Strategic Management Concepts for Professionals

Management Tools

1. Discuss the concept of related diversification as a means to achieve organizational growth. How is value created through the leveraging of core competencies, sharing activities, pooling negotiating power, and/or vertical integration in the firm?

Related diversification enables a firm to benefit from horizontal relationships across different businesses in the diversified corporation by leveraging core competencies and sharing activities. This enables a corporation to benefit from economies of scope. Economies of scope refers to cost savings from leveraging core competencies or sharing related activities among businesses in the corporation. A firm can also enjoy greater revenues if two businesses attain higher levels of sales growth combined than either company could attain independently (Dess, et al, 2007). A word of caution is in order, however:

Jones and Hill argue that related diversification implies all three types of task interdependencies - reciprocal, sequential and pooled, whereas unrelated diversification implies only pooled interdependencies. Because it is more difficult to monitor highly interdependent tasks when employees can act opportunistically, coordination costs are the highest for related diversifiers and lowest for unrelated diversifiers. Hill, Hitt and Hoskisson (1992) propose that to benefit from economies of scope, firms need to establish cooperative relationships among business units, rather than resort to standard financial controls or market-based disciplines. Nayyar (1992) argues that such relationships are costly and difficult to sustain ( Zhou, 2007).

Leveraging Core Competencies

Japanese companies pioneered the concept of diversification. For example, the Yamaha Corporation started out as a musical instrument manufacturer (pianos and organs). For many consumers Yamaha is famous for its highly-specialized and well-crafted audio equipment. Yamaha has gradually evolved into the largest musical instrument company in the world. However, an altogether different segment of consumers recognizes Yamaha for its motorcycles, watercraft and all-terrain vehicles. Yamaha utilized related diversification early in its life cycle to specialize in manufacturing a broad range of musical instruments. In time however, Yamaha utilized unrelated diversification to expand its product line and to maximize its research and development efforts. The company's intensive research into metal alloys for use in acoustic pianos has given Yamaha wide knowledge of the making of lightweight, yet sturdy and reliable metal constructions. This knowledge was easily applied to the making of metal frames and motor parts for motorcycles.

Core competencies reflect the collective learning in organizations-how to coordinate diverse production skills, integrate multiple streams of technologies, and market and merchandise diverse products and services. For a core competence to create value and provide a viable basis for synergy among businesses in a corporation, it must meet three criteria:

- The core competence must enhance competitive advantage(s) by creating superior customer value. It must enable the business to develop strengths relative to the competition. For example, Coca-Cola is testing a beverage dispenser that incorporates a touchscreen computer running Windows CE. The "Jet" can dispense up to 120 different types of soda, and tracks sales according to the time of day, says a Bloomberg.com report.

- Different businesses in the corporation must be similar in at least one important way related to the core competence. It is not essential that the products or services themselves be similar. Rather, at least one element in the value chain must require similar skills in creating competitive advantage if the corporation is to capitalize on its core competence. Yum!Brands , owner and operator of KFC, Pizza Hut, Taco Bell and Long John Silver's restaurants, is using its knowledge and expertise in the fast-food sector to acquire other restaurants and thereby expand its diversity and dominance in the industry. The common denominator in all of the Yum restaurants and its acquisitions is "fast food."

- The core competencies must be difficult for competitors to imitate or find substitutes for. Competitive advantages will not be sustainable if the competition can easily imitate or substitute them. Similarly, if the skills associated with a firm's core competencies are easily imitated or replicated, they are not a sound basis for sustainable advantages. Bang & Olufsen designs and manufactures cutting-edge televisions, telephones and high-end audio products. Many of its speaker sets, for example, have actually increased in value in the past ten years-a rare distinction enjoyed by very few companies. Its products are classified as "high-end luxury goods" and as such face little competition from the wide array of goods typically found in a mass retailer like WalMart.

