Novated Lease Explained

Novated Lease | Novated Leasing | Salary Sacrificing

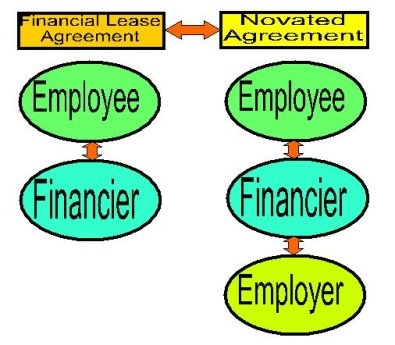

A Novated lease can accurately be described as a 3-way arrangement between an employee, an employer and a car lease company. It is very common in Australia and to a small extent in the UK.

Novated Lease Explained

Under Novated lease arrangements, the employee hires a car from a car lease firm. The employer then undertakes lease payments and all lease obligations on behalf of the staff member. The employer recovers the payments directly from the employee’s salary through a pre-negotiated salary sacrificing agreement.

In essence, Novated leasing agreements are a type of salary packaging arrangement where the employee foregoes part of their future salary in exchange for benefits equal to a similar value.

If the employee leaves the employ of current employer, the employee still gets to keep the car but all lease obligations are transferred from the employer to the employee.

Novated Lease Categories

Three main Novated lease arrangements are widely practiced, namely;

- Fully Maintained Operating Lease – this is the most superior kind of Novated lease; in this arrangement, the automobile and maintenance expenses are included in the agreement but with the added advantage that the lessee does not carry the risk related to the value of the car after the lease agreement expires.

- Fully Maintained Lease – in this arrangement, the automobile and its maintenance overheads are bundled in the agreement.

- Finance lease – in this arrangement, only the automobile is leased.

Pros of Novated Leasing

There are a number of inherent advantages of Novated leasing over other types vehicle acquisition arrangements. The following are the main advantages for employees:

- The Australian Government recently enacted reforms to the car fringe benefit rules; in essence, there is no longer an incentive for people to drive their cars longer than necessary to benefit from a larger tax concession. However, there is potential for considerable savings on income tax especially for people who use their cars for significant work-related travel. You can use a Novated lease calculator to calculate your fringe benefits tax liability.

- Acquiring a vehicle via a Novated lease allows massive savings on Goods and Services Tax (GST). Employers often pass back input tax credits to employees who then pay running costs net of GST.

- Novated leases are transferable from one employer to another.

- There is a wider choice on vehicle type as opposed to a company car arrangement.

- This is a quick option to acquire a motor vehicle without having to go through time-consuming credit appraisal channels often mandatory with commercial car loans and car finance.

- If the lease is a Fully Maintained Novated Lease, all running costs such as insurance, service and registration are included as part of the monthly payments.

- If the lease is a Fully Maintained Novated Operating Lease, in addition to running costs being included as part of monthly payments, the car lease company or employer bears vehicle value risk following expiry of the lease agreement. You simply hand over the keys at the end of the period.

Salary sacrificing arrangements are the key ingredient necessary for Novated leasing. Under the right circumstances, it is a win-win situation for both the employer and employee.

The information provided on this webpage is a mere guide. For further information please seek your own independent advice.