Islamic Project Finance Strcucture

National Power Plant

Assumptions

1. FDI – Foreign Direct Investment – 100% FDI is allowed as priority sector Infrastructure Investment.

2. Tax – As priority sector investment government has given 100% tax exemption on Corporate Income Tax.

3. If sold before 5 years 50% Capital Gains Tax will be applied.

4. Repatriation of Profit and Capital – 100% profit will in dollar is allowed from first year. Capital repatriation in dollar term is allowed after 10 years.

5. Guarantees:-

a. The power plant is gas fired. For this plant National Oil and Gas Corporation has given supply guarantee of gas for 30 years at fixed agreed price.

b. Purchase guarantee – National Power Corporation has given buying guarantee for the project for 30 year at fixed price.

c. Government Counter Guarantees: - On default of any guarantees by National Oil and Gas Corporation and National Power Corporation government of National has given counter guarantees.

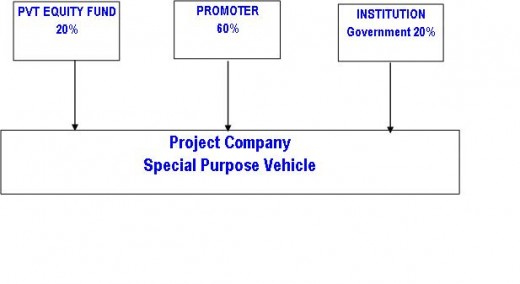

Project Finance

Project financing techniques have become a primary means for financing a broad range of economic units throughout the world. The application of these techniques has been refined in most industrial categories and with respect to most types of assets. Capital participation by Islamic banks may take place on a profit-sharing or profit and-loss-sharing basis on deferred payment although, again due to the long lead-up of major infrastructure projects, capital may be raised through the floatation of Special Bonds or Participation Certificates.

National Power Plant

The National Power Plant involves the development, design, construction, management, operation, and maintenance of a new gas fired power plant .In order to access the increased liquidity in Islamic financial markets, spurred by oil revenues in the Gulf region, traditional business tools need to be adapted to meet the relatively unique and complex needs of Islamic finance.

Overview of Financing Structure

The project financing was designed to reflect a “debt-type” profile to ensure compliance with Islamic jurisprudence or Shari’ah principles, while satisfying the commercial requirements of both BPP and the project financiers. The project financing was executed by combining the following key concepts of Shari’ah :

Musharaka—

Musharaka literally meaning “partnership,” refers to an arrangement where two or more partners pool together resources (capital and contract rights) to jointly own assets or undertake a commercial venture. Through the Musharaka Agreement, BPP and the project financiers agreed to procure assets for the project jointly and committed to making respective capital contributions representing the financing plan’s debt and equity components.

Istisna’a—

Istisna’a refers to a contractual agreement for constructing or developing assets, allowing cash payment in advance and future delivery of the assets. Through the Istisna’a Agreement, the partners appointed NATIONAL POWER PLANT as a procurer to construct the container terminal and ensure delivery of assets at the end of the construction period. Capital contributions under the Musharaka were paid to NATIONAL POWER PLANT, which in essence is equivalent to multiple draw downs under a conventional lending arrangement.

Ijara—

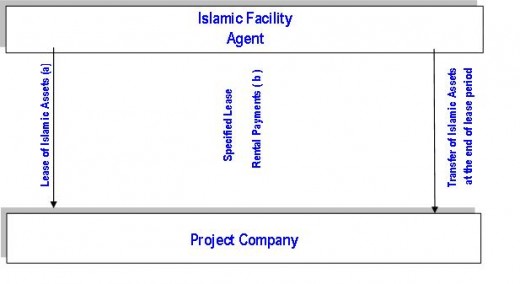

Ijara a mode of finance wherein the right to use an asset is leased by the owner (the lessor) to another party (the lessee) in exchange of rental payments. The Forward Lease Agreement allowed the project financiers (the lessor) to lease their co-ownership interest in the project to NATIONAL POWER PLANT (the lessee) in exchange of periodical rental payments linked to a floating benchmark. Given that the assets were under construction, the documentation allowed the project financiers to pay advance lease rentals during the construction period. After delivery and commencement of lease, the project financiers were to receive periodical lease rentals based on both floating and fixed rates, reflecting amortization of the loan. In addition to the above, the financing structure also entailed:

A Purchase Undertaking, which allowed the project financiers to sell their co-ownership interest to National Power Plant in case of a dissolution event (such as default or change in circumstances). The exercise price under this undertaking was an amount equal to the outstanding facility amount, any accrued and unpaid lease rentals and any other outstanding amount under the financing documents. National Power Plant was also allowed to prepay the financing via a Sale Undertaking (i.e. call option), according to which it has a right to buy out its partner (the project financiers) in return for paying off its contribution in full (equivalent to the principal of the financing).