Sony is another example of a Japanese company that has effectively harnessed its diverse competencies to be the dominant manufacturer of multimedia devices. Sony's entry into the marketplace began with the production of transistor radios that surpassed tube-based models in audio quality. As the company achieved success with its radios it gradually expanded its product line to include tape recorders, microphones, vcrs and cd players. Sony represents a company that is consistently head-and-shoulders above its competitors due to its emphasis on R&D and its utilization of related diversification methodologies.

Sharing Activities

Corporations can achieve synergy by sharing tangible activities across their business units. These include value-creating activities such as common manufacturing facilities, distribution channels, and sales forces. Sharing activities can potentially provide two primary payoffs: cost savings and revenue enhancements. Hewlett-Packard had these strategies in mind when it merged with Compaq in 2002. As a result of its merger with Compaq and its acquisition of Electronic Data Systems, HP has become the world's largest technology vendor, outpacing its long-time rival, Dell, by a margin of 4% as of February 2008.

Pooled Negotiating Power

Similar businesses working together or the affiliation of a business with a strong parent can strengthen an organization's bargaining position in relation to suppliers and customers and enhance its position relative to its competitors. General Electric dominates a wide variety of markets, from jet turbines to nuclear reactors. Prior to auctioning off its consumer appliance division, GE devoted significant advertising revenue to ensure that its products remained the consumers' top choice in household appliances. GE'S many divisions enjoy the benefits that result from having a strong parent.

Vertical Integration

Vertical integration represents an expansion or extension of the firm by integrating preceding or successive productive processes. That is, the firm incorporates more processes toward the original source of raw materials (backward integration) or toward the ultimate consumer (forward integration). The classic example of vertical integration is Standard Oil, the largest oil refiner in the world prior to its breakup in 1911. Standard Oil purchased rail lines, steel companies, shipping companies and other associated businesses with the sole aim of achieving total dominance in the petroleum industry. John D. Rockefeller was famous for his long workday as well as for his exacting efficiency. The result of Rockefeller's efforts was that Standard Oil priced its petroleum and heating oil products substantially lower than the competition.

