, large, conventional reinsurance companies in Islamic countries accept retrocession.

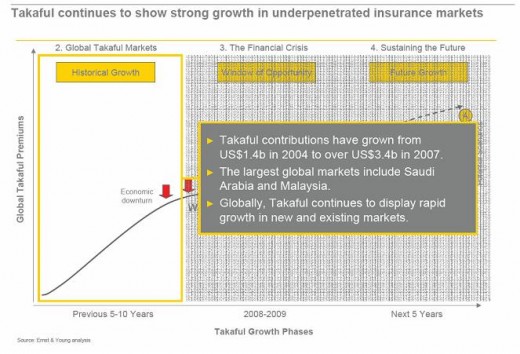

Current Trends and Future Prospects

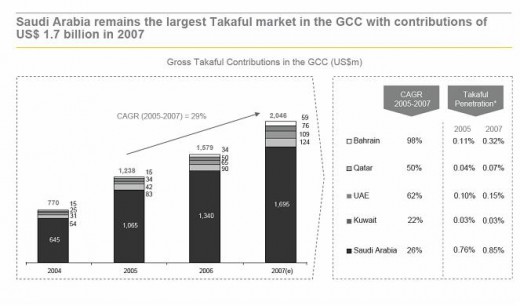

With the expanding demographics of Islamic countries and that of the Islamic population globally, the prospect of Islamic Insurance models looks promising. During 2007-2008, the emerging markets contributed close to 28% of the global economic activities. The Islamic countries on their own accounted for 23% of the emerging market’s GDP and 11% of the premiums written in these economies (source: Sigma No 5/2008, Swiss Re). The amount of Takaful premiums from emerging markets was USD 1.7 billion, with Malaysia and Saudi Arabia showing the highest growth rates. However, other insurers operating on hybrid models with their base in the Sharia accounted for another USD 4 billion in premiums.

During the same period, the ratio of written premiums to GDP in Islamic countries is 1.3% of the GDP as compared to 2.8% for emerging markets as a whole. Therefore, the potential for Takaful operators to grow in these economies is tremendous. Current research points out that the market is grossly underserved with a balanced outlook for a year on- year growth of 25% (after adjustment of inflation) for the next 3-4 years.

With the improved standards of living and increasing awareness of Takaful, the market is expected to see steady growth in per capita spend on Takaful insurance premiums and also in terms of market share in comparison with conventional insurance products.

Product Portfolio

A large portfolio of Takaful products is being offered in the market by Takaful companies and is categorized as

Motor – Third-party liability & comprehensive motor insurance for both individual and commercial markets. Other ancillary services being offered include road, personal accident insurance, among others.

Marine -Marine cargo, hull, liabilities and freight forwarders

Engineering - Erection all risks, contractors’all risks, plant and machinery, loss of profits and deterioration of stock

Property & Casualty - Fire and allied perils, property all risks, public liability, product liability, professional indemnity, medical malpractice

Miscellaneous – Money insurance, fidelity guarantee, workmen's compensation, employer’s liability, traveler’s insurance, personal accident

Specialty lines - Including bankers’ blanket bond, jewelers’ block, directors and officers insurance

Family Takaful

Life & Health – Includes group family Takaful (group life), personal accident & sickness benefits, group health insurance, medical & travel assistance benefits

Strategic Issues and Challenges

With projected growth as described in the previous sections, the Takaful industry will experience much change. As with all new product offerings, success will depend on several factors, both internal and external. Highlighted below are a number of strategic issues and challenges that providers will contend with as the industry expands.

o Standardization

The global Takaful industry, currently, includes different operational models, accounting standards and regulatory regimes. Bahrain, Malaysia and Pakistan are currently the only markets to have issued specific Takaful laws or regulations. However, in spite of the laudable efforts by AAOIFI, the industry is still wanting in building a set of global regulatory standards that will be binding on all operators, with certain localizations.

o Distribution Challenges

The Takaful industry is dominated by local operators. New entrants should create synergies that can be used to leverage existing distribution channels, banc-Takaful and strategic alliances across geographies. This will also enable the operators to increase premium volumes to improve profitability; a key factor in surviving the ‘start-up’ years.