Islamic Financing Structure for National Power Plant

1. Advance rental and rental under the Forward Lease Agreement;

2. in the event that construction is not completed, the termination payment under the Istisna’a Agreement (but under the original lease schedule);

3. In the event that the Purchase Undertaking is exercised, NATIONAL POWER PLANT’s payment obligation to purchase the assets from the project financiers (but under the original lease schedule);

4. In the event of an unwinding of the partnership and where none of the above amounts are payable, the amount owed by NATIONAL POWER PLANT as partner to the financiers under the Musharaka

Agreement (but under the original lease schedule), which will only include the “profit” component to the extent determined by a judge according to the Musharaka Agreement. The events described in 2, 3 and 4 above were referred to as “Early Termination Events.” All references to “interest” in the contract, including interest owed for late premium, etc., were replaced with “late payments,” which would be donated to charitable foundations.

Working Capital Financing

Working capital finance makes it possible for businesses to obtain capital and often supports the buildup of short-term assets needed to generate revenue, but which must be produced and sold before the receipt of cash. For example, a toy manufacturer must produce and ship its products for the holiday shopping season several months before it receives cash payment from stores. Since most businesses do not receive prepayment for goods and services, they need to finance these purchases, production / manufacture, sales, and collection costs prior to receiving payment from clients.

Working capital financing comes in many forms, each of which has unique terms and offers certain advantages to the borrower. Some of the areas of working capital financing are discussed below.

Asset-based financing is a secured business loan in which the borrower client pledges as collateral any assets owned by the client and used in the conduct of business operations. It is also known as asset-based lending.

A business can use its own assets to raise financing and secure the loan under a buy-back agreement. A bank will usually buy a saleable fixed asset, at a cost price, from a business client with a promise by the client to buy-back the asset from the bank with a marked-up price (murabaha ). The client utilises the amount received from the bank for the purpose of its working capital requirements. The bank subsequently sells back that asset to the client at a selling price (cost plus profit mark-up) on deferred payment terms. The asset will be pledged to the bank as security until the bank’s selling price is paid when the client will regain full ownership of the asset from the bank.

Alternatively, the bank may lease back the asset to the client against regular rental payments (ijarah ) with a promise by the bank to sell the asset to the client at the end of the lease period for a nominal amount which usually represents the asset’s residual value. Islamic banks may also use a combination of both. The financing operation is similar to asset acquisition financing.

(2) Asset Acquisition Financing

A business may seek financing to acquire an asset or the right to use an asset. Islamic banks may provide financing to their clients applying the concept of murabaha , mudarabah or ijarah , more commonly ijarah or a combination. Acquiring the right to acquire an asset is significant for all businesses and can become a business advantage. Asset acquisition financing makes it possible for business owners to acquire the asset without needing to invest the total cost in a lump sum payment and thus provides greater flexibility in terms of financing to meet individual business requirements.

Asset Acquisition Financing on a Murabaha basis

Under murabaha the Islamic bank finances the purchase of an asset at cost and sells it to the client at cost plus a profit mark-up (this is effectively the bank’s selling price to the client); the client settles the bank’s selling price on a deferred payment basis on terms agreed between the parties.

Asset Acquisition Financing on an Ijarah basis

If the client decides to lease an asset, then under ijarah the client pays lease rentals to the bank in return for the right to use the asset for a specified period. At the end of the lease period the asset may be sold to the business at nominal value. An example is the transaction for car financing on an Ijarah al Iqtina basis by Dubai Islamic Bank, illustrated in the section on Consumer Financing. The same structure may be applied for other asset-based financing transactions.

Financial Structure

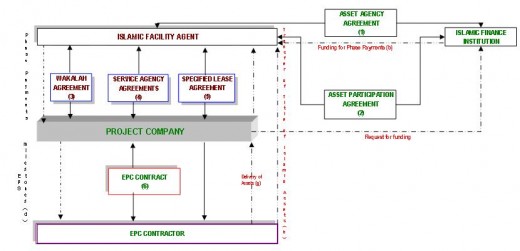

The Islamic facilities in BPP are based on a Wakalah-Ijarah Mawsufah Fi Al Dhimmah structure, a hybrid based on the existing and recognizable Ijarah Islamic finance technique, under which a financial institution leases an asset to the customer. In the context of a project financing, however, the asset needs to be built. This is where the structure must be redefined so that it remains fit for purpose while conforming to the Shariah.

Hybrid bespoke structure

Under this structure, the project company is employed as the Islamic finance institution’s agent or “wakil” under an agency agreement, entitled the Wakalah Agreement, to procure the construction and delivery of certain assets required by the project and identifi ed in the Wakalah Agreement (the Assets).

