Analysis of Marginal Costing

Introduction

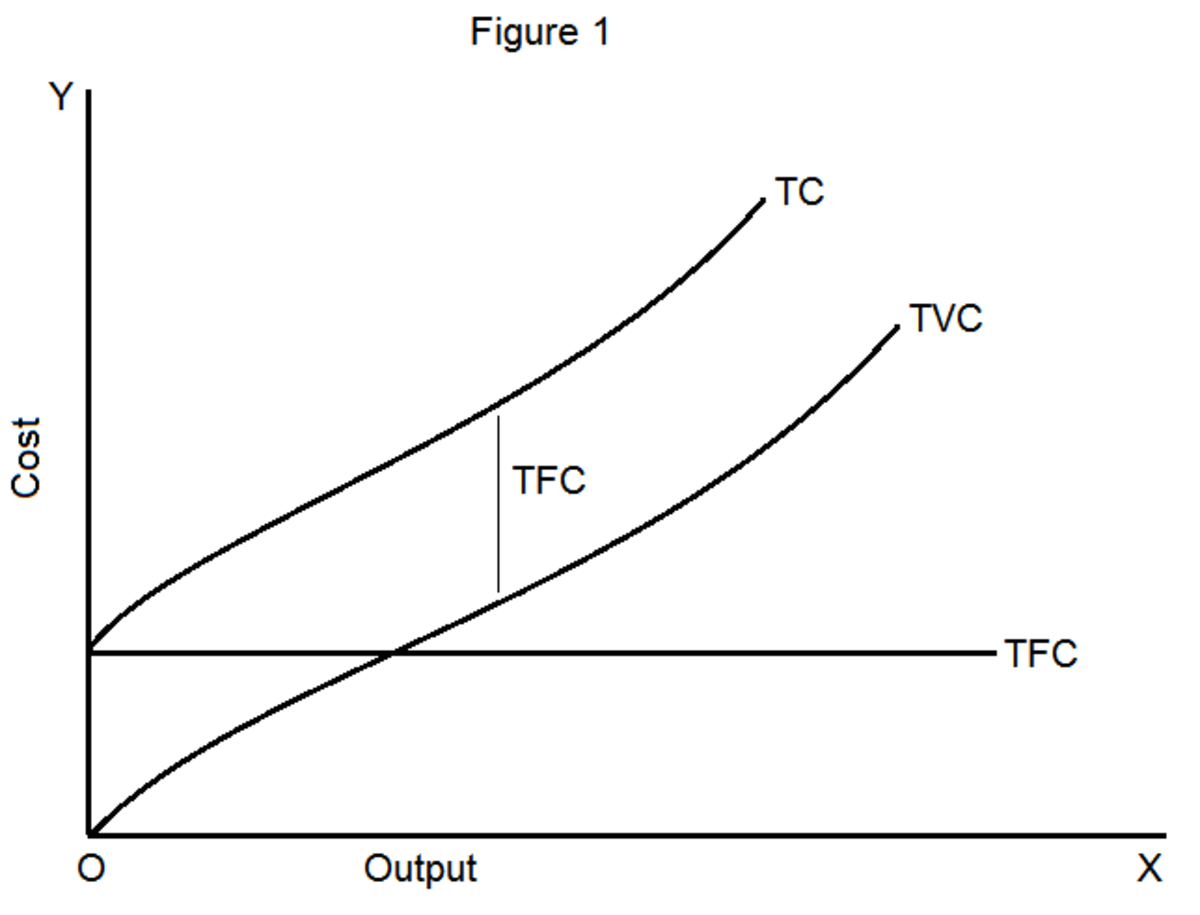

The Cost of a product of comprises of materials, labour, and over heads. On the basis of variability they can be broadly classified as fixed and variable costs. Fixed costs are those costs which remain constant at all levels of production within a given period of time. In other words, a cost that does not change in total but become. progressively smaller per unit when the volume of production increases is known as fixed cost. it is also called period cost eg. Rent, Salary, Insurance charges etc. On the other hand variable cost are those cost which very in accordance with the volume of output. To part it in another way. variable costs are uniform per unit. but their total fluctuates in direct position to the total of the related activity or volume