o Developing Innovative Products

Developing attractive and competitive products that meet diverse customer needs will be a major challenge for Takaful producers. Though Takaful providers cater to a very specific and presently unsatisfied market, they still need to create product offerings that are as sophisticated and innovative as their conventional competitors. Their ability to design products that exceed the standards presently set by conventional insurers will be the ultimate test for Takaful as a product.

o Improving Marketing and Branding Tactics

The present brand value of Takaful is relatively limited particularly in non-Islamic countries. Analysts have suggested that Takaful has enormous potential for Islamic and non-Islamic populations, offering an ‘ethical’ insurance alternative. Experts also propose that Takaful can potentially be a useful mechanism for poverty alleviation. The low penetration of insurance in many Islamic countries where Takaful operators are expected to be most successful indicates that Takaful operators have yet to make significant progress towards this end.

o Raising the Standards in Customer Service

As the industry grows and becomes more competitive, building customer service skills and developing best practices will become increasingly important. At present, general customer service standards are average among Takaful providers, relative to their conventional counterparts.

Kingdom of Saudi Arabia Takaful Market Insight

In Saudi Arabia newly launched Islamic insurance products are beginning to catch on. Second, since joining the World Trade Organisation in 2006, Saudi Arabia has opened the industry to foreign investment in takaful , sharia -compliant cooperative insurance. Now a board of Islamic scholars reviews each product and companies such as SABB TakafulSABB Takaful , affiliated with HSBC, are coaxing consumers to buy insurance. Demand for Islamic insurance is brisk in the ArabGulf, analysts say, particularly in Saudi Arabia, the largest economy.

Last year, the nascent insurance industry grew by 27 per cent to SR10.9bn in premiums last year from SR8.6bn in 2007, according to the Saudi Arabia Monetary AgencySaudi Arabia Monetary Agency , the central bank that is also the insurance regulator. Health insurance premiums, which represent 44 per cent of the market, increased by 57 per cent to SR4.1bn. Automotive insurance, accounting for 46 per cent of the market, grew by 23 per cent.

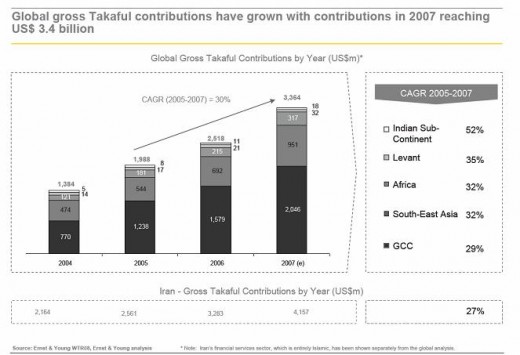

According to a report from Swiss Re, the world's second-largest reinsurer, the takaful sector grew at an annual average of 25 per cent between 2004 and 2007, adjusted for inflation. The rest of the insurance industry grew at slightly more than 10 per cent a year in that period.

Figures on the industry are scant but one estimate last year said there was US$500 billion (Dh1.83 trillion) in Islamic bank assets worldwide, a small portion of the global figure. But Accenture, the global management consultancy, forecasts that household Islamic savings will amount to $24bn a year by 2020.

According to figures from 2005, Arab countries accounted for just 24.7 per cent of total takaful contributions, while countries in the Far East - including Iran - accounted for 75.1 per cent.

The global market in Sharia-compliant insurance, or takaful, has the potential to reach $11 billion by 2015, but must surmount significant challenges to reach this goal. The Gulf Cooperation Council (GCC) region will be a leading market for takaful growth. Within the region, Saudi Arabia remains the largest market for takaful. "Over the last few years, takaful has grown in profile as an alternative to conventional insurance and transformed itself from a regional to a global industry." Estimates vary but it is generally accepted that the takaful industry has grown by 20 to 25 per cent in recent years. The Gulf has consistently represented around one third of the global takaful market. "In the short term, the GCC market is a key market for takaful growth& and takaful will continue to grow faster than conventional insurance," according to Gul Khan, global head of wealth management at HSBC bank's Islamic banking arm, Amanah.