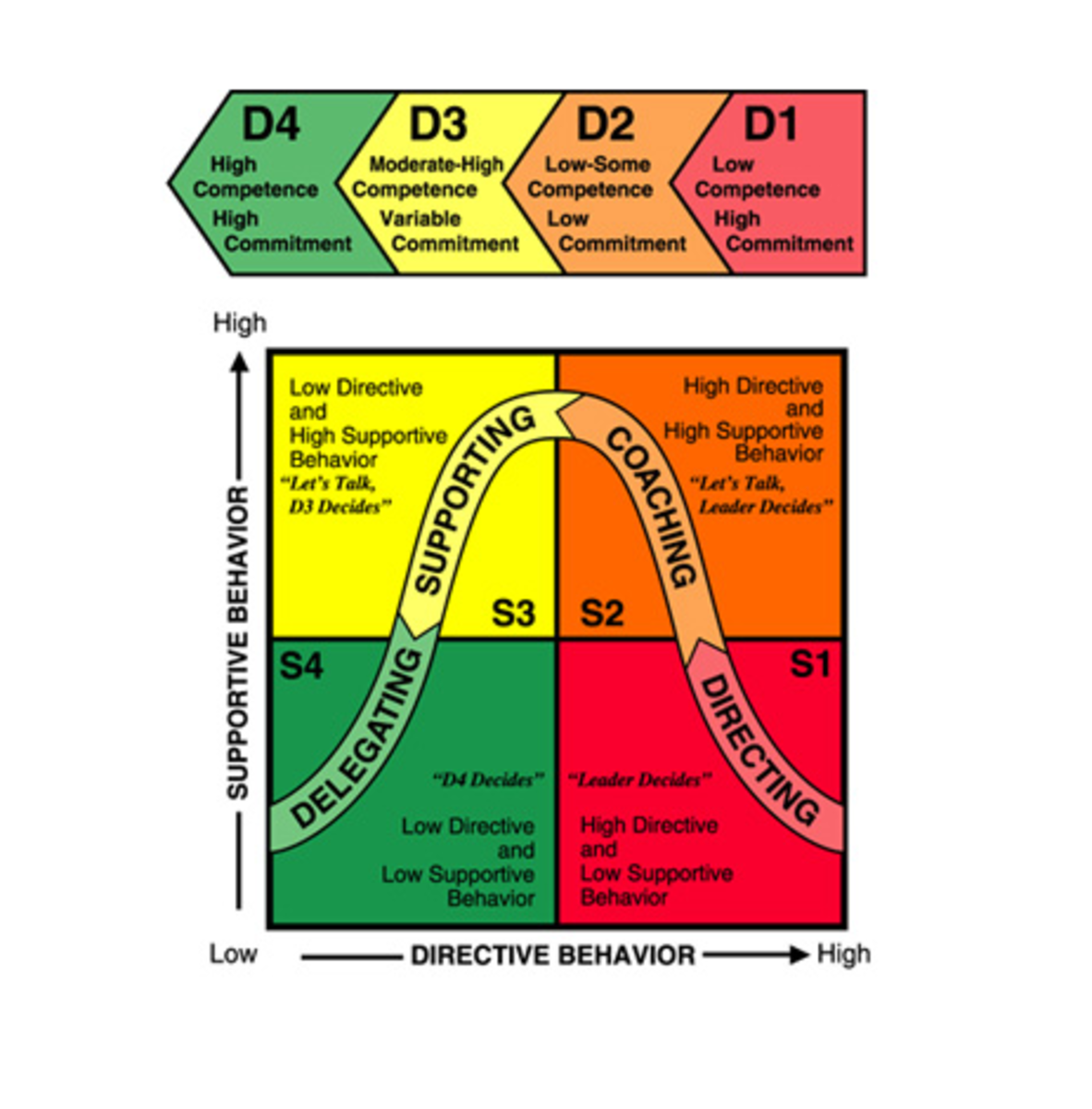

2. Describe the BCG Portfolio Matrix and identify the strategic objectives to be achieved in each cell of the matrix. What alternatives are available to management to enhance shareholder value in each cell?

The Growth-Share matrix is also called Boston Matrix or BCG Matrix, after the Boston Consulting Group who developed it. The purpose of the Boston Matrix or BCG Matrix, is to determine the current ‘location' of the business unit according to the following descriptors.

Relative market share -This indicates likely cash generation, because the higher the share the more cash will be generated. As a result of 'economies of scale' (a basic assumption of the matrix), it is assumed that these earnings will grow faster the higher the share. Note the market share is relative to its competitors.

Market growth rate - Rapidly growing brands, in rapidly growing markets, are what organizations strive for. However, the penalty is that they usually require investment. The reason for this is often because the growth is being 'bought' by the high investment, in the reasonable expectation that a high market share will eventually turn into a sound investment in future profits. The theory behind the matrix assumes, therefore, that a higher growth rate is indicative of accompanying demands on investment.

The location of the business unit will be one of four categories:

Dogs - Dogs have low market share and a low growth rate and hence neither generate nor consume a large amount of cash. However, dogs are cash traps because of the money tied up in a business that has little potential. Such businesses are candidates for liquidation. Numerous computer manufacturers have elected to sell their printer operations due to low profit margins.

Question marks - Question marks are growing rapidly and thus consume large amounts of cash, but because they have low market shares they do not generate much cash. The result is a large net cash consumption. A question mark (also known as a ‘problem child') has the potential to gain market share and become a star, and eventually a cash cow when the market growth slows. If the question mark does not succeed in becoming the market leader, then after perhaps years of cash consumption it will degenerate into a dog when the market growth declines. Question marks must be analyzed carefully in order to determine whether they are worth the investment required to grow market share. Management can consider divestiture when a strategic business unit (SBU) requires outsized or excess investment of capital in quickly-evolving technologies. The computer industry in particular requires large R & D expenditures that may never pay dividends due to the fast-paced evolution of the industry and the saturation of the market.