Marginal Costing- Definition

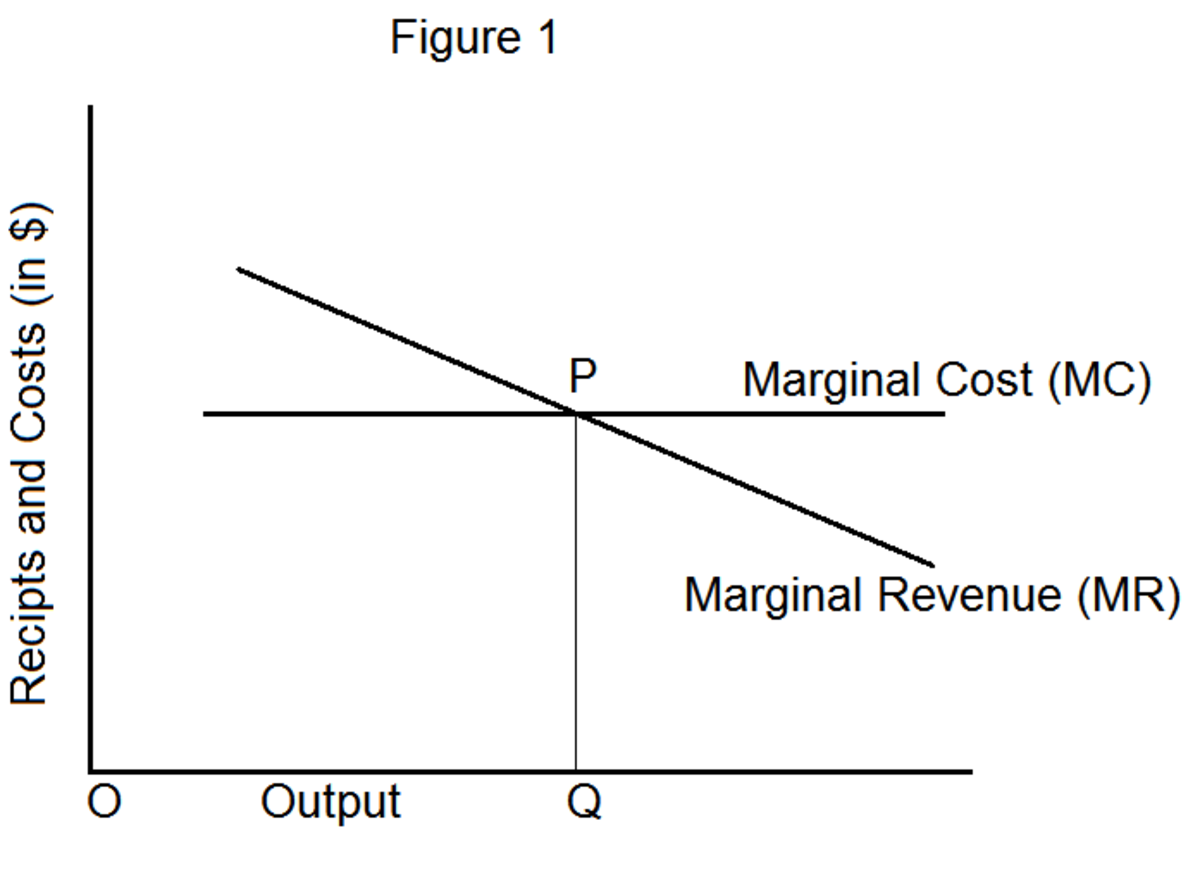

Marginal Cost may be defined as : the amount of any given volume of output by which aggregate costs are changes if the volume of output is increased by one unit"

Marginal Costing distinguishes between fixed costs variable costs. The marginal Cost of product is its variable cost. It Includes direct materials. direct labour, direct expenses and the variable part of over heads. The term marginal costing has been defined as The ascertainment of marginal cost and the effect of profit or changes in volume or type of output by differentiating between fixed costs and variable costs. "In the technique of costing only variable cost and charges to cost units and fixed costs are to be written of against contribution for that period contribution is nothing but the excess of sale price over marginal cost.