A report on the insurance industry in emerging economies by Swiss Re in 2008 reveals that Muslim countries represent 23 per cent of emerging market growth, yet insurance penetration remains comparatively very low.

Insurance penetration in Muslim countries is 1.3 per cent versus 2.8 per cent in emerging markets and well below the developed economies. A fast-growing, young, and well-educated population will be key to growth.

Yet, experts pointed to several persistent challenges stunting growth prospects. A lack of awareness about the takaful products offered as well as a shortage of relevant skills within the sector need redressal.

Ernst & Young report estimates the global takaful market to reach $ 7.7 billion in 2012 a more conservative estimate than others presented by industry practitioners at the conference. Saudi Arabia remains the largest market for Takaful with contributions totalling $1.7 billion in 2007, and the GCC is the largest market regionally, followed by Malaysia and Sudan.

Challenges

o Shariah Compliance

Shariah compliance of financial products is essential to ensure credibility of the products and institutions. It is, at the end of the day, what differentiates conventional from Islamic financial products.

We have already seen the statistics on the potential of Islamic Finance. The number of Muslim investors is increasing. They are becoming more sophisticated and will demand more from their bankers. Investors will not only look at investment performance or Shariah compatibility alone. They will demand both Shariah compliance and good returns.

In fact, using the label ‘Islamic’ or ‘Shariah Compliant’ would suggest that the product is already adhering to the principles of Shariah. Any violation of this rule would mean a loss of confidence in the product, firm or even the system itself. Investors will vote with their feet. Therefore, it is in the industry’s interest to ensure that the Shariah supervision systems in the Islamic financial institutions are managed well.

However, ensuring effective Shariah compliance is not a straightforward matter. There are many issues that confront it. For example, one of the more pertinent problems is the lack of standardisation in addressing Shariah issues. A lack of standardisation may result in problems such as increased transaction costs, lack of recognition of legal rights and marketability problems across borders. It may even impede the development of the industry.

o New Product Development

Aside from Shariah compliance, another factor that is crucial to the development of the industry is the constant innovation and development of new products. Financial markets are increasing in sophistication; the environment is constantly changing and competition is increasing. Muslim investors need a range of products to meet their desire for diversification of their investments, based on their unique individual needs. There have been many talks about the need to attract the Middle Eastern investors to this region. However, we have yet to see different asset classes of investment being created to attract these investors.

The ijarah sukuk that we issued five years back is still the only available sukuk in Singapore. We hope to contribute further in generating new products.

o Current Improvements

Hence, there are some very important issues that face the Islamic Finance industry. And two of the more crucial ones, as we have seen, are regarding Shariah compliance and new product development. Nevertheless, it is heartening to note that much effort is being made to address these challenges.

For example, institutions such as the Islamic Financial Services Board (IFSB) and the Accounting and Auditing Organisation for Islamic Financial Institutions (AAOIFI) have made great progress in developing standards, including on Shariah compliance. I am glad to note that the Monetary Authority of Singapore is a full member of IFSB, and is taking part in some of the standard setting projects.

o Developing Talents

But at the end of the day, in order to address these challenges and to achieve further improvements, we cannot run away from the fact that we need talented people. Shariah scholars, in particular, have to play a greater role. Shariah Boards may have to operate differently in order to facilitate the innovation process, without compromising Islamic principles. They have to be involved in the new product development process at the onset. They have to integrate Shariah considerations early and fully in any development or strategy. They have to provide constant supervision and work in close partnership with management to ensure innovative yet shariah compliant products.

They have to understand customers’ needs, safeguard their interests and represent them to the management of the organizations.

They have to develop Shariah compliance systems that adhere to the standards developed by AAOIFI and IFSB. And all of these procedures will have to be transparent in order to avoid problems of information asymmetry and to gain the trust of potential investors.

Ultimately, both customers and Islamic financial institutions benefit. Investors will have a range of products to choose from. Institutions will gain greater credibility and an increase in potential customers.