Stars - Stars generate large amounts of cash because of their strong relative market share, but also consume large amounts of cash because of their high growth rate; therefore the cash in each direction approximately nets out. If a star can maintain its large market share, it will become a cash cow when the market growth rate declines. The portfolio of a diversified company always should have stars that will become the next cash cows and ensure future cash generation. The Apple Corporation has enjoyed a crop full of stars: the Mac, iTunes, the iPod, and the iPhone. These products are generating sizeable revenues for Apple and will ensure that it can continue to compete against Sony and Samsung.

Cash cows - As leaders in a mature market, cash cows exhibit a return on assets that is greater than the market growth rate, and hence generate more cash than they consume. Such business units should be ‘milked', extracting the profits and investing as little cash as possible. Cash cows provide the cash required to turn question marks into market leaders, to cover the administrative costs of the company, to fund research and development, to service the corporate debt, and to pay dividends to shareholders. Because the cash cow generates a relatively stable cash flow, its value can be determined with reasonable accuracy by calculating the present value of its cash stream using a discounted cash flow analysis.

Limitations

The growth-share matrix once was used widely, but has since faded from popularity as more comprehensive models have been developed. Some of its weaknesses are:

A. Market growth rate is only one factor in industry attractiveness, and relative market share is only one factor in competitive advantage. The growth-share matrix overlooks other factors in these two important determinants of profitability.

B. The framework assumes that each business unit is independent of the others. In some cases, a business unit that is a ‘dog' may be helping other business units gain a competitive advantage.

C. The matrix depends heavily upon the breadth of the definition of the market. A business unit may dominate its small niche, but have very low market share in the overall industry. In such a case, the definition of the market can make the difference between a dog and a cash cow (Anonymous, 2009 ).

3. There are numerous entry modes for international expansion. Describe each mode and discuss how they compare on the degree of commitment required by the expanding firm. What are the risks? What are the benefits of each form of entry?

As the business world becomes more global and the level of international competition continues to increase, managers will find themselves facing increasingly complex strategic decisions. Perhaps first and foremost among these decisions are the decisions relating to methods of expanding the firms' international operations. However, as one considers the prospects of international expansion one can not help but be aware of the many and varied risks facing firms in these "strange new lands."

Risks

Ghoshal (1987) has postulated that managing risks is one of three strategic objectives for managers of multinational firms. Yasai-Ardekani (1986) has suggested that industry environmental characteristics such as risk, influence management perception which, in turn, leads to an influence on the structure of the organization. Carman and Langeard (1980) have stated that service firms face far greater risks in international expansion than do product firms: (1) the inseparability of production and consumption for services eliminates certain entry mode choices, (2) the lack of visibility of services (intangibility) increases the time needed to diffuse service innovation, and (3) service providers may be perceived by host governments as contributing little to the national economy while draining resources, precipitating regulations that favor domestic service providers over foreign providers.

Existing research has shown a relationship between risk and international diversification, i.e. how firms can reduce overall financial risk by diversifying into international markets. Risk has also been shown as a motivation for international expansion, e.g. entry into competitor markets as a bargaining tool through the "exchange of threats" (Casson 1987, Graham 1985, Vernon 1985, Vernon 1974). In addition entry mode research has included "risk" as a key element in many of their studies of entry mode determinants (Root 1987, Anderson and Gatignon 1986, Hennart 1988, Contractor 1990, Buckley and Mathew 1980). Vernon (1985) and Miller (1992) have suggested that the perception of a more comprehensive "international" risk and the strategic choice of entry mode may be related. They suggest that looking at individual international risks, such as exchange rate or political risks, in isolation of the other international risks results in an incorrect analysis of the internalization question and can lead to an incorrect entry mode choice ( Brouthers, 1995).

Entry Modes of International Expansion

A firm has many options available to it when it decides to expand into international markets. Given the challenges associated with such entry, many firms first start on a small scale and then increase their level of investment and risk as they gain greater experience with the overseas market in question. The modes of foreign entry include: Exporting, licensing, franchising, joint ventures, strategic alliances, and wholly owned subsidiaries.