Assumption of Marginal Costing

The Marginal Costing technique is based on the following assumptions.:-

1. All elements of costs can be divided in to two parts viz.variable and fixed

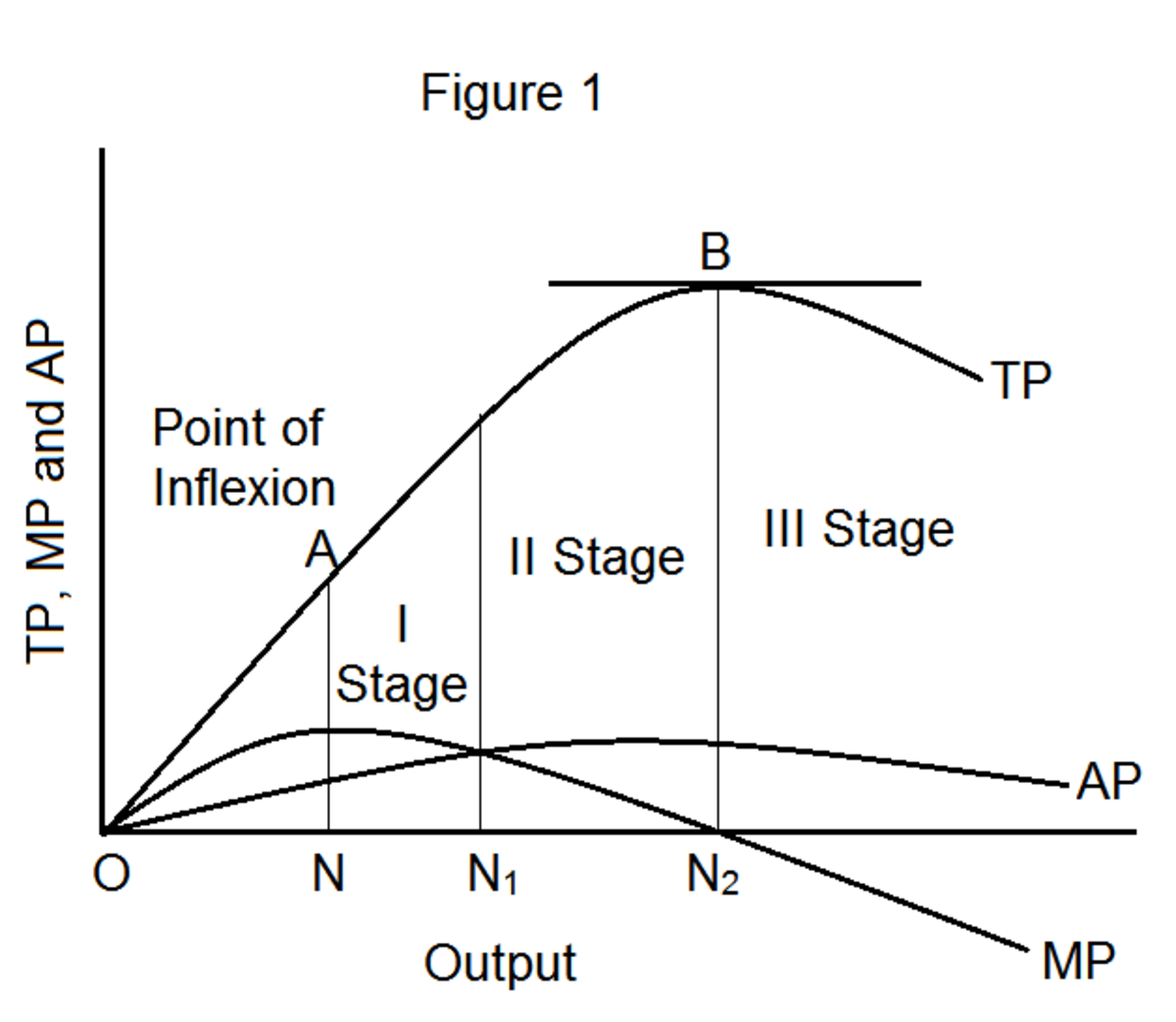

2. Variable cost remain constant per unit and fluctuates directly in proportion to change in the volume of out put.

3. Fixed Cost remain constant at all levels of production. the share of fixed cost per unit output vary according to the volume of production.

4. The selling price per unit remains unchanged at all levels of activity

5. The volume o f output is the only factor which influences the cost.

Advantages of Marginal Costing

The following are some of the advantages of marginal costing:-

1. Marginal costing technique is very simple to operate and easy to understand.

2. it avoids the problem of arbitrary apportionment of fixed costs.

3. it helps effective cost control by separating costs into fixed and variable

4. Marginal costing techniques helps the concern in taking vital managerial decision such as accepting foreign orders at low price, profitable products mix-change in market, to make or buy etc.

5. fixed costs are charges to current years profit. This prevents the practise of carrying over a part of fixed costs to the following year through the valuation of closing stock.

6. it yields good results when used along with standard costing.

7. it shows clearly the inter-relationship between cost. volume and profit there by help the management in profit planning.

8. it has unique approach in reporting cost data to the management to focus its attention towards more important areas.

Limitations of Marginal Costing

Despite the advantages, mentioned above the technique of marginal costing suffers from the following limitations:-

1. The technique of marginal costing in based on a number of assumption which are unrealistic.

2. It is very difficult to categorise all costs into fixes and variable components.

3. variable overheads are estimated which may result in over or under recovery of overheads.

4. The availability of better techniques such as budgetory control and standard costing reduce the importance of marginal costing.

5. The technique is not suitable to concerns where the proportion of fixed costs.

6. Since stock is valued at marginal cost. in case of loss by fire.full loss cannot be recovered from the insurance company.