Quicken Is A Great Project Management Tool

Manage your own personal finances like you would expect to manage your business finances.

If you do this every day, then stepping up to managing large business budgets is almost easy to do.

This can be useful for those who:

- Are not yet running your own business, but want to some day

- Might only now be starting out in the working world, but want to move up into management

- Are managers wanting to move up but don't yet have significant money management experience

Pick A Personal Financial Management Tool

Quicken is a great home financial project management tool. Using it is no different than what you would do at work to manage the financials of your business project.

Quicken is not the only personal financial management tool. Microsoft

Money is another good example. I've not done more than look at Money

periodically over the years, but from the reviews I’ve read it is comparable

with Quicken. Unfortunately, Microsoft has just said they will no longer

sell Microsoft Money.

There is also a growing number of online financial tracking products that have

the advantage of being free (Mint.com, Quickenonline.com, etc.). I don't

yet consider them in the same class as the installed Quicken software, but they

have real potential for the future.

Use Your Personal Financial Management Tool To Answer Real Questions

Fundamentally, Quicken can answer some questions that everyone asks, questions for

which no one ever seems to have an answer. For example:

- The market just went down (or up) 2% today. What does that mean to me?

- I want to buy that 50" HD TV. What does it really matter if I buy it?

- How long will it be until I've saved up enough money to buy that car I want?

- I've been trying to be green, how much have I saved on my electricity bill by doing this (if any)?

- Gas prices have gone up over the year. How much more has it really cost me?

- We want to splurge on a Disney Cruise, can we really get away with that?

- When will I be financially independent so I no longer need a salaried job?

- Will I be able to pay for my kid's college education?

I’ve quickly found answers to all these using Quicken. The trick, of course, is to use Quicken regularly in a way that it captures the information to answer these questions.

I've been using Quicken since around 1990 and can no longer imagine how I can live day to day without it. For many families and businesses your finances are your lifeblood and determine much of what you can and cannot do. For the financially independent it allows you to intelligently monitor your finances and to double check your accountants and brokers (e.g., Bernie Madoff).

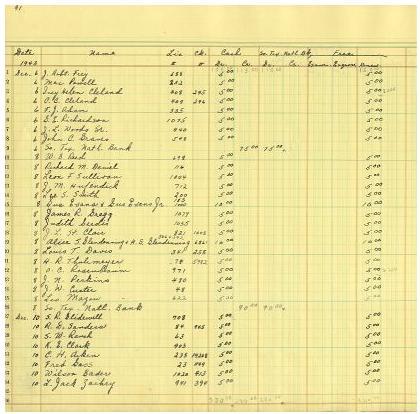

To be able to answer the type of questions above, you will need to record and categorize each of your expenses and income. This is made relatively easy if you use checks and credit or debit cards to pay for your purchases. Your income and expenses will automatically flow into Quicken as your bank records the transactions. You have to tell Quicken about each of your bank, investment, and credit card accounts. Quicken will then connect to those accounts over the web and pull down your transactions.

Capture The Details of Your Finances As They Happen

As the purchases flow into Quicken you will need to categorize the expenses (gas, electricity, grocery, repairs). While I do this daily, you can also do this once a week. Your investments will also be in Quicken and the updates (prices, dividends, purchases, sales) will also automatically flow into Quicken. For investments, you will generally want to go through your records and enter all your back transactions for the investments you currently hold.

Even if you don't quite categorize everything just right the first time, you

will still have all the transactions and hence can go back and recategorize as

needed.

Once you have these transactions and a little history (one year works really

well, but even a month is great), you can readily answer the type of questions

above. For example, using my data from

the past few years and from this year so far, I was able to quickly tell that while

gasoline prices had gone up significantly we had cut back enough on driving

that we were still spending no more per month than we had spent in the past.

See Your Future By Looking At The

Real Trends In Your Finances

You will want to fill out the planning tabs in Quicken. These help

you plan ahead for purchasing a car, house, college education and eventually

retirement (or better, financial independence). This is where you

will finally discover how much you live on each month and year. It will also

tell you if you are on track for any of your goals.

Once you have the transactions and the plan, you now have essential control

over your finances or at least a view into what the trend shows you.

Fear Not A Market Crash Nor Loss Of Your Job

As the market crashed over the last year, I found myself replanning by

reducing

my expected expenses. I could shave off 10% of expenses (i.e., from

what I spent the last 12 months) and see what that does to my plan. As

the market dropped more, I could track the impact and try out various

adjustments. I had planned for six years of college at the local

university for each of my kids and had to adjust it back to only 4

years. My plan at the top of the previous market had suggested I could

increase my spending

in the future. Most of that potential increase had to be removed as

the market fell.

I went on a one year Sabbatical from my job based upon the insights I had

gained from Quicken over the years. I also used ESPlanner and some rules

of thumb (5% of net worth as annual budget, etc.) as second and third opinions

on the plan. Unfortunately, the economy tanked after I went on Sabbatical

and in the 9th month my position was eliminated as part of a general reduction

in force. Quicken showed at any given point what my finances looked like

into the future with no employment income. It allowed me to keep a level

head even as I saw my financial foundation deflate.

Having a live plan, based upon current finances, made all the difference in the

world. It allowed me to see through all the media hype and answer the

question: "What does this mean to me and my family?"

Start Simple If You Don't Have A Lot To Start With

For folks whose finances are centered on getting from the beginning of the month

to the end of the month, one of the free on-line products would probably be a

good start (Quickenonline.com, Mint.com, etc.). This should help you keep

your cash flow positive. Once this is under control you can look more

into the future using an installed program such as Quicken. Using such a

program can pay for itself in terms of peace of mind, if not actual savings based

upon finally knowing how much it is costing you to live each month and where

the money is going.

Learn How To Survive Without Carrying A Credit Card Balance

Tracking expenses (including credit card interest expenses), helped me

realize

that if I could afford to carry a balance on a credit card, then I

could afford

to pay cash and it would be cheaper. The data showed me a simple

reality. I would stop using my cards "cold turkey" for a year to both

break

the habit and to pay off all my debt. One day I took my cards and cut

them up. This was when cards were reissued once a year, so I knew I

would

get all new ones by the time a year was up. It worked. I never went

into credit card debt again. That was over 25 years ago.

Achieve Your Goal Of Financial Independence

Of course, you could do all this without purchasing or using a financial program. It is just that Quicken makes it that much easier. My path to financial independence started with a simple goal followed by a simple calculation. At around 30 years of age after reading a personal finance article, I calculated that it was not unreasonable to be worth a million by the time I was 55 years old. I had to tighten my belt and put aside $10K a year on top of what I already had. I later came to equate my goal of one million to the notion of achieving financial independence. Financial independence meant that I would no longer need a salary and I could reasonably expect to maintain my current standard of living over the rest of my life.

There is no doubt in my mind that setting that goal is the reason I achieved independence. Using financial tools helped me regularly monitor and track my progress and helped me to keep a level head during good and bad financial times.

Apply What You Have Learned To Your Business

The technique of using real data to

support your judgment about what to do is essential in a business

environment. It is no less useful in your personal home life. In

fact, your ability to manage your home finances will provide you with a

discipline that will make managing business finances that much easier. It

will also help you understand the value of getting real data to make decisions

and support personal judgments (both in financial and non-financial

areas).

And that is what project management tools are all about. They help you do

what you already know how to do. They just make it easier to do it. Sometimes, that makes all the difference.

Bruce Benson has no relationship with Quicken/Intuit and writes about "Project Management Tools That Work", "Getting To OnTime Software Projects" and "You Are Your Best Project Management Tool", at Project Management Tools That Work!.