The provision of the Assets is facilitated by the project company’s entry into the engineering, procurement and construction (EPC) contract with the EPC contractor. A key Shariah principle is that the financial institution must share the commercial risks with the project company, and thus it is expressed to be responsible for affecting the insurance and major maintenance of the asset. In order to offset the financial institution’s risks in this regard, the project company agrees separately in the Service Agency Agreement to insure and maintain the Assets on behalf of the Islamic facility agent. This structure can be characterized by the ongoing risk over the asset that the Islamic finance institution is agreeing to take.

Title to the Assets passes directly from the EPC contractor to the Islamic facility agent

Under the Agency Agreement, the Islamic finance institutions appoint the Islamic facility agent as their agent in respect of the financing and, under the Asset Participation Agreement, agree to participate in financing the construction and ownership of the Assets procured from the EPC contractor by the project company. Title to the Assets passes directly from the EPC contractor to the Islamic facility agent and the Islamic facility agent undertakes (on behalf of the Islamic fi nance institutions) to lease the Assets (to be constructed). The lease will be effective from a specifi ed date as set out in the Specified Lease Agreement. In certain jurisdictions, this may lead to concerns over the relevant tax treatment and thus appropriate structuring should be considered.

Contracts with an uncertain price may be treated as void under Shariah principles

During the construction period, upon receipt of funds from the Islamic finance institutions, the Islamic facility agent will make phase payments to the project company in accordance with an agreed payment schedule for on-payment to the EPC contractor under the EPC contract. All responsibilities relating to the procurement of the Project’s execution, completion and supervision rest with the project company.

During this period, the project company is required to pay to the Islamic facility agent advance lease rentals set out in a pre-determined advance lease rental schedule. The specified lease rental comprises two elements:

(a) a fixed element for each payment date which represents the capital repayment; and

(b) a variable amount representing the Islamic finance institutions’ profit.

While the Shariah prohibits the payment of interest (on the basis that money may not be used to make money as this would represent an unfair exploitation), Islamic principles do not prohibit the making of

profit, provided that there is a level of risk sharing between the parties. The specified lease rental represents the financial institutions’ return based on the profits generated on the sale of the asset to the project company. Project fi nance by its very nature means that the fi nancial institutions are assuming certain risks in the project and this is consistent with Shariah principles. At the end of the lease period, provided that all lease rentals have been paid, legal title to the leased assets will be transferred to the project company.

The Islamic finance institutions are bound by the inter-creditor arrangements

In order to ensure that all of the finance parties (conventional and Islamic) are bound by the inter-creditor arrangements, under which the finance parties agree among other things not to take independent action against the project company, they enter into an inter-creditor agreement.

Challenges going forward

The demand for Islamic finance at present is relatively high and, coupled with increasing market liquidity, has led active participants in the sector to conclude that the growth in demand will continue. However, there remain some challenges for participants in Islamically funded project financing which should not be underestimated. Islamic funding must be structured so that it meets the requirements of each Islamic financial institution’s Shariah committee (responsible for providing guidance on Shariah requirements and determining (on behalf of its institution) whether the proposed financing and related documentation is Shariah compliant). The views of the Shariah committee at a certain institution or in a different jurisdiction may be different from another’s, which may be more or less conservative. Amendments to the structure may be required to balance the changing requirements of the respective

Shariah committees within the context of a parallel conventional financing. Islamic finance institutions may not be as flexible in their approach as conventional lenders in similar circumstances as a result of the constraints imposed on Islamically financed products. The strict views of certain Shariah committees may not be immediately compatible with the project company’s structuring requirements, with the result that project companies need to be willing to be fl exible in their approach. The long-term nature of project finance brings its own challenges in this regard since project companies may be unable to obtain from certain Islamic institutions the flexibility to change the transaction or refinance during its tenor.

While maintaining adherence to Shariah principles, Islamic finance institutions will need to keep these matters under review and be creative in their approach if they are to remain competitive in the international capital markets.

Financing Structures

Project Finance Structure

Istisna’a (contract to manufacture)

Istisna’a is a trading mode where specific goods or an asset is made against a purchase order for delivery at a specified future date. An order to manufacture goods or assets requires various expenses including expenditures on raw materials, utilities, labour, and direct and indirect over-heads; these types of expenses may not be suited to murabaha financing which is primarily focused on the trade in commodities.

The payment schedule may be tailored according to receipt of contract proceeds, as a result clients’ can have better control over their cash flow management throughout the contract period. Thus, the payment can be flexible depending on the agreement between the bank and the client.

