Tax Checklist for Small Business Owners

Tax Checklist – Small Business Owners and Entrepreneur Business Tax

In businesses in every state, there is no escape from taxes and so for small business owners it is wise to have a tax checklist to make sure everything is being paid on time. Taxes affect every single move you make for your business. Entrepreneurs are often faced with many tax questions, often not even knowing the right questions to ask in the first place. Unless you have an accounting / financial background this is completely understandable and regardless all small business owners should have a relationship with an accounting professional as rules and regulations change quickly and it is difficult to be up to speed on all details.

When it comes to business tax matters it should always be discussed with your tax consultant or a local CPA firm including factors of moving business to another location or state. Always be sure that you are managing your taxes properly or you can land with an increased risk of audit, penalties and even disallow your business as a separate unit.

The following are several potential business taxes that you may be responsible for paying as small business owner. It is important for entrepreneurs to remember that even in their earliest stages when the company is not generating lots of income that there will be taxes and fees payable to the government. Failure to pay these can compound with late fee penalties and grow into large debts so it is best to consult with a CPA or at least an accounting professional with experience supporting small businesses.

Maximize Business Tax Returns

Tax Checklist of Common Taxes for Businesses

This tax checklist is some of the most common taxes small business owners may face depending on their specific location and industry. Taxes vary from location to location and different fees may be applied to specific industries.

· Property Tax

· Excise Taxes

· Gross Receipts Tax

· Business Income Tax

· Sales Tax

· Self-Employment Tax

· Employment Tax

· Franchise Tax

Great Tax Advice

Tax Checklist - Deductions Might Be Possible

But with that said, a business should also be aware of the taxes that can be deducted from a Business Tax Return. It is always strongly recommended to check with your preferred CPA firm or accounting professional to verify the exact amounts eligible for deductions in these categories and confirm your companies eligibility for all potential deductions. Relying on the sound financial advice of a trained professional is the way to run a company rather than wondering about possibilities or taking a guess, business taxes should be taken serious due to ramifications that may occur from problems.

Here is a few areas that may offer deductions:

· State Income Tax / Franchise Tax

· City Gross Receipts Tax

· Local, City – State Sales Taxes Paid for Purchases

· Real Estate Tax

· State Income Tax

· State Unincorporated Business Tax

· Both Tangible / Intangible Property Tax

· License Tax

· Business Vehicles Registration Tax

It pays off, to keep your taxes up to date in a business you want to want to grow. There is not much worse than a major tax violation for a small business owner that wants to focus on serving their customers and developing a business. Cleaning up a business tax problem can take lots of time and financial resources taking away from the businesses potential. Work closely with a trained accounting professional to keep your companies financials organized and the potential for major headaches will be reduced. As an entrepreneur trying to already do many roles this peace of mind will allow for you to focus on serving your customers and implementing your strategic marketing plans to reach new customers and grow your business instead of reviewing expense reports and preparing for a tax audit.

Ever forget to submit your taxes?

Ever miss a deadline for taxes

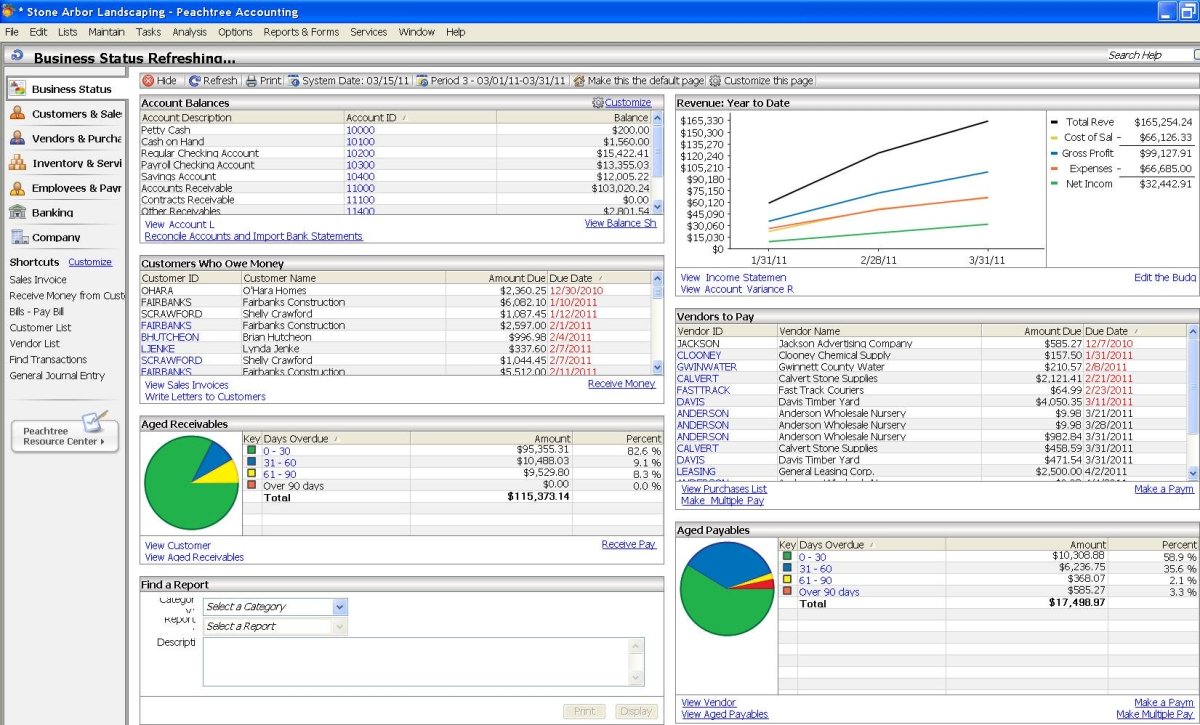

Finding A Bookkeeper

Many successful small business owners have found that is very good to have a trained bookkeeper supporting their day to day operations. Entrepreneurs looking to find a bookkeeper sometimes run into a big challenge as it can be difficult to find the right person you can trust with this part of your business. Working with your accountant to assist you in locating the right person for the day to day operations of running the books for the company can be a great asset. They may know someone they can refer to or have capabilities to support you directly. Set up the business financials according to the way in which your CPA will need to be able to assist you with quarterly or monthly activities as needed for your business. Finding a bookkeeper that will work within the rules set by your CPA is an important way to make sure everything is done properly day in and day out.