Exporting

Exporting consists of producing goods in one country to sell in another. This entry strategy enables a firm to invest the least amount of resources in terms of its product, its organization, and its overall corporate strategy. Not surprisingly, many host countries dislike this entry strategy because it provides less local employment than other modes of entry. The benefits of exporting, for a multinational, are the relative lower cost to enter a completely new market. Another benefit is the relationships that the exporting firm builds with the distributors and the knowledge gained as a result of those relationships. One of the risks inherent in exporting is the fact that the exporter exhibits very little control over its product. Another danger attributed to the exporting goods is the fact that some countries are politically insecure, which can result in defaults on payments, exchange transfer blockages, nationalization or confiscation of property, not only from companies with the country but also from the country itself.

Licensing and franchising

Licensing as an entry mode enables a company to receive a royalty or fee in exchange for the right to use its trademark, patent, trade secret, or other valuable item of intellectual property. In international markets, the advantage is that the firm granting the license incurs little risk, since it does not have to invest any significant resources into the country itself. In turn, the licensee gains access to the trademark, patent and so on, and is able to potentially create competitive advantages. Also, comparatively, there is little or no government regulation in licensing, and there is substantial and complex government regulation in franchising. Nevertheless, franchising has the advantage of limiting the risk exposure that a firm has in overseas markets while expanding the revenue base of the parent company. An important downside to licensing is the reality that the licensee may appropriate the patent or trade secrets to modify the product and thereby avoid paying the royalty fee. The rampant piracy in China precludes many technology firms from establishing operations there-they fear the loss of intellectual property and indirectly, competitive advantage.

Strategic Alliances and Joint Ventures

Joint ventures and strategic alliances have become in recent years an increasingly popular way for firms to enter and succeed in foreign markets. These two forms of partnership differ in that joint ventures entail the creation of a third-party legal entity, whereas strategic alliances do not. The advantage of these partnerships is that they enable firms to share the risks as well as the potential revenues and profits. Also, by gaining exposure to new sources of knowledge and technologies, such partnerships can help firms develop core competencies that can lead to competitive advantages in the marketplace. Finally, entering into partnerships with host country firms can provide very useful information on local market tastes, competitive conditions, legal matters, and cultural nuances. One of the risks inherent in strategic alliances and joint ventures is neglecting to adopt a clearly defined strategy that will be supported by the organizations in the partnership. Without such consensus, the firms may work at cross-purposes and not achieve any of their goals. Also, there must be a clear understanding of capabilities and resources that will be central to the partnership. Trust must also be developed between the partners. Finally, cultural issues need to be addressed so as to avoid potential conflicts and disruptions.

Wholly Owned Subsidiaries

A wholly owned subsidiary is a business in which a multinational company owns 100 percent of the stock. There are two means by which a firm can establish a wholly owned subsidiary. It can either acquire an existing company in the home country or it can develop a totally new operation. Establishing a wholly owned subsidiary is the most expensive and risky of the various entry modes. However, it can also yield the highest returns. In addition, it provides the multinational company with the greatest degree of control of all activities, including manufacturing, marketing, distribution, and technology development. The greatest disadvantage for a wholly owned subsidiary is that it is typically the most expensive and risky of the various modes for entering international markets. The parent company assumes all the risk, with a wholly owned subsidiary (Dess, et al, 2007). Other risks are possible, still:

A firm with proprietary technology or know-how such as IBM may choose to enter a market through a fully integrated entry mode, as it did in India in the 1960s. A number of years after establishing the subsidiary in India, IBM felt it necessary to withdraw completely from India because of changes in the business laws requiring a minimal level of Indian national ownership. In this case the decision to minimize the risk of exposing IBM's know-how (dissemination risk) results in the firm exposing itself to other risks, both financial and political. Establishing a wholly owned subsidiary is more expensive than other forms of entry and therefore increases the firm's financial risks. In addition, having a physical presence in a country opens the firm up to political risks, such as changing laws, regulations, governmental philosophies, and exposes the firm's assets to the possibility of nationalization ( Brouthers, 1995).