Istisna’a may be used by Islamic banks for:

• Home financing (property under construction)

• Project financing (construction projects, industrial equipment, plants and machinery, ships, aircraft and various capital goods)

• Contract financing

• Asset financing

• Trade financing (some forms of working capital finance such as packing credit to enable a client exporter to purchase raw materials)

Ijarah is one of the simplest asset-based financial instruments. Under Islam, leasing began as a trading activity and then much later became a mode of finance. As a mode of finance, under an ijarah contract, the Islamic bank purchases an asset or equipment at the request of a client and leases / rents it to the client a price that includes a fair return for the bank. The lease contract specifies the leasing period, the amount and timing of lease payments and the responsibilities of both parties during the life of the lease. Lease can be simple rental or more elaborate contractual arrangements committing the parties to future action. The bank can, by agreement with the client, re-negotiate the quantum of the lease payment at agreed intervals.

Ijarah is an increasingly popular Shari’ah-compliant financial structure in all forms of asset financing, including financing consumer goods, equipment and vehicles; it has also found its way into project and transportation financing as a building block in larger and more complex transactions. It is easily constructed and well understood by the clients, which leads to the popularity of the mode.

Ijarah may be used by Islamic banks for:

• Consumer financing (for household good)

• Automobile / Vehicle financing

• Home financing

• Project financing

• Asset acquisition financing

• Asset-based financing

Musharakah | Diminishing Mushrakah (partnership or joint venture)

Musharakah implies an arrangement of business or its financing based on the concept of profit-and-loss sharing in which all parties contribute capital or labour skills or a combination of all three in a venture. The profit of the venture can be shared in any agreed proportion but any loss is shared in strict proportion to the capital contributed by each party. As a participatory mode with profit-and-loss sharing musharakah is considered to be the most desired mode of Islamic financing.

It a form on equity participation and also widely regarded as the purest form of an Islamic financial contract, conforming to the underlying partnership principles of sharing in, and benefiting from, risk. All key Shari’ah essentials are promoted in a musharakah contract, such as

(a) Absence of profit

(b) Sharing in the risk

(c) Sharing in the profit-and-loss (profits can be divided up in any agreed ratio, while losses must be shared in strict proportion the investment)

(d) Direct link between capital investment and underlying asset-backed transactions

Musharakah may be used by Islamic banks for:

• Structured Trade financing

• Real Estate financing

• Project financing

• Working Capital financing

• Asset financing

• Pre-export shipment financing

• Import financing

Diminishing Musharakah (DM)

The DM arrangements, as in the case of musharakah, allow equity participation and sharing of profits on a pro-rata basis, but also provide a method through which the bank keeps on reducing its equity in an asset against periodical payments, ultimately transferring ownership of the asset to the client. Over and above the payment against the bank’s share in the equity held by the bank, the client also makes rental payments based on the level of equity held by the bank, with each payment, the bank’s equity reduces followed by a reduction in the rental calculated on the reducing equity. Thus, by the capital repayments the client purchases the bank’s equity, progressively increasing the client’s equity and reducing (diminishing) the bank’s equity until the bank has no equity and thus ceases to be a partner and the client has acquired complete ownership. Likewise, the rental payments to the bank reduce with the bank’s diminishing equity in the asset until no further rental payment has to be made. The real estate, housing and construction sectors increasingly use DM.

Diminishing Musharakah may be used by Islamic banks be used for:

• Home financing

• Real Estate financing

• Project financing

• Equity financing

Mudarabah (profit-and-loss sharing partnership)

In Mudarabah one party provides the capital while another other party, as the managing partner, provides the labour and skills to manage the venture. Profits are shared between the parties according to a pre-agreed ratio; however losses are borne by the capital provider only.

As a financing mode adopted by Islamic banks, it is a contract in which all the capital is provided by the Islamic bank and the business, or a project, is undertaken by the client. The profit is shared in pre-agreed ratios, and loss, if any, is borne by the bank only, except in the case of misconduct, negligence, or violation of the conditions agreed with the bank. While many banks are providing mudarabah financing for various business activities, they may also make mudarabah investments in the small budding entrepreneurs in the form of venture capital finance transactions.

Mudarabah may be used by Islamic banks for:

• Project financing

• Working Capital financing (against inventory of goods, accounts receivables, factoring)

• Asset backed financing

• Asset acquisition financing

• Import financing

Frequently there are projects which call for the use of a variety of, or a combination of, modes within an Islamic financing transaction. In such a situation, the prudent

Islamic banker basically describes the transaction and breaks the transaction into its constituent parts, using some modes as building blocks where it appears to be most appropriate, but they must all be independent of one another. Islamic banks may use

these modes with accessory contracts, such as:

• Jua′alah (Wages, pay, stipend, or reward in exchange for a service provided by the

bank)

• Wakalah (Whereby the bank acts on behalf of a client for a fee)

• Amanah (Trust)

• Hawalah (Assignment of debts)

• Kafalah (Whereby the bank acts as guarantor)

In combining different modes it is essential that the following general rules are observed:

• The combination must not contradict an explicit Text

• The combination must not attempt to circumvent a prohibition

• The combination must not involve contradictory contracts / conditions

• The combination must not involve contingent/conditional contracts