PETD announced 1Q17 results with a net profit of RM253m (+15% yoy)

The results are broadly within consensus and our expectations. PETD's 1Q17 net profit accounts for 27% of consensus and 32% of our full year earnings forecasts. The key variance between Macquarie and the street forecast - we have pencilled in margin compression starting 3Q17 in anticipation of introduction of price competition in Malaysia's retail fuel market.

- PETD's 1Q17 revenue grew 36% yoy to RM6.7bn on higher contribution from both retail and commercial segments; both registered higher selling prices but lower sales volume. Retail revenue grew by 24% yoy to RM3.6bn on a 31% increase in average selling prices, offset by a 6% decline in volume. Similarly, commercial revenue grew by 54% to RM3.1bn driven by a 60% increase in selling prices (tracking 65% yoy increase in Ringgit-Brent crude price), offset by a 3% decline in sales volume.

- EBIT increased 13% to RM336m on a stronger contribution from the retail segment (+28% yoy to RM199m) - LPG reported higher profit on cost rationalisation while an increasing MOPS (Mean of Platts Singapore) price trend has lifted Mogas and Diesel margins. Meanwhile, the commercial segment reported a 2% decline in 1Q17 EBIT to RM132m.

- Sequentially, net profit fell by 3% due to lower sales volume (-6% qoq) and lower gross profit, partly mitigated by seasonally lower opex.

- Management will host a briefing to discuss these results at 10am Malaysian time today.

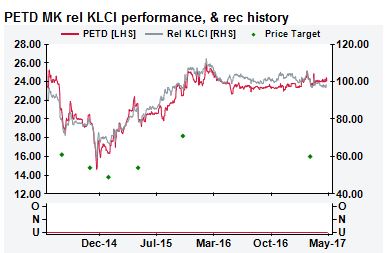

- Underperform maintained. The Malaysian government introduced a weekly adjusted ceiling price system for the retail fuel market in Apr17. The government has yet to issue the guidelines on price discounting and hence retailers have yet to start competing on prices.

- Price competition is a question of when, not if, we believe. The introduction of price competition (vs. current fixed margin system) should structurally erode PETD’s profitability and could lower its annual profit by over RM210m (-22%), we estimate. Valuation of 26x current PER (2016A) looks expensive, taking into consideration a strong likelihood for EPS contraction in 2017-18E.