Sector Rotation Strategies Have Often Beat the Market

Sector Rotation - Is it Possible to Achieve Above Average Returns with Below Average Risk?

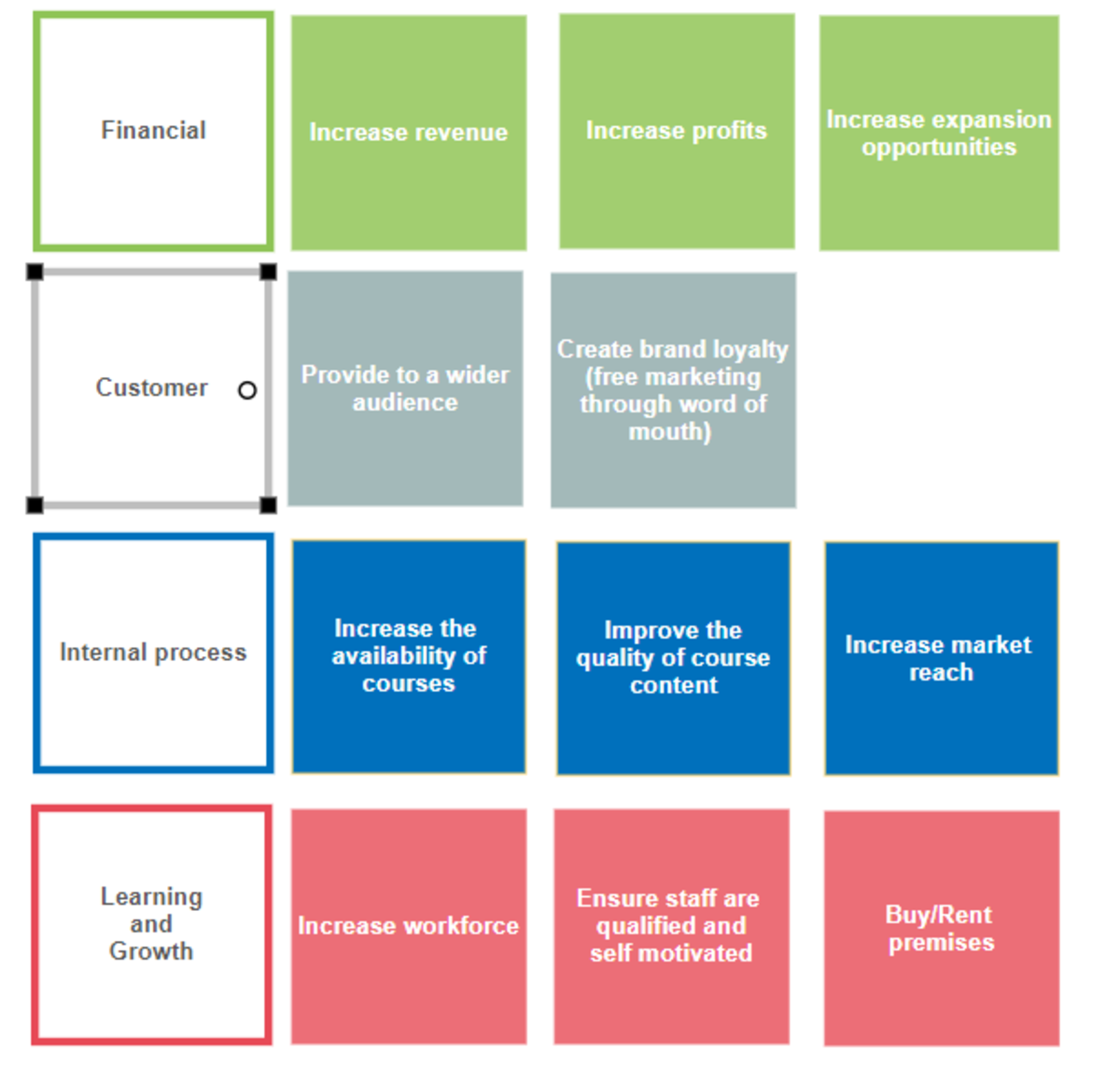

One of the goals of most investors is to get higher overall investment returns than the overall market but at a lower overall risk than the markets. One way to do this has historically been to use a sector rotation strategy. Here is a look at a freely available strategy using Fidelity Select Funds that works by finding the best mutual funds and rotating through them as they gain and loose strength.

A Free Sector Rotation Strategy

Playing the Market with Thought Out Strategy

The overall stock market has had a run of flat performance over the last several years. If you look at the performance of the S&P 500 from 1999 through 2005, you'll see that it was up about 0.2% compounded annual return, not much better than a money market fund, and the Nasdaq 100 has fared even worse. Granted, it got there in an interesting way, but overall it basically went nowhere.

For an investor looking to better that performance, what are the alternatives to index funds or buy and hold investing? Sector fund investing, using a rotation strategy has been shown to work by a variety of different newsletters and advisors. Many of the top performing newsletters in the Hulbert Financial Digest use some variant of this type of strategy. This is easily done using sector mutual funds, such as the Fidelity Select Funds family.

Fidelity Select Mutual Funds - A plug for a system that works

Here we look at a mutual fund trading system that trades the Fidelity Select Mutual Funds. The Fidelity Select Mutual Funds are a good choice for several reasons:

- Fidelity Select Mutual Funds historically have persistence in their trends so they can be held for the Fidelity imposed minimum 30 day holding period while realizing a return well above that of the market.

- Fidelity Select Mutual Funds historically have persistence in their trends so they can be held for the Fidelity imposed minimum 30 day holding period while realizing a return well above that of the market.

- If you hold the funds for a 30 day minimum, Fidelity allows unlimited trading with no redemption fees.

- With over 40 Fidelity Select Funds, there is a sector fund is available to track most market sectors. If there is strength in any domestic market sector, you'll probably capture it using Fidelity Select Funds.

- Fidelity's minimum investment requirement for the Fidelity Select Funds is only $2500 per fund, so that is all you need to start. Fidelity has eliminated the load on the Select funds, so there is no up front cost to get into them.

The 5-Step Strategy

Many sector rotation strategies have been published, dating back to the late 1990s, but this one is one of the simplest for you to follow. The steps are as follows.

1) Track the 25 day (or 5 week) price change in all of the Fidelity Select Mutual Funds.

2) Invest in the Fidelity Select Fund with the highest percentage gain over that 5 weeks.

3) Hold that Select fund for at least 30 calendar days, to avoid the Fidelity early redemption fees.

4) After 30 days, if that Select Fund is still the top Select fund, continue to hold it. Otherwise, exchange it immediately for the currently top ranked Select fund

5) Hold the new Select Fund for 30 calendar days

For the 1999 to 2005 years that the major indexes have been almost flat, this sector fund rotation system would have gained almost 200%, or over 16% per year.

There is one significant drawback to this system. It does not have a much better drawdown than the overall markets. During the down years of 2000 to 2002 this strategy had a drawdown of almost 50 percent. Fortunately, it has achieved new all time highs in 2006, but that kind of drawdown need to be factored in to how much you might want to invest in this or any investment strategy.

One way to improve the performance while reducing risk is to rotate into a cash fund when the strongest fund has not had a positive return over the last 30 days. Another way is to weigh the fund rankings by adjusting for the recent volatility and favoring the less volatile ones as a way to find the best mutual funds.

As you can see, even a simple sector rotation strategy can give a real performance advantage over buy and hold investing. This type of strategy should be part of every investor's portfolio.